Best Crypto & Bitcoin Exchanges in 2024

Best Crypto Exchanges in 2024

With so many options, finding the best Bitcoin exchanges isn’t easy. However, the CCN team is confident that these are the best options on the market.

promotions

Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade.Coins

promotions

Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link.Coins

promotions

Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin.Coins

promotions

Get mystery boxes worth up to $10,000 when you register through a referral from a friend.Coins

Review of Our Top 10 Crypto Exchanges

Before buying digital coins, pause for a few minutes and look at snapshots of each of the Bitcoin exchanges featured on this page.

1. Binance

- 0.0000039 - 0.0005

- spot trading

- derivatives trading

-

futures trading

12

No result

- Bitcoin

- Ethereum

-

Binance Coin

291

No result

- Sepa

- GiroPay

-

Visa

305

No result

- English

- Indonesian

-

Spanish

22

No result

- France

- Italy

-

Lithuania

13

No result

- 2FA Google Authenticator

- 2FA SMS

- German

- Russian

-

Korean

15

No result

- Blog

- News

-

Announcements

1

No result

2. Blockchain.com

- spot trading

- margin trading

-

staking

3

No result

- Bitcoin

- Ethereum

-

Bitcoin Cash

28

No result

- Bank transfer

- Sepa

-

Faster Payments

49

No result

- English

- Spanish

-

Portuguese

2

No result

- Singapore

- Puerto Rico

- English

- Learn and Earn

- Podcasts

- Research and Analysis

3. LBank

- spot trading

- derivatives trading

-

futures trading

5

No result

- Ethereum

- Terra

-

Polygon

241

No result

- Visa

- MasterCard

-

Bank transfer

255

No result

- English

- Russian

-

Spanish

27

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Turkish

-

Polish

24

No result

- Academy

- Guides

- Videos

4. Binance TR

- spot trading

- wallet

- Holo

- Internet Computer

-

The Graph

80

No result

- Bank transfer

- Ziraat Bankasi

-

VakifBank

84

No result

- English

- Turkish

- 2FA Mobile App

- 2FA SMS

- 2FA Google Authenticator

- Turkish

- English

- Blog

- Announcements

5. BitMEX

- Maker/Taker: 0.0200% - 0.0750%

- spot trading

- derivatives trading

-

futures trading

3

No result

- BitMEX Token

- Bitcoin

-

TRON

8

No result

- Visa

- MasterCard

-

ApplePay

12

No result

- English

- Russian

-

Turkish

1

No result

- 2FA Google Authenticator

- 2FA Authy

- Chinese (Mandarin)

- Korean

- Russian

- Knowledge Base

- Videos

- Guides

6. MEXC

- Free

- spot trading

- derivatives trading

-

futures trading

9

No result

- SHIBA INU

- Wrapped Dogecoin

-

ADAX

191

No result

- Visa

- MasterCard

-

Bank transfer

110

No result

- English

- Russian

-

Turkish

14

No result

- Seychelles

- Estonia

-

Switzerland

2

No result

- 2FA Google Authenticator

- 2FA SMS

- English

- Turkish

-

Vietnamese

5

No result

- Videos

- Learn and Earn

-

Blog

2

No result

7. Okcoin

- 3.99%

- spot trading

- OTC trading

-

staking

1

No result

- Bitcoin

- Ethereum

-

Tether

101

No result

- Visa

- MasterCard

-

ApplePay

107

No result

- English

- United States

- Canada

-

United Kingdom

26

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Blog

- Developer Grant

-

Videos

1

No result

8. OKX

- Free

- spot trading

- derivatives trading

-

perpetual swaps trading

9

No result

- Tether

- Bitcoin

-

Litecoin

92

No result

- Bank transfer

- Visa

-

MasterCard

344

No result

- English

- Chinese (Mandarin)

-

Simplified Chinese

14

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Learn and Earn

- Announcements

- Videos

9. Phemex

- 0.0001 BTC

- spot trading

- derivatives trading

-

perpetual contracts trading

8

No result

- Ethereum

- Cardano

-

Chainlink

233

No result

- SwiftCash

- Bank Transfer (ACH)

-

Sepa

310

No result

- English

- Russian

-

Japanese

6

No result

- 2FA Google Authenticator

- English

- Japanese

-

German

2

No result

- Blog

- Videos

-

Academy

4

No result

10. Poloniex

- 3.5% - 5%

- spot trading

- derivatives trading

-

futures trading

7

No result

- APENFT

- Bitcoin

-

Ethereum

364

No result

- Bank transfer

- Visa

-

MasterCard

367

No result

- English

- Chinese (Mandarin)

-

Simplified Chinese

9

No result

- Panama

- 2FA SMS

- 2FA Google Authenticator

- English

- Videos

- Guides

- Blog

Why Trust Us?

