Projected US Interest Rates in Five Years: Will the Fed Cut Occur In 2024?

Where do we expect the US Interest rates to be in five years?

- The Federal Reserve kept record-high rates unchanged.

- Chair Jerome Powell announced three cuts in 2024.

- The Next Federal Open Market Committee meeting will be on April 30 and May 1.

- How do interest rates influence cryptocurrencies?

Dot Plot Expectations

Interest Rates’ Impact on Financial Markets

Projections and decisions regarding interest rates hold immense sway over the broader economy, affecting various financial markets, including equities, bonds, and commodities.

The Fed’s key tool in this regard is the Federal Funds Rate (FFR). This serves as the base interest rate that influences banks, bond markets, and the overall economy. The Fed makes these rate decisions during its Federal Open Market Committee (FOMC) meetings, held eight times a year. The rate adjustments in 2022 brought about several hikes, with more in store for 2023.

The increase in FFR, in turn, leads to a rise in the prime rate, the fundamental interest rate charged by banks to creditworthy customers. If the FFR goes up, so does the cost of loans and mortgages. This uptick in the cost of servicing loans translates to reduced discretionary income for consumers and businesses. This, in turn, can dampen overall demand and mitigate inflationary pressures.

The implications for stocks are twofold: consumer-dependent sectors like retail and hospitality may face headwinds due to reduced consumer spending. Growth stocks that rely on capital and borrowing could also suffer, as investors shift their focus toward more stable, value-oriented investments in response to market volatility and potential downturns.

Pressure On Bonds

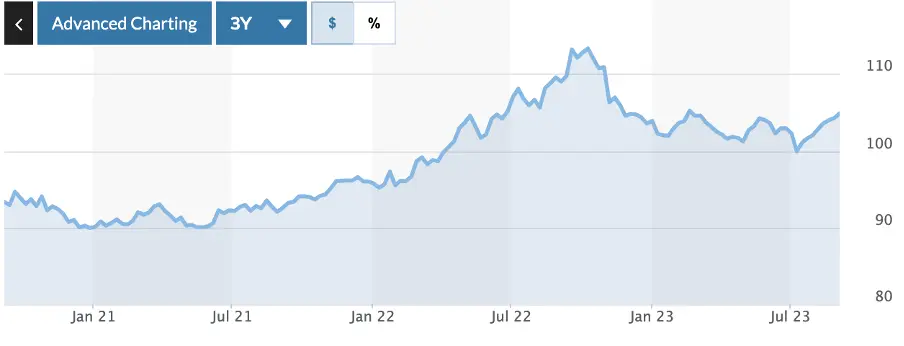

From a mechanical perspective, rising interest rates put downward pressure on bond values. As rates climb, the yield on bonds becomes less attractive compared to the prevailing base rate. This has led to a sell-off in bonds.

This effect is particularly pronounced in the case of long-term bonds, as the discrepancy between their yield and the base rate grows over time.

As a result, fixed-income securities also lose value as the opportunity cost of not owning interest-rate tracking assets increases. Thus, predicting interest rates over the next five years becomes a critical indicator for market trends.

