How To Buy Crypto in 2024

The world of cryptocurrencies can appear daunting for newcomers. However, armed with the right knowledge, learning how to buy crypto can be a rewarding endeavor. In this comprehensive guide, we’ll shed light on the essentials, such as:

- Understanding the basics of cryptocurrencies,

- Choosing the right platform,

- Deciding on the best method to purchase.

We’ll also explore alternative purchasing methods for added versatility. This guide will be extremely helpful to both novices and experienced investors with the knowledge they need to confidently navigate the realm of cryptocurrencies.

Best Crypto Exchanges in 2024

With so many options, finding the best Crypto exchanges isn’t easy. However, the CCN team is confident that these are the best options on the market.

- Coinbase – Best for beginners

- Kraken – Best for low fees and experienced traders

- eToro – Overall best crypto exchange

- Gemini – Best for security

- Crypto.com – Best for crypto exchanges and mobile app

Review of Our Top 10 Crypto Exchanges

Before buying digital coins, pause for a few minutes and look at snapshots of each of the Crypto exchanges featured on this page.

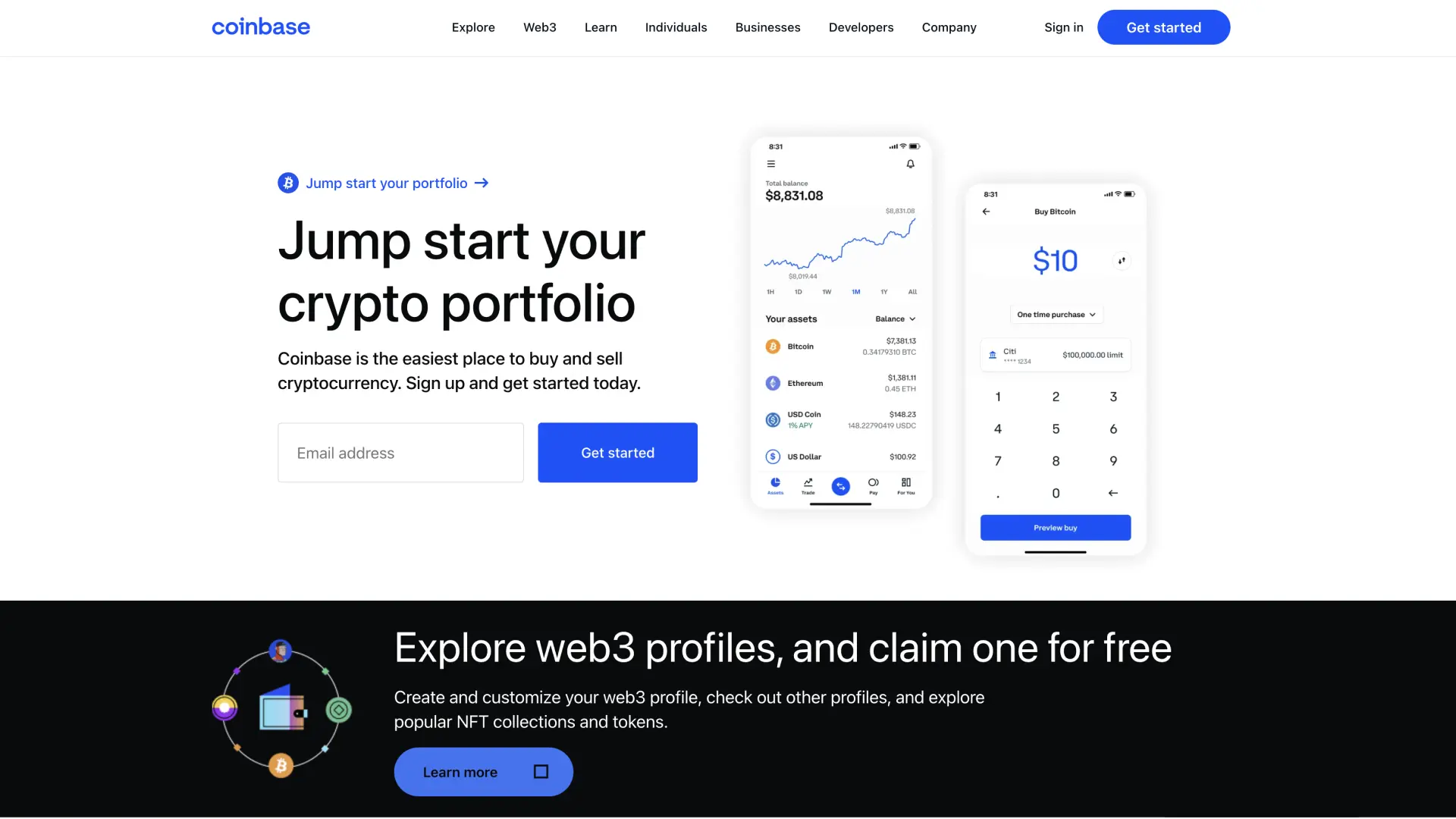

1. Coinbase Exchange Review

Overview: Coinbase was founded in 2012 and is headquartered in San Francisco, California. It is a centralized exchange that allows users to buy, sell, and trade cryptocurrencies.

Tradable coins: Coinbase supports over 200 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Fees: Coinbase charges a spread of about 0.5% for cryptocurrency purchases and sales. Additionally, there is a Coinbase fee of $0.99 to $2.99 depending on the transaction amount. Coinbase Pro, the exchange’s advanced trading platform, charges a maker fee of 0.5% and a taker fee of 0.5%.

Pros:

- User-friendly interface

- High liquidity

- Supports a wide range of cryptocurrencies

Cons:

