How To Buy Crypto With a Credit Card in 2024

Do you want to learn how to buy crypto with a credit card? You’ve come to the right place.

In this guide, I’ll take you through the steps to buying cryptocurrency using your credit card. We have also put together a list of the top exchanges that support credit card transactions. Continue reading to learn more about:

- Step-by-step guide on how to buy crypto with credit card

- Safety and security measures

- Fees and costs

- Pros and cons of buying crypto using credit cards

Best Sites To Buy Crypto With Credit Card in 2024

These are the top recommended sites where you can buy cryptocurrency using credit cards.

- Coinbase – Best for beginners and overall cryptocurrency exchange

- Crypto.com – Best for a wide selection of cryptocurrencies and rewards for Crypto.com Visa Card users

- Binance – Best for zero fees trading and a wide range of cryptocurrencies

- KuCoin – Best for beginners and a wide library of altcoins at low fees

- Bitpanda – Best for buying bitcoins and various other cryptos with a credit card

Review of our top 5 Best Sites To Buy Crypto With Credit Card

Our team has compiled reviews of the exchanges where you can buy crypto with a credit card.

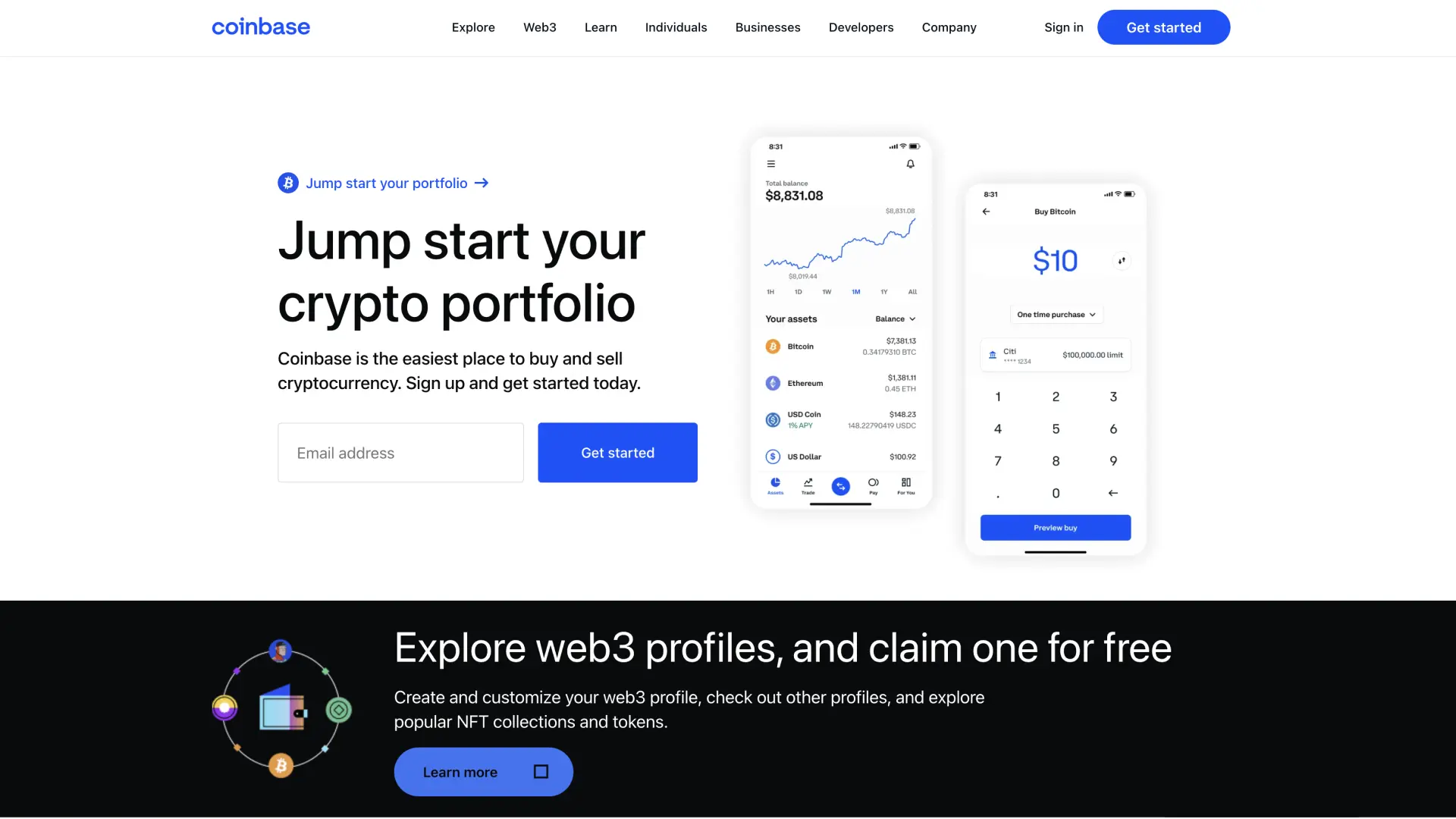

1. Coinbase Exchange Review

Overview: Founded in 2012, Coinbase is a US-based cryptocurrency exchange that operates in over 100 countries. It is one of the most popular and user-friendly exchanges for beginners.

