Fetch.ai Price Prediction 2024: FET Drops From Record High, Is AI Hype Over?

What's next for Fetch.ai?

Key Takeaways

- Fetch.ai’s FET token reached its all-time high on March 6.

- The coin then dropped, in line with retracement made by all cryptocurrencies sector.

- One price prediction says it may reach $38.55 next year.

Fetch.ai, a crypto artificial intelligence project built on Cosmos, reached its all-time high after it said it is investing $100 million into its infrastructure program, Fetch Compute. This initiative aims to enhance developers’ tools, computing power, and training capabilities while offering GPU credits to users.

Utilizing Nvidia H200, H100, and A100 GPUs, Fetch Compute will provide a platform for developers and users to access computing power, funded by the Fetch.AI ecosystem fund.

The project wrote : “The move is expected to accelerate the pace of innovation within the fetch.ai ecosystem by providing the capacity to explore complex models and solutions.”

In addition, “users staking Fetch.ai’s native coin $FET will earn Fetch Compute Credits as rewards which they can then use to pay for GPU utilization on the Fetch Compute network” starting on March 7.

Anyway, after an AI boom, the coin retraced a bit in the second half of March. Is the AI boom already over?

Fetch.ai did not immediately respond to a request for comment.

But what is Fetch.ai (FET)? How does Fetch.ai work? Let’s see what we can find out, and also take a look at some of the Fetch.ai Price Predictions that were being made as of March 25, 2024.

Fetch.ai Coin Price Prediction

Let’s examine some of the Fetch.ai price predictions being made on March 25, 2024. It is crucial to bear in mind that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate. Additionally, please remember that many long-term crypto price predictions are generated using algorithms, which means they can change at any time.

| 2024 | 2025 | 2030 | |

|---|---|---|---|

| Prediction #1 | $5.55 | $6.40 | $18.93 |

| Prediction #2 | $3.82 | $5.78 | $37.70 |

| Prediction #3 | $23.13 | $38.55 | $84.81 |

First, CoinCodex had a short-term Fetch.ai price prediction that saw the coin reach $2.58 by Aprile 1 before climbing to $2.82 by April 24. The site’s technical analysis was bullish, with 25 indicators sending encouraging signals and five making bearish ones.

Fetch.ai Price Prediction for 2024

DigitalCoinPrice said Fetch.ai would reach $5.55 this year, while PricePrediction.net expects it at $3.82 and CoinCu said FET would close the year at $23.13.

Fetch.ai Price Prediction for 2025

CoinCu said Fetch.ai would reach $38.55 while PricePrediction.net sees it at $5.78. DigitalCoinPrice said FET would trade at $6.40.

Fetch.ai Price Prediction for 2030

Moving on to a more long-term Fetch.ai price prediction, PricePrediction.net said the coin would be worth $37.80 in 2030 while CoinCu expects it at $84.81. DigitalCoinPrice made a FET price prediction of $18.93 at the start of the next decade.

Google Gemini AI Price Prediction for Fetch.ai (as of March 25)

Google’s Gemini AI platform gave the following price prediction for Fetch.ai on March 25. Please remember that the exact price prediction of an asset or cryptocurrency in the future is nearly impossible to achieve. Additionally, artificial intelligent price predictions are predicated on past performances and are in no way entirely accurate.

Short Term (Next 3 months)

- Expected price: $2.41

- Factors to Consider:

- Market sentiment: Overall market sentiment towards cryptocurrencies can significantly impact individual token prices.

- Regulations: Regulatory changes and uncertainty can affect the entire crypto market, including Fetch.ai.

- Project development: Progress on Fetch.ai’s development roadmap and adoption can influence its price.

- Unforeseen events: Unexpected events like major news stories or technological breakthroughs can impact the market.

Medium Term (Next 6 months)

- Expected price: $1.70

- Factors to Consider:

- Remember, these are just forecasts and should not be taken as financial advice. It’s crucial to do your own research and consider various factors before making any investment decisions.

Long Term (Next 5 years)

- Expected price: $5.12

- Factors to Consider:

- Market sentiment: Overall sentiment towards the cryptocurrency market can significantly influence individual coin prices.

- Adoption and Use Cases: Increased adoption and usage of Fetch.ai’s technology and token could drive up the price.

- Regulations: Regulatory changes and policies can affect the entire cryptocurrency market and specific coins like FET.

- Technological advancements: Advancements in artificial intelligence and blockchain technology could impact the demand for FET.

Recent Updates from Fetch.ai

Fetch.ai has launched new AI Agents, that are programs able to operate autonomously within decentralized landscapes, aligned with user-defined objectives. These agents have the ability to connect, search, transact, establish dynamic markets, and so on.

FET Price History

Let’s now take a look at some of the highlights and lowlights of the Fetch.ai price history . While past performance should never be taken as an indicator of future results, knowing what the coin has done can help give us some very useful context when it comes to either making or interpreting an STRK price prediction.

When FET first came onto the open market on March 6, 2019, it was worth $0.406. It moved sideways until the end of that year, when it increased to $0.9287.

The coin had a negative 2022 but increased the following year, reaching its maximum level of $0.7618 in the second half of the year.

It then started 2024 on a strong positive note, jumping to $3.0823 – its all-time high – on March 10, 2024. The coin retraced a bit, being worth $2.58 on March 25, 2024.

