Best Decentralized Exchanges in 2024

Best Decentralized Exchanges in 2024

Here are the best decentralized exchanges we were able to find online in 2024. Check them out and pick one that offers all the features you need.

promotions

Earn a 5% discount on trading fees when you sign up with a referral link from a friend.Coins

Review of Our Top 2 Decentralized Exchanges

Here are short reviews of the best decentralized exchanges you can check to get all the essential data within minutes.

1. Uniswap V2

- Dynamic

- spot trading

- day trading

-

staking

2

No result

- Ethereum

- Tether

-

Beam

47

No result

- Bank Transfer (SEPA)

- Instant SEPA

-

Visa

56

No result

- English

- Afrikaans

-

Arabic

27

No result

- 256-Bit SSL Encryption

- English

- Help Center

- Docs

- Blog

2. dydx

- spot trading

- margin trading

-

staking

1

No result

- Ethereum

- Bitcoin

-

Solana

34

No result

- MetaMask

- Trust Wallet

-

Coinbase

45

No result

- English

- Japanese

-

Chinese (Mandarin)

6

No result

- 256-Bit SSL Encryption

- English

- Forum

- Introduction

-

Guides

3

No result

Why Trust Us?

We have been using cryptocurrencies and various types of exchanges for several years. Our team is capable of testing and ranking all the exchanges available with superb accuracy thanks to the knowledge and skills they have gathered over the years. Over time, we have analyzed over 30 different exchanges.

- Best Crypto & Bitcoin Casinos

- Best Crypto & Bitcoin Sports Betting Sites

- Best Crypto & Bitcoin Gambling Sites

- Best Crypto & Bitcoin Plinko Sites

- Best Crypto & Bitcoin Dice Sites

- Best Crash Gambling Sites

- Best New Crypto Casino Sites

- Best Crypto & Bitcoin Sports Betting Canada

- Best Crypto Sports Betting Australia

- Best Crypto Basketball Betting Sites

- Best Crypto Sports Betting Sites in the UK

- Best Crypto Soccer Betting Sites

- Best Tron Sports Betting Sites

- Best Ethereum Casinos

- Show More

Overview of the Best Decentralized Exchanges in 2024

| Casino | Welcome Bonus | Our Rating |

|---|---|---|

| Uniswap V2 | 4.00 | |

| dydx | Earn a 5% discount on trading fees when you sign up with a referral link from a friend. | 3.50 |

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

Decentralized Exchanges: Basics

The first things to know are the basics regarding decentralized exchanges. Keep in mind that these are also known as DEX exchanges , so don’t get confused when you see this term.

In general, these are online exchange platforms that offer cryptocurrency trading. But this is processed directly peer-to-peer, with no intermediary involved. As you may know, these exchanges operate using blockchain technology.

On the other hand, you can still buy, sell, or trade most of the cryptocurrencies available online.

DEX Exchanges: Pros and Cons

Try to remember that a DEX exchange offers a lot of advantages to users. On the other hand, we can see some cons too. It is crucial to know about all of these before you start using one.

Pros:

- Better security: These exchanges have much better security than any other type. In a nutshell, your coins and data are more secure here than on any other exchange.

- It is impossible to hack the exchange: There is no way to hack the company or organization and steal data and money.

- Market manipulation is not possible: Decentralized operators are known for eliminating market manipulation. Fake trading is not a thing here.

- Lower fees: Because there is no intermediary, fees are much lower compared to other types of online exchanges.

- More private: These exchanges don’t require a lot of data and personal details from users, making them more private.

