Dow Soars as Trump & Kudlow Tease Market With China ‘Surprise’

The Dow soared toward a mammoth recovery on Friday after Donald Trump and Larry Kudlow teased the market with a China "surprise." | Source: Brendan Smialowski / AFP

The Dow Jones surged as traders shrugged off a huge miss in hourly wages and a lower than expected non-farm payrolls number.

US President Donald Trump made positive noises about a trade deal with China , reinforced by chief economic adviser Larry Kudlow, while Fed Chairman Jerome Powell helped push the Dow higher late in the session.

Dow Jones Climbs Further as Fed Chair Powell Turns Dovish

Ahead of the closing bell, the Dow Jones Industrial Average had secured gains of 285.19 points or 1.09%. The DJIA last traded at 26,486.23.

Major US stock indexes all rose today, as the S&P 500 (+1.11%) tracked closely with the Dow. The Nasdaq led the way again, rallying 1.15%.

Commodity prices were highly mixed, with no real direction across energy markets, and gold and silver dropped.

Further confirmation of risk-on was seen as the Australian dollar rallied 0.43% against the US dollar, while the trade war risk barometer, USD/CNH (offshore yuan), dropped as well.

What Moved the Markets Today

The US jobs report was widely touted as a success after the Dow rallied strongly at the open of trade. It appears the bounce may have been due to expectations of truly horrendous data which did not materialize.

Nevertheless, there was still plenty of evidence that the report was in line with the view that the US economy is slowing. Sharply dropping unemployment, combined with a contradictory miss in wages, must be viewed with caution.

Larry Kudlow added a boost to stocks as he hinted at some surprises next week for investors in the US-China trade talks. Investors took it as further evidence that Trump and his team are laying a trail of bullish breadcrumbs for investors that a trade deal is coming before the 2020 election.

Federal Reserve Chairman Jerome Powell capped off a busy week as he spoke late in the session , helping lift stocks by hinting at measures to boost inflation.

“While we believe our strategy and tools have been and remain effective, the US economy, like other advanced economies around the world, is facing some longer-term challenges,” Powell said.

Trade Balance Suggests More Trump Tariff Woes for Stock Market

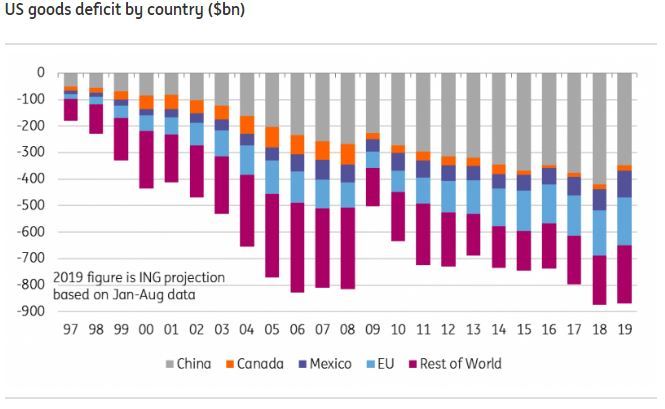

Aside from the jobs data, the trade balance was also wider than expected. Given that Trump has made trade a particular focus of his political agenda, tariff escalation remains a significant threat to the global stock market, along with the Dow Jones.

In an ING report, Chief International Economist James Knightley explains that other nations continue to pick up the slack from China to fill US orders, as he writes:

“President Trump is likely to take some comfort from the fact that the trade deficit with China narrowed yet again, which he can use to justify his tough rhetoric in trade negotiations. On a year-to-date basis, the trade deficit with China has narrowed by US$30bn. Unfortunately, this has been fully offset by a YTD increase in the trade deficit with Mexico of US$15.8bn and US$14.9bn with the EU. In aggregate the US trade deficit is currently on track to be broadly in line with the record trade deficit experienced last year.”

Despite the administration’s frequent claims, US manufacturing is not feeling the benefit of the trade war. Trump may have to do more to fight the free market, an exceptionally worrying consideration for stocks worldwide.

Dow Stocks: Buoyant Apple Carries The Load

The Dow 30 enjoyed a strong rally led primarily by Apple (+2.6%) as reports surfaced that the tech giant is increasing the output of the iPhone 11 on better than expected demand.

Disney rose more than 1.3% as bulls appeared to enjoy its decision to block Netflix ads from all its channels, excluding ESPN.

Only Dow Inc. traded in the red, falling 0.26% as the other 29 DJIA components reported session gains.

Click here for a live Dow Jones Industrial Average chart.