How to Buy Bitcoin With a Credit Card in 2024

Wondering how to buy Bitcoin with a credit card in 2024? You’re in the right place!

In this guide, I will share the entire process, making it accessible to anyone interested in buying BTC with a credit card.

Bitcoin, also called “digital gold,” has revolutionized the financial landscape. Buying Bitcoin with your credit card is a simple yet crucial step towards your crypto journey.

Here’s what I’ll cover in this comprehensive guide:

- How to buy Bitcoin with a credit card: I’ll provide a step-by-step roadmap.

- Pros and cons of buying Bitcoin with credit cards: I’ll show you what are the pros and cons of buying BTC with a credit card.

- Can you buy Bitcoin with a credit card? I’ll address this common query of buying BTC with a credit card.

- What to do after buying Bitcoin: Once you’ve acquired your Bitcoin, I’ll guide you on the next steps.

Ready to dive in and embark on your Bitcoin buying journey? Let’s get started!

Best Bitcoin Exchanges That Support Credit Cards in 2024

With so many options, finding the best Bitcoin exchanges isn’t easy. However, the CCN team is confident that these are the best options on the market.

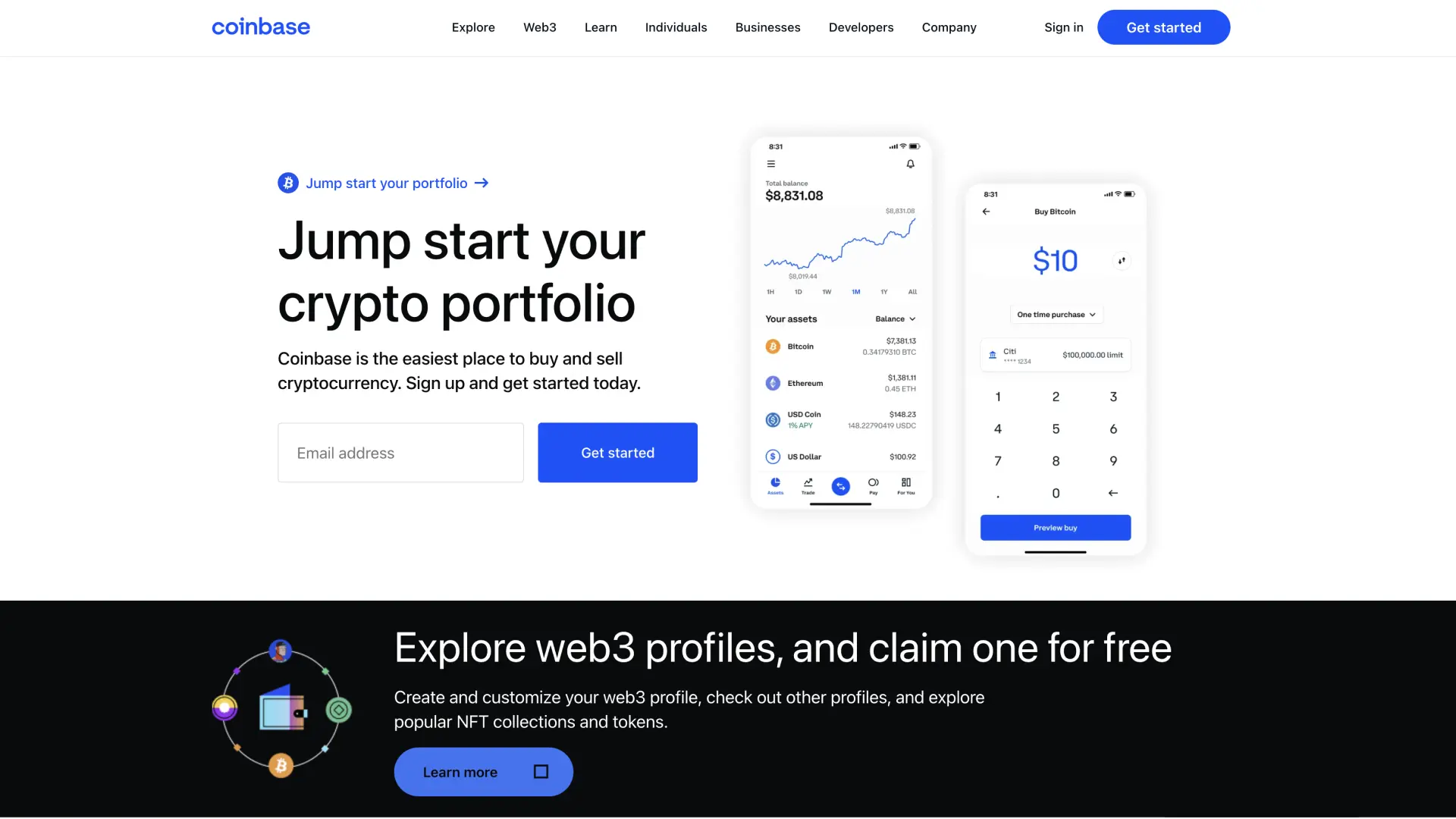

- Coinbase – Best for beginners and crypto exchanges

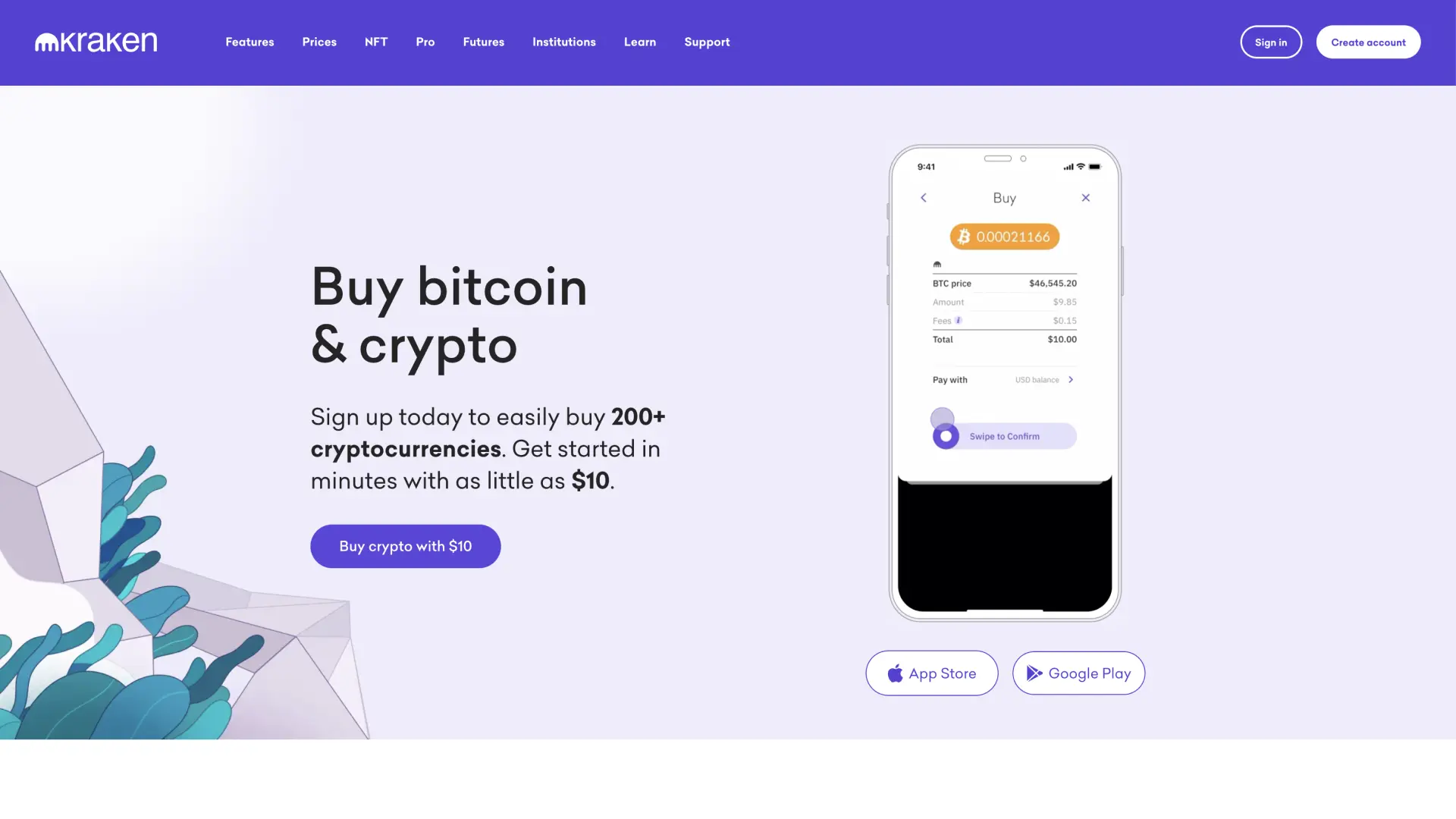