Tradable coins: Over 50 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

Fees: Coinbase charges a spread of about 0.5% for buying and selling cryptocurrencies, as well as a flat fee of up to 3.99% for credit/debit card purchases. These fees are relatively high compared to other exchanges.

Pros:

- User-friendly interface

- High liquidity

- Insured deposits

- Wide range of supported countries.

Cons:

- High fees

- Limited selection of cryptocurrencies

- Occasional downtime during high traffic periods.

2. Crypto.com Exchange Review

Overview: Crypto.com is a Hong Kong-based cryptocurrency exchange that offers a wide range of services, including a Visa card that rewards users with cryptocurrency cashback.

Tradable coins: Over 100 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Fees: Crypto.com charges a 0.4% trading fee for makers and takers, with discounts available for users who hold their native CRO token. Credit/debit card purchases have a fee of 3.5%.

Pros:

- Wide selection of cryptocurrencies

- Rewards for using the Crypto.com Visa card

- Low trading fees for CRO holders

Cons:

- Limited availability in some countries

- High credit/debit card fees

- Occasional issues with customer support

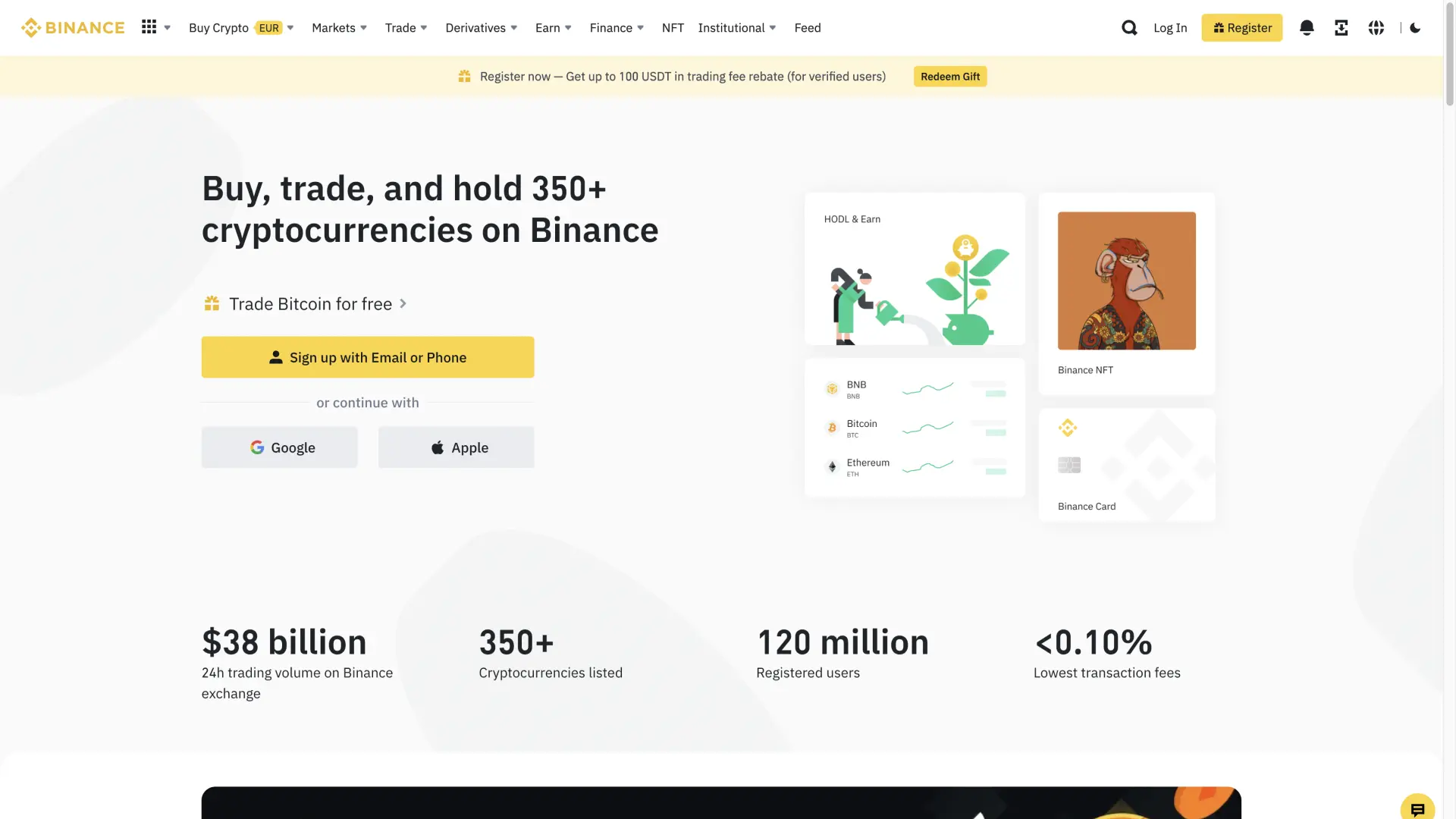

3. Binance Exchange Review

Overview: Founded in 2017, Binance is a global cryptocurrency exchange that offers a wide range of trading pairs and advanced trading features.