CCN is one of the leading lights in the cryptocurrency information sphere. Our team has spent countless hours analyzing hundreds of Bitcoin trading platforms. This detailed process involved going through thousands of data points and dozens of first-rate sources.

Our review team used as many exchanges as possible, acting as a trader to get a first-hand look at what was on offer. We investigated crucial information, such as security, features, and fees, to give you a high-level overview of each platform.

We strongly believe that the crypto exchanges on this page represent the best of what’s out there.

Overview of the Best Crypto & Bitcoin Exchanges in 2024

| Casino | Welcome Bonus | Our Rating |

|---|---|---|

| Binance | Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade. | 4.83 |

| Blockchain.com | N/A | 4.83 |

| LBank | Get 255 USDT Bonus when you sign up. | 4.83 |

| Binance TR | Get a 50 USD Bonus when you Register and complete authentication. | 4.67 |

| BitMEX | Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link. | 4.67 |

| MEXC | Get 5 USDT bonus when you deposit 300 USDT. | 4.67 |

| Okcoin | Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin. | 4.67 |

| OKX | Get mystery boxes worth up to $10,000 when you register through a referral from a friend. | 4.67 |

| Phemex | Earn up to $6050 in crypto when you sign up | 4.67 |

| Poloniex | Get Up to $1000 Welcome bonus when you sign up and complete tasks. | 4.67 |