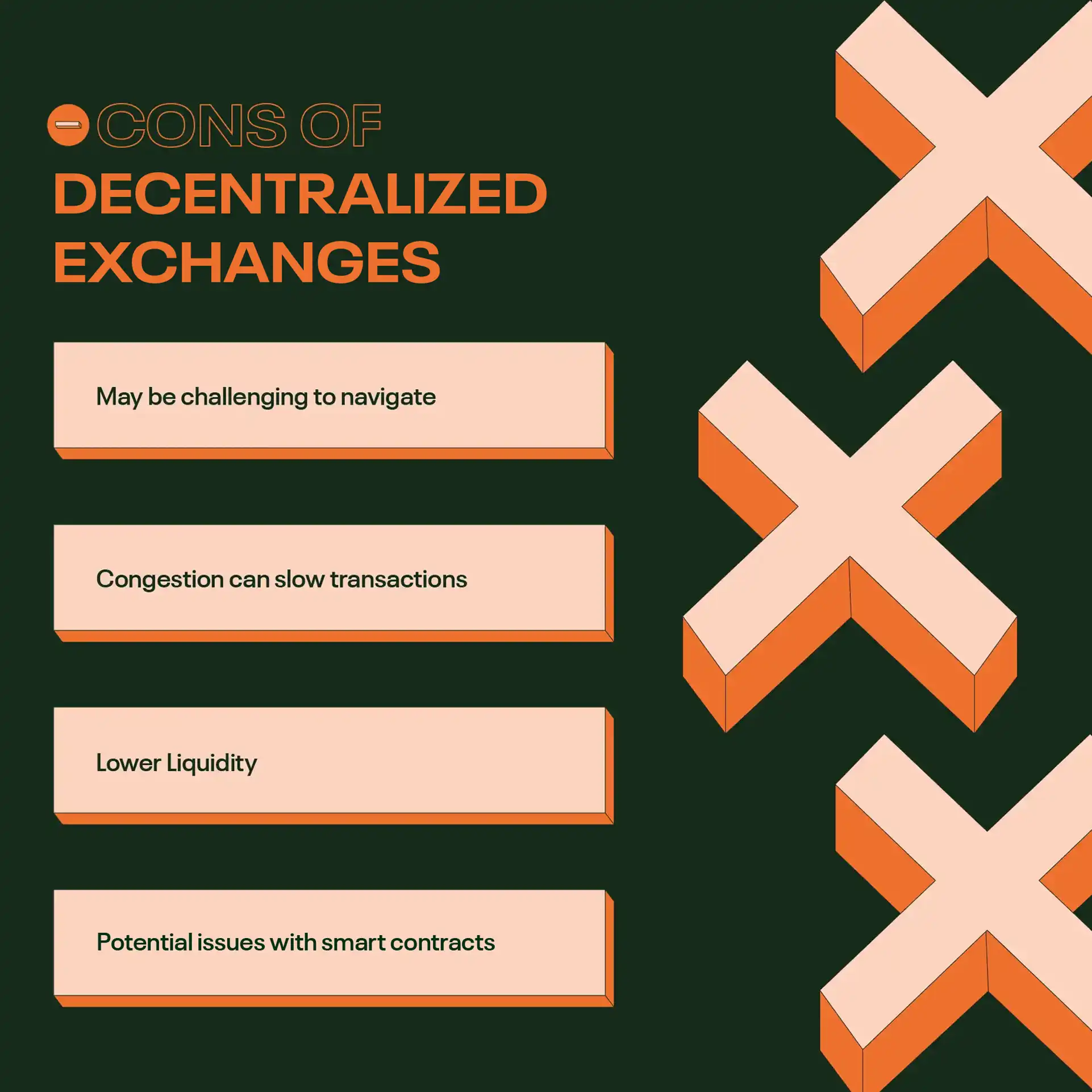

Cons:

- More complicated to use: They are more complicated to use than centralized alternatives.

- Network congestion: The network could become congested at times, which would affect your transactions.

- Liquidity is lower: Usually, DEX exchanges have lower liquidity than centralized platforms due to a smaller user count.

- Possible smart contract issues: If the smart contract is poorly developed, it can cause issues within the network.

Choosing The Best Decentralized Exchanges For You

In order to find the best decentralized exchange we had to test many different platforms. If you want to find the best platform as well, you need to do the same. This is possible using the factors listed below that can distinguish the best crypto exchanges from mediocre ones. Use these factors in all exchanges of this kind when you look for a new one.

Learn how these work

The first thing is to learn how these exchanges work. This can help you with future steps and overall usability. It can also help you determine whether these exchanges are the right ones for you.

Keep in mind that there is no bank or other institution that controls decentralized crypto platforms. All transactions are done between you and the buyer/seller directly.