Tradable coins: Over 500 cryptocurrencies, including Bitcoin, Ethereum, and Binance Coin.

Fees: Binance charges a 0.1% trading fee for makers and takers, with discounts available for users who hold their native Binance Coin (BNB) token. Credit/debit card purchases have a fee of 3.5%.

Pros:

- Wide selection of cryptocurrencies

- Low trading fees

- Advanced trading features

Cons:

- Limited customer support

- Occasional security issues

- Complex interface for beginners

4. KuCoin Exchange Review

Overview: Founded in 2017, KuCoin is a Singapore-based cryptocurrency exchange that offers a wide range of altcoins at low fees.

Tradable coins: Over 400 cryptocurrencies, including Bitcoin, Ethereum, and KuCoin Shares.

Fees: KuCoin charges a 0.1% trading fee for makers and takers, with discounts available for users who hold their native KuCoin Shares (KCS) token. Credit/debit card purchases are not available.

Pros:

- Wide selection of altcoins

- Low trading fees

- User-friendly interface for beginners

Cons:

- Limited selection of major cryptocurrencies

- Occasional security issues

- Limited customer support

5. Bitpanda Exchange Review

Overview: Founded in 2014, Bitpanda is an Austria-based cryptocurrency exchange that specializes in buying and selling bitcoins and other cryptocurrencies with a credit card.

Tradable coins: Over 50 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Fees: Bitpanda charges a spread of about 1.49% for buying and selling cryptocurrencies with a credit card. Other payment methods have lower fees.

Pros:

- User-friendly interface

- Fast verification process

- Wide range of payment options

Cons:

- Limited selection of cryptocurrencies

- High credit card fees

- Limited availability in some countries

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

Why You Should Consider Using a Credit Card

Buying cryptocurrencies with a credit card can be a convenient and fast way to invest in digital assets. Many cryptocurrency exchanges support this payment method, making it easier than ever to buy cryptos.

But, it is important to understand the fees, rates, and limits associated with using a credit card for these transactions.

While there are some benefits to using a credit card, such as potential rewards or cashback, there are also drawbacks, including high fees and interest rates.

Ultimately, it is up to you to decide whether buying cryptocurrencies with a credit card is the right choice for you.