- Kraken – Best for low fees and experienced traders

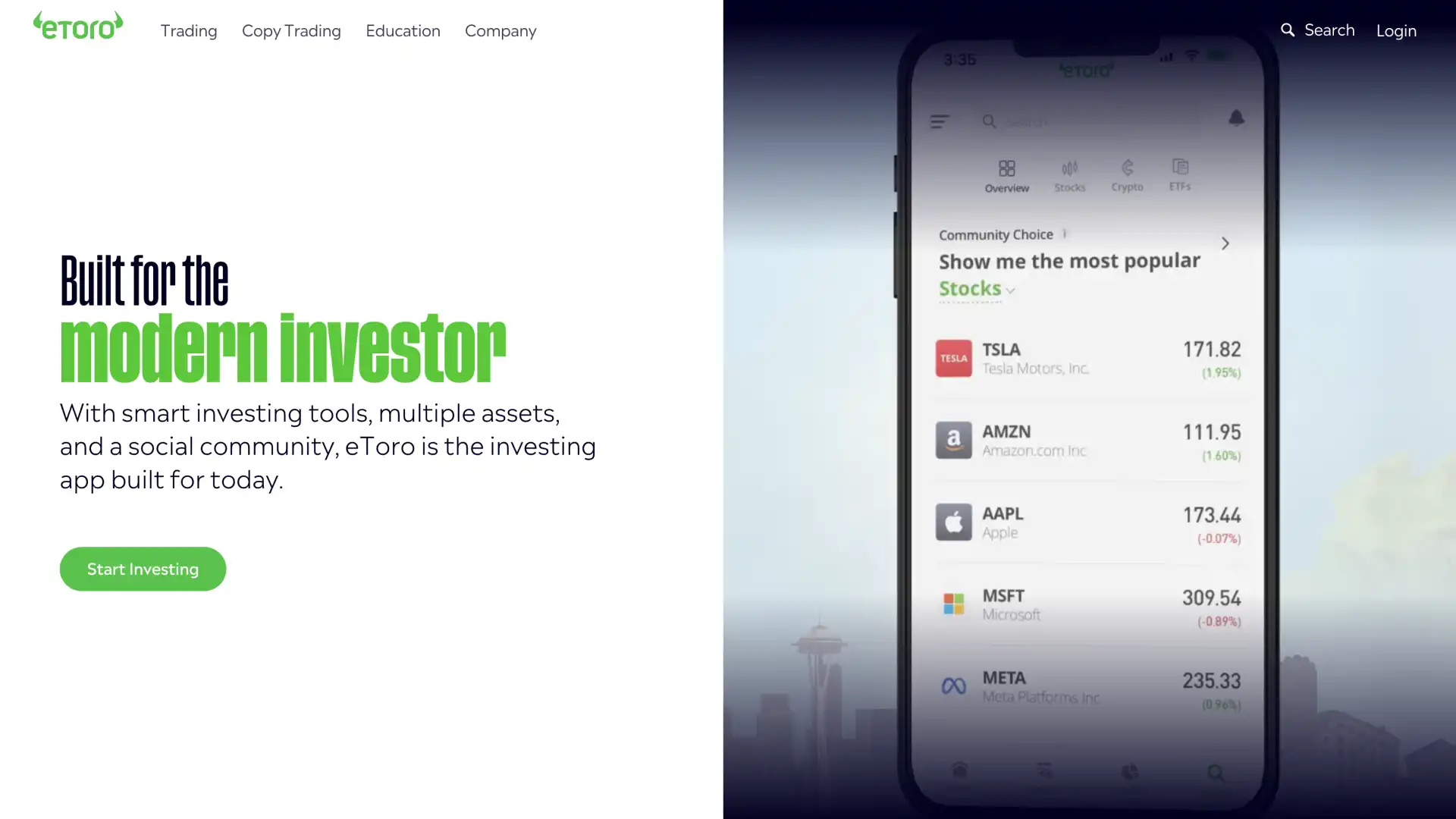

- eToro – Overall best crypto exchange

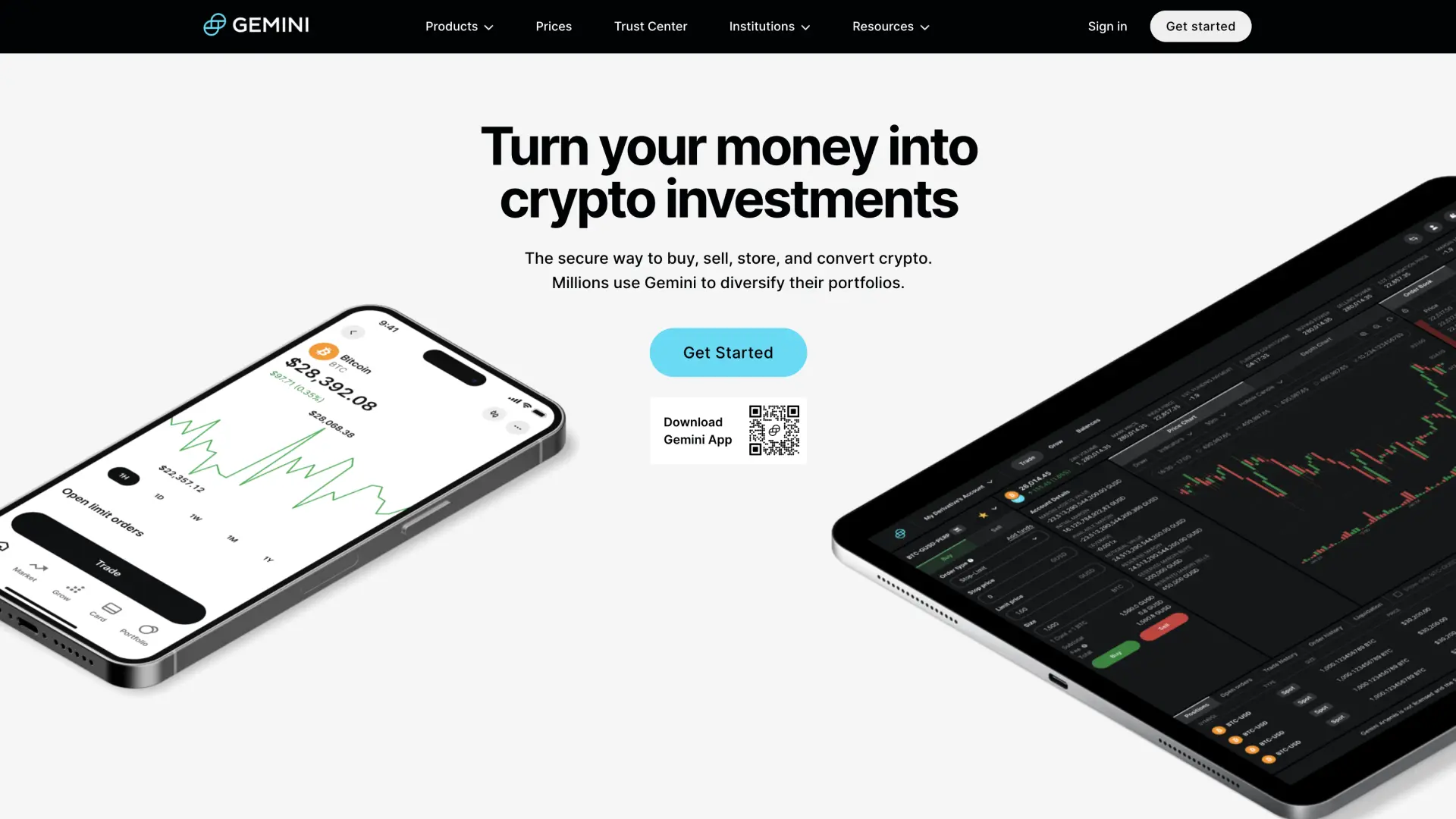

- Gemini – Best for security

- Crypto.com – Best for crypto exchanges and mobile app

Review of Our Top 5 Bitcoin Exchanges

Before buying digital coins, pause for a few minutes and look at snapshots of each of the Bitcoin exchanges featured on this page.