Applicable fees at decentralized crypto exchange

Every single decentralized exchange has some fees. These can be charged when you deposit funds, buy crypto , or withdraw it. Just make sure that the fees are low. Sadly, there is no way we can generalize them; however, it’s safe to say that they usually range between 0% and 5%.

Make sure the exchange has sufficient liquidity

All exchanges have liquidity. This basically means how fast an exchange can sell the assets to obtain cash without decreasing the price of those assets. Exchanges with higher liquidity can get more cash this way sooner, and don't have to change the price of the product.

There are many ways to check the liquidity of the exchange, but they might be a little complicated. A much easier way is to use sites such as Coin Market Cap, where you can see trading volume and other details relating to the exchange. A higher trading volume usually means higher liquidity.

Check out different types

Always check the different types of exchanges before you begin. You never know which one is most suitable for you and offers features you truly need. More on the types of exchanges later.

Pay attention to security measures

As you may know, checking the security of the exchange plays a huge role in all of this. The goal is to make sure your account and your funds are secure. That’s why you should check the security features at the exchange, such as biometric security, SSL, and the overall security of the blockchain the exchange is based on.

The user experience of decentralized exchanges

Basically, here you need to check how the exchange feels when using it. It should be easy to use and offer simple navigation. At the same time, it should offer dedicated and professional customer support.

Check reviews and feedback

These are two different things that both have the same role. The first one is to check the expert reviews. You can find these DEX exchanges reviews above based on actual testing by our team members.

Secondly, check the feedback of other users. The goal is to find a platform where most users are satisfied and haven’t come up against any issues using the exchange.

Online communities and development

You also need to check for active online communities and the overall development of the exchange. The first refers to blogs and groups on social media where you can interact with other users and learn valuable information or stay up to date.

The second refers to the development, improvement, and changes that exchange has made in the past. A well-known exchange has a long list of improvements, and is transparent about them.

Educational Resources At DEXs

If you are a beginner, this is more important than you may think. In a nutshell, educational resources should be offered to all users and be available 24/7. There are a few things you need to know here.

The overall importance of educational resources

Educational resources play a huge role in online crypto exchanges. Thanks to these, you can learn how to use the platform, trade, and how all of this works. In turn, these can help you make more calculated transactions and decrease the risk of losing money.

Types of educational resources to look for

The best decentralized crypto exchange should offer a few different types of educational resources. When all of these are available, you can learn a lot in no time.

- Basics: These are perfect for beginners and allow them to learn how all of this works and how cryptocurrencies operate.

- Trading strategies: Here you can find strategies or series of steps that can make your investment safer and possibly more profitable.

- Analyzing the market: this is probably one of the most important educational resources. Here you can learn how to analyze the market and make proper investments at the right time.

- Simulation trading: This allows you to trade cryptocurrencies for free and see how all of this works.

- Other resources: Additional educational resources are also important. For instance, you can find videos, the Academy section on the exchange, and blogs.

Some of the great examples you should check out include:

- 101 Blockchains

- Gemini

- Hedera

Quality of educational resources

It is always important to check the overall quality of the educational resources available. There are two main things to look for here.

- Accuracy: All the resources should be accurate and based on proper research.

- Latest data: The data should be the latest and up to date so you can get the latest information.

- Simplicity: The information should be easy to understand and optimized for beginners.

Licensing and availability in different countries

There are two things you need to know here. The first is the availability of the exchange in your country, and the second is the license that the exchange carries. Here are more details you should know about.

Licenses of crypto exchanges

All decentralized exchanges must be safe places online where you can sell or buy cryptocurrencies. One way to tell if that is the case with the platform you want to use is to get a license.

If the DEX exchange has a license, it means that you can enjoy safety and security on the platform. It also means that you have rights if something goes wrong.

Also, in some parts of the region, these licenses are impossible to get, while in others they are much easier. In addition, some licenses are linked to a particular country.

What regulators look for

In order to get a license, an exchange must comply with a lot of different criteria. The first one is that it must be registered as an actual business. Once this is done, the regulator takes a look at a few different things.

- AML and CTF: These are Anti-Money Laundering and Counter-Terrorist Financing requirements. It means that the funds from the exchange cannot be used for illegal activities such as these two.

- KYC: Know your customer. An exchange should complete this in order to verify the account owner.

