Best XRP Exchanges in 2024

Best XRP exchanges in 2024

Here are the best XRP exchanges available to you right now. Check them out and try to find the one that matches your needs perfectly. Keep in mind that each one is different and special in its own way.

promotions

Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade.Coins

promotions

Get mystery boxes worth up to $10,000 when you register through a referral from a friend.Coins

promotions

Invite a friend and earn up to 30% of their trading fees as a reward.Coins

Review of Our Top 10 XRP Exchanges

Dive straight into this selection of the best XRP exchanges.

1. Binance

- 0.0000039 - 0.0005

- spot trading

- derivatives trading

-

futures trading

12

No result

- Bitcoin

- Ethereum

-

Binance Coin

291

No result

- Sepa

- GiroPay

-

Visa

305

No result

- English

- Indonesian

-

Spanish

22

No result

- France

- Italy

-

Lithuania

13

No result

- 2FA Google Authenticator

- 2FA SMS

- German

- Russian

-

Korean

15

No result

- Blog

- News

-

Announcements

1

No result

2. LBank

- spot trading

- derivatives trading

-

futures trading

5

No result

- Ethereum

- Terra

-

Polygon

241

No result

- Visa

- MasterCard

-

Bank transfer

255

No result

- English

- Russian

-

Spanish

27

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Turkish

-

Polish

24

No result

- Academy

- Guides

- Videos

3. Binance TR

- spot trading

- wallet

- Holo

- Internet Computer

-

The Graph

80

No result

- Bank transfer

- Ziraat Bankasi

-

VakifBank

84

No result

- English

- Turkish

- 2FA Mobile App

- 2FA SMS

- 2FA Google Authenticator

- Turkish

- English

- Blog

- Announcements

4. MEXC

- Free

- spot trading

- derivatives trading

-

futures trading

9

No result

- SHIBA INU

- Wrapped Dogecoin

-

ADAX

191

No result

- Visa

- MasterCard

-

Bank transfer

110

No result

- English

- Russian

-

Turkish

14

No result

- Seychelles

- Estonia

-

Switzerland

2

No result

- 2FA Google Authenticator

- 2FA SMS

- English

- Turkish

-

Vietnamese

5

No result

- Videos

- Learn and Earn

-

Blog

2

No result

5. OKX

- Free

- spot trading

- derivatives trading

-

perpetual swaps trading

9

No result

- Tether

- Bitcoin

-

Litecoin

92

No result

- Bank transfer

- Visa

-

MasterCard

344

No result

- English

- Chinese (Mandarin)

-

Simplified Chinese

14

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Learn and Earn

- Announcements

- Videos

6. Phemex

- 0.0001 BTC

- spot trading

- derivatives trading

-

perpetual contracts trading

8

No result

- Ethereum

- Cardano

-

Chainlink

233

No result

- SwiftCash

- Bank Transfer (ACH)

-

Sepa

310

No result

- English

- Russian

-

Japanese

6

No result

- 2FA Google Authenticator

- English

- Japanese

-

German

2

No result

- Blog

- Videos

-

Academy

4

No result

7. Poloniex

- 3.5% - 5%

- spot trading

- derivatives trading

-

futures trading

7

No result

- APENFT

- Bitcoin

-

Ethereum

364

No result

- Bank transfer

- Visa

-

MasterCard

367

No result

- English

- Chinese (Mandarin)

-

Simplified Chinese

9

No result

- Panama

- 2FA SMS

- 2FA Google Authenticator

- English

- Videos

- Guides

- Blog

8. ProBit Global

- 0.0005

- spot trading

- staking

-

wallet

2

No result

- ProBit Token

- Bitcoin

-

Geegoopuzzle

638

No result

- Bank transfer

- Visa

-

MasterCard

755

No result

- English

- Azerbaijani

-

Indonesian

42

No result

- South Korea

- 2FA SMS

- 2FA Google Authenticator

-

2FA Microsoft Authenticator

2

No result

- Arabic

- Bulgarian

-

Czech

36

No result

- Videos

- Learn and Earn

-

Academy

1

No result

9. BitMart

- 0.001

- spot trading

- derivatives trading

-

futures trading

8

No result

- Argentine Football Association Fan Token

- Berry

-

Burn

1616

No result

- Bank transfer

- Bank Transfer (ACH)