1. Coinbase Exchange Review

Overview: Coinbase was founded in 2012 and is headquartered in San Francisco, California. It is a centralized exchange that allows users to buy, sell, and trade cryptocurrencies.

Tradable coins: Coinbase supports over 200 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Fees: Coinbase charges a spread of about 0.5% for cryptocurrency purchases and sales. Additionally, there is a Coinbase fee of $0.99 to $2.99 depending on the transaction amount. Coinbase Pro, the exchange’s advanced trading platform, charges a maker fee of 0.5% and a taker fee of 0.5%.

Pros:

- User-friendly interface

- High liquidity

- Supports a wide range of cryptocurrencies

Cons:

- High fees compared to other exchanges

- Limited payment options

2. Kraken Exchange Review

Overview: Kraken was founded in 2011 and is headquartered in San Francisco, California. It is a centralized exchange that offers advanced trading features for experienced traders.

Tradable coins: Kraken supports over 70 cryptocurrencies, including Bitcoin, Ethereum, and Ripple.

Fees: Kraken’s fees vary depending on the trading volume and currency pair. The maker fee ranges from 0% to 0.16%, and the taker fee ranges from 0.10% to 0.26%.

Pros:

- Low fees compared to other exchanges

- Advanced trading features

- High liquidity

Cons:

- Not user-friendly for beginners

- Limited payment options

3. eToro Exchange Review

Overview: eToro was founded in 2007 and is headquartered in Tel Aviv, Israel. It is a social trading platform that allows users to buy, sell, and trade cryptocurrencies, as well as copy the trades of other successful traders.

Tradable coins: eToro supports over 120 cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin.

Fees: eToro charges a spread of about 0.75% for cryptocurrency purchases and sales. Additionally, there is a withdrawal fee of $5 and an inactivity fee of $10 per month after 12 months of inactivity.

Pros:

- User-friendly interface

- Social trading features

- Supports a wide range of cryptocurrencies

Cons:

- High fees compared to other exchanges

- Limited payment options

4. Gemini Exchange Review

Overview: Gemini was founded in 2014 and is headquartered in New York, USA. It is a centralized exchange that focuses on security and regulatory compliance.

Tradable coins: Gemini supports over 40 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Fees: Gemini charges a maker fee of 0.35% and a taker fee of 0.35%. Additionally, there is a Gemini ActiveTrader fee of 0.25% for users who trade more than $500,000 per month.

Pros:

- High security and regulatory compliance

- Supports a limited but high-quality range of cryptocurrencies

Cons:

- High fees compared to other exchanges

- Limited payment options

5. Crypto.com Exchange Review

Overview: Crypto.com was founded in 2016 and is headquartered in Hong Kong. It is a centralized exchange that offers a mobile app for buying, selling, and trading cryptocurrencies.

Tradable coins: Crypto.com supports over 100 cryptocurrencies, including Bitcoin, Ethereum, and Binance Coin.

Fees: Crypto.com charges a maker fee of 0.10% and a taker fee of 0.16%. Additionally, there is a Crypto.com Visa Card fee of $0 to $50 depending on the card tier.

Pros:

- User-friendly mobile app

- Supports a wide range of cryptocurrencies

- Low fees compared to other exchanges

Cons:

- Limited payment options

- Not available in all countries

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

Why Trust Us

At CCN, we understand how important trust is when dealing with cryptocurrencies. We’re committed to giving you reliable advice and trustworthy information on how to buy Bitcoin with a credit card.

We thoroughly examine different aspects, like interest rates, the types of cryptocurrencies you can use, the terms of the transactions, how secure it is, any fees involved, and how good their customer support is.

What sets us apart is that we don’t just talk about it; we get hands-on. Our CCN team members actually use these platforms with their own money to see how they work. Whether you’re new to crypto or an experienced user, our reviews have the information you need.

Pros and Cons of Buying Bitcoin with Credit Cards

Pros

- Instant transactions: When you buy Bitcoin with a credit card transactions happen almost instantly, so you can start your crypto journey without delay.

- Convenience and accessibility: Credit cards are like your golden tickets to the crypto world. They’re widely accepted, making buying Bitcoin a breeze.

- Potential rewards and cashback: Some credit cards offer rewards and cashback. It’s like getting a little bonus for your crypto purchases.