- Overall security: A licensed exchange must have strong security, which is another thing regulators check for.

Products you can find at decentralized exchanges

You should always check for products available at the exchanges. There are a few things that can make a huge difference, and you need to know about each one. Luckily, many of the defi exchanges offer all of these.

Tools and cryptocurrency trading

Here, you can trade cryptocurrencies directly from your crypto wallets. This is possible thanks to the smart contracts that are behind the exchange. Despite sounding complex, this process is actually super-easy and you can see that once you use the decentralized exchange for the first time.

Available tokens

Most of these platforms offer a long list of available tokens or coins. When you look for a new exchange, make sure most tokens are available; or, at least, the ones you want to use.

Yield farming

If you provide liquidity to the liquidity pool, you can earn rewards at these exchanges. This is possible because all of the providers can get a slice of the fees generated by the liquidity pool in question.

Cross-chain swaps

The best platforms of this kind should allow cross-chain swaps. This means that you can exchange different cryptocurrencies over different networks. These days, this is one of the more appealing and useful features.

Lending and borrowing

Basically, you can lend some of your coins to other users at the exchange. In return, you get interest. If you take a look at the list of decentralized exchanges, you can see that many platforms offer this feature.

Staking

If you want to lock and hold the cryptocurrencies on the exchange, you can earn various rewards. In other words, you can get a portion of the transaction fees that the network has generated.