-

Visa

1624

No result

- English

- Spanish

-

Japanese

6

No result

- United States

- 2FA SMS

- 2FA Google Authenticator

- English

- News

- Videos

10. Bitstamp

- 0.0005

- spot trading

- staking

- wallet

- Bitcoin

- Ethereum

-

Tether

74

No result

- Bank Wire Transfer

- Bank transfer

-

Faster Payments

86

No result

- English

- Luxembourg

- United States

-

Spain

1

No result

- 2FA SMS

- 2FA Google Authenticator

-

2FA Microsoft Authenticator

1

No result

- English

- Blog

- Learn and Earn

Why Trust Us?

Experts at CCN have used all of the exchanges featured here and tested each one, so you can get the latest and most accurate data. We have been using XRP for years to trade, make deposits, and carry out transactions. As a result, you can be positive that all the data is based on detailed experience, and comes with superb accuracy.

Overview of the Best XRP Exchanges in 2024

| Casino | Welcome Bonus | Our Rating |

|---|---|---|

| Binance | Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade. | 4.83 |

| LBank | Get 255 USDT Bonus when you sign up. | 4.83 |

| Binance TR | Get a 50 USD Bonus when you Register and complete authentication. | 4.67 |

| MEXC | Get 5 USDT bonus when you deposit 300 USDT. | 4.67 |

| OKX | Get mystery boxes worth up to $10,000 when you register through a referral from a friend. | 4.67 |

| Phemex | Earn up to $6050 in crypto when you sign up | 4.67 |

| Poloniex | Get Up to $1000 Welcome bonus when you sign up and complete tasks. | 4.67 |

| ProBit Global | Invite a friend and earn up to 30% of their trading fees as a reward. | 4.67 |