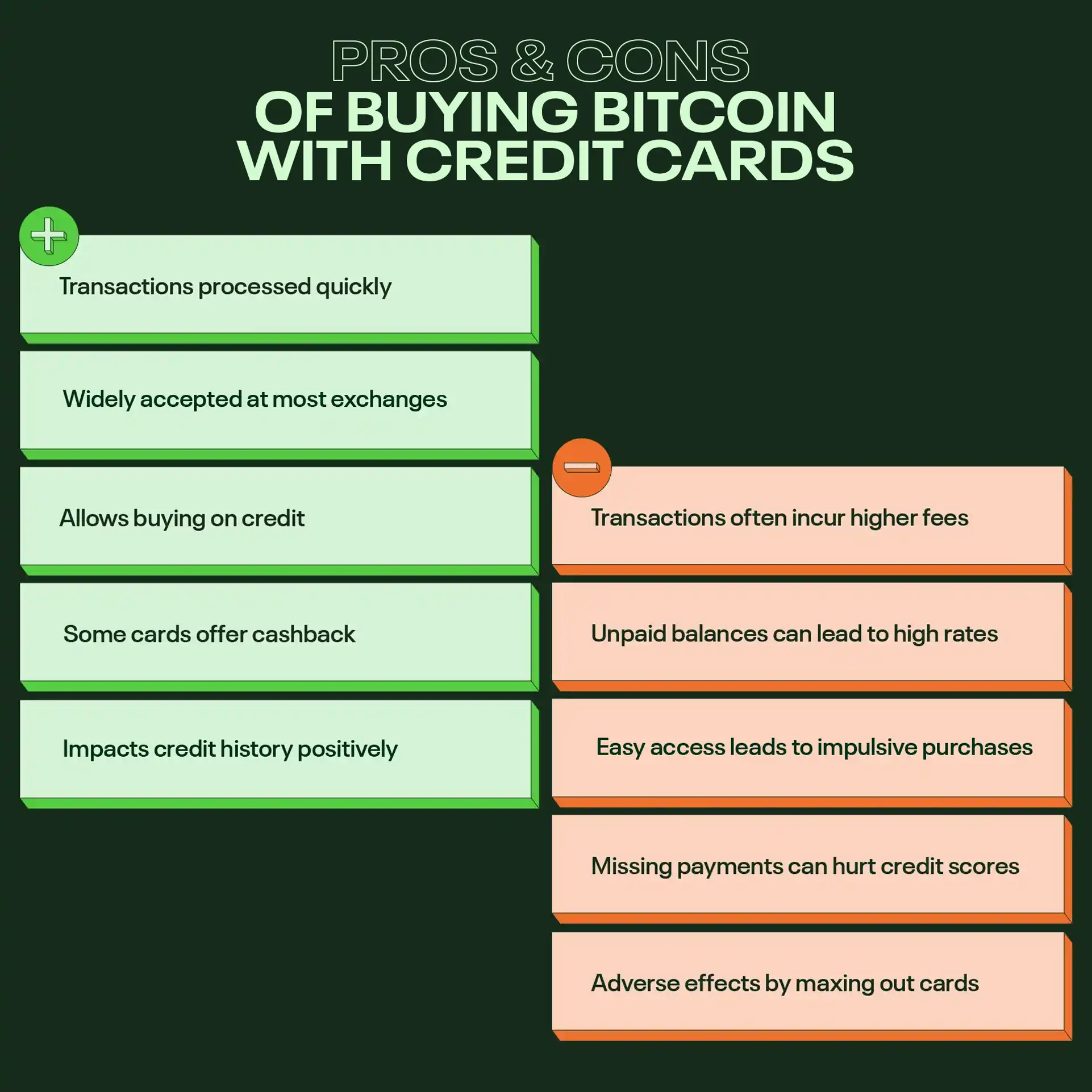

Pros and Cons of Buying Bitcoin with a Credit Card

Top crypto exchanges allow you to purchase Bitcoin with a credit card. However, using a credit card has its advantages and disadvantages.

Pros of buying crypto with a credit card

- Instant access: Credit card transactions are often processed almost instantly, allowing you to buy BTC when the market is just right. This is unlike bank transfer transactions, which can take a few days.

- Accessibility: Credit cards are widely accepted on most cryptocurrency exchanges. This makes it easy for beginners to enter the market without the need for complex transactions.

- Credit line: Using a credit card doesn’t require you to have the funds readily available in your bank account. You can essentially buy cryptos on credit, which can be helpful if you’re confident in your investment strategy.

- Rewards and cashback: Some credit cards offer rewards or cashback programs. As such, you can earn perks or even a percentage of your purchases back in cash. This can make buying crypto a little more cost-effective.

- Build credit: Responsible use of your credit card for crypto purchases can contribute positively to your credit history.

Cons of buying crypto with credit card

- High fees: Credit card transactions for cryptocurrencies often come with higher fees compared to other payment methods. These fees can eat into your investment, especially if you are a frequent trader.

- Interest rates: If you don’t pay off your credit card balance in full each month, you may incur high interest rates on crypto purchases. This potentially leads to substantial interest charges over time.

- Risk of overspending: The ease of using credit cards can lead to impulsive buying and overspending. Cryptocurrencies are highly volatile. Investing more than you can afford to lose can be financially risky.

- Cash advance fees: Some credit card companies treat crypto purchases as cash advances. They subject them to additional fees and higher interest rates.

- Credit score impact: Buying cryptocurrencies with your credit card can affect your credit score, especially if you max out your credit limit or miss payments. A lower credit score can have long-term financial consequences.

What You Need to Know Before Purchase

In this section, I will take you through some of the key things you need to know about how you can buy crypto with a credit card.

Research and choose a reputable cryptocurrency exchange

There are many crypto exchanges where you can buy cryptocurrency with a credit card. Look for exchanges that are well-established and have a good reputation.

Read reviews and check online forums. Also, ask for recommendations from experienced crypto enthusiasts. We have also compiled for you a list of the best sites that accept credit card crypto purchases.

What other factors should you consider when selecting an exchange?

Security matters

Make sure the exchange takes security seriously. Look for features like two-factor authentication (2FA) and cold storage for your funds.

User-friendly interface

As a beginner, you’ll want to find a crypto exchange with a user-friendly interface.

Understand exchange fees, rates, and limits

Before you hit that “Buy” button, it’s important to understand the financial aspects.

- Fees: Every exchange charges transaction fees. These can include trading fees, withdrawal fees, and deposit fees. Be sure to read the fine print to know what costs you should factor in.

- Rates: Cryptocurrency prices can vary slightly from one exchange to another. Keep an eye on the exchange rates to get the best deal. Some exchanges even offer price alerts to help you make informed decisions.

- Limits: Exchanges often have limits on how much you can buy or withdraw at once. Make sure these limits align with your investment goals.

Understanding your credit card terms

Your credit card is your trusty tool for buying cryptocurrencies. But it comes with its own set of rules. Here’s what you need to know:

- Interest rates: Credit cards also have interest rates. These rates tend to be higher, especially when used for crypto investments. Unfortunately, high interest rates can eat into your profits.