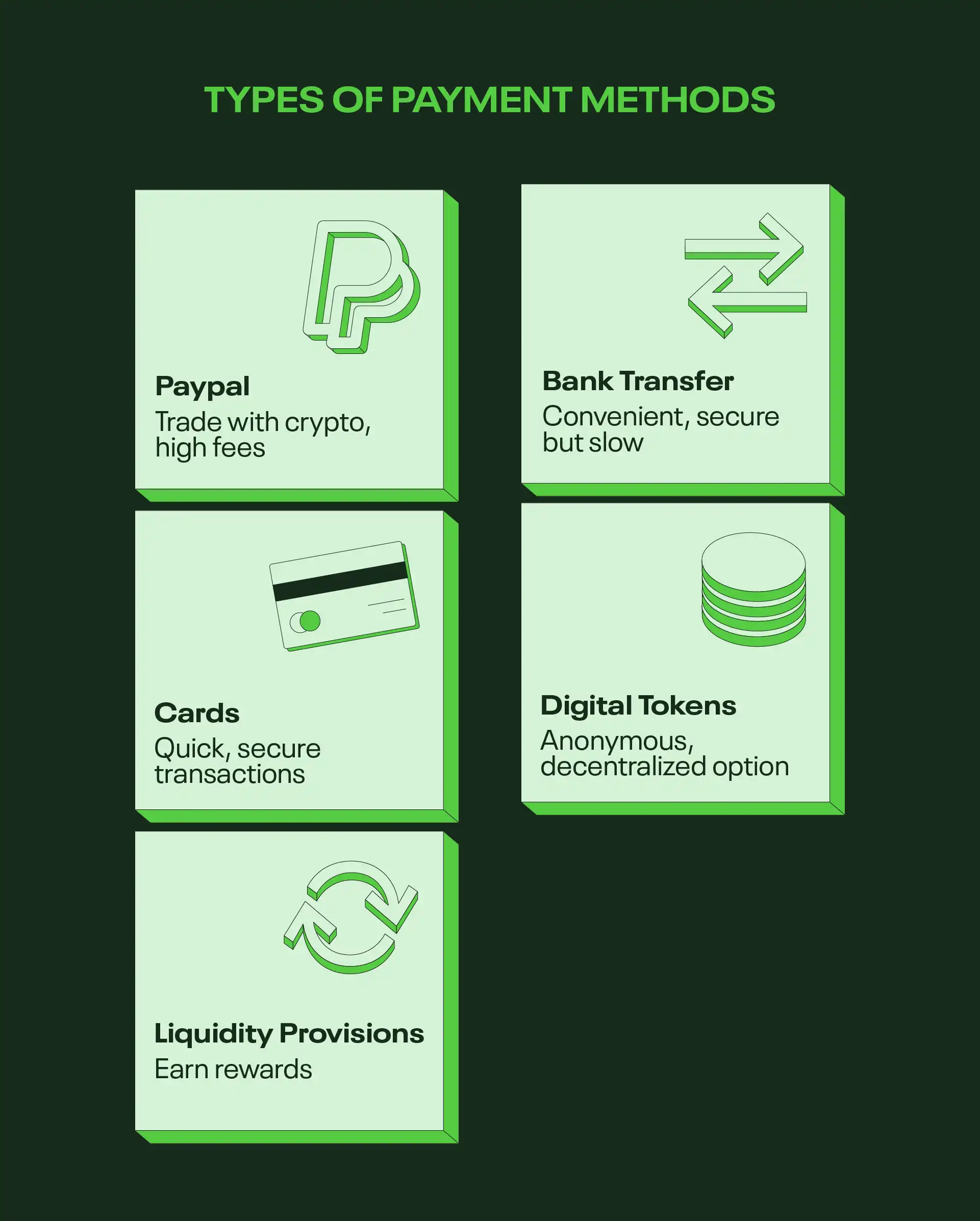

Accepted payment methods

In order to use the decentralized crypto exchange, you have to deposit funds. Basically, you need to invest money in some form to buy cryptocurrencies. Luckily, there are a few common options you can use, and each one comes with pros and cons you should know about.

Credit and debit cards

This is one of the oldest and most secure methods. At the same time, it is the most versatile due to the fact that most exchanges accept it. You can use MasterCard, Visa, or some other credit card to deposit funds and buy digital tokens. However, sharing the card number could be an issue for some users.

Bank transfer

In some parts of the world, it may be difficult to use cards at crypto DEXS. If you live in a country like that, you can use a bank wire transfer. It is not the fastest method, but it could be ideal if you want to deposit a huge amount of money.

PayPal

PayPal is commonly used at top DEXs and there are some benefits to it. For instance, it offers fast transactions at any given moment. PayPal is a reputable company that protects users as well. It also has two-factor authentication technology. The issue could be the high fee, which makes it unsuitable for certain users.

Liquidity provision

You can enjoy liquidity provision on these platforms as well. This means that the exchange takes a portion of the transaction fees once you have provided liquidity to liquidity pools. These rewards can vary.

Digital tokens

You can use digital tokens, or, better said, cryptocurrencies, to buy other cryptocurrencies. This is usually the fastest method, and many regular users have relied on it for a long time.

There are many advantages here. For instance, you can enjoy anonymity, lower fees, and an extreme level of security that is simply not available with fiat currencies.

Different payment methods and fees

It is important to remember that a defi exchange still has fees that can be based on the payment method you use. For example, using PayPal usually comes with very high fees when compared to other methods.

On the other hand, you can find cryptocurrencies that come with very low fees. Despite the fact that this method can be a bit more demanding and complex than using a debit card, it has a lot of perks.