- High fees compared to other exchanges

- Limited payment options

Visit Coinbase

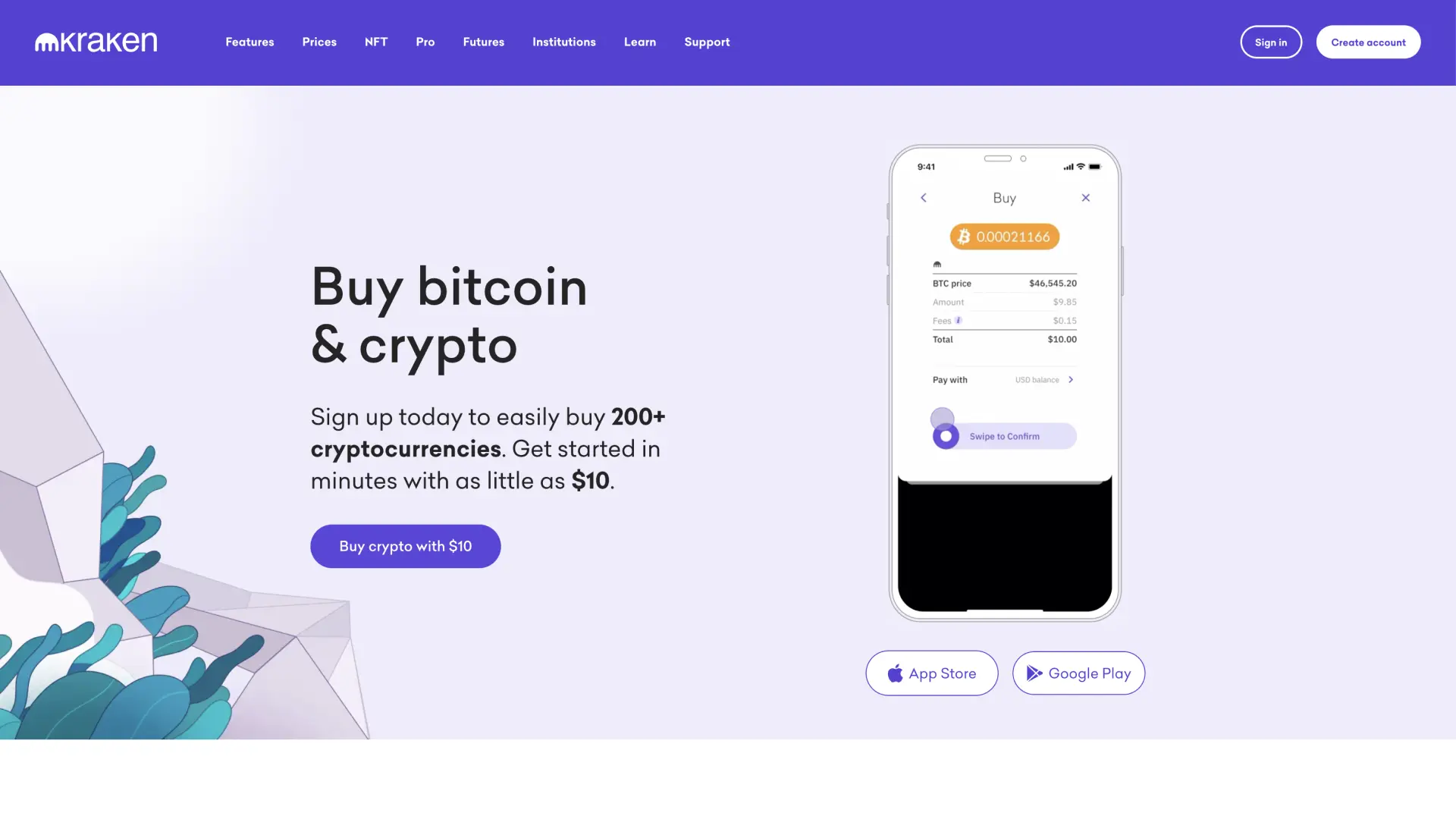

2. Kraken Exchange Review

Overview: Kraken was founded in 2011 and is headquartered in San Francisco, California. It is a centralized exchange that offers advanced trading features for experienced traders.

Tradable coins: Kraken supports over 70 cryptocurrencies, including Bitcoin, Ethereum, and Ripple.

Fees: Kraken’s fees vary depending on the trading volume and currency pair. The maker fee ranges from 0% to 0.16%, and the taker fee ranges from 0.10% to 0.26%.

Pros:

- Low fees compared to other exchanges

- Advanced trading features

- High liquidity

Cons:

