Dow Breaknecks to 27,000 as Investors Shrug Off Trump Impeachment Drama

The Dow is within touching distance of 27,000 again. | Source: Lev radin via Shutterstock.com

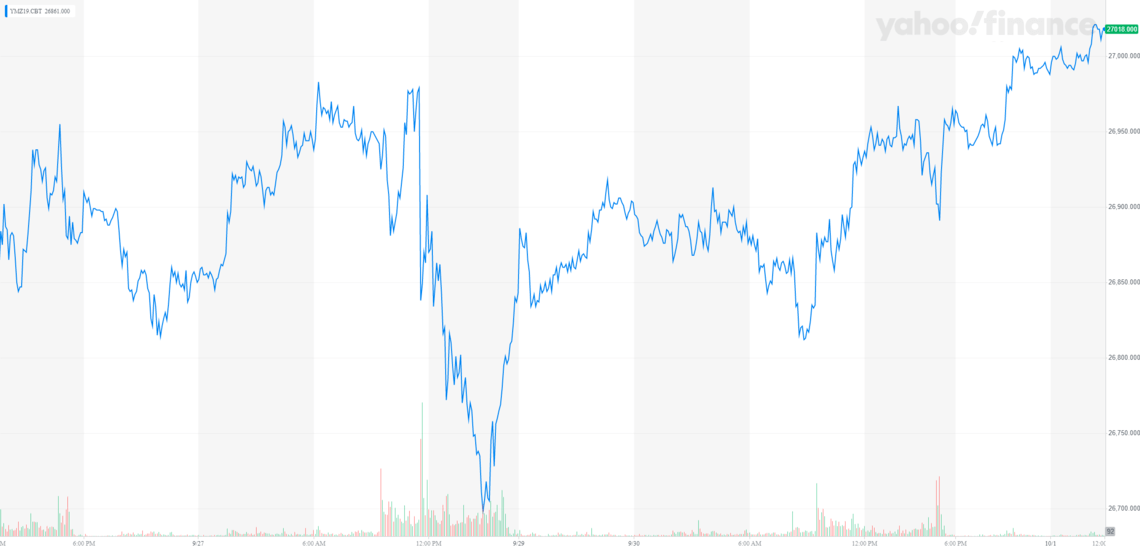

Based on pre-market trading, the Dow Jones has surpassed 27,000 points with an implied opening gain of 125 points as markets shrug off impeachment talks.

Within a month, the Dow Jones has surged from 26,118 points to over 27,000 points, demonstrating a noticeable increase in the confidence of investors towards the short to medium term performance of U.S. stocks.

The recovery of the Dow Jones at this juncture could be proven to be crucial considering the anticipated release of earnings reports by major conglomerates in October that is set to coincide with possible interest rate cut discussions by the Federal Reserve.

Despite the move of the Democratic Party to pursue the impeachment inquiry and the plan of Republican Senate majority leader Mitch McConnell to hold a Senate trial if the house decides to impeach President Trump, the Dow Jones and the rest of the U.S. equities market are showing resilience.

Dow Jones makes its way towards its record high: key catalysts to sustain momentum

In the short term, at least until the year’s end, the Dow Jones would need to see significant progress in the U.S.-China trade discussions in October, strong earnings from top sectors in October, and the willingness of the Federal Reserve to maintain the interest rate low heading into 2020.

According to White House trade advisor Peter Navarro, the U.S. will not restrict Chinese companies and that reports surrounding any developments regarding it are false.

Navarro told CNBC:

“It was really irresponsible journalism and the problem we have here … these bad stories push out the good. And what happens is, as soon as Bloomberg puts it out there, there’s pressure from others to put it out there. This story was just so full of inaccuracies. And in terms of the truth of the matter, what the Treasury said, I think, was accurate.”

With the White House emphasizing that the U.S. does not intend to impose restrictions on Chinese companies and Chinese President Xi Jinping stating that the government will look to pursue peaceful development at the 70th anniversary of the Chinese Communist Party’s rule celebration, strategists anticipate a trade deal to materialize in the upcoming months.

Due to the rising optimism towards the Dow Jones, safe-haven assets in the likes of gold and silver have declined in value throughout the past several weeks.

Technical analysts have said that gold is likely to see a further sell-off based on technical indicators, indicating that investors have become more confident towards the short term trend of the Dow Jones and the U.S. equities market in general.

Not all are convinced stocks are heading upwards

Richard D. Wolff, an economics professor at UMass Amherst, suggested that the U.S. economy has been bloated with empty promises, which could lead the Dow Jones rally to be short-lived.

Wolff, citing JP Morgan, said :

“No way fooled by empty Trump boasts about US economy. JP Morgan bank downgrades US stocks and upgrades European stocks.”

Some analysts also believe that the potential effect of a trade deal between the U.S. and China on the Dow and U.S. stocks has been overstated, with Stephen Roach of Yale University stating that a grand deal is highly unlikely to happen anytime soon.

He stated :

“The best that we can hope for is that China does agree to a buying program; soybeans, airplanes, and the usual menu of goods. But the structural issues, which are the defining issues of this conflict–intellectual property rights, forced technology transfer–I don’t think we will be making progress on those before the election.”