Dow Edges Higher After Mixed Jobs Report Cements Fed Rate Cut Odds

The Dow prepared to close the week in negative territory, even though the jobs report empowered the stock market to crawl to moderate gains. | Source: AP Photo / Richard Drew

The Dow prepared to close the week firmly in negative territory, even though a mixed jobs report empowered the stock market to crawl to a moderate recovery for a second straight day.

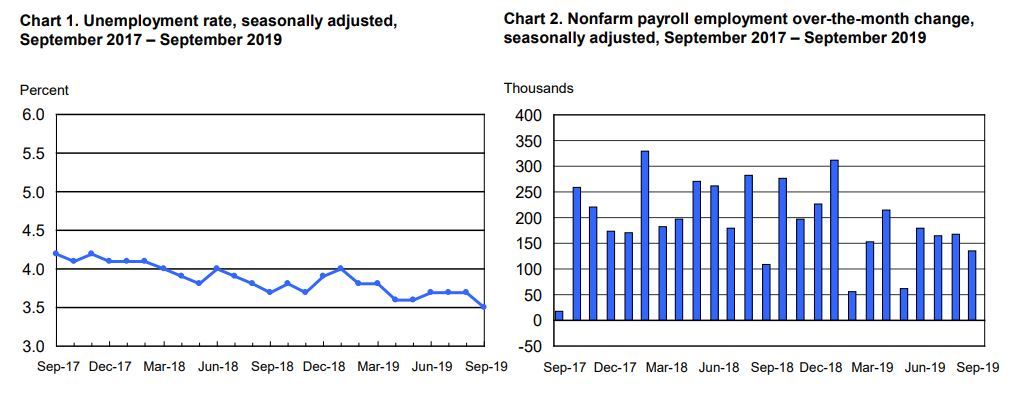

Nonfarm payrolls missed estimates for September, but upward revisions to the previous two months helped bring the unemployment rate down to a five-decade low.

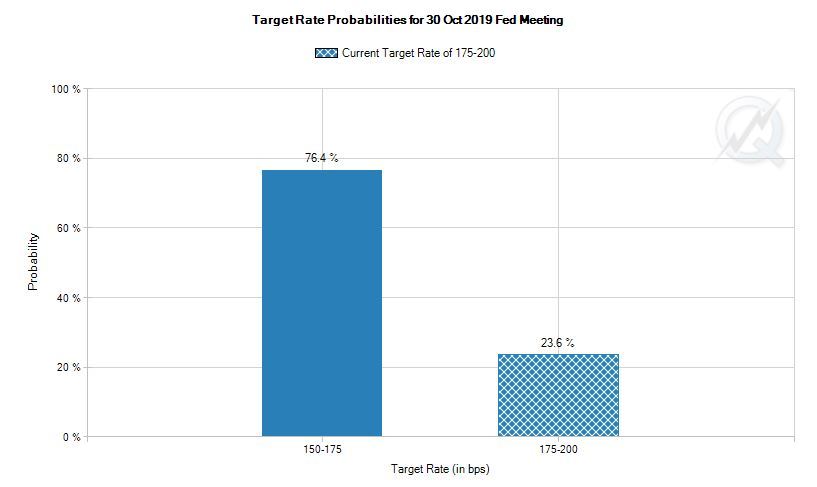

Absent a jobs report bombshell, Wall Street remains incredibly confident that the Federal Reserve will cut interest rates by another 0.25% at the bank’s policy meeting this month.

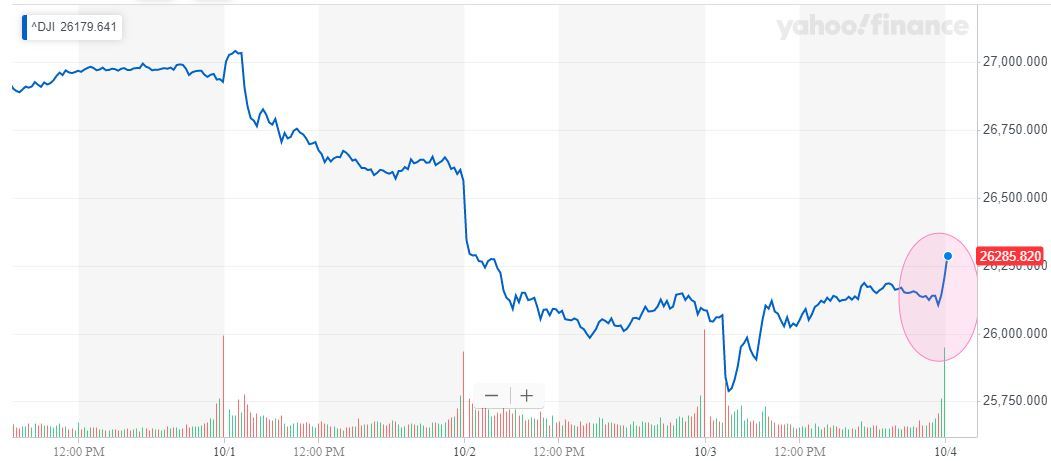

Dow Ticks Higher, But Heads for Steep Weekly Loss

Wall Street’s three major indices plodded toward substantial gains during the week’s final trading session. The Dow Jones Industrial Average rose 147.16 points or 0.56% to 26,348.20.

The S&P 500 added 15.78 points or 0.54% to climb to 2,926.41. All 11 primary sectors reported gains, led by technology (+0.86%).

The Nasdaq jumped 44.49 points or 0.57% to 7,916.75.

September Jobs Report Incites Investor Yawns

Stocks traded slightly higher because the September non-farm payrolls report failed to inspire investors to alter their market forecasts.

According to the Labor Department , the economy added 136,000 jobs in September, slightly below the Dow Jones consensus estimate of 145,000. However, the government revised its August and July numbers upward for a net gain of 45,000.

Those upward revisions helped reduce the US unemployment rate to 3.5%, its lowest mark since December 1969.

Investors remain conflicted about how to feel about the economy. On the one hand, a recent spate of bearish data bodes ill for the market. On the other, a slowdown could persuade the Federal Reserve to commit to an aggressive easing program.

Those differing outlooks have often caused violent market swings.

Yesterday, ISM’s nonmanufacturing index missed economist estimates by a wide margin, suggesting a slowdown in the US services sector. That data release sent the Dow into a downward spiral, only to see the index close the session with a triple-digit gain on expectations that the Fed would cut interest rates later this month.

Wall Street Bets on 3rd Straight Interest Rate Cut

The market remains confident that the Fed will cut rates at a third straight FOMC meeting, though Friday’s jobs report caused the probability to decrease slightly.

At present, CME’s FedWatch Tool indicates that Fed funds futures imply a 76% probability of a rate cut this month, down from 90% on Oct. 3.

Click here for a live Dow Jones Industrial Average chart.