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

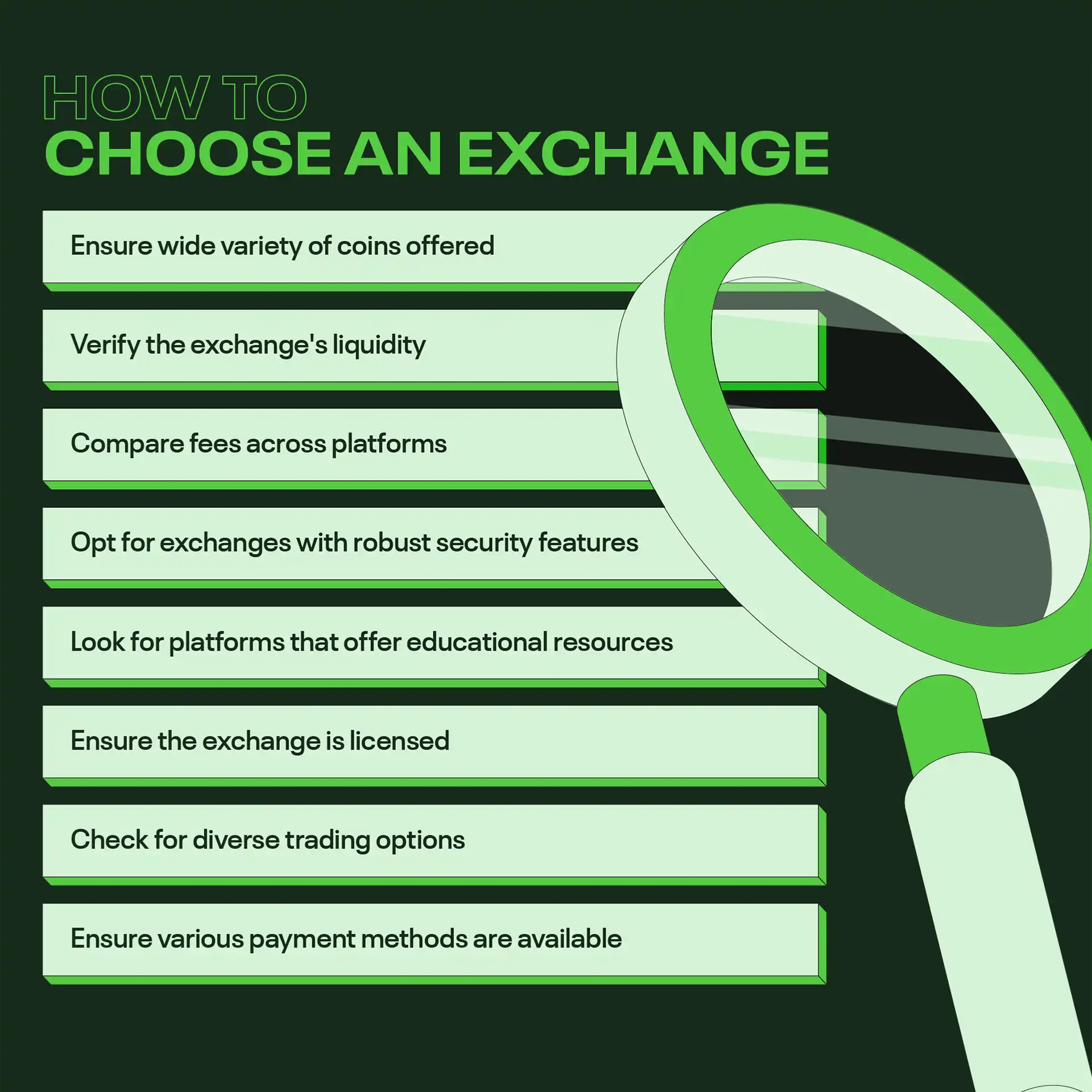

How To Select Your Crypto Exchange

We use a substantial number of data points when analyzing the best cryptocurrency and Bitcoin exchange providers. This ensures you don’t need to scour the Internet for the best places to buy digital currency.

However, you need to understand WHY you’re selecting a business. After all, each person is different. The factors that matter to you may prove irrelevant to someone else and vice versa.

Thus, it’s essential to know more about what exchange companies offer. Below, I highlight some of the most crucial criteria to consider before parting with your money.

Consider the variety of coins offered

According to CoinMarketCap , there are almost 23,000 cryptocurrencies. Granted, many of them are effectively ‘dead’ or get no attention as trading options.

Nonetheless, the best crypto trading platforms offer several hundred coins as standard. For instance, you can buy, trade, and hold over 350 cryptos on Binance.

Safe to say, the more options, the better. Bitcoin, Ethereum, Litecoin, and Bitcoin Cash get lots of attention. However, coins like Ripple, Cardano, Tron, and Monero are also valid options.

Yet you shouldn’t assume that a Bitcoin exchange with hundreds of digital currency pairs features the one(s) you want. This means that you need to check and see whether the platform you’re interested in has the coins you want to use.

Ensure the crypto exchange has sufficient liquidity

In trading, liquidity is king. “Liquidity” refers to how quickly or easily you can buy or sell an asset. Liquid investments are convenient because you can access them without many problems.

Imagine that you bought an obscure altcoin, and its value starts to plummet. Alternatively, you spot a coin that’s about to explode in value. In either scenario, you want your sell or buy order filled ASAP.

When you choose a BTC exchange, checking its trading volume is a good idea. The higher this figure, the better off you are.

For instance, you could be sitting on a goldmine. But it’s useless if the exchange lacks the liquidity to let you sell.

CoinMarketCap is an excellent resource for this purpose. It lets you check the 24-hour trading volume of hundreds of platforms. For the record, Kraken, Coinbase, and Binance routinely show the highest trading volumes.

Compare the fees

Despite the pros of using a crypto trading platform, fees are an unfortunate reality. People who trade stocks on well-known brokerage accounts with fiat currencies are used to avoiding fees.

Unfortunately, it is not the same when you trade on cryptocurrency exchanges. In fact, investors can expect to pay a fee every time they trade, deposit, or withdraw.

What’s more, these charges can vary significantly depending on the transaction and platform. For instance, the commission on Binance.US can range from 0.1% to 5%, depending on your payment method.

Meanwhile, Coinbase Pro promises to charge lower fees compared to a standard Coinbase account.

On Pro, the maximum transaction fee is 0.6%. By contrast, Coinbase charges a 1% flat fee and 2.49% for purchases with the Coinbase Card. There is also a 0.5% spread.

To get lower fees, making a small volume of large trades is usually better. Most Bitcoin exchanges have “fee tiers” based on your 30-day trading volume. The percentage you pay in fees drops when you make large trades.

Review security measures

I wish I could say that cryptocurrency trading is safe for customers. Sadly, there are clear and present threats to your crypto wallet.

Crypto exchanges are a regular target of hackers. Sites with weak security are ruthlessly exposed to this, with even well-known trading platforms falling victim.

For instance, in 2021, BitMart lost around $200m worth of assets after a cyber-attack.

This means that you must focus on a top crypto exchange with exceptional security. Such sites enable you to add extra protection to your account.

For instance, two-factor authentication (2FA) is a prerequisite. Yet, this is the tip of the iceberg. The best crypto exchanges go several steps further.

Crypto.com is known for its biometric login. You can only log into your account via fingerprint and facial recognition on your mobile device.