- Cash advance fees: Some credit card companies consider buying cryptocurrencies as a cash advance. This can come with additional fees and higher interest rates.

- Credit score impact: Be aware that using your credit card for crypto purchases can affect your credit score.

Checking credit card limits and available credit

Yes, you can buy crypto with a credit card, but what is your card limit?

- Available credit: Check your available credit on your credit card. You don’t want to max it out on buying crypto and then struggle with unexpected expenses.

- Daily purchase limits: Some credit cards have daily purchase limits. Make sure your intended crypto purchase doesn’t exceed these limits.

- Setting a budget for crypto purchases: This is perhaps the most crucial step. Never invest more than you can afford to lose. Crypto markets are volatile, and prices can change drastically. This is why it is important to set a budget that won’t affect your daily life or financial stability.

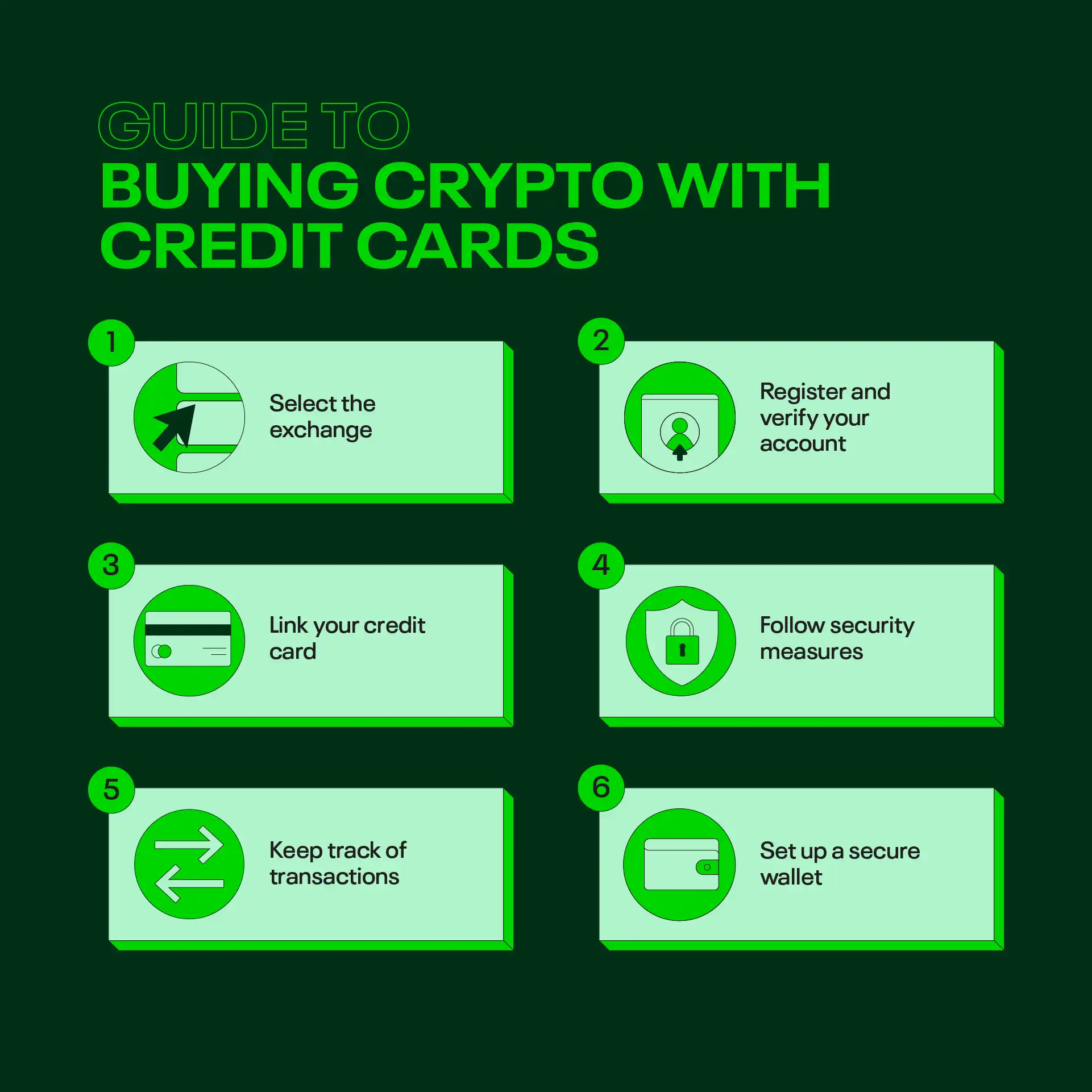

Step-by-Step Guide on How to Buy Crypto with a Credit Card

Ready to buy your crypto? In this section, we will discuss the steps to follow and what you should consider in each stage.

Step 1: Choosing a cryptocurrency exchange

Before we can dive into buying cryptos, you first have to settle on the right platform.

Research the exchange’s reputation. Look for reviews and ratings online. Ensure the exchange is regulated in your country. It is also important to check that the site is licensed. Regulation can provide an extra layer of security.