Cons

- Higher fees compared to other payment methods: Credit card transactions often have higher fees compared to other methods, like bank transfers. They can be foreign exchange fees, cash advance fees (3 to 5% of the amount withdrawn), and higher interest rates.

- Security concerns and potential fraud: With great convenience comes great responsibility. Credit card transactions can be vulnerable to fraud. Stay vigilant and protect your crypto.

- Limits on purchase amounts: Your credit card may have limits on how much Bitcoin you can buy. Be aware of these limits.

Bitcoin and Credit Cards

Now, let’s see why people are so interested in using Bitcoin , the world’s largest coin by market capitalization:

- The Rise of Bitcoin and its Popularity: Bitcoin started as an idea and has become a big deal in the financial world. People like it because it’s not controlled by any single person or group. Instead, it uses something called blockchain to operate.

- Convenience of Buying Bitcoin with Credit Cards: These days, you can easily buy Bitcoin using your credit card. This makes it simple for anyone to get involved in the world of cryptocurrencies.

- Importance of Understanding the Process and Potential Risks: While Bitcoin is exciting you should understand how it works and be aware that its value can fluctuate which brings risks.

Bitcoin came into the world in 2008, thanks to anonymous Satoshi Nakamoto. It’s not like regular money; it’s digital and doesn’t need any central authority. Instead, it uses blockchain technology to keep track of transactions.

Credit cards have revolutionized the way we manage money, offering a convenient alternative to cash for everyday purchases as well as larger expenditures. They function as a type of short-term loan, allowing users to make purchases up to a certain limit and pay back the balance later, often with interest.

People use credit cards for all sorts of purchases, from groceries to gadgets. But did you know you can use them to buy Bitcoin too?