At that time, there were 840.0 million FET in circulation, out of a total supply of 1.15 billion. This gave Fetch.ai a market cap of about $2.17 billion, making it the 56th largest crypto by that measurement.

Fetch.ai Analysis

FET’s price began its last significant upward trend on November 26, 2022, with support found at $0.070. This uptrend reached its peak at $0.61 in mid-February before experiencing a pullback to a higher low of $0.17 in August 2023.

After establishing support at $0.17, FET embarked on a new uptrend, soaring to a record high above $3 on March 8. However, signs suggest this upward momentum may be pausing for now. The rise from last August’s low likely marks the beginning of a new five-wave uptrend, with the March peak representing its third wave.

If this analysis holds, a correction may be in store for wave 4, with a mid-term target around $1.50. The correction seems to have commenced as the price dipped below $3 on the daily chart, accompanied by a Relative Strength Index of 94%, signaling overbought conditions.

While the correction unfolds, the bullish overall structure of FET remains intact. Once the anticipated correction concludes, further upside potential awaits in 2024. Our next upside target stands at $8, representing a 230% increase from current levels.

Is Fetch.ai a Good Investment?

It is hard to say. The coin has dropped after its launch and so did for at least two years, before jumping in 2024.

As ever with crypto, you will need to make sure you do your own research before deciding whether or not to invest in FET.

Will Fetch.ai go up or down?

No one can really tell right now. While the Fetch.ai crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can, and do, go down as well as up.

Should I invest in Fetch.ai?

Before you decide whether or not to invest in Fetch.ai, you will have to do your own research, not only on FET, but on other, related, coins and tokens such as Ethereum (ETH) and Solana (SOL). Either way, you will also need to make sure that you never invest more money than you can afford to lose.

Who are the Founders of Fetch.ai?

Fetch.ai was developed and created in 2017 by a team based in Cambridge, UK. The project was co-founded by Toby Simpson, Humayun Sheikh, and Thomas Hain.

Who Owns the Most Fetch.ai (FET) Tokens?

On March 25, 2024, one wallet held 9.84% of FET’ supply.

Richest FET Wallet Addresses

As of March 25, 2024, the five wallets with the most Fetch.ai tokens were

- 0x947872ad4d95e89e513d7202550a810ac1b626cc. This wallet held 113,446,772 FET, or 9.84% of the supply.

- 0x947872ad4d95e89e513d7202550a810ac1b626cc. This wallet held 80,616,476 FET, or 6.99% of the supply.

- 0x8400ac235ed4f139a3e05670a9a3c724e448129b. This wallet held 74,193,198 FET, or 6.43% of the supply.

- 0xbe0eb53f46cd790cd13851d5eff43d12404d33e8. This wallet held 49,333,112 FET, or 4.28% of the supply.

- 0x5a8de252ea228dece61638c336fe43ac8166166a. This wallet held 45,001,000 FET, or 3.90% of the supply.

Fact Box

| Supply and distribution | Figures |

|---|---|

| Total supply | 1,152,997,575 |

| Circulating supply (as of March 25, 2024) | 840,034,433 (80% of maximum supply) |

| Holder distribution | Top 10 holders owned 37% of supply, as of March 25, 2024 |

From the Whitepaper

In its technical documentation, or whitepaper , Fetch.ai says it is a next-generation protocol built with a ready-to-go useful proof-of-work (PoW) system invented by world-leading AI minds.

Fetch.ai (FET) Explained

Fetch.ai (FET) is an Ethereum token that powers Fetch.ai, a decentralized machine learning platform for applications such as asset trading, gig economy work, and energy grid optimization.

Fetch.ai’s first decentralized finance application helps Uniswap users automate trading according to predefined conditions.

How FET Works

FET and Fetch.ai are used to revolutionize and enhance a multitude of diverse industries and sectors by utilizing AI and the capacity of agents to improve and learn from past mistakes.

Fetch.ai’s technology is relevant for a great number of industries, which include the popular sector of decentralized finance, supply chain, transport and mobility, electric vehicle infrastructure, train systems, and other industries.

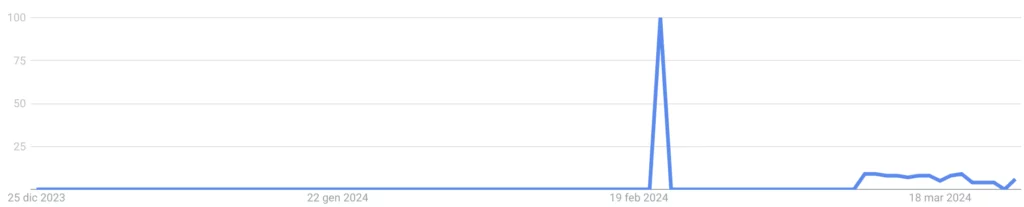

FET Attention Tracker

Here is a chart for the Fetch.ai Google search volume for the past 90 days. This represents how many times the term “Fetch.ai FET” has been Googled over the previous 90 days.

FAQs

Will Fetch.ai reach $10?

According to main price predictions, FET will reach double digits this year already.

What is Fetch.ai?

Fetch.ai (FET) is an Ethereum token that powers Fetch.ai, a decentralized machine learning platform for applications such as asset trading, gig economy work, and energy grid optimization.

Fetch.ai’s first decentralized finance application helps Uniswap users automate trading according to predefined conditions.

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.