Other big-name Bitcoin exchanges, such as Gemini, require you to show United States government-issued ID when you create an account. Of course, providing this information eliminates the anonymity many crypto users seek.

Does the crypto exchange offer educational resources?

It’s in the best interests of Bitcoin exchanges to educate users. Spreading digital currency literacy is one of the top ways to help the market grow.

The more people know about crypto, the less skeptical they may become. Also, they’re more likely to make smarter decisions and earn money.

Newer users will likely feel intimidated when they use an exchange’s service. So if the business is serious about retaining clients, it’ll serve as a guide to the industry.

What type of educational resources are available?

There’s a steep learning curve involved in becoming a true crypto expert. It takes lots of experience and research to know when to make a move.

Since there’s a lot of road to travel, a crypto exchange should start at the beginning. This means providing info on digital asset basics.

The trading platform needs to educate readers about concepts such as the blockchain. It must also discuss currencies like Bitcoin, Ethereum, Litecoin, and Dogecoin.

From there, it’s necessary to gently introduce the platform’s trading features. Next, the company should discuss strategies and tips for beginners. The site will gradually make users feel more comfortable by explaining things in easy-to-understand language.

Then users may increase their crypto holdings and be ready to advance. Ideally, the platform would be capable of moving clients down an educational funnel.

It should explain advanced concepts like detailed market analysis, spot trades, and other insights.

Overall, a crypto exchange should have a library filled with resources. This may include blogs, guides, FAQs, a help center, videos, etc. In essence, the platform should be capable of answering most user questions.

Are the resources useful?

The quality of the available resources also matters. There’s no point in having more data than Harvard’s library if customers can’t access it easily!

Users should have 24/7 access to the entire suite of resources. Furthermore, the Bitcoin exchange must explain everything in layperson’s terms.

Finally, it must routinely check its content to make sure it’s up to date. The crypto industry changes quickly, and information doesn’t take long to go out of date.

Licenses and geo-restrictions

The evolution of the crypto market is happening at lightning speed. As a result, the best Bitcoin exchanges understand the importance of keeping up with the latest regulations.

Depending on the jurisdiction, they also know that it’s important to have certain licenses. Let’s take a closer look at cryptocurrency regulatory requirements.

Understanding crypto exchange licenses

It is becoming more challenging for trading platforms to get licensing. However, they know they must proceed, or their competitors will have a major advantage.

This is great news for consumers. They know that exchanges related to the crypto market must meet certain criteria to operate legally. For instance, getting a recognized license involves a crypto exchange:

- Creating a detailed compliance strategy

- Building a rapport with regulators

- Developing partnerships with reputable companies, including legal teams

- Constantly checking the rules to ensure they are adhering to regulations

It’s also true that crypto market regulations vary from one location to the next. For instance, you can’t expect Australia to have the same rules as the U.S. This means that Bitcoin trading companies must conduct much research.

Quite a few cryptocurrency exchanges don’t bother going through all of these steps. Instead, they decide to take the risk of operating illegally. These exchanges may be closed down if caught, with the founders potentially going to prison.

It’s a sad fact that you’re far more likely to fall victim to a scam if you use an unlicensed Bitcoin trading platform.

Key factors considered by regulators

When they monitor crypto exchanges, regulators consider various factors. These can include:

- Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) requirements to prevent money laundering and the financing of terrorists

- Know Your Customer (KYC) protocols to verify the identity of clients

- HR rules - companies may need to have AML compliance officers and other in-house experts

- Financial requirements, such as having insurance to cover losses or maintaining a minimum level of capital

- Technical requirements like 2FA and secure storage

- Ensuring the crypto exchange is registered as a legal entity within the jurisdiction

Any exchange that follows the above, even as a small business, deserves a second look. As you can see, it isn’t easy to comply with the above. This is why scam trading platforms don’t bother trying.

What products are available on the crypto exchange?

It's important to note that the best Bitcoin exchanges are not one-trick ponies. They offer many useful features, and I outline a few below.

Trading platforms and tools

Firstly, a high-quality cryptocurrency exchange has an easy-to-use interface. Also, it has advanced software platforms to help you analyze, monitor, and trade crypto in real-time.

While novices will enjoy a straightforward platform, professional traders love the advanced order types. They also can’t get enough of the different trading charts, which may include:

- Depth Charts

- Order Book Volume by Exchange

- Volume-Weighted Average Price

- Trading Vol Distribution

- Bid-to-Ask Ratio

The above merely scratches the surface. Fast processing of trades is another must-have feature, since the crypto market moves quickly.

