Ripple Price Prediction 2024: Can XRP Reach $1?

What's next for Ripple (XRP)?

Key Takeaways

- There is speculation that Ripple’s XRP could be the next coin to get its own ETF, despite an ongoing court case.

- Ripple is one of the oldest cryptos around, having come onto the open market in 2014.

- Price forecasts for the ripple coin vary.

- One Ripple price prediction says it can reach $1.80 next year.

Ripple’s XRP cryptocurrency has been in the news after New York judge Analisa Torres ruled that the crypto was not a security, so long as it was being sold on a crypto exchange.

The judge’s ruling, which was made on July 13, 2023, put an end to nearly three years of legal wrangling as the United States Securities and Exchange Commission only partially succeeded in having it dubbed a security.

Judge Torres did find that XRP was a security if its parent company, Ripple Labs, was selling it. That, however, did not stop it from getting relisted by exchanges.

The SEC appealed the judge’s ruling, but this was thrown out in October.

The case could, potentially, affect the SEC’s proceedings against the Binance and Coinbase exchanges.

However, the SEC is still bringing charges against Ripple’s management. The regulator asked the court to order the company to provide details of audits, sales of XRP to people not working for Ripple, and proceeds from sales of XRP after the lawsuit was filed in 2020.

Ripple was able capitalize on a buoyant market in the last two months of 2023, but has seen a downturn in 2024 so far.

November’s news that the network had upgraded its Ripple Payments platform, together the previous week’s announcements that Georgia’s central bank was to partner with Ripple in its bid to create its digital currency and its acceptance by the Dubai International Finance centre helped spark interest.

SEC tries to get cryptos judged securities again

After the SEC approved 11 spot Bitcoin exchange-traded funds (ETFs) in January, speculation mounted over the next crypto to get an ETF. XRP was among the potential coins speculated as being next in line.

One other potentially interesting development came after Ripple CEO Brad Garlinghouse implied that US banks were set to adopt XRP.

On March 12, 2024, XRP was trading at around $0.70.

Ripple did not immediately respond to a request for comment.

But what is Ripple (XRP)? How does Ripple work? What is XRP used for? Let’s see what we can find out and also take a look at some of the Ripple price predictions that were being made as of March 12 2024.

Ripple Coin Price Prediction

Let’s examine some of the Ripple price predictions made on March 12. It is crucial to bear in mind that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate. Additionally, please remember that many long-term crypto price predictions are generated using algorithms, meaning they can change over time.

| 2024 | 2025 | 2030 | |

|---|---|---|---|

| Prediction #1 | $0.6768 | $1.80 | $4.51 |

| Prediction #2 | $1.01 | $1.44 | $9.26 |

| Prediction #3 | $1.46 | $1.69 | $5.07 |

Firstly, CoinCodex made a short-term Ripple price prediction for 2023 that suggested XRP would reach $0.8584 by March 17 before falling to $0.7238 by April 11. The site’s technical analysis was bullish, with 28 indicators sending positive signals compared to just three making bearish ones.

Ripple Price Prediction for 2024

CaptainAltCoin said XRP would drop to $0.6768 by December. PricePrediction.net said Ripple would be worth $1.01 in 2024. DigitalCoinPrice said the coin would stand at $1.46 this year.

Ripple Price Prediction for 2025

Moving on, DigitalCoinPrice said Ripple would reach $1.69 in 2025, while CaptainAltCoin thought it would be worth $1.80 then. PricePrediction.net had XRP stand at $1.44 next year.

Ripple Price Prediction for 2030

Looking at a more long-term Ripple price prediction, PricePrediction.net said it would be worth $9.26 in 2030. DigitalCoinPrice said it would trade at $5.07 then. Meanwhile, CaptainAltCoin’s XRP price prediction said it would stand at $4.51 by the start of the next decade.

Google Gemini Price Prediction for Ripple (as of March 12)

Google’s Gemini AI platform gave the following price prediction for Ripple on March 12. Please remember that the exact price prediction of an asset or cryptocurrency in the future is nearly impossible to achieve. Additionally, artificial intelligence price predictions are predicated on past performances and are in no way entirely accurate.