| BitMart | Get Up to $3,000 Welcome Bonus when you sign up. | 4.50 |

| Bitstamp | Not Applicable | 4.50 |

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

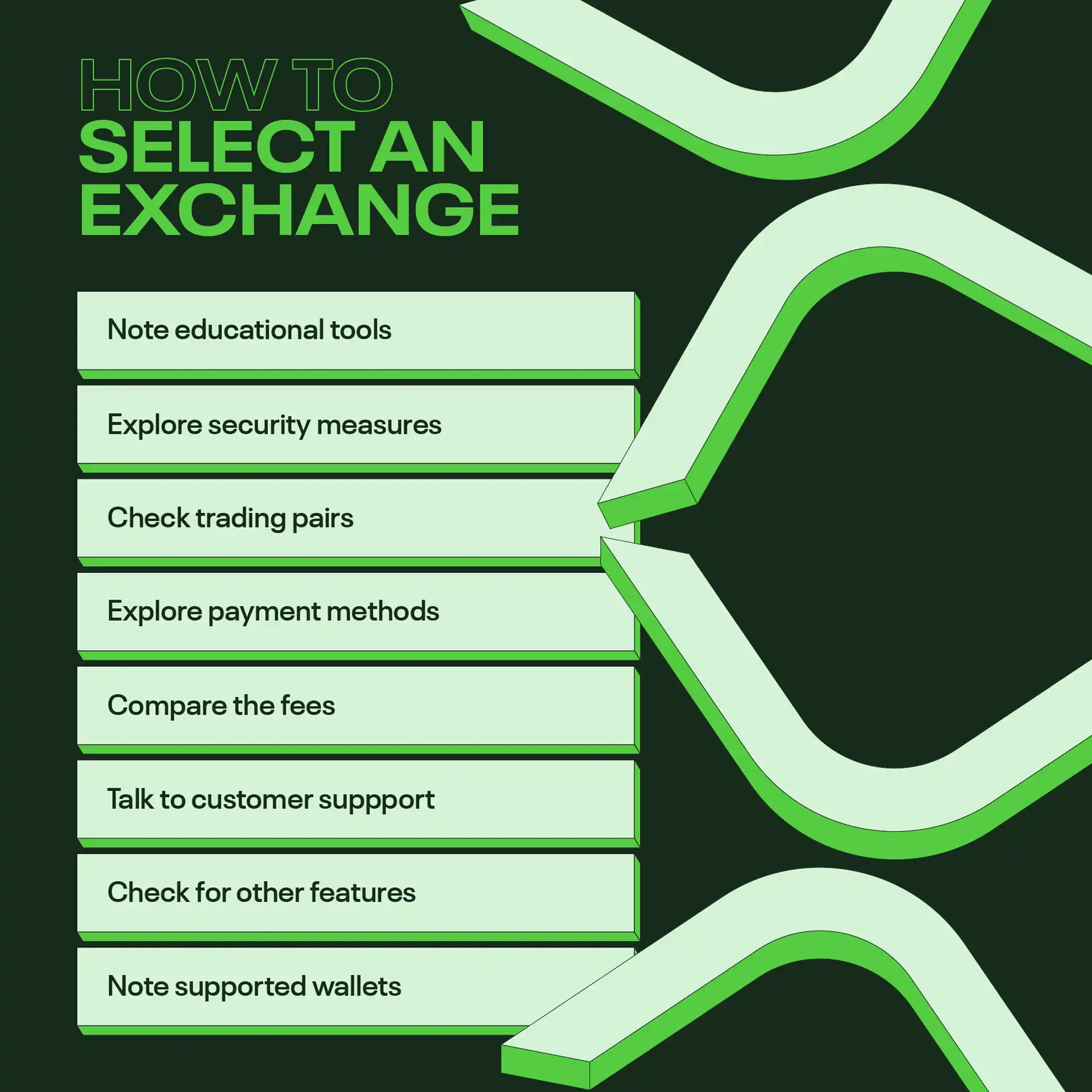

Factors To Check When Looking for Best XRP Exchange

Finding the best XRP exchange can be a complicated process. Luckily for you, I have explained all the main and even less-known factors you should use. As a result, you can learn what to look for and how to distinguish exchanges. Then, simply pick the one that matches your needs the most.

Check the list of available coins

One of the first things to look for is the list of supported coins. These are the coins or digital assets that are available on that exchange platform. Obviously, Ripple exchanges should offer XRP, so check for that first.

But you also should check other tokens. Perhaps you may eventually want to trade or buy different cryptocurrencies. This is why you should make sure that the platform supports as many tokens as possible.

There are over 10,000 different digital assets these days. But there is no exchange out there that offers support for all of these. Even Coinbase, a huge and popular exchange, supports 450 coins. Kraken, another popular one, supports 160.

Compare fees exchange platforms can charge you

Even the best XRP exchanges have fees. Keep in mind that all platforms of this kind have fees. Obviously, you cannot avoid the fees, but you can compare them and make sure to use exchanges with the lowest fees.

In general, most exchanges charge you fees when you deposit, trade, or withdraw funds. The accent here is on the trade part. It is usually much better to have one big trade than multiple, smaller ones. This is the case because you pay fees for each trade, but the fees decrease if your trade increases. Here are some of the fees that popular exchange platforms charge.

- Kraken: 0.9%-2%

- Binance: 0.1%-5%

- Coinbase: 0.5%-4.5%

- Crypto: 0%-2.99%

Pay huge attention to the liquidity of the XRP exchange

Liquidity is a complicated term with a simple explanation. Basically, it refers to the ability to convert tokens into cash or to use the cash to get tokens. An exchange with sufficient liquidity can do both of these things much faster and more efficiently than one with insufficient liquidity.

This is even more important at Ripple exchanges or any crypto exchange due to the high volatility. As you may know, the price of XRP goes up and down quickly. If the price goes up and you issue a ‘’buy’’ order, you want that to happen almost instantly. An exchange with sufficient liquidity can provide that.

The secret is to look at the trading volume of each exchange you are considering. In this case, I recommend that you use CoinMarketCap to get accurate data. The exchanges with the highest trading volume in recent times are Kraken and Coinbase.

Test security of top XRP exchange

All exchange platforms are huge websites that work with millions of users. This makes them ‘’appealing’’ in the eyes of hackers and criminals. This means that you should use an exchange where your money and your data are safe.

Look for two-factor authentication. Most exchanges have this system, thanks to Google Authenticator. Next, look for biometric features that are considered to be the best way to secure your account.

