Stock Market Jerks Lower as Economy Triggers Recession Alarms

The US stock market jerked into decline in response to alarming economic data, thrusting the S&P 500, Dow Jones, and Nasdaq toward losses. | Source: Johannes EISELE / AFP

By CCN.com: The US stock market jerked lower during mid-morning trading after troubling economic data presaged a recession.

Dow, S&P 500, and Nasdaq All Shoot Lower

The major US stock market indices all flashed losses heading toward the latter half of the morning session. As of 10:50 am ET, the S&P 500 had lost 13.43 points or 0.46%; the index was last seen at 2,911.03.

The Dow Jones Industrial Average, which had climbed more than 100 points earlier in the session, lost 50.14 points or 0.19% to settle at 26,152.59.

The Nasdaq suffered the worst intraday slide, dropping 0.81% to 7,955.

US Manufacturing Growth Contracts for First Time Since 2009

The Dow Jones Industrial Average, S&P 500, and Nasdaq were all well on their way to solid gains on Thursday, at least until IHS Markit published its August manufacturing report .

Markit’s US manufacturing PMI (purchasing managers index) revealed that US manufacturing growth had contracted for the first time since 2009, dipping to 49.9 from 50.4 in July. A reading below 50 indicates contraction.

“Manufacturing companies continued to feel the impact of slowing global economic conditions,” Tim Moore, economics associate director at Markit, said in a statement on Thursday. “August’s survey data provides a clear signal that economic growth has continued to soften in the third quarter.”

CCN.com previously reported that US industrial production growth had slowed to a crawl, forcing the manufacturing sector into a technical recession – and the stock market toward a potential hurdle.

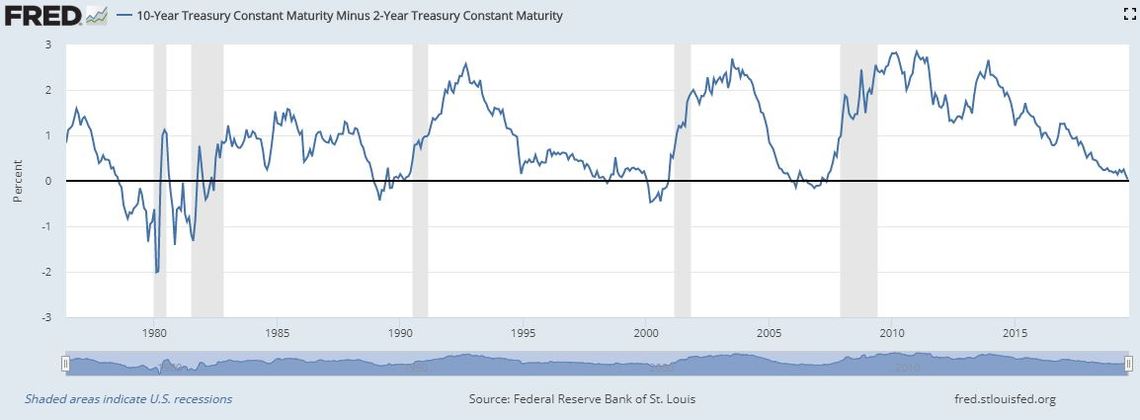

Main Yield Curve Inverts for Second Time in Two Days

Concurrently the main yield curve inverted for the third time in August, and the second time in as many days.

According to CNBC , the yield curve inverted shortly before 10:20 am ET when the 10-year Treasury yield dipped to 1.597%, just below the 1.601% yield on the 2-year note.

A main yield curve inversion has preceded every recession since the 1950s, though the economy does not actually slide into contraction for an average of 22 months, and the stock market often continues to rise for at least a year following the inversion.