Short-Term (Next Week):

- Prediction: $0.70 – $0.80

- Reasons: XRP has recently seen a surge, reaching a multi-month high of $0.7440. Analysts predict it could reach $0.80 due to positive technical indicators and continued bullish momentum.

Medium-Term (Next 6 Months):

- Prediction: $0.80 – $1.00 (possibly higher)

- Reasons: Wider adoption of Ripple’s technology for cross-border payments by financial institutions could drive the price up. Positive developments in the ongoing SEC lawsuit could also boost confidence and price.

Long-Term (Next 2-5 Years):

- Prediction: $1.00 – $3.00 (with significant uncertainty)

- Reasons: Long-term prediction is difficult. If Ripple gains widespread adoption in the global payments market, the price could reach $3.00 or higher. However, regulations and market fluctuations could hinder growth.

Important to Consider:

-

- These are just predictions, and the actual price could be higher or lower.

- The cryptocurrency market is volatile, and unexpected events can cause significant price swings.

- Do your own research before making any investment decisions.

Advantages and Disadvantages of Ripple

Blockchain analytics company Messari recently released its quarterly report on Ripple . In it, they highlighted that it had responded well to the legal rulings and outlined some key advantages and disadvantages of the platform.

They found that in the fourth quarter of 2023, XRP had

- 30,000 average daily active addresses, down from 66,000 year-on-year and down from 44,000 quarter-on-quarter.

- 1.4 million daily transactions, steady year-on-year but up from 1.1 million quarter-on-quarter basis.

- An average market cap of $33.7 billion, up from $27.8 billion both year-on-year and quarter-on-quarter

- Quarterly revenue of $191,000, up from $59,000 year-on-year and up from $145,000 quarter-on-quarter.

Advantages of Ripple

In its report, Messari said Ripple

- Works well with NFTs, with the ability to create the tokens built into the core protocol.

- Is a key player in the drive for governments to create their own Central Bank Digital Currencies (CBDCs).

- Has been able to develop its ecosystem.

Disadvantages of Ripple

Messari’s quarterly report also said Ripple

- Did not support smart contracts, computer programs that automatically execute once certain conditions are met. Smart contracts are a mainstay of such blockchains as Ethereum (ETH).

- Had fewer active addresses.

- Had seen a decline in average daily payment values.

Ripple price history

Now, let’s examine some of the highlights and lowlights of the Ripple price history . While we should never take past performance as an indicator of future results, knowing what the coin has achieved can provide us with some very useful context if we want to make or interpret a Ripple price prediction.

In terms of the Ripple price history, the coin started trading at around $0.005 in 2014, before it reached an all-time high of $3.84 on 4 January 2018, as the world of cryptocurrency was caught up in a significant bubble.

The coin dropped to below $1 in March of that year but was able to break above the dollar during the bull run of early 2021. By early 2022, though, it was back below the dollar and even spent a large chunk of the year below $0.50 as the crypto market suffered a series of crashes.

Ripple in 2023 and 2024

There were some encouraging signs in 2023, though. On 1 June, XRP was worth about $0.504. Over the following six weeks or so, following the news that the SEC was suing Binance and Coinbase, Ripple struggled. It fell to $0.4593 on 16 June. The court’s ruling saw it recover to $0.8875 on July 13. After that, it back down, and, on September 11 it was worth $0.4671. The coin recovered somewhat and, following the rejection of the SEC’s appeal, it cashed in on a blossoming market. By November 6, it was worth $0.7299. It dropped slightly over the following days to trade at $0.59 on November 17. XRP closed the year at $0.6149. Ripple dropped in the new year and, on January 25, 2024, it was worth about $0.5135. A buoyant market saw it rise in March and it was worth about $0.70 on March 12.

Ripple Price Analysis

XRP started a significant upward trend on January 31, after falling below $0.50 and retesting its crucial ascending support line. By March 4, it had climbed to a peak of $0.67, but experienced a sharp drop to $0.53 the following day, marking a 20% decline.

