Axelar Price Prediction 2024: Can AXL Resume Upturn?

What's next for Axelar?

Key Takeaways

- Axelar announced a new partnership with Ripple.

- Its native token, AXL, reached an all-time high on the partnership news.

- One Axelar price prediction says it may reach $3.20 in 2025.

Ripple and Axelar have announced a strategic partnership to ensure seamless interoperability on the XRP Ledger (XRPL) across different blockchain networks.

The goal of the collaboration is to create a more interconnected blockchain ecosystem, allowing developers to explore new possibilities for application integration and development.

This effort also aims to expand the use and influence of the XRP Ledger across the broader financial services landscape. Let’s see all the details below.

Will this new partnership boost AXL, which has recently hit its all-time high price?

Axelar did not immediately respond to a request for comment.

But what is Axelar (AXL)? How does Axelar work? Let’s see what we can find out, and also take a look at some of the Axelar Price Predictions that were being made as of May 3, 2024.

Axelar Coin Price Prediction

Let’s examine some of the Axelar price predictions being made on May 3, 2024. It is crucial to bear in mind that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate. Additionally, please remember that many long-term crypto price predictions are generated using algorithms, which means they can change at any time.

| 2024 | 2025 | 2030 | |

|---|---|---|---|

| Prediction #1 | $2.68 | $3.20 | $9.21 |

| Prediction #2 | $1.62 | $2.39 | $15.44 |

| Prediction #3 | $1.89 | $2.82 | $16.93 |

First, CoinCodex had a short-term Axelar price prediction that saw the coin reach $1.60 by May 8 before climbing further to $4.03 by June 2. The site’s technical analysis was neutral, with 16 indicators sending bullish signals and eight making bearish ones.

Axelar Price Prediction for 2024

DigitalCoinPrice said Axelar would reach $2.68 this year, while PricePrediction.net sees it at $1.62 and Changelly said AXL would close the year at $1.89.

Axelar Price Prediction for 2025

Changelly said Axelar would reach $2.82 while PricePrediction.net sees it at $2.39. DigitalCoinPrice said AXL would trade at $3.20.

Axelar Price Prediction for 2030

Moving on to a more long-term Axelar price prediction, PricePrediction.net said the coin would be worth $15.44 in 2030 while Changelly sees it at $16.93. DigitalCoinPrice made an AXL price prediction of $9.21 at the start of the next decade.

Google Gemini AI Price Prediction for Axelar (as of May 3)

Google’s Gemini AI platform gave the following price prediction for AXL on May 3. Please remember that the exact price prediction of an asset or cryptocurrency in the future is nearly impossible to achieve. Additionally, artificial intelligent price predictions are predicated on past performances and are in no way entirely accurate.

Short Term (Next three months)

- Expected price: $4.08

- Factors to Consider:

- Market sentiment: Overall positive sentiment towards the cryptocurrency market could drive AXL’s price up, while negative sentiment could lead to a decrease.

- Developments within the Axelar ecosystem: Any significant advancements or partnerships within the Axelar network could positively impact the price.

- Regulatory landscape: Regulatory changes or uncertainties surrounding cryptocurrencies could affect the overall market and potentially AXL’s price.

Medium Term (Next six months)

- Expected price: $3.48

- Factors to Consider:

- Market sentiment: Overall positive sentiment can drive prices up, while negative sentiment can lead to price drops.

- Regulation: Government regulations can significantly impact the cryptocurrency market.

- Technological advancements: Innovations in the blockchain space can influence AXL’s adoption and price.

- Unexpected events: Unforeseen events, like hacks or economic crises, can drastically impact the cryptocurrency market.

Long Term (Next five years)

- Expected price: $24.75

- Factors to Consider:

- Market trends: The overall health and direction of the cryptocurrency market can significantly impact individual coin prices.

- Adoption and use case: Widespread adoption and strong use cases for the Axelar network could drive its price up.

- Regulations and developments: Regulatory changes and new developments in the blockchain space could influence AXL’s value.

- Team and community: A strong team and a passionate community can contribute to the project’s success and potentially impact the price.

AXL Price History

Let’s now take a look at some of the highlights and lowlights of the Axelar price history . While past performance should never be taken as an indicator of future results, knowing what the coin has done can help give us some very useful context when it comes to either making or interpreting an AXL price prediction.

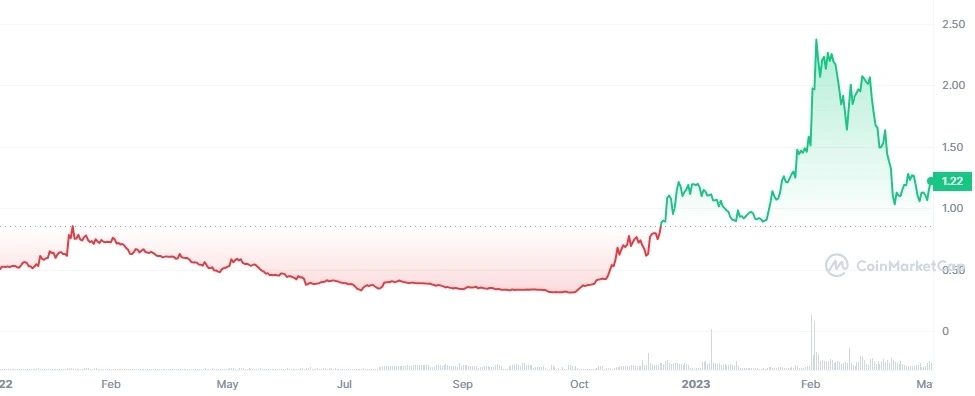

When AXL first came onto the open market in September 2022, it was worth $0.8516. It soon fell, closing the year at $0.4943, before moving down for quite all the following year.