- Not user-friendly for beginners

- Limited payment options

Visit Kraken

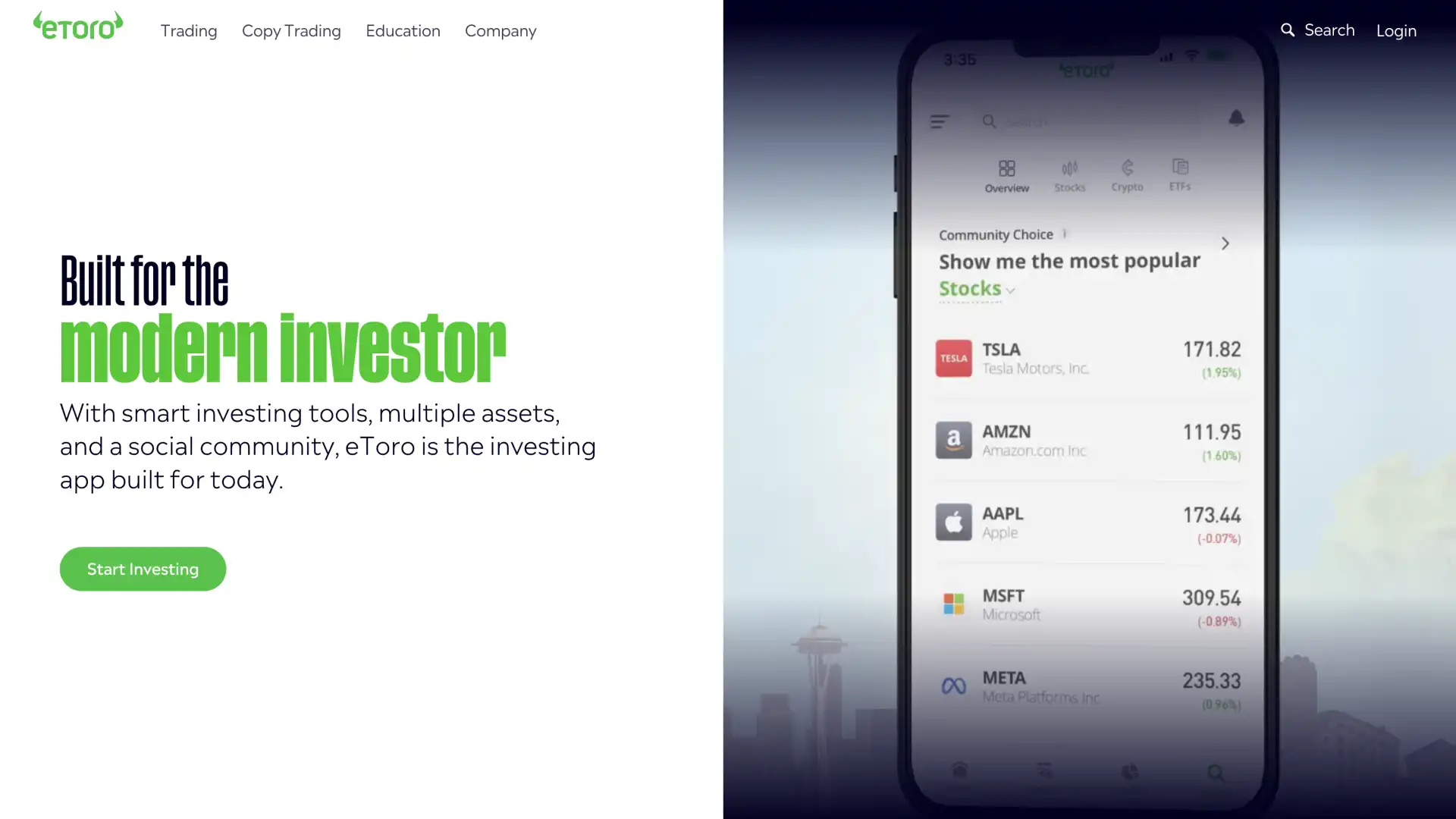

3. eToro Exchange Review

Overview: eToro was founded in 2007 and is headquartered in Tel Aviv, Israel. It is a social trading platform that allows users to buy, sell, and trade cryptocurrencies, as well as copy the trades of other successful traders.

Tradable coins: eToro supports over 120 cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin.

Fees: eToro charges a spread of about 0.75% for cryptocurrency purchases and sales. Additionally, there is a withdrawal fee of $5 and an inactivity fee of $10 per month after 12 months of inactivity.

Pros:

- User-friendly interface

- Social trading features

- Supports a wide range of cryptocurrencies

Cons:

- High fees compared to other exchanges

- Limited payment options

Visit eToro

4. Gemini Exchange Review

Overview: Gemini was founded in 2014 and is headquartered in New York, USA. It is a centralized exchange that focuses on security and regulatory compliance.

Tradable coins: Gemini supports over 40 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Fees: Gemini charges a maker fee of 0.35% and a taker fee of 0.35%. Additionally, there is a Gemini ActiveTrader fee of 0.25% for users who trade more than $500,000 per month.

Pros:

- High security and regulatory compliance

- Supports a limited but high-quality range of cryptocurrencies

Cons:

- High fees compared to other exchanges

- Limited payment options

Visit Gemini

5. Crypto.com Exchange Review

Overview: Crypto.com was founded in 2016 and is headquartered in Hong Kong. It is a centralized exchange that offers a mobile app for buying, selling, and trading cryptocurrencies.

Tradable coins: Crypto.com supports over 100 cryptocurrencies, including Bitcoin, Ethereum, and Binance Coin.

Fees: Crypto.com charges a maker fee of 0.10% and a taker fee of 0.16%. Additionally, there is a Crypto.com Visa Card fee of $0 to $50 depending on the card tier.

Pros:

- User-friendly mobile app

- Supports a wide range of cryptocurrencies

- Low fees compared to other exchanges

Cons:

- Limited payment options

- Not available in all countries

Visit Crypto.com

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

Choosing Your Crypto Purchase Platform

The first critical step towards buying cryptocurrencies involves selecting the right platform. With an array of platforms available, making an informed choice might seem challenging. This guide will help simplify this process by focusing on key factors you should consider.