This dip was likely the result of a long squeeze and might have been overstated. Subsequently, a rebound occurred. Since reaching its last peak, XRP seems to be the fourth wave of a five-wave sequence.

Should this analysis hold, we can anticipate the start of a new uptrend after the completion of the current formation, aiming for another peak.

Is Ripple a good investment?

It is hard to say with any certainty right now.

With a market cap of around $37.8 billion at the time of writing, it is the sixth largest crypto by that metric. Unless it suffers the sort of crash that affected the LUNA cryptocurrency last year, it looks like it will be at the higher end of the crypto charts for some time.

As ever, though, the crucial thing before investing in any crypto is to do your research and never invest more money than you can afford to lose.

Will Ripple go up or down?

No one can say with any certainty. Remember that price predictions are very often wrong and that prices can, and do, go down as well as up.

Should I invest in Ripple?

Before you decide whether or not to invest in XRP, you will need to do your research, not only on Ripple but on other coins and tokens related to international money payments, such as Stellar Lumens (XLM). You should also remember that prices can go down as well as up, and never invest more money than you can afford to lose.

Who are the Founders of Ripple?

Ripple was founded by Jed McCaleb and Chris Larsen. McCaleb is a software developer and former student at the University of California. Before founding Ripple in 2012, he helped set up the now-defunct Mt Gox exchange and has gone on to found the Stellar (XLM) cryptocurrency. Larsen, meanwhile, has an MBA from Stanford and has been a prominent investor and privacy advocate. Larsen is currently chairman at Ripple, whose CEO is Brad Garlinghouse.

Who owns the most Ripple (XRP)?

The wallet with the most XRP is linked to Ripple itself.

The richest XRP Wallet Addresses

As of March 12, 2024, the addresses with the most XRP were

- rMQ98K56yXJbDGv49ZSmW51sLn94Xe1mu1. Listed as Ripple29, this wallet had 1,960,027,032 XRP or 1.96% of the supply.

- rKveEyR1SrkWbJX214xcfH43ZsoGMb3PEv. Listed as Ripple39, this wallet had 1,541,294,080 XRP, or 1.54% of the supply.

- rEy8TFcrAPvhpKrwyrscNYyqBGUkE9hKaJ. Listed as Binance4, this wallet had 1,477,168,712 XRP, or 1.48% of the supply.

- rBEc94rUFfLfTDwwGN7rQGBHc883c2QHhx. Listed as Uphold4, this wallet had 1,372,766,274 XRP, or 1.37% of the supply.

- rs8ZPbYqgecRcDzQpJYAMhSxSi5htsjnza. Listed as Binance5, this wallet had 931,894,888 XRP or 0.93% of the supply.

Fact Box

| Supply and distribution | Figures |

|---|---|

| Maximum supply | 100,000,000,000 |

| Circulating supply (on March 12, 2024) | 54,736,825,690 (54.74% of maximum supply) |

| Holder distribution | Top 10 holders own 11.07% of maximum supply, as of March 12, 2024 |

From the Whitepaper

Ripple’s whitepaper is a technical document that aims to explain what the platform is and what XRP does.

It says that many crypto platforms suffer from being slow because every computer, or node, on the network, has to work at the same time as all the others.

It says: “We present a novel consensus algorithm that circumvents this requirement by utilizing collectively trusted subnetworks within the larger network.

We show that the “trust” required of these subnetworks is minimal and can be further reduced with principled choice of the member nodes.

In addition, we show that minimal connectivity is required to maintain agreement throughout the whole network. The result is a

low-latency consensus algorithm that still maintains robustness in the face of Byzantine failures. We present this algorithm in its embodiment in the Ripple Protocol.”

Ripple (XRP) explained

In 2012 , Ripple Labs, then called NewCoin, created the Ripple payment protocol. The Ripple, or XRP, cryptocurrency powers it.

