U.S. Stocks Dial Strong Open as Hope Swells for Fed Rate Cut

Markets are edging toward a positive open on Monday as the Chicago Fed's President hinted at an interest rate cut. | Source: Spencer Platt/Getty Images/AFP

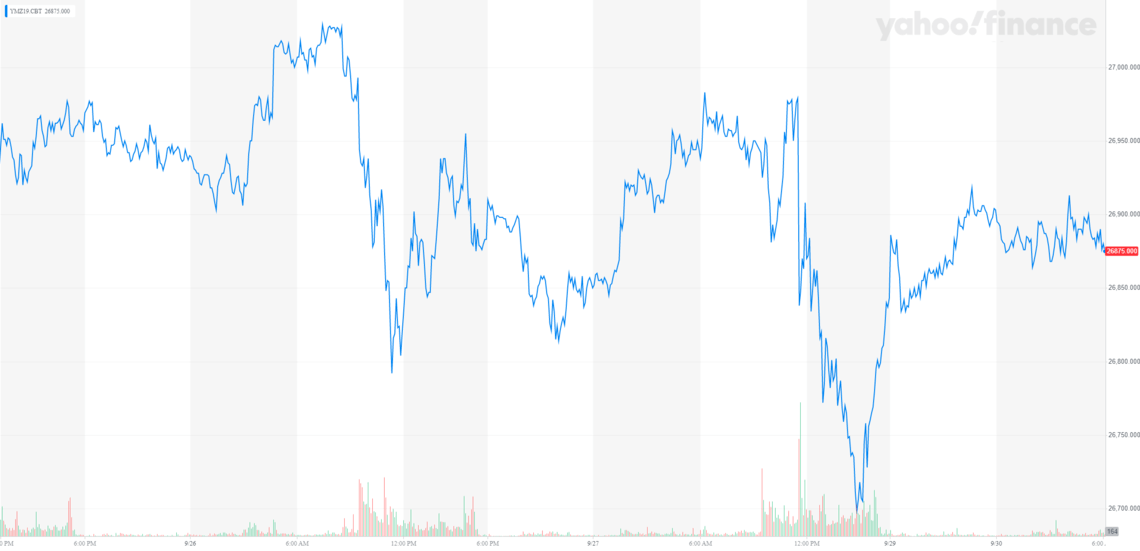

U.S. stocks are set for a strong opening based on pre-market data as the Federal Reserve turns dovish, increasing chances of additional cuts on the interest rate, alleviating pressure from the stock market.

Speaking to CNBC, Charles Evans, president of the Federal Reserve Bank of Chicago, said that he remains open towards more interest rate cuts in the future as the global economic growth rate slows.

Another interest rate cut before the year’s end would certainly act as a short to medium-term catalyst for U.S. stocks with the Fed already having approved a rate cut in September.

The Dow Jones is expected to open with a 100-point gain based on futures trading, raising the sentiment around the U.S. stock market at a period in which the result of the U.S.-China trade talks in October still remains unpredictable.

Fed turning dovish will be considered a catalyst for stocks

During his interview, Evans emphasized that while he maintains the view that the current monetary policy set forth by the Fed is sufficiently accommodating for the current state of the economy and possibly the stock market, he will not disregard suggestions for more cuts entering into 2020.

He said:

“Over the last six months we’ve had more challenges getting inflation to 2%, there’s more uncertainty, the trade negotiations have been challenging, European and Chinese growth has been slowing, so it seems a more accommodative stance is a good one for the U.S. What we’ve done already might be sufficient, I’m open minded to suggestions that we might need more. At the moment I’m going to be looking at the data.”

Although global economic growth is slowing and the talks between the U.S. and China could drag on throughout the medium term, an interest rate cut during a period in which the U.S. stock market is nearing its record high and U.S. stocks are set for an earnings month in October could be crucial.

Strategists generally seem to expect the October earnings month to have a negative effect on the stock market, initiating a sell-off as major companies release subpar earnings as a result of various geopolitical risks in the global economy.

If the Fed gears towards an interest rate cut in the near term as analysts at Deutsche Bank previously forecasted, it would lessen the anticipated negative impact of earnings reports on U.S. stocks.

Evans noted :

“We have reduced the federal funds target by 50 basis points and I think that’s helped move us into an accommodative stance, more than where we were for sure, but that could be a moving target if headwinds are increasing and we might need to do more

At the moment I think appropriate monetary policy is somewhat under the neutral rates so that we are providing accommodation.”

The trade talks still remain an unpredictable variable for U.S. stocks at least in the short term however, which could prevent the stock market from engaging in an extended rally.

Why the trade war could drag on for longer

Journalists based in China like Hu Xijin have said that the trade war between the U.S. and China have united the Chinese society more, ultimately raising a sense of nationalism as reports indicated in mid-2019.

The Trump administration also has received bipartisan support in pursuing the trade war since 2018.

With both countries confident that their respective economies and markets can sustain growth without a deal, a partial trade deal could not happen by the year’s end as easily as many may have thought.