Assessing cryptocurrency exchanges

Several cryptocurrency exchanges can facilitate your cryptocurrency purchase. Leading exchanges like Binance, Kraken, and Coinbase each have their distinct features. It’s paramount to evaluate these features to identify an exchange that aligns with your needs.

Importance of security

Security is a primary concern when picking a platform. It is recommended to opt for crypto exchanges that employ robust security measures like two-factor authentication and encryption. In addition, the platform’s security track record should be reviewed; exchanges with past security breaches might not be the most reliable choice.

User interface

An exchange’s user interface should be intuitive and easy to navigate, even for beginners. The platform should simplify the process of buying cryptocurrencies and managing your holdings.

Customer support

Prompt and efficient customer support enhances the overall user experience. Reviews from other users can provide insights into a platform’s customer service reputation.

Fee considerations

Fees can significantly impact your investment returns, so it’s essential to consider them before settling on a platform. I advise you to compare the fees among different platforms to identify the most cost-effective option.

Trading pair availability

Lastly, consider the available trading pairs on the platform. Some exchanges allow direct cryptocurrency purchases with fiat currencies, while others may necessitate the initial purchase of a different cryptocurrency like Bitcoin or Ethereum, which can then be traded for the desired cryptocurrency.

Payment method options

After selecting your platform, the next step is determining your preferred payment method. Different platforms offer various payment options, each with its unique benefits and disadvantages. Below, we will examine the common payment methods to guide you in making an informed decision.

Credit/Debit cards

Credit or debit cards are popular payment options due to their convenience. Most platforms support card purchases, making it a quick and simple method to buy cryptocurrencies. However, card purchases often attract higher fees, and some platforms may not support them. Privacy can also be a concern, since transactions are linked to your bank account.

Bank transfers

Bank transfers, especially wire transfers, are favored for their security and relatively low fees. They are ideal for larger transactions, but they can be slow, with processing times varying between banks and countries.

Other cryptocurrencies

If you already possess cryptocurrencies like Bitcoin or Ethereum, you can use them to buy other cryptocurrencies. This method offers quick transaction times and can provide more privacy than traditional banking methods. However, this option requires you to already own or purchase these other cryptocurrencies, which might involve additional steps.

Setting Up Your Payment Method

Once you’ve chosen your platform and payment method, it’s time to set it up. Each platform has its own setup process, but the following steps provide a general guide to setting up your payment method on a cryptocurrency exchange.

Account verification

Most platforms require you to verify your account before conducting transactions. This process often involves providing personal information, such as your full name, address, and a photo of your government-issued ID. This is referred to as the Know Your Customer (KYC) process, designed to prevent fraudulent activities.

Card setup

If you’ve opted to use a debit or credit card, you’ll need to enter the card details, including the card number, expiration date, and CVV. Some platforms might charge a small amount to your card to verify its validity. Ensure that your bank permits these transactions, as some banks might block them.

Bank transfer setup

For bank transfers, you’ll need to provide your bank account details, including the bank name, account number, and routing number. Verification may also be required, usually by confirming small test deposits made by the platform.

Cryptocurrency as a Payment Method

If you’ve opted to use other cryptocurrencies as a payment method, you’ll need to deposit them into your account on the platform. This generally involves generating a deposit address for the specific cryptocurrency and transferring your coins to this address.

Setting up your payment method might seem cumbersome, but it’s a crucial step in your journey towards buying cryptocurrencies. Always double-check your information and maintain your account’s security. Once you’ve completed this process, you’re one step closer to becoming a cryptocurrency holder.

Understanding Crypto Order Types

As soon as your payment method is set up, the next step is to place your order and buy your chosen cryptocurrency. This process might appear complex at first, but with some understanding, it can be simplified. Let’s delve into how you can do this.

Market orders

Market orders are the most straightforward way to buy cryptocurrencies. With a market order, you buy at the current market price. You specify the amount of the cryptocurrency you want to buy, and the platform matches you with a seller. This method is quick and easy, but you may end up paying more if the market price rapidly increases.

