Dow Crashes After China ‘Weaponizes’ Yuan, ‘Abandons’ Trade Deal

The Dow crashed on Monday after China retaliated against Trump's tariff threats by "weaponizing" the yuan and "abandoning" the trade deal. | Source: Drew Angerer / Getty Images / AFP

The Dow Jones suffered another nauseating crash on Monday after China retaliated against President Trump’s tariff threats by escalating the trade war – and perhaps abandoning the negotiations altogether.

Dow Careens 430 Points Lower

All of Wall Street’s major indices shot lower at the opening bell.

The Dow Jones Industrial Average crashed 431.76 points or 1.63% to 26,053.25. Just one of the index’s 30 components, Verizon, rose during the morning session.

The S&P 500 slid 52.02 points or 1.77%, dropping the broad large-cap index all the way to 2,880.03.

The Nasdaq suffered the worst decline, losing 187.06 points or 2.34% to 7,817.01.

The CBOE VIX, a measure of implied volatility, spiked 21.29% to 21.36.

China Weaponizes Yuan, Trump Slams ‘Currency Manipulation’

Stocks imploded after Beijing responded to President Trump’s recent tariff threats, not with a whimper, but with a roar.

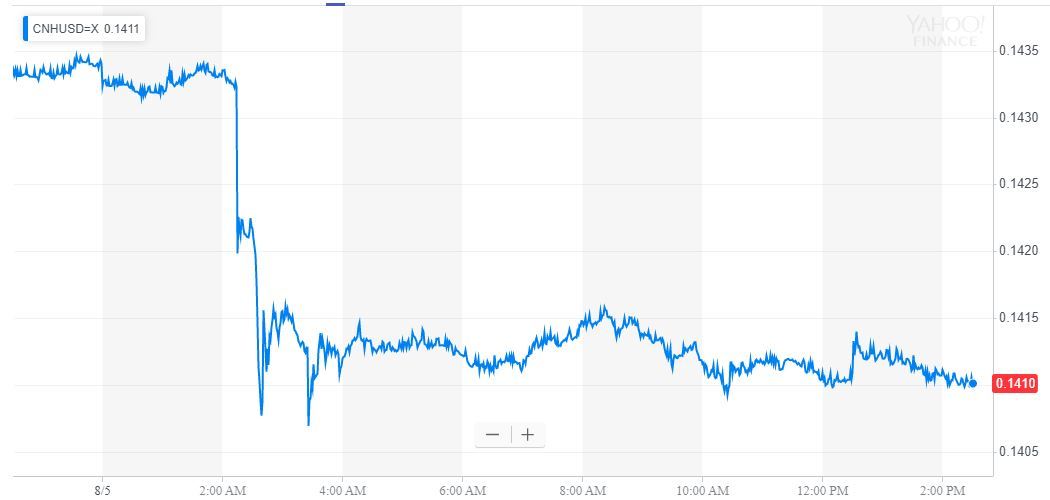

First, the Chinese government resumed what Trump has attacked as “currency manipulation,” allowing the value of the yuan to dive to $0.14 – its lowest level in more than 10 years.

According to the South China Morning Post, the People’s Bank of China (PBoC) blamed the weakening yuan on the United States , which plans to levy a new 10% tariff on $300 billion worth of Chinese goods beginning in September.

The central bank said the decline was the product of “unilateral trade protectionism, as well as expectations of more tariffs on China.”

Julian Evans-Pritchard, a senior China economist at Capital Economics, said it’s clear the PBoC is “weaponising” the CNY/USD exchange rate in anticipation of a full-blown US-China currency war.

Even worse, the action likely means that Beijing has effectively “abandoned” hope of striking a new trade agreement with the United States, regardless of whether negotiators continue to go through the motions at the next round of scheduled talks in September.

“[China] appears to have decided that, given the increasingly dim prospects of a trade deal with the US, the boost to China’s export sector from currency depreciation is worth attracting the ire of the Trump,” Pritchard added in a note cited by CNBC. “The fact that they have now stopped defending 7.00 against the dollar suggests that they have all but abandoned hopes for a trade deal with the US.”

But that wasn’t Beijing’s only response to Trump. As if to remove any doubt that it was actively escalating the trade war, Bloomberg reports that the government ordered state-run companies to suspend US agricultural purchases , reversing a previous pledge to increase imports of US farm goods.

Morgan Stanley: US Economy Just Three Quarters Away from Recession

According to Morgan Stanley, the sudden escalation in US-China tensions threatens to thrust the global economy into a brutal recession .

The ball now sits in the Trump administration’s court, and Morgan Stanley fears the White House will react by increasing tariffs on all Chinese imports to 25%. If that happens, the US economy could succumb to recession in just three quarters.

“As we view the risk of further escalation as high, the risks to the global outlook are decidedly skewed to the downside,” Morgan Stanley chief economist Chetan Ahya told investors, CNBC reports. “Trade tensions have pushed corporate confidence and global growth to multi-year lows.”

The Dow now looks poised to close lower for the fifth consecutive session. The weeklong plunge has wiped more than 1,150 points, or 4.2%, off the DJIA.

Click here for a real-time Dow Jones Industrial Average chart.