Dow Recovers After Federal Reserve Sparks a Sharp US Dollar Sell-Off

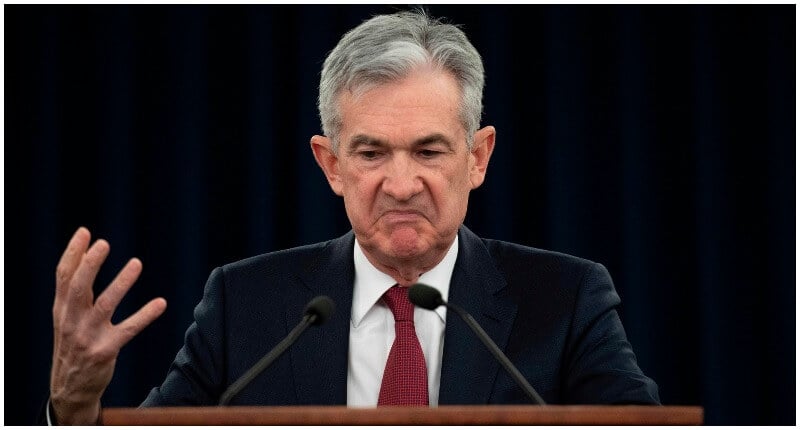

The Dow Jones limped into neutral after the Federal Reserve kept interest rates on hold, which sparked a Dow-supportive sell-off in the USD. | Source: Jim WATSON / AFP

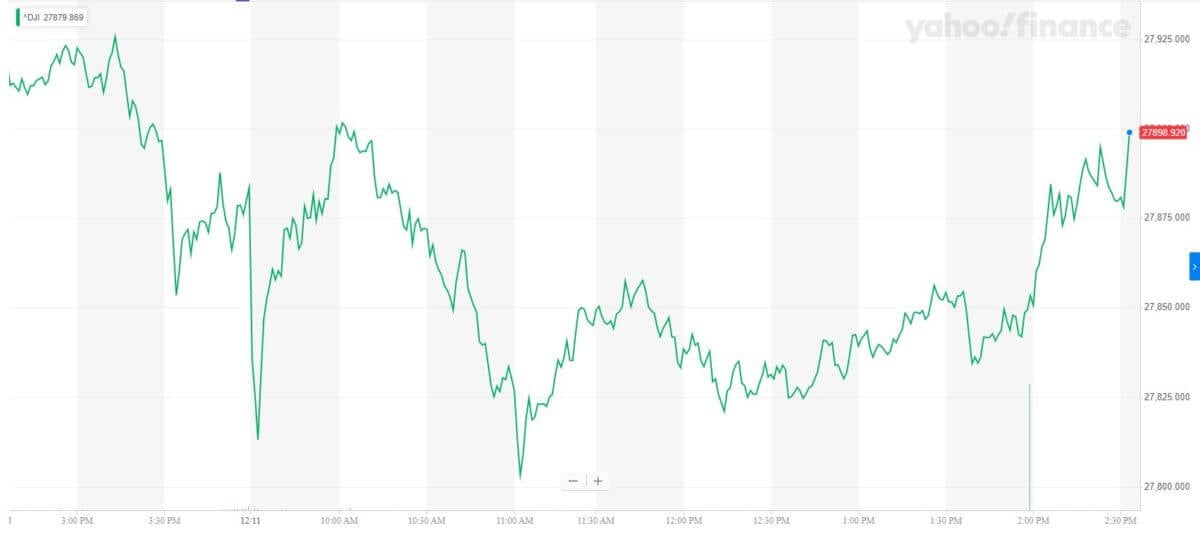

- The Federal Reserve kept interest rates on hold on Wednesday, helping slightly boost a struggling Dow Jones as the US dollar sold off.

- Jerome Powell’s press conference did nothing to rock the Dow from its narrow trading range.

- Trouble for Boeing, Home Depot, and Chevron anchored the stock market from posting more sizable gains.

The Dow Jones recovered back to neutral territory after the Federal Reserve kept rates unchanged and indicated no rate moves were on the horizon even through 2020 . In the accompanying statement, the economic outlook was practically identical.

Meanwhile, unrelated issues anchored the Dow 30, as Home Depot (HD), Boeing (BA), and Chevron (CVX) stock all struggled.

Dow Jones Treads Water as Federal Reserve Holds Steady

Primarily due to the woes of several core members, the Dow Jones Industrial Average was the worst-performing of the three major US stock market indices . Minutes before the closing bell, the Dow had declined 3.26 points or 0.01% to 27,878.46.

The Nasdaq and S&P 500 were able to rally on the day, but these were minor gains – 0.38% and 0.21%, respectively.

Despite a low volatility day in the stock market, the price of gold was 1% higher as the US dollar index fell . Crude oil slid aggressively after an unexpected bounce in inventories but pared that decline to a roughly 0.5% loss.

Jerome Powell Treats Dow with Kid Gloves Amid Trade War Uncertainty

Jerome Powell was his usual optimistic, yet cautious self, and did little to dent the slight rally in the Dow as his press conference reiterated his concerns about low inflation and anticipated growth to continue around 2%.

With no confirmation on the outlook for the US-China trade war, the FOMC is showing an abundance of caution to avoid spooking sky-high stock prices.

US CPI Is Not a Threat to the Stock Market

Today also saw US CPI data released , which demonstrated the steady-state of US inflation. While not enough to worry the Dow Jones of imminent rate hikes, inflationary pressure continues to run higher than interest rates. Despite this, the futures markets are still pricing an interest rate cut as more likely than a hike in 2020 .

Analysts at Nordea do not expect this reading to change the FOMC’s take on the economy moving forward. In their view, Powell’s team seems far more concerned with the outlook for growth than about inflation :

Today’s CPI prints should not be a game-changer for the Fed, as the numbers were close to consensus. Moreover, the Fed is currently more concerned about growth, although the low inflation expectations (as measured by the University of Michigan) continue to be a somewhat of a concern for the Fed.

The Fed has furthermore clearly emphasized that it wants core PCE (it’s preferred inflation gauge) to run above 2% for a prolonged period to be in line with its symmetrical 2% target. Hence, a few inflation prints surprising on the upside should not make the case for a more hawkish stance.

Dow 30: Boeing Revelations Weigh, Home Depot and Chevron Struggle

It was always going to be a challenging day for the Dow 30 with its most heavily weighted stock (Boeing) under a constant onslaught of negative headlines.

Today, it was the 737 MAX causing the trouble, as its return to service is going to take longer than Boeing (BA) initially claimed . Adding to this was the unwanted news that the FAA allowed the infamous jet to fly even though they had serious concerns about its safety.

Once the darling of the Dow Jones, Boeing stock is up just 7% YTD, underperforming the index by some 12% in 2019.

Apple (AAPL) stock rose 0.72%, as the tech giant’s stock looks to finish a stellar year strong. Looming tariffs are a concern to AAPL bulls, but hopes are high for some kind of delay at the eleventh hour.

The worst performing stock in the Dow was Home Depot (HD), which fell more than 1.95% after the corporation forecast a downbeat sales forecast for 2020 .

Chevron (CVX) stock was also battered; the oil giant indicated it would be writing down some $11 billion in assets and announced a $20 billion capital spending plan .