You can also check online to see if any of the top XRP exchanges have been targeted or affected by a lack of security in the past.

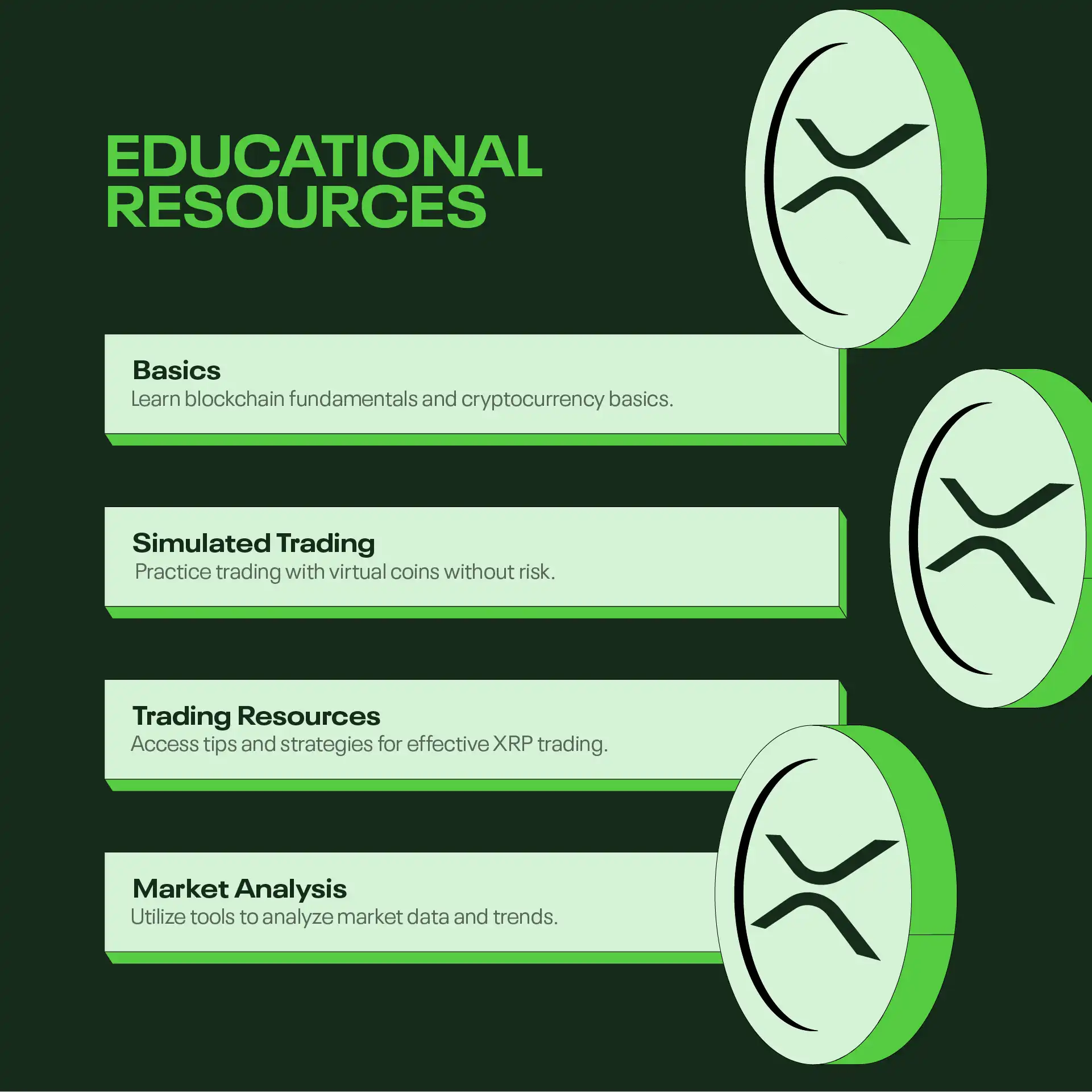

Available educational resources at the XRP exchange

Let’s say that you are a beginner who wants to learn all about trading XRP or just buying crypto. Well, you can learn that at the top Ripple exchanges thanks to the educational resources provided. Of course, you should know how to test that section and make sure that all the basics are covered.

