Stellar Price Prediction 2024: Can XLM Shine?

What's next for Stellar?

M Key Takeaways

- XLM is one of the longer-standing cryptos, founded in 2014.

- The Stellar blockchain was a hard fork from Ripple and was co-founded by XRP creator Jed McCaleb.

- XLM recently launched an upgrade.

- One Stellar price prediction said the coin would get to $0.4281 next year.

Stellar’s XLM has stagnated somewhat recently. The Ripple hard fork had gone up after a new upgrade was launched, but still underperformed in 2023.

On February 28, 2024, Stellar was worth about $0.1225.

Stellar did not immediately respond to a request for comment

But what is Stellar (XLM)? How does Stellar work? Let’s see what we can find out, and also take a look at some of the Stellar Price Predictions that were being made as of February 28, 2024.

Stellar Coin Price Prediction

Let’s examine some of the Stellar price predictions being made on February 28, 2024. It is crucial to bear in mind that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate. Additionally, please remember that many long-term crypto price predictions are generated using algorithms, which means they can change at any time.

| 2024 | 2025 | 2030 | |

|---|---|---|---|

| Prediction #1 | $0.25 | $0.30 | $1.25 |

| Prediction #2 | $0.3057 | $0.4281 | $1.04 |

| Prediction #3 | $0.1682 | $0.2373 | $0.90 |

First, CoinCodex had a short-term Stellar price prediction which XLM drop to $0.1206 by March 4 before climbing to $0.1262 by March 29. The site’s technical analysis was bullish, with 22 indicators sending positive signals and just seven making bearish ones.

Stellar Price Prediction for 2024

DigitalCoinPrice said Stellar would reach $0.25 in 2023, while Bitnation said it would get to $3.057. PricePrediction.net , on the other hand, said that XLM would trade at $0.1682 this year.

Stellar Price Prediction for 2025

Bitnation said Stellar would reach at $0.4281 in 2025, higher than DigitalCoinPrice’s Stellar price forecast of $0.30. Again, PricePrediction.net was the most cautious, saying XLM would be worth $0.2373 next year.

Stellar Forecast for 2030

Looking at a more long-term Stellar price prediction, PricePrediction.net said it would get to $1.44 in 2030. Bitnation said it would be worth $1.04. DigitalCoinPrice made an XLM price prediction that had it at $0.90 at the start of the next decade.

Google Gemini AI Price Prediction for Stellar (as of February 28)

Google’s Gemini AI platform gave the following price prediction for Stellar on February 28. Please remember that the exact price prediction of an asset or cryptocurrency in the future is nearly impossible to achieve. Additionally, artificial intelligent price predictions are predicated on past performances and are in no way entirely accurate.

Short Term (Next 3 Months):

- Prediction: XLM price might decrease slightly, potentially reaching around $0.11 by May 2024.

- Reasons: Current technical indicators like the Fear & Greed Index at 72 (Greed) and a neutral sentiment suggest a potential correction. Additionally, analysts at Changelly predict a -2.35% decrease.

Medium Term (Next 12 Months):

- Prediction: XLM could experience moderate growth, potentially reaching around $0.18 by February 2025.

- Reasons: While some analysts like CoinCodex predict a significant increase, others like PrimeXBT remain cautious. Overall, the crypto market’s recovery and XLM’s potential use case growth might lead to moderate gains.

Long Term (Next 5+ Years):

- Prediction: XLM’s price holds long-term potential, potentially reaching $1 or even higher by 2030.

- Reasons: Long-term predictions are highly speculative. However, factors like wider adoption of Stellar’s technology for cross-border payments and potential partnerships could contribute to significant growth. Coinpedia, for example, predicts a price as high as $1.30 by 2030.

It added: “It’s important to remember that these are just predictions, and the actual price of XLM could be much higher or lower. It’s crucial to do your own research, consider your risk tolerance, and never invest more than you can afford to lose.”

Recent Updates from Stellar

Stellar’s Protocol 20 launched its testnet on September 20. The update provides support for Soroban smart contracts, computer programs that automatically execute once certain conditions are met.

The news came not long after Stellar revealed that it had invested money in transfer business Moneygram. The blockchain now has a seat on Moneygram’s board

XLM Price History

Let’s now take a look at some of the Stellar price history . While we should never take past performance taken as an indicator of future results, knowing what the coin has done can help give us some very useful context when it comes to either making or interpreting a Stellar price prediction.