Different Types of Decentralized Exchanges Available

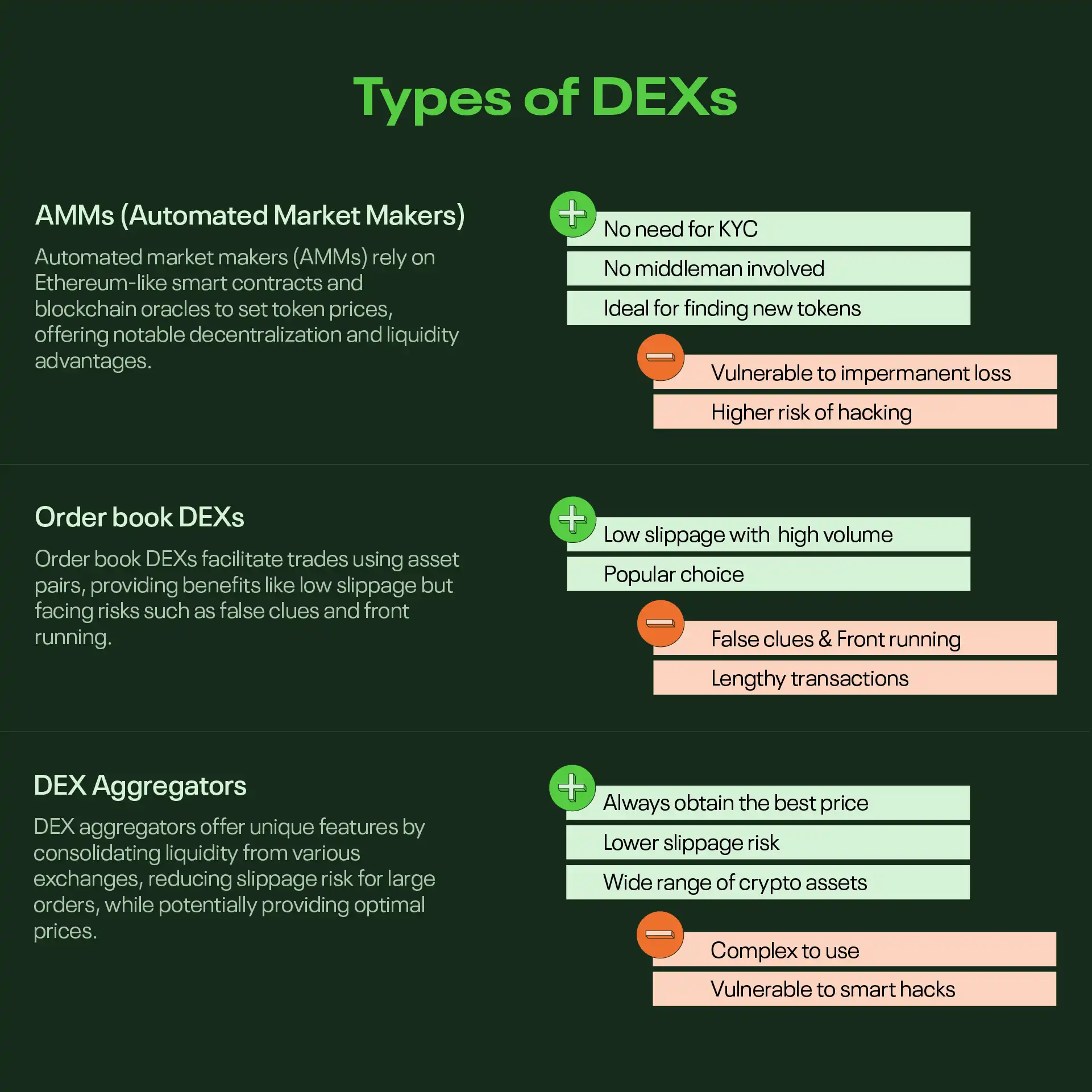

If you still want to use decentralized exchanges crypto platforms, you need to know about the three types. As you can imagine, they come with their own set of pros and cons. The best thing you can do here is check out these pros and cons. This could help you choose the best type for you and your needs.

AMMs

Automated market makers are a very common type. They’re based on smart contracts similar to the ones on the Ethereum network. The exchanges base the price of the tokens on other platforms. This is called a blockchain oracle. But these do offer some impressive pros.

Pros:

- KYC is not needed

- There is no middleman

- It is best to find extremely new tokens

Cons:

- Impermanent loss can cause financial loss

- The risk from hacking can be high

Order book DEXs

These exchanges use records to make the sale possible. There are asset pairs you need to know about. For instance, the exchange forms one order for the seller and another for the buyer. This comes with pros and cons too.

Pros:

- Slippage is low when the trading volume is high

- The most popular type here

- If there is no liquidity, transactions are very long

Cons:

- False clues are possible

- Front running is possible as well

DEX aggregators

The decentralized exchange crypto of this type is something special. They can aggregate liquidity from many other decentralized exchanges. As a result, this decreases the risk of slippage, especially when orders are large. But it can also offer the best price at any given moment.

Pros:

- They always get the best price

- Slippage risk is much lower

- There are countless crypto assets here

Cons:

- Complicated to use

- Smart contracts can be hacked

Our Best Tip: Try Many Options

If you want to use DEXES crypto exchanges, you should do it properly. There is one thing you need to know about here. Using multiple exchanges is beneficial and can be a smart idea. If you use this simple tip, you can get a few perks.

Pro user

If you use multiple exchanges, you can learn how to use different user interfaces, different tools, and so much more. In general, you can become a more advanced user and adapt more to trading with cryptocurrencies.