Spot, margin and futures trading

Having additional trading options is great news for the experienced professional.

Spot trading involves buying or selling assets at the current market price for near-term or immediate delivery. The nature of spot trading means you need to have all the funds available to pay for the trade.

With margins, you use borrowed money to make a trade. Imagine that you want to buy $500 of LTC at a leverage factor of 4x. In this situation, you only pay $125 with the other $375 borrowed from the trading platform.

However, you must pay what you owe if the trade loses money. Otherwise, the platform has the power to sell any other assets you have on the exchange.

As the name suggests, futures trading is an agreement to buy/sell an asset at a certain time in the future.

Savvy traders know how to combine the above to help them in any given situation. After all, you can profit in the short, medium, or long term.

Also, you can use these features to hedge against possible losses. Alternatively, you can leverage your trades for greater profits.

Crypto wallets and storage options

The most safe and convenient ways to store your digital coins are:

- Self-hosted wallets

- A third-party custodian

With a self-hosted wallet, you are in control of your coins. You can choose a software, hardware, or paper wallet.

With a software wallet, you store your coins on a desktop, smartphone, or another web-based location.

Hardware wallets involve offline storage. Accessing the funds consists of connecting the device to the Internet.

Paper wallets are analog crypto wallets with a private and public key pair. They are created from a key generator program and printed on paper. If you get hold of this kind of wallet, you should see two QR codes and two strings of characters.

A third-party custodian means that a company, such as a crypto exchange, stores your wallet. It is easy to access your funds, and you don’t need to remember your private key. However, you also lose an element of control.

Services for individuals

As an individual trader, crypto exchanges let you buy, sell and trade crypto. It’s also possible to earn certain rewards and even borrow cash if you have digital coins as collateral.

You’ll also find that Bitcoin exchanges let you purchase NFTs.

Services for businesses

If you’re a business entering the crypto market, you may wish to take advantage of software solutions to help you navigate the market easily.

You’ll also find it useful when the exchange accepts crypto payments. There’s even a possibility to list assets on the exchange.

Of course, you get all the options available to individuals, too, such as trading in the futures market.