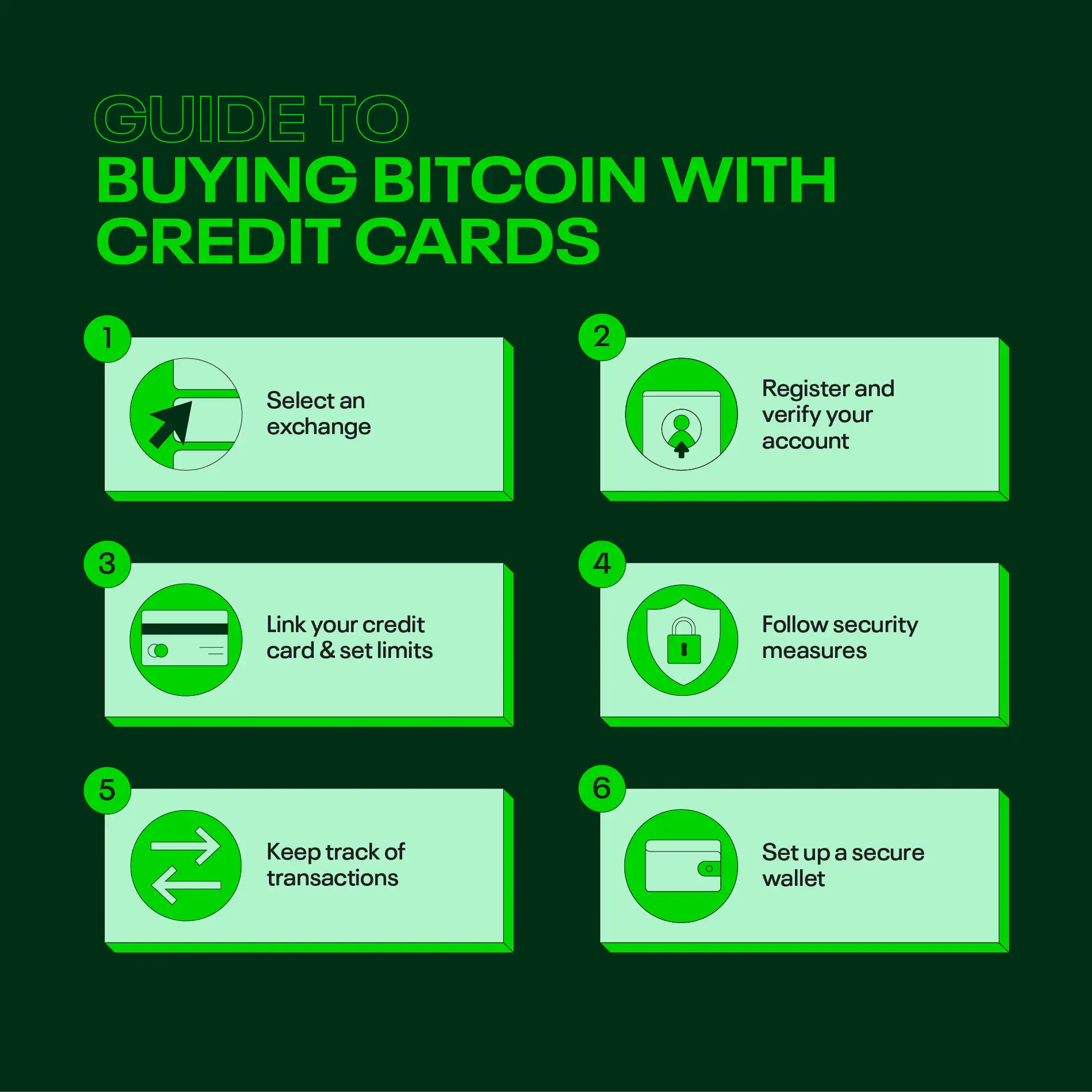

Step-by-Step Guide to Buying Bitcoin with Credit Cards

So, if you’re interested in using your credit card to buy Bitcoin, here’s what you need to do to get ready:

- Research and choose a reputable cryptocurrency exchange: You’ll need to find a trustworthy place to buy Bitcoin with your credit card. Not all exchanges offer this option.

- Understand exchange fees, rates, and limits: Know what it will cost you, how much you can buy, and at what rate. Fees can vary from one exchange to another.

- Set up a secure cryptocurrency wallet: You’ll need a digital wallet to keep your Bitcoin safe. Think of it like a digital bank account for your crypto.

- Ensure your credit card is eligible for international transactions: You might need to check with your credit card company. See if it can be used for buying Bitcoin from an international exchange.

Now that you’re all set to buy Bitcoin with your credit card let’s explore the process step by step.

Create an account

Register on the chosen cryptocurrency exchange: Look for a reputable cryptocurrency exchange platform. Then you should search for a button that says “Sign Up” or “Register.” Click on it and you’ll be asked for your email address and password.

Add a credit card

Link your credit card to your exchange account: Once your account is up and running, log in and find the section where you can add a payment method. Go ahead and choose “Credit Card.”

Now you type in some card details like the card number, CVV, expiration date, and billing address. This helps the exchange make sure your card is real and links it successfully. You might have to make a small confirmation transaction as well, depending on your card and the exchange.

Place an order

Navigate to the trading or buy/sell section: After you’ve linked your credit card, head over to the exchange’s trading area. Here, you can pick the option to buy Bitcoin.

Choose Bitcoin as the desired cryptocurrency: You’ll see a list of cryptocurrencies available. Find Bitcoin and click on it.

Enter the amount in USD or your local currency: Tell the exchange how much Bitcoin you want to buy. You can usually type in the amount in US dollars or whatever currency you use.

Select the credit card as the payment method: When it comes to paying, pick your linked credit card as the payment method.

Review and confirm the purchase

Double-check the order details and exchange rate: Right before you go through with the transaction, check everything again. Make sure the amount of Bitcoin you’re buying is correct, and don’t forget to check the exchange rate.

Confirm the purchase and get a summary: If everything looks good, hit that confirm button. The exchange will give you a summary of your purchase that you can keep for your records.

Wait for confirmation

The time required for the transaction to be confirmed: Bitcoin transactions have to get the green light from the network. This process, called “confirmation,” can take anywhere from 10 to 30 minutes.

Monitor the transaction status on the exchange: Keep an eye on how things are going by logging back into your exchange account. Your transaction’s status will change from “Pending” to “Completed” once your BTC is in.

Safety and security measures

In the crypto world, safety and security are super important. Here’s what you need to know:

- Importance of two-factor authentication (2FA): Think of 2FA as your extra layer of armor. It adds a second step to your login process, like a code sent to your phone.

- Use hardware wallets for added security: A hardware wallet is like your secret vault. It’s a physical device that stores your Bitcoin offline, away from sneaky online hackers.