Limit orders

With a limit order, you specify the price at which you’re willing to buy the cryptocurrency. If the market price drops to your specified price, the platform automatically executes the order. This method offers more control over the price but may require patience, as the market price may not immediately reach your specified price.

Stop orders

A stop order, also known as a stop-loss order, lets you set a price to buy the cryptocurrency if the price starts to rise. This method is more advanced and is often used to minimize losses or secure profits during volatile market conditions.

Placing an order to buy cryptocurrencies may seem complex initially. Yet, with a bit of practice, you’ll become comfortable with the process. Always review your order before confirming to ensure you’re buying at the desired price and quantity.

Store Your Crypto Securely

After acquiring your chosen cryptocurrency, it’s crucial to secure your holdings. Like any digital asset, cryptocurrencies need to be stored securely to protect them from cyber threats. Let’s look at your storage options and some security tips.

Hot wallets

Hot wallets, which are connected to the internet, offer convenience and ease of access. They’re typically provided by cryptocurrency exchanges or third-party services. While they’re user-friendly, their constant online presence makes them more susceptible to hacks.

Cold wallets

Cold wallets, also known as offline wallets, provide enhanced security since they’re stored offline. They’re ideal for storing large amounts of cryptocurrency that you don’t intend to trade frequently. However, their recovery process can be complex if you forget your password or lose your backup phrase.

Hardware wallets

Hardware wallets are physical devices that store your cryptocurrencies offline until you connect them to the internet. They offer the security of cold wallets with the user-friendly interface of hot wallets. These wallets are often considered the most secure way to store cryptocurrencies, but can be more expensive than other options.

Wallet security

Regardless of your chosen wallet, following certain security practices is crucial. Use a strong, unique password and enable two-factor authentication. Stay vigilant against phishing attempts, and never share your private keys or backup phrases with anyone.

Scam awareness

Unfortunately, scams are common in the cryptocurrency world. Be skeptical of offers that appear too good to be true, and never send your cryptocurrencies to unfamiliar addresses.

Securing your cryptocurrencies is just as important as purchasing them. With the right storage and security measures in place, you can rest assured that your investment is safe.

Final Word

Selecting a crypto exchange involves weighing essential factors. Explore security, user interface, customer support, fees, available trading pairs, payment methods, and platform reliability. After choosing, setting up the preferred payment method, from credit cards to bank transfers or other cryptocurrencies, forms a crucial part of the investment process.

Understanding crypto order types and storing assets securely, whether via hot, cold, or hardware wallets, underscores the guide’s emphasis on safety measures. These insights not only simplify crypto purchasing but also emphasize the significance of security and informed decision-making in successful cryptocurrency investments.

Frequently Asked Questions

How can I keep my cryptocurrency investments secure in 2024?

Several steps can be taken to keep cryptocurrency secure. First, be sure to use strong, unique passwords on any and all crypto exchange accounts and wallets. Enable two-factor authentication (2FA) wherever possible. Physical security keys are the safest form of 2FA.

Second, keep the bulk of funds in an offline, cold storage device like a hardware wallet. This makes crypto storage much more secure. Third, never share information about your crypto activities on social media.

Can I buy fractional shares of cryptocurrencies in 2024?

Yes. It’s not necessary to buy one whole unit of any cryptocurrency. There may be minimum purchase amounts required by an exchange, but these tend to be very small. Users can get started with as little as $5 or $10, perhaps less.

What payment methods are accepted for buying crypto in 2024?

The accepted payment methods will vary from exchange to exchange. A few of the most common payment methods for buying crypto include bank transfer via ACH and PayPal.

Are there any fees associated with buying crypto in 2024?

Yes, all exchanges have some kind of fees associated with them. Fees will vary according to the exchange. The fee tends to scale with the size of the purchase.

How do I track the price and performance of my cryptocurrency investments in 2024?

There are a number of ways to track the performance of your crypto investments. One way would be to simply monitor prices manually on a site like Coinmarketcap.

Another might be to set up price alerts for certain coins on a financial site like TradingView. There are also several crypto portfolio tracker apps on the market that allow users to enter their trades. The app will then update itself with real-time price data, informing users of the performance of their portfolios.