In December 2023, it spiked quickly, ending the year at $1.1937 and moving up in the first two months of 2024, reaching $1.56 on March 1, 2024. It reached its all-time high at $2.3706 on March 3 before entering a downtrend that brought AXL to $1.22 on May 3, 2024.

At that time, there were 647.6 million AXL in circulation, out of a total supply of 1.15 billion. This gave Axelar a market cap of about $790.2 million, making it the 96th largest crypto by that measurement.

Is Axelar a Good Investment?

It is hard to say. The coin has experienced some ups and down over recent months. Its announcement of a partnership with Ripple to ensure seamless interoperability on the XRP Ledger (XRPL) across multiple blockchain networks may sustain the coin price.

As ever with crypto, you will need to make sure you do your own research before deciding whether or not to invest in AXL.

Will AXL Network go up or down?

No one can really tell right now. While the Axelar crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can, and do, go down as well as up.

Should I invest in Axelar?

Before you decide whether or not to invest in Axelar, you will have to do your own research, not only on AXL, but on other, related, coins and tokens such as Ethereum (ETH) and Solana (SOL). Either way, you will also need to make sure that you never invest more money than you can afford to lose.

Who are the Founders of Axelar?

Sergey Gorbunov and Georgios Vlachos are the minds behind Axelar. Their motivation stemmed from the need to tackle the fragmentation plaguing the blockchain sphere, driven by the proliferation of isolated networks. In response, they conceived Axelar, a decentralized platform engineered to bridge the gap between disparate blockchain ecosystems. Axelar stands as a beacon of innovation, offering a secure and seamless avenue for communication across blockchain networks, thereby unlocking the full potential of decentralized technologies..

Who Owns the Most Axelar (AXL)?

On May 3, 2024, one wallet held 18.52 % of the supply of Axelar.

Richest AXL Wallet Addresses

As of May 3, 2024, the five wallets with the most Axelar were

- 0xd2ff2d432a0078672cf4f9e2e97858a33cbdeebc. This wallet held 14,326,406 AXL, or 18.52% of the supply.

- 0x54d1774631980b22c85f13bfaf2f45291b22cbf9. This wallet held 7,994,448 AXL, or 10.33% of the supply.

- 0xae2a25cbdb19d0dc0dddd1d2f6b08a6e48c4a9a9. This wallet held 7,379,894 AXL, or 9.54% of the supply.

- 0xb322919a3b4cf3f14dd6d75392a1142cc8a48b3c. This wallet held 5,357,143 AXL, or 6.92% of the supply.

- 0x808e5374106e820ae54662fcf8a5e3cca6afa13d. This wallet also held 2,854,073 AXL, or 3.69% of the supply.

Fact Box

| Supply and Distribution | Figures |

|---|---|

| Total supply | 1,147,386,912 |

| Circulating supply (as of April 24, 2024) | 647,572,434 (50% of total supply) |

| Holder distribution | Top 10 holders owned 67% of total supply, as of May 3, 2024. |

From the Whitepaper

In its technical documentation, or whitepaper , Axelar says its stack provides a decentralized network, protocols, tools, and APIs that allow simple cross-chain communication. Axelar protocol suite consists of cross-border routing and transfer protocols.

“A decentralized open network of validators powers the network; anyone can join, use it, and participate. Byzantine consensus, cryptography, and incentive mechanisms are designed to achieve high safety and liveness requirements unique for cross-chain requests,” it said.

Axelar (AXL) Explained

AXL is the native, proof-of-stake token of Axelar network, supporting the smart-contract functionality that makes Axelar a programmable interchain layer spanning Web3.

Recently, Axelar Foundation published a detailed blog post summarizing the features of $AXL – what it is used for on Axelar network, and how benefits accrue to the tokenholders and validators who use the token to provide services supporting the network.

Unlike cross-chain bridges , Axelar enables General Message Passing (GMP) . This means applications that connect to the interchain can compose liquidity and compute across blockchains, connecting functionalities and networks seamlessly and securely.

How AXL Works

AXL is the native utility token that powers a secure cross-chain communication platform. AXL tokenholders provide decentralized security and governance, and receive rewards and fees.

Axelar builds on battle-tested proof-of-stake with layers of security and programmability, powered by AXL token.

AXL also pays for transactions on the blockchain. It can be staked in return for rewards, and it can also be bought, sold, and traded on exchanges.

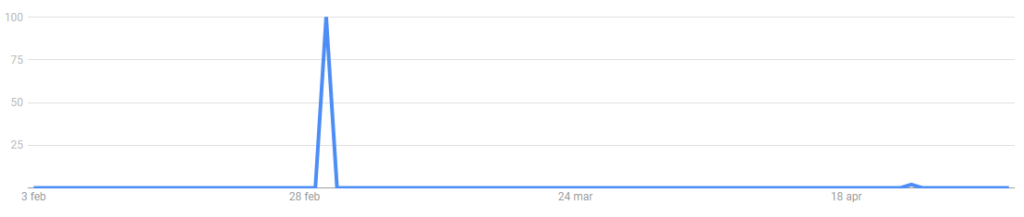

AXL Attention Tracker

Here is a chart for the Axelar Google search volume for the past 90 days. This represents how many times the term “Axelar AXL” has been Googled over the previous 90 days.

FAQs

Will AXL reach $10?

It might, but not soon. According to main price predictions, AXL would reach double digits in 2030.

What is Axelar?

AXL is the native, proof-of-stake token of Axelar network, a programmable interchain layer spanning Web3.

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.