High Rates Critical To Lower Inflation

Historical Perspective on Interest Rate Policy

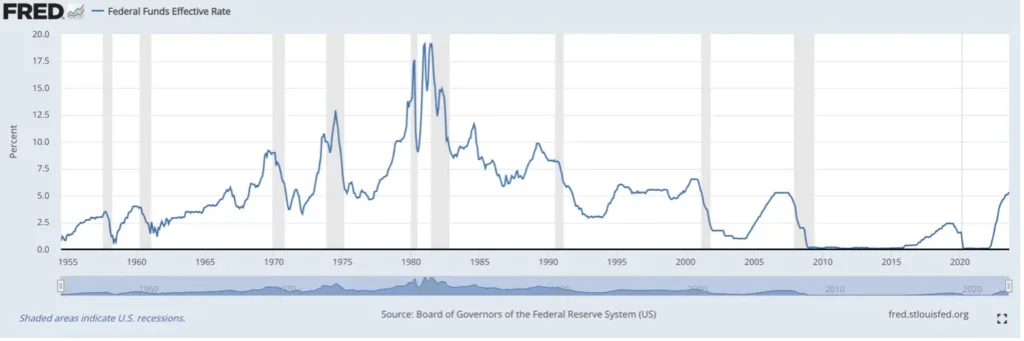

The US has experienced periods of both high and low-interest rate volatility in its history. In the postwar era of the 1950s, the FFR remained below 2%, bolstered by postwar stimulus and income growth. Over the next two decades, the rate fluctuated between 3% and 10% during the 1960s and 1970s, soaring to a record high of 19.1% in 1980 amid rampant inflation.

As the US economy stabilized and inflation was brought under control, the FFR hovered around 5% throughout the 1990s. However, recessions in 2001 and 2008 forced rates down to historically low levels, where they remained until 2016.

The COVID-19 pandemic necessitated another significant rate cut, nearly to zero. In 2022, the Fed increased rates seven times, followed by three hikes in 2023. The central bank brought the rate to its current range between 5.25% and 5.50%, the highest level in 16 years.

Factors Influencing Future Interest Rates

The Fed now faces the challenge of navigating uncertain economic conditions, marked by rising prices and an economic slowdown compounded by supply chain disruptions. Inflation, as well as the potential for a recession, are top concerns.

High Inflation

Inflation has been a focal point for central bank action. In 2022 and 2023, inflation was driven by a mix of demand and supply factors, sometimes interconnected. The Fed’s more hawkish stance appeared to have contributed to a moderation in price increases. In the May meeting, Fed Chair Jerome Powell indicated that the central bank no longer anticipates additional rate hikes but remains data-dependent.

The rhetoric shifted in July. Official data from the US Labor Department revealed that the inflation rate had reached 3.2% year-over-year. To drive this increase were costs in housing, car insurance, and food.

This marked an uptick from June, which had seen the lowest rate in over two years, at 3%. Analysts had anticipated this rise in the headline rate, considering the relatively weak price inflation observed in the previous July.

U.S. Dollar Resilience

Despite economic turbulence, the US dollar has remained remarkably resilient. Its status as a safe-haven currency, coupled with increased investor appeal due to the Fed’s hawkish monetary policy, has bolstered its performance. However, as the Fed’s monetary tightening slows and potentially pauses, the strength of the US dollar appears to be waning.

Is Recession Looming?

New data from the Bureau of Economic Analysis indicates a slightly weaker performance for the US economy in the final quarter of 2023 compared to earlier projections.

The second estimate reveals that real gross domestic product (GDP) increased by 3.2% quarter-on-quarter on an yearly basis, down from the previous quarter’s robust growth of 4.9%.

This figure falls short of the initial estimate of 3.3%, primarily due to a downward revision in private inventory investment, although there were upward revisions in state and local government spending as well as consumer spending.

Year-on-year, GDP growth accelerated to 3.1% in the fourth quarter, surpassing the 2.9% rise in the third quarter.

Personal consumption expenditures, an important measure of inflation, saw an upward revision, increasing by 1.8% on-quarter in the last three months of the year, compared to the initial estimate of 1.7%.

These adjustments shed light on the evolving dynamics of the US economy, highlighting areas of strength and areas for potential improvement as policymakers navigate economic challenges.

Projected Interest Rates in the Next Five Years

Analysts primarily focus on near-term interest rate forecasts, but long-term projections extend over the next several years. These forecasts offer valuable insights into interest rate expectations.

ING’s interest rate predictions indicate 2024 rates starting at 4%, with subsequent cuts to 3.75% in the second quarter. Then, 3.5% in the third, and 3.25% in the final quarter of 2024. In 2025, ING predicts a further decline to 3%.

The University of Michigan inflation expectations in the US for the five-year outlook were revised slightly higher to 3% in August 2023. This is higher than the preliminary estimate of 2.9%, matching July’s reading.