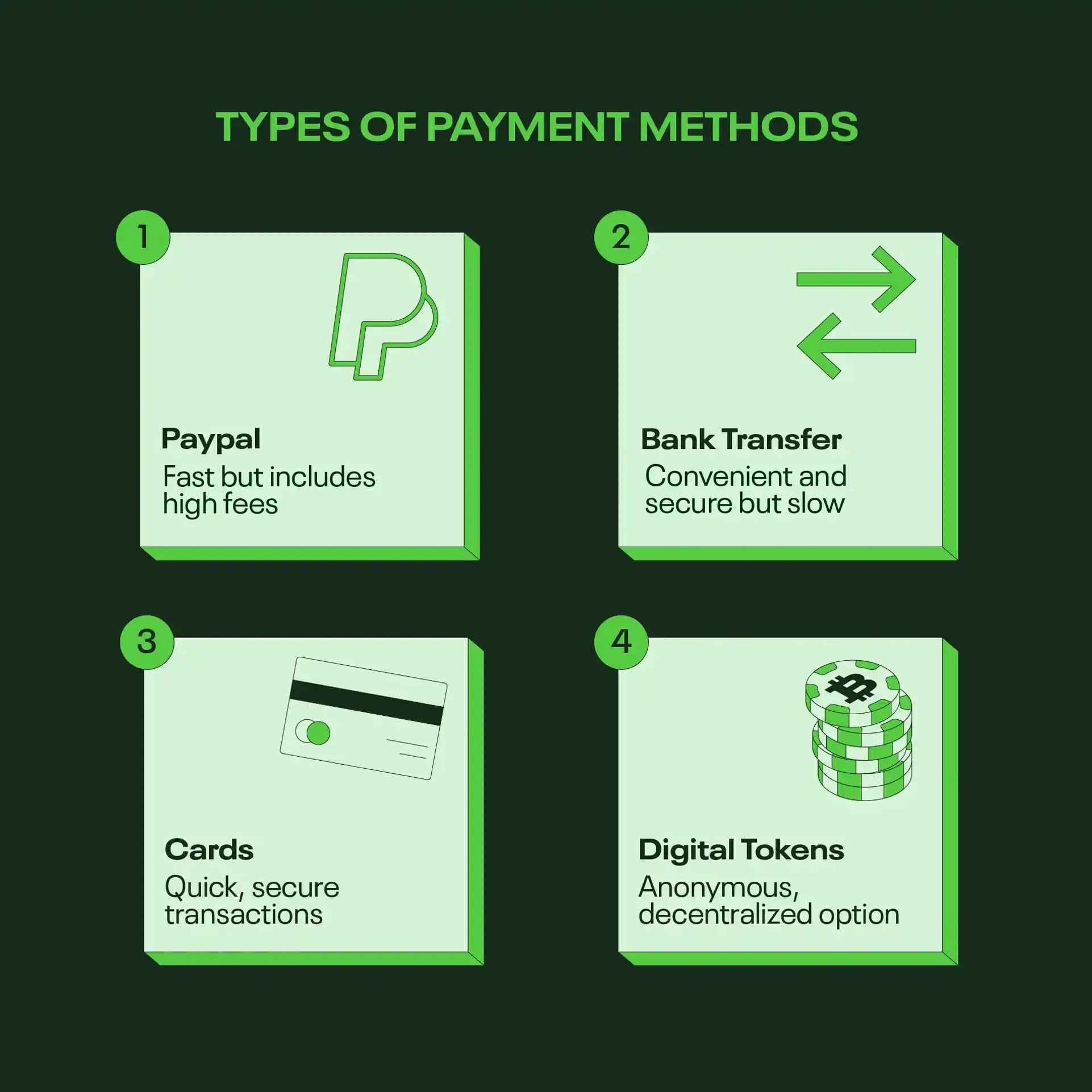

What payment methods are accepted?

Ideally, a crypto exchange would offer various payment options. By doing this, it gives customers a great degree of financial freedom.

You can use fiat to get involved in the crypto markets, but you should have multiple choices. Let’s look at some of the most commonly accepted payment methods.

PayPal

With hundreds of millions of users, PayPal remains one of the premier eWallets in the world. In October 2021, the company announced a new service that allowed customers to trade with crypto.

These days, you can use PayPal to deposit, transfer, store, and withdraw fiat to crypto exchanges. It also works with eToro and other online brokers.

PayPal has a fairly high level of security since it lets you use 2FA. It is also an efficient way of buying and selling cryptos.

As anyone with experience in the field knows, speed matters. The longer transactions take, the more likely you won’t get value.

The main downside of using PayPal is the size of the transaction fees. If you’re a prolific trader, these fees can mount up fast.

Credit/debit card

Traders can instantly fund their portfolios using debit cards or credit cards. Using your bank card allows for quick and easy purchasing of crypto.

It is also a beginner-friendly method, as buying coins on a crypto exchange like Binance is a little different to regular online shopping.

The money comes directly from your bank account with minimal processing time. You also benefit from a high level of security.

For instance, when you try to buy digital coins with a debit card, you’ll probably be asked to authenticate the purchase on your smartphone.

Bank transfer

Try as we might, we can’t quite get away from banks! Most of the best Bitcoin exchanges allow you to pay via bank transfer.

This is a highly convenient payment method for individuals who live in a location where using credit cards is difficult.

While bank transfers are often slow, they can be almost instant in certain cases. These transactions are safe and secure and aren’t subject to chargebacks.

Digital tokens

If you want to remain anonymous on a trading platform, it makes sense to stick with crypto. It is widely available in many countries around the world, so you can use it almost anywhere.

Best of all, there are thousands of coins available. That said, most crypto exchanges offer no more than a few hundred. So, you may need to shop around if you want obscure coins like NEO, EOS, IOTA, or DASH.

With digital tokens, you have the bonus of decentralization, which ensures banks are not involved. This is good news for anyone looking for loans!

Cryptocurrency is also highly secure. No one can access your digital money without your wallet’s private key.

Also, the blockchain system secures transactions, along with a network of computers that verify payments.

Impact of payment method on fees

As I mentioned earlier, transaction fees vary significantly depending on the Bitcoin exchange and payment method. These trading fees can play havoc with your funds if you don’t take note.

Generally, most cryptos are cost-effective as you pay lower fees. However, the cost grows when you use eWallets. You can also expect to pay when using a debit/credit card or a bank transfer.

Thus, depending on the cryptocurrency, you might find that digital currency is the best option for low fees.

Different Types of Crypto Exchanges

It’s best to simplify matters by saying there are two primary types of crypto exchange: Centralized and Decentralized. Let’s look at them both and analyze their pros and cons.