Educational resources are extremely important

First of all, these resources are more important than you may think. Basically, this section allows you to learn everything about XRP and trading. Then you can make careful decisions and decrease the risk factor. In other words, you can learn how to use XRP like an intermediate user or even a professional.

Different types of educational resources explained

At the best Ripple exchanges, you can see a few different types of resources provided. All you can do is use all of these to make sure you get all the help you need.

Basic resources

These are the first sections you should check. In a nutshell, here you can learn about blockchain technology, including Bitcoin, Ethereum, Ripple, and all the basics.

Simulated trading

This is something I personally like. It is a feature where you can get a demo account and trade using virtual coins. There is no need to deposit anything, and you cannot make real money. But you can see how trading actually works.

Trading resources

In this section, you can learn about useful tips, how trading actually works, and which strategies are available. If you are seriously interested in trading XRP, this section is mandatory for you to check out.

Analysis of the market

Here you can learn how to check the market. For instance, a top Ripple exchange can share other websites that allow you to check the exchange volume of that exchange.

Quality of the resources provided

It is important to add that the quality of all provided resources has a huge role. The main thing to look for is accuracy. All of the resources should be accurate, detailed, and based on the latest data.

Secondly, the resources should be easy to understand, even if you are a complete beginner. While some exchanges have very simple resources that are easy to understand, others may have complex explanations with terms most beginners aren’t familiar with.

Geo-restrictions and licenses of XRP exchanges

The best Ripple exchange must have a proper license and accept users from your country. Keep in mind that all exchanges have a list of countries from which users are not allowed. Typically, these platforms need to get a suitable license and meet local regulations to offer their services in that particular country.

For you, this means checking the licensing details to see whether customers from your country are allowed to trade XRP on that exchange.

XRP exchange licenses: Basics

XRP exchanges must be registered as a legal entity, or a business, if you like. But, in order to get the license, these exchanges generally need to have a sufficient amount of money circulating and meet security requirements and certain laws.

For you, this means more security and safety while trading XRP. In other words, trading Ripple at an unlicensed exchange can be risky or even a total mistake. You can lose money if the exchange goes bankrupt, or it can be a scam.

Main factors regulators consider

In order to get a license, exchanges need to meet certain criteria. Only then can they be considered safe and trustworthy. Some of the essential factors regulators have are listed here.

CTF and AML

Counter-Terrorist Financing and Anti-Money Laundering are the first things regulators need. In a nutshell, they want to make sure the exchange is a reputable business and doesn’t have any links to criminal organizations or is involved in criminal activity.

KYC

Know Your Customer is usually seen at reputable businesses. Keep in mind that this has a huge role in crypto trading because of its associated anonymity. Simply put, exchanges need to make sure you are using their services for proper trading and not criminal purposes.

Risk and security management

Regulators also pay a lot of attention to the security at the exchanges and risk management. This refers to how well they can handle and solve the issue if something happens in the future.

Products available at XRP exchanges

Best XRP trading platforms are extremely versatile and advanced. This means that they offer a lot of different products and services that users can use. As a new user, you should check the available ones before you start trading there. Here is what to look for.

Trading tools and platforms provided

All of the best Ripple trading platforms allow you to buy or sell XRP. However, some have even more tools and features to offer. For instance, most carry out your orders at high speed. They also offer the ability to customize the charts as you like and multiple order types. These are essential for professional traders or users who want to become those.

Futures, margin, and spot trading

All of these refer to different types of trading. As you may assume, most of these are available if you want to invest in Ripple. But before you do, it is advisable to know the differences between futures, margin, and spot trading.

Futures allow you to buy tokens in a predetermined future. The advantage here is that you can buy more tokens for a lower price. However, this type of trading can be complex.

In margin trading, you are pretty much borrowing money from the broker and using it to buy digital assets. You have to pay the interest once you are done. Here, margin refers to the amount you have borrowed and the difference between the loan and the final investment value.

Spot trading is the simplest form of trading. In this case, you can immediately exchange fiat currencies or other cryptocurrencies for XRP. If you are a beginner, start with spot trading.

Storage options and XRP wallets

Once you have started with XRP trading and got the tokens, where are you planning to keep them? One option is to keep them at the exchange. However, this is not a clever idea unless you are planning to sell the tokens within hours.