Comparing fees and supported cryptocurrencies

Compare the fee structures of different exchanges. Pay attention to trading fees, deposit fees, and withdrawal fees.

Make sure the exchange supports the cryptocurrencies you want to buy. Some exchanges have a broader selection than others.

Reading user reviews and checking for security measures

Read user reviews and forum discussions. These can give you valuable insights into the exchange’s performance and user experiences.

Check if the exchange uses security features like cold storage for funds and two-factor authentication (2FA). Your crypto’s safety is non-negotiable.

Selecting an exchange that accepts credit card payments

Ensure the exchange you choose accepts credit card payments. Not all exchanges do, so double-check this to avoid disappointment.

Step 2: Registering and verifying your account

Once you have settled on your preferred exchange, it’s time to create your account. The registration process is often straightforward, and you only need to fill in a few details.

How to register

Go to the exchange’s website and look for the sign-up button. It’s usually prominently displayed. Provide the required information, which typically includes your name, email address, and password.

Check your email for a verification link. Click on it to confirm your registration.

Complete identity verification (KYC) requirements

You’ll need to provide some personal documents, such as a government-issued ID or passport. Follow the exchange’s instructions for uploading these securely.

The exchange will review your documents. This process can take a little time, so be patient.

Another key security measure is enabling 2FA. This adds an extra layer of protection. You’ll typically use an authentication app on your phone to generate codes.

Step 3: Link your credit card

Now that you’ve done the groundwork, it’s time to connect your credit card to your chosen cryptocurrency exchange. This process is essential for making seamless transactions.

Your credit card information is sensitive, so make sure it’s entered securely:

Ensure that you’re on the exchange’s official website and the connection is secure. Look for “https” and the padlock icon in the address bar.

Follow the prompts to enter your credit card details accurately. This typically includes your card number, expiration date, and the three-digit CVV code on the back.

Verify your card details before confirming.

Verifying the card with the exchange

Verification is a crucial step to ensure the legitimacy of your credit card. Some exchanges might place a small, temporary charge on your credit card (usually less than a dollar). This is to confirm that your card is valid.

Monitor your credit card statement for this temporary charge. It will usually have a code you need to confirm on the exchange’s platform.

Enter the code from your statement on the exchange’s website to complete the verification process.

Confirming credit card limits and fees on the exchange

Before you start buying cryptocurrencies, let’s get a handle on your credit card’s limits and the associated fees:

- Check the daily and monthly transaction limits for your credit card on the exchange. Make sure they align with your purchasing goals.

- Review the fees associated with using your credit card for cryptocurrency purchases. These fees can vary between exchanges.

- If you’re buying cryptocurrencies in a currency other than your credit card’s native currency, be aware of potential currency conversion fees. These can add up, so factor them into your budget.

Step 4: Making a purchase

It’s time to take the plunge and make your first cryptocurrency purchase.

Before you jump in, take a moment to decide which cryptocurrency you want to buy and how much of it.

- Choose your crypto: Go to the exchange’s trading platform and select the cryptocurrency you want to purchase. Popular choices include Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). But there are thousands to choose from.

- Enter the amount: Specify the amount of cryptocurrency you want to buy. You can enter it in the cryptocurrency itself or its equivalent in your local currency.

- Check the rates: Pay attention to the exchange rate and the current market price. Crypto prices can change rapidly. So be sure you’re comfortable with the rate at the time of purchase.

- Confirm the transaction: Double-check all the details of your transaction. Make sure you’re buying the right cryptocurrency in the correct amount.

- Click the “Buy” or “Purchase” button to confirm your intention to buy: This is the point of no return, so be sure everything looks good.

- Review the transaction details: Ensure that the amount you’re paying matches the amount of cryptocurrency you’re receiving. You might receive a confirmation message or email. Keep this information for your records.

Security best practices

Congratulations on your first cryptocurrency purchase. Now, let’s talk about keeping your investment safe and secure. The crypto world, while exciting, can be a bit like the Wild West when it comes to security. Below are some essential practices to keep your digital assets locked down.

Importance of two-factor authentication (2FA)

Think of 2FA as an extra layer of protection for your cryptocurrency accounts.

Even if someone gets hold of your login credentials, they won’t be able to access your account without the second verification step. This can prevent unauthorized access and protect your investments.

Most exchanges offer 2FA as an option. You’ll typically use an authentication app on your phone to generate unique codes for each login.

Avoid keeping too much on an exchange

Cryptocurrency exchanges provide an efficient platform where you can buy, sell, and trade a variety of digital coins. However, they’re not the safest sites to store your assets long-term. If you’re not planning to actively trade, consider moving your cryptocurrencies to a more secure storage.

Use hardware wallets for added security

If you plan to hold a substantial amount of cryptocurrency for the long term, consider investing in a hardware wallet:

A hardware wallet is a physical device that stores your cryptocurrency offline, making it nearly immune to online hacks and theft. With a hardware wallet, your crypto is as safe as it can get.