Centralized Exchanges

Also called CEXs, centralized crypto exchanges are under the purview of one entity. A significant percentage of trading occurs on this type of platform. Here are some of the benefits of using one:

- You can quickly get started by converting fiat currency into digital coins

- CEXs offer user-friendly interfaces, making them suitable for beginners

- They have much higher liquidity than their decentralized counterparts

- This type of platform tends to support a significant number of digital assets

- Some CEXs enable you to trade asset derivatives such as options and futures

However, not everyone will enjoy using a CEX due to these downsides:

- They go against the decentralized ethos of crypto

- These platforms tend to adhere to KYC regulations, which means you must provide personal information

- There remains a high risk of hacking

Decentralized Exchanges

Also known as DEXs, decentralized exchanges are not controlled by a single authority. They support peer-to-peer trading between crypto users. Smart contracts, which are self-executing blockchain-based apps, control the processes.

The benefits of using a DEX include the following:

- With no intermediaries, you don’t have to go through the KYC process

- They are ideal for individuals who don’t have access to traditional banking options

- If you’re part of the DEX network, you can certify transactions; this action increases transparency and accountability

- You can earn passive income via DeFi staking

- Users of DEXs enjoy lower transaction fees than if they use CEXs

Alas, for all the pros, there are a few decided cons to consider:

- DEXs have much lower liquidity than CEXs; the result is potentially large price deviations from standard rates

- There’s a steep learning curve involved; users need to be familiar with blockchain technology

- Paying for gas fees involves buying native platform tokens; this is a complex process, and novices might make mistakes

Author Tip: Try A Few Options

If you’re a beginner, taking your time and assessing your options is wise. It’s true that prices change rapidly, and you may feel you’ll miss out by hesitating. But it’s better to play it safe first rather than risk your retirement savings!

Initially, setting up accounts with a few of the best crypto exchanges on this page is a good idea. Next, go through the interfaces to get acquainted with everything. You’ll soon pick the right option based on how easy it is to navigate the site.

Also, it’s sensible to diversify your selection. There are dozens, if not hundreds, of digital coins. Yes, you probably want to trade in Bitcoin and Ethereum Classic and avoid any BitConnect-type situations.

Still, it’s also a good idea to look at other coins. Lesser-known options such as Waves, Zcash, OmiseGO, Stellar, and NEM exist. For lower volatility, you may opt for stablecoins such as Tether.

In the end, you want to spread the risk. If some of your ‘long shots’ fare badly, you can fall back on the old faithfuls like BTC.

Diversification also relates to the crypto exchange itself. Anyone with any knowledge of digital currency knows what happened to FTX.

It was one of the world’s biggest exchanges but went bankrupt. It highlighted the inherent risks of the market. FTX was considered a ‘reputable’ brand, but no one knew what was happening behind the scenes.

This proves that it’s wise to store your crypto in more than one trading platform.

How Crypto Exchanges Work

In simple terms, a cryptocurrency exchange functions as a marketplace. On it, you can buy and sell digital assets.

If you’ve ever used a fiat trading platform, you’ll notice many similarities between it and a BTC exchange.

Once you register with an exchange, you have access to its trading functions. You can create various order types to purchase, sell, and speculate in the digital currency market there.

This happens via a live order book that displays the buy and sell orders in real-time. These orders directly impact the exchange rate of the chosen coin.

It’s important to note that every Bitcoin exchange calculates prices based on its own volume of trading. Therefore, exchanges with more users are likely to have prices closest to market value.

“Market Order” and “Limit Order” are the most widely used orders. Let’s say you want to buy 0.2 ETH on an ETH/LTC pair. Placing a limit order to purchase 0.2 ETH at $1,500 (let’s imagine that was the price of ETH) tells the crypto exchange to trade your funds at this price or better.

While it guarantees you’ll get your requested price, it doesn’t mean your limit order will occur. That only happens if someone is willing to buy or sell at that price.

How to Buy Bitcoin

Here’s a quick and easy guide to buying Bitcoin from a crypto trading platform. Hopefully, it’ll take some of the stress out of the process.

Pick your crypto exchange

There are dozens of exchanges, but I believe the best in the business is right here on this page.

If you’re a novice, it’s best to stick with a centralized exchange (CEX) until you become more familiar with the technical aspects of crypto. Look for a provider that offers dozens of altcoins and has a strong reputation.

The downside of using a CEX is that you must adhere to its KYC rules. As a result, prepare to submit personal documents. On the plus side, you should benefit from decent customer service.

It’s also important to see if the site has an app you can download. If it does, you can trade on the move.

Select your payment method

I already mentioned the different ways you can buy crypto. You must then decide whether to use a bank transfer, debit/credit card, eWallet or existing digital coins.