The idea was to set up a system that allows people to transfer money internationally quickly and simply. While it has not, as some crypto enthusiasts predicted, replaced the Swift/BIC international money transfer system, it has proven to be popular, and it is one of the largest cryptos by market cap.

XRP pays for transactions on the Ripple platform. People can also buy, sell, and trade it on crypto exchanges.

How Ripple Works

XRP is something a little different from a lot of other cryptos. With most crypto coins, such as, for instance, Bitcoin (BTC), people can validate transactions and secure the network regardless of whether or not they have the approval of the people behind the blockchain. Ripple only allows people who have been approved to do this.

Compared to other blockchain networks, XRP is a lot more centralized. On the other hand, it is, at least in theory, more secure than other platforms.

Something else that makes Ripple – the organization, rather than the crypto – stand out from its competitors is that it is a registered, for-profit company. This contrasts it with a lot of other blockchain organizations, which operate on a not-for-profit basis.

XRP is not mineable. Instead, every single one of the 100 billion XRPs that will ever exist already does exist. They are released onto the open market every month. As of March 12, 2024, there were about 54.7 billion XRP in circulation.

At that time, there was a total supply of 99,987,824,103 XRP. This implied that just over 12 million XRP had been burned, or removed from the market. Since Ripple does not burn XRP, it is pretty safe to assume that the coin holders had, at some point, burned their crypto.

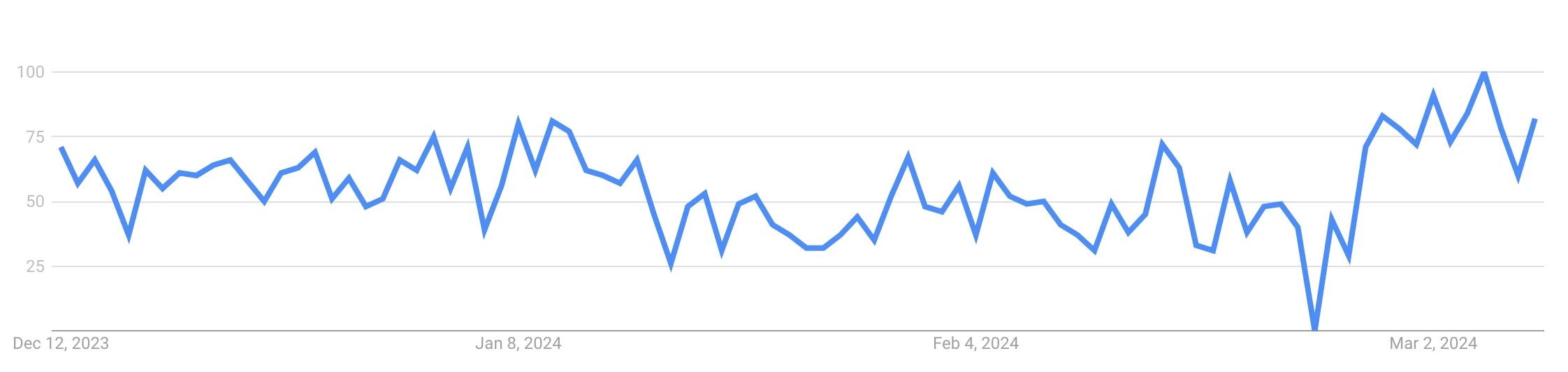

Ripple Attention Tracker

Here is a chart for Ripple (XRP) Google search volume for the past 90 days. This represents how many times the term “Ripple (XRP)” has been Googled over the previous 90 days.

FAQs

Will Ripple reach $10?

It might do, but not for some time. PricePrediction.net thinks XRP can get there in 2031 while DigitalCoinPrice says it can hit double figures by 2030.

Remember that Ripple’s highest ever price is $3.84, which it reached in January 2018.

What is Ripple used for?

The XRP cryptocurrency helps power the Ripple network. People can also buy, sell, and trade XRP on exchanges.

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about this information’s completeness, reliability, and accuracy. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto user should research multiple viewpoints and be familiar with all local regulations before committing to an investment.