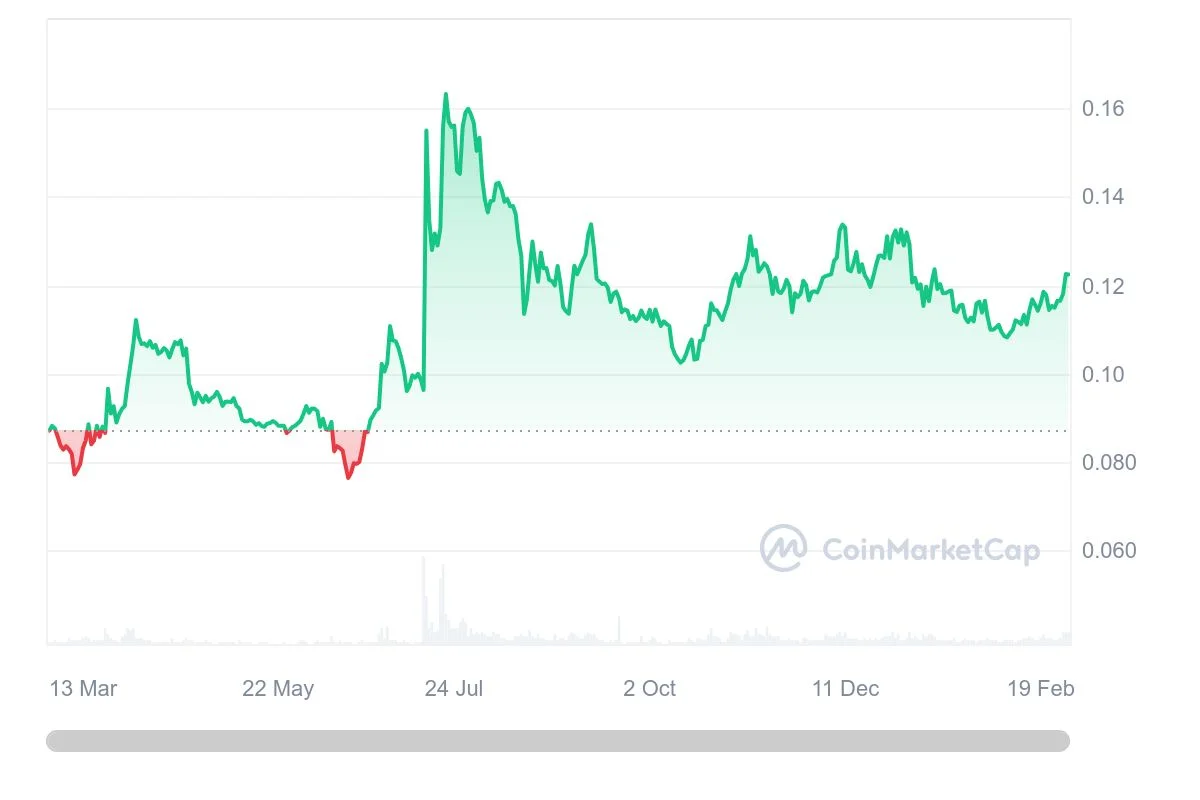

XLM first came onto the open market in 2014, when it was worth about $0.003. It rose past the cent in 2017 and, when crypto experienced a bubble late that year and early the next, the coin responded. Stellar traded at what remains an all-time high of $0.9381 on January 4, 2018.

It then fell as the market entered a so-called crypto winter, falling below $0.10 in 2019 and not recovering until November 2020.

XLM had something of a revival as the crypto market flourished in 2021. It reached a high of $0.6898 on April 14, before dropping down over the summer. Stellar recovered past $0.40 in the autumn and closed the year at $0.27.

2022 was less encouraging for both the general market and for Stellar itself. The coin fell perilously close to $0.10 in May and June. Although XLM made something of a recovery later on in the summer, the collapse of the FTX exchange in November saw it drop below $0.10. XLM closed the year at $0.0711, an annual loss of nearly 75%.

Stellar in 2023 and 2024

2023 could have got better for XLM. Although it rose above $0.10 in late March and stayed there until the middle of April, it fell back down.

On June 15, as the crypto market was shaken following the news that the SEC was suing Binance and Coinbase, Stellar sank to a low of $0.0753. After that, it made a recovery. July’s news that a court had found Ripple’s XRP crypto was not a security if it was being traded on exchanges boosted the market. XLM responded well, reaching $0.1793 on July 20.

August saw more of a downturn. The market collapsed when Elon Musk’s SpaceX sold millions of dollars worth of Bitcoin (BTC) and XLM dropped to $0.1076 on August 17. After that, there was something of a recovery. On September 10, it reached $0.1343 before dropping to $0.1013 on October 12. By November 1, 2023, Stellar was worth about $0.1215. The coin closed the year at $0.129, an annual rise of more than 80%. With XLM underperforming slightly against a crypto market that doubled in 2023, there was a further downturn in 2024. By February 28, it was worth about $0.1225.

At that time, there were 28.4 billion XLM in circulation out of a total supply of 50 billion. This gave the coin a market cap of about $3.4 billion, making it the 36th-largest crypto by that metric.

Stellar Price Analysis

Stellar bottomed out at $0.071 on January 3, 2023, after being in a bear market from $0.80 in May 2021. A recovery took place throughout last year.

It is possible that XLM could reach above $0.30 in 2024.

Is Stellar a Good Investment?

Stellar is one of the medium-sized institutions in the crypto space and has been a fixture of the second tier for a long time.

XLM has been performing pretty weakly over the last 18 months or so, It remains to be seen whether it can capitalize on new developments.

On the other hand, it does have a strong base of both developers and investors. Updates and improvements are being made to the Stellar platform all the time.