Rate Cuts On The Horizon?

Economic growth was seen in a range between 1.2% and 1.7% in 2024, and 1.5% and 2% in 2025. Core PCE inflation is expected to fall to between 2.4% to 2.7% in 2024 and 2% to 2.2% in 2025.

Also, median home price growth expectations decreased to 2.8% in July from 2.9% in June. Meanwhile, consumers also see lower inflation in three years at 2.9% from a previously expected 3% and in five years at 2.9% from 3%.

Economic Activity Improves

Figures from the Bureau of Economic Analysis revealed the U.S. economy experienced even stronger growth than initially projected in the third quarter. The quarter-on-quarter gross domestic product (GDP) expanded by an annualized rate of 5.2% in the three months to September 30. It surpassed the 2.1% growth observed in the second quarter.

An earlier estimate reported a month ago had suggested a 4.9% growth for the same period. The Bureau of Economic Analysis credited the upward revision to nonresidential fixed investment and state/local government spending. To partially balance this was a consumer spending downturn. Crucially, the boost in real GDP was fueled by increased consumer spending, private inventory investment, exports, government spending at various levels, and both residential and non-residential fixed investments.

This represents the most significant quarter-on-quarter GDP growth since the fourth quarter of 2021’s 7% increase. It reflects five consecutive quarters of economic expansion. On a year-on-year basis, U.S. GDP accelerated to 3% in the third quarter. This followed a 2.4% increase in the second quarter. The latest reading marks the fastest annual GDP growth since the 3.6% rise in the first quarter of 2022’s.

Despite the Federal Reserve’s decision to raise rates by 525 basis points since March 2022, the data indicates that the U.S. economy has built significant momentum in the last quarter.

Factory, Labor, And Wages Trends

Manufacturing activity displayed mixed results, though multiple districts showed a brighter outlook for the sector.

The labor market showed signs of easing nationwide. Most districts reported slight to moderate increases in overall employment, albeit with a reduced sense of urgency among firms in their hiring efforts. However, recruiting and hiring skilled workers remained challenging.

Wage growth remained moderate, with candidates showing less resistance to wage offers. Many firms adjusted their compensation packages to offset higher labor costs. They incorporated measures like remote work options instead of wage increases, reduced sign-on bonuses, or other enhancements.

Price trends indicated modest overall increases, with input costs stabilizing or slowing for manufacturers while continuing to rise for service sector businesses.

Factors such as fuel costs, wages, and insurance contributed to price growth. Sales prices increased at a slower rate than input prices, as businesses grappled with passing on cost pressures due to heightened price sensitivity among consumers, thus impacting profit margins.

In the coming quarters, firms generally anticipate price increases, but at a slower pace compared to previous periods. Several districts reported a reduced number of firms expecting significant price hikes in the foreseeable future.

How Do Interest Rates Affect Crypto?

Bitcoin and other digital assets have demonstrated resilience in a rising interest rate environment. For instance, Bitcoin experienced remarkable growth of 2,000% in 2015 and 2016, during a period marked by rising interest rates.

Nevertheless, some experts argue that persistently high inflation, gas prices, and energy costs resulting from elevated interest rates may dampen risk appetite, potentially posing headwinds for cryptocurrencies.

Central Banks and Connection With Cryptocurrencies

Central banks wield significant influence, directly affecting money circulation and financial market stability. They have the power to modify interest rates, which, in turn, affects the borrowing rates for financial and banking institutions. Recently, central banks in major developed economies, such as the Fed, ECB, and BoE, have opted to increase interest rates in response to widespread inflation.

The increasingly intertwined relationship between cryptocurrencies and these macroeconomic and monetary shifts is noteworthy. In particular, the decisions to raise interest rates, especially by the Fed, have direct repercussions on the cryptocurrency markets.

In simpler terms, the Fed’s more assertive stance has cast a shadow over cryptocurrencies. This has an impact on market sentiment as tighter monetary policies loo