A much better idea is to keep the coins in the eWallet. The best option here is to go with self-hosted XRP eWallets. Once you get the private key, you are the only person who can access the coins.

Additional services to individuals offered

Trading Ripple at exchanges is simply one of the things you can do. There are a lot more features available. For example, you can create or collect NFTs, earn XRP via rewards, and even borrow cash while XRP is used as collateral.

Check for all of these features before you start using an exchange platform. Perhaps, in the future, you can use these features and make even more money.

Services available to businesses

If you have a private business and want to use the exchange, you have even more options. For instance, you can enjoy trading in the futures markets, listing your business assets on the exchange, and even accepting XRP payments. As you can see, trading crypto is just one of many things you can do at exchanges.

Accepted payment methods at XRP exchanges

Where can I buy XRP crypto? You can buy the tokens at online exchanges easily. But you have to know how to buy these coins. For instance, you have to deposit funds at the exchange and then buy XRP. A list of available payment methods is one of the factors to check out before you create an account there. Below, I cover the main ones.

PayPal

At most cryptocurrency exchanges, you can use PayPal. This is an eWallet where you can keep your fiat currencies. In addition, you can connect it to your bank account or a credit card and use PayPal as a medium.

In general, users can use PayPal to deposit funds on the cryptocurrency exchange and trade. But you can also withdraw fiat currencies from the exchange and keep them in your PayPal account.

PayPal is widely accepted on exchanges such as eToro and many more. It is fast too, so you can deposit or withdraw funds within seconds. Add two-factor authentication and [impressive level of security, and you can see why so many users like using PayPal.

Bank wire transfer

Once you know where to trade XRP, you need to know one more thing. Using bank wire transfers is still possible and common. You can deposit funds within minutes.

This particular method is commonly used by traders who deposit huge amounts of money. It can also be ideal if using debit or credit cards is difficult in your area.

Other digital assets

If you want to start trading XRP but have other tokens, you can use those to buy XRP. In a few words, you can exchange any other digital token for XRP. One advantage is anonymous transactions. The second advantage is a very low deposit fee.

Credit and debit cards

Most users opt for credit or debit cards. This method allows them to deposit funds at the exchange directly from their bank account or withdraw the funds from that account.

One advantage here is the ability to get an extreme level of security when you make transactions. Also, you can see ‘’Verified by Visa’’ on some exchanges, meaning that the platform has been tested by the Visa company and is secure.

The link between payment methods and fees

XRP trading comes with different fees. Some of those fees are linked to the payment method you use. For instance, using digital assets is the most affordable option. On the other hand, using PayPal might come with withdrawal fees.

For instance, withdrawals from Binance are always free if you use cryptocurrencies. But they are not free if you use fiat currencies, hence bank transfers or PayPal. In that scenario, you pay a 1% withdrawal fee.