Regularly update passwords and maintain security hygiene

Cybersecurity is an ongoing effort, not a one-time task. Change your passwords regularly and use strong, unique passwords for each of your accounts. Password managers can help you keep track of them. Keep your computer, smartphone, and any cryptocurrency-related software up to date. These updates often include important security patches.

Be cautious of phishing and scams

Scammers are always on the prowl, so stay vigilant. Be mindful of unsolicited phishing emails, especially those asking for your personal information or login details. Legitimate organizations won’t ask for this via email.

Always double-check the website’s URL before entering any sensitive information. Scammers create fake sites that look remarkably similar to the real thing.

If an investment opportunity sounds too good to be true, it probably is. Be wary of promises of quick riches.

Monitor your credit card statements

Even after your initial purchase, it’s important to stay vigilant with your credit card. Monitor your credit card statements for any unauthorized transactions. Report any suspicious activity immediately to your card issuer. Keep your physical credit card in a safe place to prevent theft.

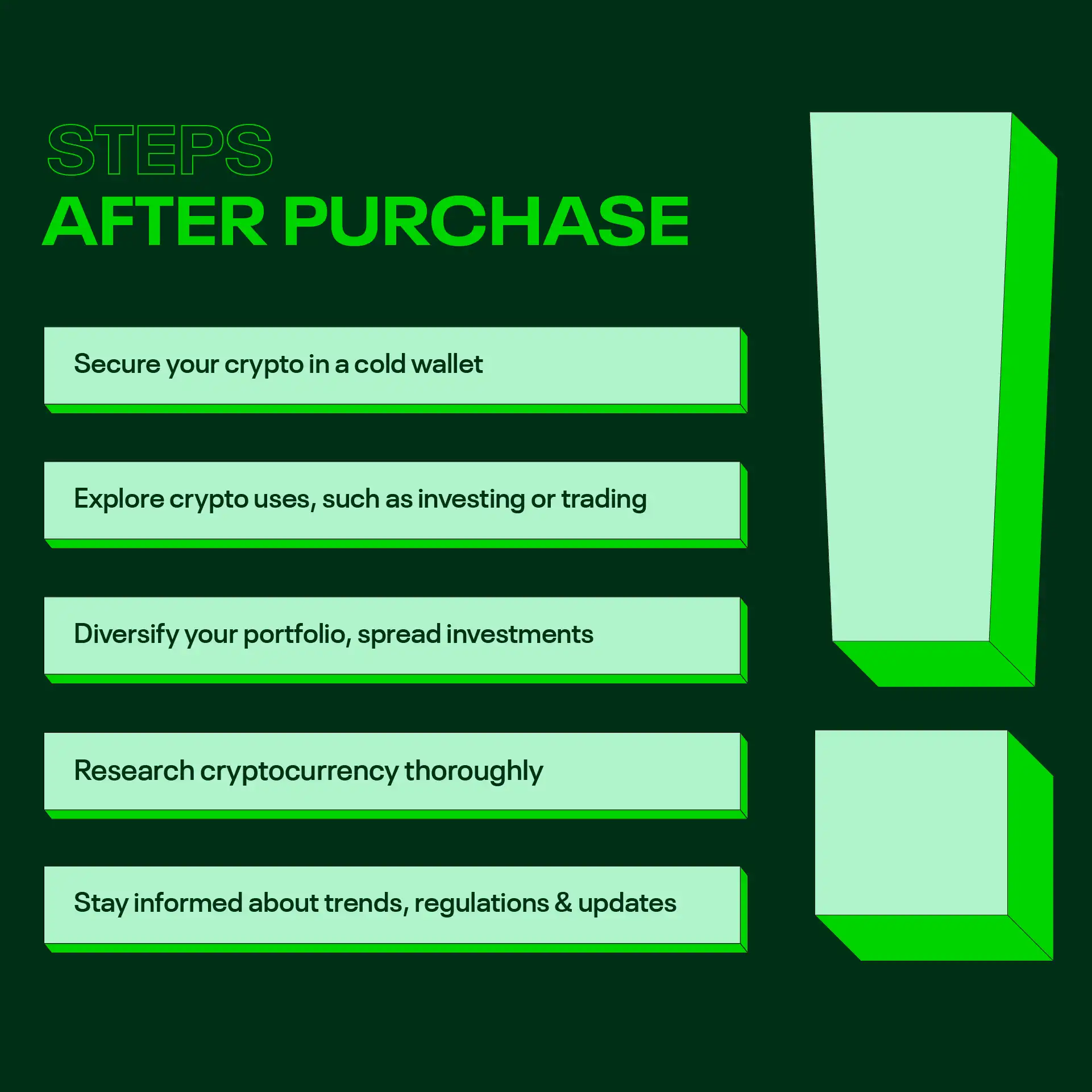

You Have Bought Your Crypto, What Next?

