Dow Swings 400 Points Because Awful Economy May Force Trump’s Hand

The Dow swung 400 points on Thursday because the awful economy could force Trump to prioritize a trade deal with China. | Source: REUTERS / Kevin Lamarque

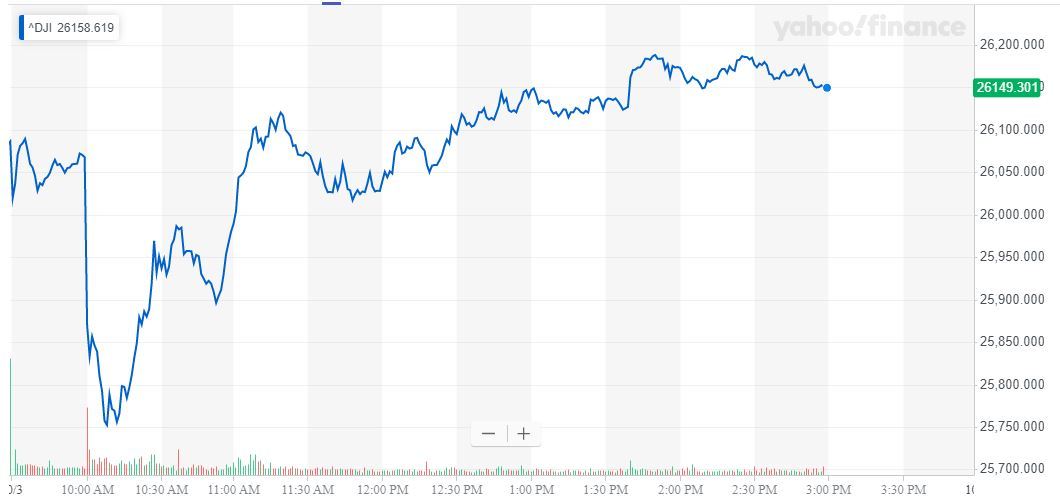

The Dow Jones recovered from a sharp 300-point plunge following the release of a troubling ISM Non-Manufacturing Index report to record a gain of nearly 125 points on Thursday.

Expectations for a Fed rate cut in October rose for the third straight day, helping boost the fragile stock market.

An additional push came from Donald Trump, who stepped in to announce a Chinese delegation was coming to the US for trade talks , bolstering risk sentiment.

Dow Jones Rallies as Rate Cut Expectations Hit 90%

The Dow Jones Industrial Average closed with gains of 122.42 points or 0.47% to settle at 26,201.04. The Dow had dropped as low as 25,743.46 during the morning session.

The Nasdaq outperformed with a 1.12% rally t0 7,872.27, while the S&P 500 rose 0.8% to 2,910.63.

Commodity markets were mixed again. Oil sold off (-0.61%), but gold (+0.21%) continued to press toward record highs.

The benefits of a weaker US dollar were clearly seen on Thursday. The DXY declined 0.06% as Federal Reserve rate cut expectations for October hit 90% . The weak USD helped reverse daily losses for the Dow after a cavernous decline earlier in the week.

ING: Dismal Economic Data Could Force Trump to Prioritize Trade Deal

More miserable data hung heavy over the US stock market, as another ISM reading (non-manufacturing employment) missed big. Chief International Economist James Knightley believes that risks are rising for a very weak non-farm payrolls figure on Friday, stating:

“This is the worst employment reading since early 2014 and given the ISM manufacturing employment number was already pointing to a sharp fall we are not optimistic for tomorrow’s all-important jobs number. The consensus is still for employment growth of 147,000, but the labour surveys (including yesterday’s ADP report) suggest 100-120k may be more realistic.”

A bad jobs report could be highly detrimental to the Dow Jones, but Knightley believes there may be a silver lining for stock bulls. The dramatic slide in US economic activity may persuade Trump to make a deal with China, or at least prompt much more aggressive easing from the Federal Reserve.

“The latest developments should add a sense of urgency to talks seeking a resolution to the US-China trade dispute and will keep the pressure on the Fed to ease monetary policy further. We continue to look for a December rate cut and a further move in 1Q20, but the risks are increasingly skewed towards more aggressive action.”

Dow Stocks: Financials Tumble, Apple and Microsoft Rise

The Dow 30 was mixed. Falling Treasury yields hit major banking stocks Goldman Sachs (-0.51%) and J.P. Morgan (-0.14%), as the investment banks continue to struggle.

Elsewhere, things were brighter, as global multinational stocks like Nike, Coca-Cola, and McDonald’s enjoyed the profitability boost from a softer US dollar, with the latter two rising more than 1.4%. These companies offer stable P/E ratios , making them attractive during periods of market stress.

Apple stock rose 0.85%, while Microsoft headlined the DJIA’s tech stock rally with an impressive 1.2% bounce. Boeing was also able to recover nearly 1.3% despite some fresh allegations of safety mismanagement among its executives.

Click here for a live Dow Jones Industrial Average chart.