As ever with crypto, you will need to make sure you do your research before deciding whether or not to invest in XLM.

Will Stellar go up or down?

No one can tell right now. While the Stellar crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can, and do, go down as well as up.

Should I invest in Stellar?

Before you decide whether or not to invest in Stellar, you will have to do your research, not only on XLM, but on other, similar, coins and tokens such as Ethereum (ETH) or Solana (SOL). Either way, you will also need to make sure that you never invest more money than you can afford to lose.

Who are the Founders of Stellar?

Jed McCaleb and Joyce Kim founded Stellar in 2014. McCaleb was best known for his involvement with XRP, while Kim is a lawyer.

Fact Box

| Supply and distribution | Figures |

|---|---|

| Maximum supply | 50,001,806,812 |

| Circulating supply as of February 28, 2024 | 28,484,085,602 |

From the Whitepaper

In its technical documentation or whitepaper , Stellar says it aims to fix the problem of closed financial systems.

It says: “We need a worldwide financial network open to anyone so that new organizations can join and extend financial access to unserved communities. The challenge for such a network is ensuring participants record transactions correctly.

“With a low barrier to entry, users won’t trust providers to police themselves. With worldwide reach, providers won’t all trust a single entity to operate the network.

“A compelling alternative is a decentralized system in which participants together ensure integrity by agreeing on the validity of one another’s transactions. Such agreement hinges on a mechanism for worldwide consensus.”

Stellar (XLM) Explained

The Stellar blockchain is designed to make transactions quicker, and cheaper. Set up in 2014 by crypto entrepreneur Jed McCaleb, better known for his involvement in the Ripple (XRP) cryptocurrency, and lawyer Joyce Kim.

The system, which is a spin-off from Ripple, is designed to allow people to easily transfer assets, including but not limited to fiat currency, into crypto.

Stellar is supported by its native token, properly called Stellar Lumens but often just referred to as either Stellar or by its ticker handle, XLM.

How Stellar Works

Stellar uses a platform called Stellar Core which is based on technology called Horizon 2.0. Stellar has three kinds of network operators or nodes.

Full Validators submit transactions, validate transactions, and publish history. Basic Validators submit and validate transactions, while Archivers can submit transactions and publish history.

In terms of XLM, it is used to pay for transactions on the network, and it is used to reward node operators. Holders can create their own, new, tokens, and they can also be bought, sold, and traded on exchanges.

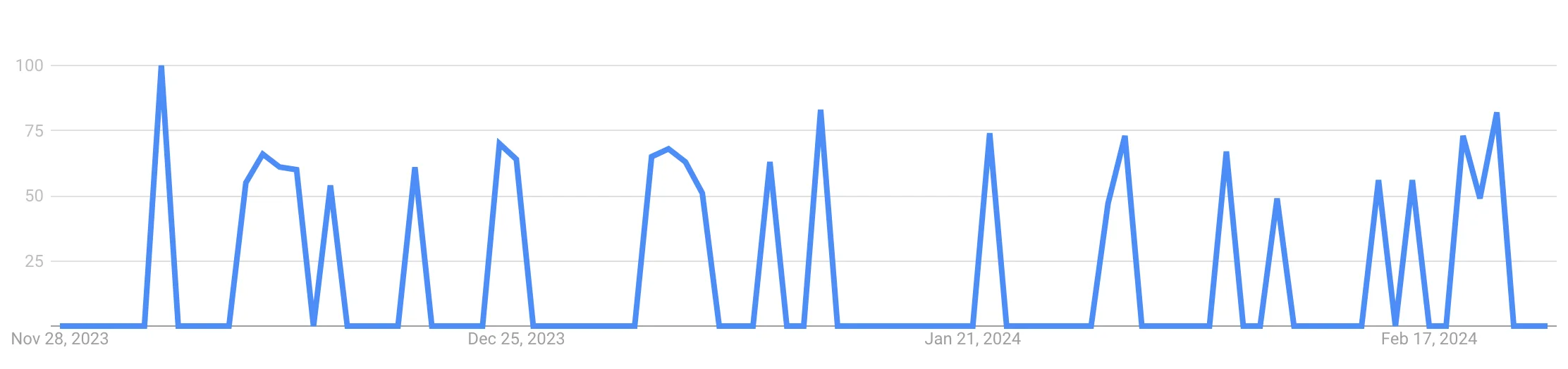

Stellar Attention Tracker

Here is a chart for the Stellar (XLM) Google search volume for the past 90 days. This represents how many times the term “Stellar (XLM)” has been Googled over the previous 90 days.

FAQs

Will Stellar Reach $1?

It could happen but, if it does, it won’t be for some time. PricePrediction.net says it in 2028, while DigitalCoinPrice and Bitnation have it break past the dollar in 2030. Keep in mind that XLM has never traded above $1, with its all time high of $0.9381 coming more than five years ago.

What is Stellar used for?

The XLM crypto pays for transactions on the Stellar blockchain. People can also buy, sell, and trade it on exchanges.

Further reading

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability, and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto user should research multiple viewpoints and be familiar with all local regulations before committing to an investment.