Now that you’ve made your initial purchase, it’s time to plan your next moves wisely. This guarantees the safety and growth of your digital assets. I will take you through some of the effective tips to keep your assets safe. You can also opt to invest your assets.

Secure your crypto

One of the top priorities in the crypto world is security. Some of the best practices include moving your crypto away from the exchange to the cold wallet. A cold wallet, such as a hardware wallet or a paper wallet, offers the highest level of security.

These wallets keep your assets offline, away from potential online threats. Transferring your holdings to a cold wallet is like placing your digital fortune in a fortified vault.

Explore how to use crypto

Cryptocurrencies are incredibly versatile. Here are some of the common options you can consider.

Holding (HODLing)

Many crypto enthusiasts adopt a “buy and hold” strategy with the hope that the long-term value of cryptocurrencies will increase. This approach requires patience and a strong belief in your assets.

Purchases

Some businesses and online retailers accept cryptocurrencies as payment. You can use your crypto to buy products and services, just like you would with fiat currency.

Investments

Beyond simply holding, you can explore different cryptocurrencies and invest in those you believe have promising potential. Diversifying your investment portfolio can help spread risk.

Staking

Some cryptocurrencies offer staking opportunities. By staking your assets, you help secure the network and earn rewards in return. It’s an alternative way to generate passive income.

Trading

If you enjoy the thrill of the crypto markets, you can consider actively trading. Keep in mind that trading can be highly volatile and risky. So, be well-informed and prepared.

Diversify your portfolio

Diversification is a fundamental strategy in the world of crypto investment.

Spread your investments

Instead of putting all your funds into a single cryptocurrency, consider diversifying your portfolio by holding multiple coins. This can help mitigate risks and potentially lead to more balanced returns.

Research before diversifying

Don’t diversify blindly. Thoroughly research each cryptocurrency you’re considering and understand its utility, technology, and potential in the market.

Stay informed

Cryptocurrencies are known for their fast-paced and ever-changing nature. Staying informed is crucial. Always stay up to date with:

- Market trends: Keep a close eye on market trends, news, and developments. Understanding market sentiment can help you make informed decisions about buying, selling, or holding your assets.

- Regulatory changes: Cryptocurrency regulations can vary widely from one country to another and can impact the market significantly. Stay informed about any regulatory changes in your region that may affect your crypto holdings.

- Security updates: Continuously educate yourself about security best practices and updates for your chosen storage solutions. New threats emerge regularly, and being informed can help you protect your assets.

The Rise of Cryptocurrencies and Their Popularity

Digital currencies have taken the financial world by storm in recent years. Their popularity can be attributed to their decentralized nature. As such, they are free from government control. Additionally, they operate on a secure technology called blockchain.

Bitcoin, the pioneer, paved the way for thousands of other digital currencies. But it’s not just about Bitcoin; it’s about a revolution in the way we think about money.

Why does this matter to you?

Well, it means you can potentially gain from this new financial frontier. Unlike traditional investments, cryptocurrencies are accessible to anyone, anywhere, anytime. Plus, you’re not just investing; you’re part of a global movement shaping the future of finance.

Final Word

Buying cryptocurrencies with a credit card presents both convenience and potential risks. It offers quick access to the market, allowing instant transactions. This makes it beginner-friendly, enabling simple entry. Moreover, credit cards can provide rewards or cashback, enhancing cost-effectiveness for buyers.

However, this method comes with drawbacks. High fees accompanying credit card transactions can significantly impact investments, especially for frequent traders. Failure to pay off the credit card balance can lead to substantial interest charges, affecting long-term financial stability. Additionally, credit score implications and potential cash advance fees are factors to consider before buying crypto with a credit card.

Frequently Asked Questions

How can I buy crypto with a credit card?

Buying crypto with a credit card is a relatively straightforward process. But, it’s important to understand the risks and fees associated with this method of payment. First, you’ll need to find a reputable exchange or broker that allows you to purchase crypto with a credit card. Many exchanges and brokers offer this service. We have put together a list of the best exchanges where you can buy crypto and Bitcoin using a credit card.

What are the benefits of buying crypto with a credit card?

There are many benefits of buying crypto with a credit card. For starters, it’s a faster and easier way to purchase crypto than traditional methods like bank transfers or wire transfers. Credit cards are also a more secure payment method than cash. They provide an extra layer of protection against fraud and theft. Plus, credit card transactions are usually processed instantly, so you don’t have to wait days or weeks to receive your crypto.

Where can I find a list of exchanges that accept credit cards for payment?

Several exchanges accept credit cards for payment. In this guide, we have highlighted the most popular and widely used exchanges where you can buy and sell crypto. These sites are fully licensed and regulated and have implemented stringent security measures. Furthermore, they have higher liquidity which means that you will find your preferred trading pair at a reasonable price.

How do I know if my credit card is safe to use for buying crypto?

You first need to make sure you are using a reputable and secure platform. Check if the site is licensed and if it has a valid SSL certificate. Additionally, you should make sure the platform has a secure payment gateway and that the website is encrypted.