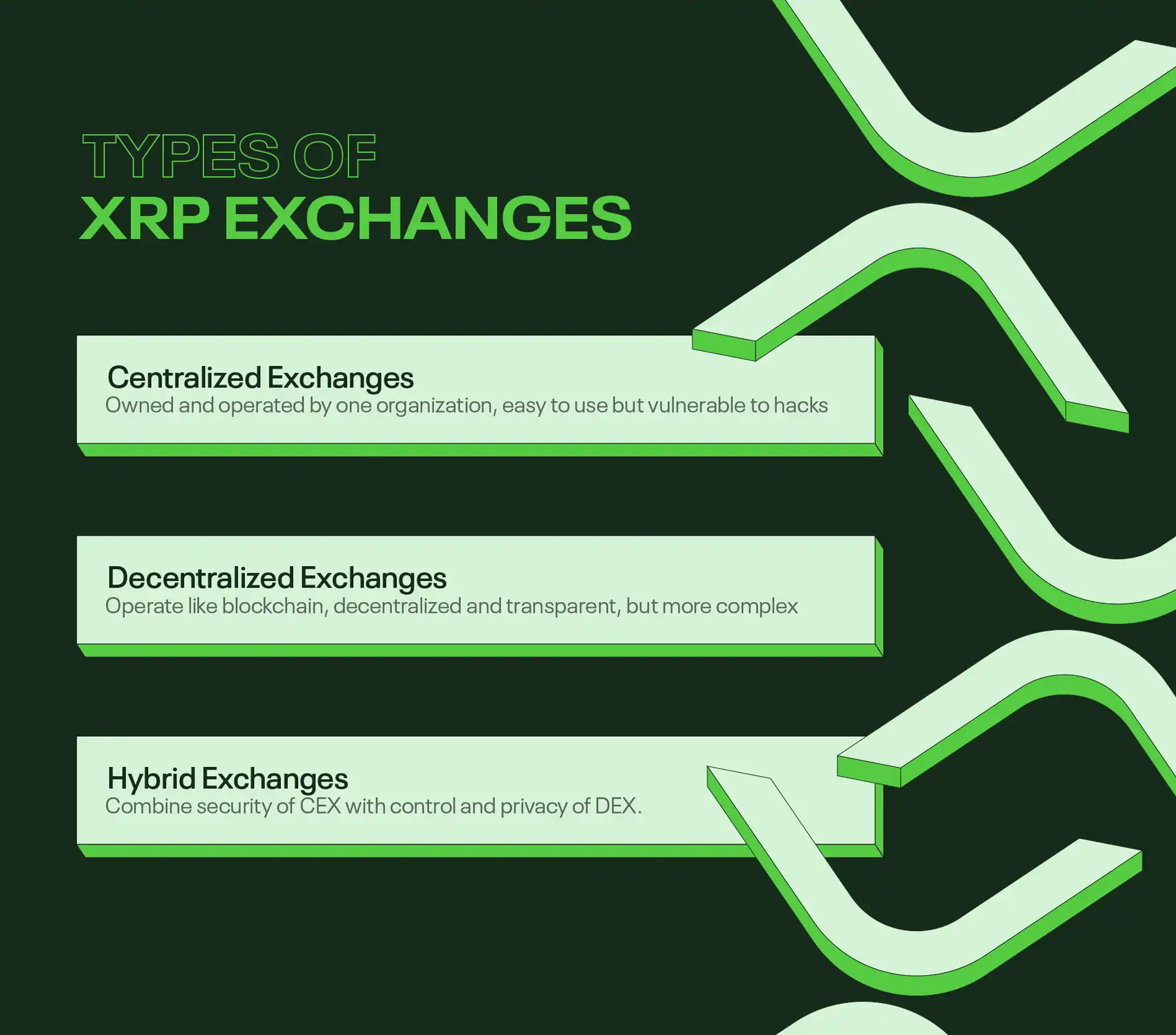

Popular Types of XRP Exchanges

Trading cryptocurrency can be done at one of these three types of exchanges. While they all allow you to do the same thing, they are different and have specific pros and cons.

Centralized exchanges (CEX)

With centralized exchanges, the whole platform is owned and operated by one organization. It is very easy to use this type of exchange, and there are many of them. But all the assets are held in one place, which makes them vulnerable against hacker attacks.

Decentralized exchanges (DEX)

Decentralized exchanges work in the same way as blockchain does. They are decentralized, meaning each user can certify many transactions. There is no single company that owns the exchange. In addition, these exchanges are more transparent and available all over the world. Sadly, they are more complicated to use.

Hybrid exchanges

Hybrid exchanges bring the best of both worlds. They offer the security centralized exchanges are known for but also the control and privacy that decentralized exchanges have.

Author Top Tip: Try All Of Them

Ideally, a user should use multiple best exchanges to buy XRP. First of all, this allows you to learn and master different user interfaces and become more advanced users. Secondly, you can diversify your investment, which is a wise thing to do.

There is one more advantage. When trading BTC, XRP, or any other crypto at multiple exchanges, you decrease the risk of losing the tokens if the exchange fails. This doesn’t happen frequently, but it is a great preventative measure.

Buying XRP Tokens the First Time: Step-by-Step Guide

Trading XRP can sound complex and even scary at first. However, it is a very simple process, and I can prove that. Here is a simple guide to how you can buy XRP today in under 10 minutes.

1. Choose the exchange

The first step is to choose the exchange platform you want to use. I have covered all the factors you should use to make a wise choice. Use them.