- Regularly updating passwords and maintaining security hygiene: Just like changing the locks on your doors, make it a habit to update your passwords. Use strong, unique ones for each service you use. Also, keep your computer and software up to date.

- Be cautious of phishing and scams: There are pirates out there trying to trick you into losing crypto. Always double-check website URLs and never share your private keys

Fees and costs

All good things come at a cost, right? Here’s what to watch out for:

- Understand the exchange fees for credit card transactions: When you buy Bitcoin with your credit card, the exchange might ask for a small fee.

- Additional fees associated with credit card purchases: Credit cards can sometimes have their own fees for using them to buy Bitcoin. These can vary depending on your card provider.

- Consider the overall cost of the transaction: Don’t focus on one fee; think about the big picture. Factor in all the fees you might encounter during the transaction.

- You can only buy Bitcoin with a credit card if both the credit card issuer and crypto exchange allow it.

There will be multiple fees involved, including:

- Cash advance fees

- Extra exchange fees

- Foreign exchange fees (for exchanges based outside the U.S.)

- Interest fees over time

Most cash advances come with a fee of 3% or 5%. In addition, an exchange might charge 5% for using a credit card to buy Bitcoin. Using a credit card for Bitcoin purchases could, therefore, cost an extra 10% right off the bat.

Tips for Successful Transactions

Here are some useful tips to help you manage the market:

Monitor the market for favorable exchange rates

Stay sharp and watch the market. Look for the best time to buy Bitcoin when exchange rates are in your favor. Patience can pay off.

Avoid impulse buying and conduct thorough research

Don’t let FOMO drive your decisions. Do your homework, research, and plan your purchases wisely. Knowledge is power.

Consider alternative payment methods for larger purchases

For significant Bitcoin buys, explore alternative payment methods. They might offer better rates or lower fees. It’s like shopping around for a good deal.

Keep track of your transactions for tax purposes

Taxes are a part of life, even in the crypto world. Keep records of your transactions. It’ll save you headaches when tax season rolls around.

So You’ve Bought Bitcoin, What To Do Next?

Now that you’ve bought Bitcoin with your credit card, you can do several things. First things first, focus on keeping your BTC safe. Then, you can spend it or HODL.

- Move your Bitcoin to a cold wallet – These wallets are offline and highly secure.

- Learn different ways to use Bitcoin – Bitcoin is versatile. You can hold onto it, spend it, invest in it, or trade it. Explore your options and find what suits your crypto lifestyle.

- Diversify – Make sure your portfolio includes at least 5 different coins- As I always say, don’t put all your crypto eggs in one basket. Diversify your portfolio with different coins to mitigate risks.

- Stay informed about market trends and regulatory changes – Stay sharp and in the loop. Market trends and regulations can change quickly. Being informed helps you make smarter moves in this dynamic landscape.

Over To You

You’ve now navigated the exciting world of learning how to buy Bitcoin with a credit card. I’ve covered the entire journey, from creating your account to securing your Bitcoin and beyond.

Prioritize security with two-factor authentication, hardware wallets, and good online hygiene. Be aware of fees and costs associated with credit card purchases.

Understand the advantages of instant transactions and accessibility. But also be mindful of higher fees and security concerns. Follow our tips to make your Bitcoin purchases smooth.

Frequently Asked Questions

Are there any limits on purchasing Bitcoin with a credit card?

Because crypto purchases are treated as cash advances, the amount of Bitcoin you can purchase with a credit card will be limited to the maximum cash advance available on your card. This amount will vary depending on your cardholder agreement.

How can I ensure the security of my credit card information when buying Bitcoin?

When using a credit card to buy Bitcoin, users entrust their sensitive information to the exchange. Once a purchase has been made, it’s up to the exchange to keep that data secure. Use a reputable and exchange and research its privacy and security practices.

What are some alternative payment methods to buy Bitcoin if I don't have a credit card?

The most common payment methods used to buy Bitcoin other than a credit card include bank transfer via ACH and PayPal. If you already have other cryptocurrencies such as stablecoins, these can also be deposited to an exchange and used to buy Bitcoin.

Can I use a prepaid credit card to buy Bitcoin?

Yes, prepaid cards can be used to buy Bitcoin. Find the right exchange and register. Verify your account and connect your prepaid card. Select the crypto you want to purchase and follow the steps to buy.