Making investments more secure

Users who use multiple crypto DEXES for exchanges are more secure. Even if one of the exchanges fails or something similar happens, you can still continue trading and keep your coins.

Finding the best option

Using multiple exchanges also allows you to check out different fees, educational resources, and so much more. In this way, you can find the exchange that matches your needs the most.

Decentralized Exchanges: How Do They Work?

If you want to know how decentralized crypto exchanges work, this is the section for you. In general, an exchange of this type connects buyers and sellers. But you trade cryptocurrencies directly from your eWallet. In other words, there are no intermediaries. These exchanges always work on blockchain networks, making them even more secure and user-friendly.

On the other hand, the centralized cryptocurrency exchange is an intermediary. It controls all transactions and charges higher fees for doing that.

Despite the fact that these are decentralized, customers can still trade all popular cryptocurrencies. Some examples include:

- Bitcoin

- Cardano

- Ethereum

- Avalanche

- Polygon

- Solana

- Litecoin

- Monero

- Stablecoins

Buying Coins at Decentralized Exchanges For The First Time

Now, when you want to become part of the DEX crypto exchange and buy or trade tokens, you need to follow a few steps.

1. Choose the exchange

The first thing you have to do is choose the exchange where you want to trade. All of these support BTC and ETH, but not all support less common cryptocurrencies. In addition, some offer an app people can use to trade. Once you’ve done this, register an account.

2. Choose which method you want to use

Once you have chosen the exchange, choose which method you want to use to deposit funds on the platform. You can use cards, other virtual currencies, and plenty of other methods.

3. Set up the payment method

If you want to use cryptocurrencies, make sure you have a crypto wallet ready and funds at that address. This approach also comes with lower trading fees, which traders really like.

4. Deposit funds

Now you have to deposit funds at the exchange. Just opt for the deposit method you like and complete the guided steps. This means that the funds are in your account on the same day, and you can begin with the DEX market.

5. Buy tokens

Just find the token you like on the site and issue the buy order. You can generally buy a small number of tokens or massive amounts if you are one of many investors.

6. Completing the trade

Now that you have cryptocurrency on your account, you can trade it. Other options include keeping it and waiting to see whether the price goes up. There are some risks here, but some huge perks too.

What To Do After You Have Used Decentralized Exchanges

Once you’ve used the crypto DEX exchange for the first time, you can still do a couple of things. These can help you in the long run, and can make a massive difference.

You can summarize how the whole experience felt and how much you like or dislike the user interface at the provider. Always keep in mind that the private key for the wallet should stay secure at all times. Make sure you don’t share it with anyone. Follow the latest news and changes in the cryptocurrency realm. These always affect the price. Some changes can even affect the process of buying crypto.

Conclusion

Navigating the decentralized exchange (DEX) landscape requires careful consideration to find the best platform. Important things include security, liquidity, fees, and user experience. These blockchain-based exchanges offer good security and privacy but can be hard to learn due to their complexity compared to their centralized counterparts.

Assessing reviews, user feedback, educational resources, and platform advancements can help users make a well-informed selection.

Utilizing multiple exchanges provides multiple benefits, from honing expertise to exploring different fee structures and fortifying security. Understanding the functionality of DEXes, executing transactions, and conducting post-transaction evaluations are pivotal for effective utilization within the evolving cryptocurrency realm.

Frequently Asked Questions

What services can I use at decentralized exchanges?

You can trade cryptocurrencies, lend coins, and also use liquidity investments that can help you generate more funds on a regular basis in the form of rewards.

How much money do I need to have in order to start using decentralized exchanges?

Usually, you can deposit a very small amount of money to the exchange, and this amount is specified by the decentralized exchange. There is no way we can generalize this.

What are the main benefits of decentralized exchanges?

These exchanges offer better security and lower fees. Since they are not centralized, they can offer similar advantages to cryptocurrencies compared to fiat currencies.

Are decentralized exchanges secure?

Yes, decentralized exchanges are secure, and are almost immune to hacks and similar issues.

Will decentralized exchanges be available in the future?

Yes, decentralized exchanges are here to stay. After all, they offer a lot of benefits and advantages that users need and like. Some say that decentralized exchanges are the most promising future exchange.