2. Choose the payment method

Create the account and choose the deposit method. It can be a debit card, PayPal, or another token.

3. Deposit funds

Click ‘’deposit’’ and follow the steps. Now you have money on the exchange platform.

4. Place your order

Choose XRP and enter the amount you want to use to buy the coins. Approve the order, and you are done.

5. Withdraw the tokens

Now you can click on ‘’withdrawal’’ and withdraw the tokens to your eWallet.

There are a few ways you can buy XRP. The first one is to buy coins directly from the exchange. The aforementioned guide refers to that process. But you can also use the peer-to-peer method. This means that you can replace your tokens with XRP tokens another user owns.

You can also get XRP using gift cards. For example, if someone gets your XRP gift card, you can use it to buy tokens and store them in your non-custodial crypto wallet.

So You’ve Bought XRP Coins; What Now?

Believe it or not, buying XRP is the simplest part of the process and one you can complete in minutes. But what can or should you do after that? There are a few things you have to keep an eye on.

Move it to the eWallet

Once you have used XRP best exchanges to buy the tokens, move the coins to your eWallet. It is much safer to keep them, and there are no fees when keeping the coins in your eWallet. Of course, if you are planning to trade the coins within hours or days, there is no need to do this.

Use XRP for many things

Be free to experiment and use XRP coins for different things. For instance, you can use them to pay for things. You can also use them and exchange them for other tokens. But you can also simply keep them in your eWallet and wait until the price jumps.

Always keep 5 coins

Trading XRP currency alone is not the best thing you can do. A much better option is to invest in or trade 5 different coins. This number is ideal due to the fact that you don’t have to invest a lot, but you can keep a decent number of coins in your eWallet.

Perhaps 3 of the coins will rise in value and make you a profit. In simple words, when holding 5 coins, you have 5 times better odds of making a profit.

Stay informed

XRP and Bitcoin trading are known for countless variations, changes, and new trends on a daily basis. That means that you should stay well-informed about all of the latest trends, new rules, laws, news, and changes that occur. If you know these things, you can react in no time and prevent a loss or change your investment.

Brief History of XRP

The history of XRP starts with Ripple, which is a currency exchange, and RTGS (Real-time gross settlement) back in 2012. The company was the idea of Jed McCaleb and was created with the help of David Schwartz and Arthur Britto. They got help from Ryan Fugger, who developed the OpenCoin system back in 2005. That system was the origin of Ripple.

The Ripple network works with fiat currencies, cryptocurrencies, and even commodities. The native cryptocurrency of Ripple is XRP. Also, Ripple holds an ISC license.

Final Word

In conclusion, this guide has shed light on the landscape of exchanges offering XRP. Platforms like Binance, LBank, and Binance TR boast high ratings and enticing bonuses. However, there are varying fee structures and liquidity levels.

Examining security measures, educational resources, regulatory compliance, and supported payment methods is important for safe and informed trading decisions. Don’t forget the importance of diversifying investments across multiple exchanges to mitigate security and counterparty risks.

Frequently Asked Questions

What services can I find at XRP exchanges?

Trading XRP is just one of the services you can find at exchanges. Futures, margins, and spot trading are others. Also, you can trade many other cryptocurrencies and NFTs.

How much money do I have to invest in XRP trading?

Each exchange has a minimum deposit you can use as your initial investment. A good thing is that trading Bitcoin or XRP is very affordable. You can start with $10 or $20 in most cases.

What are the most popular XRP exchanges?

There are a lot of different options. Some very popular exchanges include Coinbase, Kraken, and Binance. These are also some of the biggest exchanges available today.

What is the XRP exchange with the highest liquidity?

According to CoinMarketCap, the exchanges with the highest exchange volume and therefore the highest liquidity are Kraken and Coinbase. These are also some of the most popular exchanges available.

What are the three types of XRP exchanges?

The three types of exchanges are centralized, decentralized, and hybrid exchanges. Each one has different pros and cons. You should check those pros and cons before choosing the type that suits you the most.

What exchange can I buy XRP at?

All three types of the aforementioned exchanges can be used to trade XRP. However, most users will opt for decentralized or hybrid exchanges due to transparency and anonymity.