Your payment method of choice may be restricted by location too. Then you have to consider banks.

For instance, BTC is legal in the United States, but some financial institutions may prevent you from depositing into a crypto exchange.

Depending on the trading platform, you may have the chance to make a purchase via gift cards or peer-to-peer transactions.

Place an order

This is straightforward if you’ve ever used a fiat currency trading platform. Crypto exchanges almost mimic their stock market counterparts.

Virtually all offer limit and market orders, along with stop-loss, take-profit, and stop-limit.

The best Bitcoin exchanges make things as easy as possible. They often let you set recurring purchases for certain times of the month. So, you can automatically buy $500 of BTC, for instance, on the first of the month, regardless of its price.

Securely store your crypto

Top-rated cryptocurrency exchanges have exceptional security. Your funds are safe as long as you keep them within the exchange.

You have the option to store it outside the platform. However, you must keep your private key secure. You can say goodbye to your money if you lose it or someone else gains access.

So, You’ve Bought Bitcoin; What to Do Next?

I hope this complete guide to crypto exchanges is useful. By now, you should know how to trade digital assets.

But the journey is far from over. You need to secure your digital assets to keep them safe from theft.

Most people keep their funds in hot wallets, which are apps on devices like tablets, smartphones and desktops. If you use this option and don’t have strong security, there’s a chance you’ll lose your money.

Instead, you should consider transferring your money to a cold wallet. These offline storage units store your key on something unconnected to the Internet. Options include a hardware wallet (which is like a USB) and a paper wallet.

When you have crypto, you must have a contingency plan. What will you do if the coin’s value goes above or below a certain point? Will you HODL, sell, or even buy when the currency has hit a trough?

Also, remember to purchase several different coins for diversification purposes. Ideally, you’d have at least five.

Finally, keep up to date with regulatory changes and market trends. Doing this allows you to remain within the law and take advantage of any significant movements.

Frequently Asked Questions

What services do crypto exchanges offer?

The top Bitcoin exchanges offer an impressive range of services. First and foremost, they allow you to buy, sell, and trade digital assets. They also provide secure storage for your investments and have features such as stop-loss, margins, and futures.

How much money do I need to use on a Bitcoin exchange?

The minimum balance requirements differ from one brand to the next. However, I can tell you that Coinbase has a minimum deposit and balance of just $2! This means that you can dip your toe into crypto waters with little risk.

How to ensure compliance with tax regulations when using crypto exchanges in 2024?

Users may want to consider advising with their chosen tax professionals on this matter. Laws and regulations can vary from state to state and country to country.

In general, selling crypto can be a taxable event. Keeping track of every trade can help traders be prepared for filing their taxes. There are also several crypto tax software services on the market that can help make things easier. These services help automatically track all of a user’s crypto transactions and calculate capital gains/losses. Note that users may still have to enter or alter some information manually.

Which exchanges have the lowest fees for trading cryptocurrencies?

It can be hard to say for certain. Exchanges offer different discounts on trading fees. For example, users who hold Binance Coin (BNB) on Binance receive a 25% fee discount. The fees are paid in BNB.

There are also maker/taker differences. A market “maker” order is one that a trader places on the order books at a price other than the current market price. When a trader buys or sells an existing order on the books, they are considered a “taker.” Taker fees are generally higher than maker fees.

How to stay updated with the latest developments and innovations of crypto exchanges in 2024?

Consider following an exchange’s social media accounts. Many of them will post up-to-date, relevant information for users. Exchanges may also have a blog section on their website, or perhaps a Medium page where they provide regular updates.

You can also do your own research, asking searching for answers to specific questions. Make sure any source used is reliable and reputable.

How to ensure compliance with tax regulations when using crypto exchanges in 2024?

Users may want to consider advising with their chosen tax professionals on this matter. Laws and regulations can vary from state to state and country to country.

In general, selling crypto can be a taxable event. Keeping track of every trade can help traders be prepared for filing their taxes. There are also several crypto tax software services on the market that can help make things easier. These services help automatically track all of a user’s crypto transactions and calculate capital gains/losses. Note that users may still have to enter or alter some information manually.

Which exchanges have the lowest fees for trading cryptocurrencies?

It can be hard to say for certain. Exchanges offer different discounts on trading fees. For example, users who hold Binance Coin (BNB) on Binance receive a 25% fee discount. The fees are paid in BNB.

There are also maker/taker differences. A market “maker” order is one that a trader places on the order books at a price other than the current market price. When a trader buys or sells an existing order on the books, they are considered a “taker.” Taker fees are generally higher than maker fees.