Gold Price Is Crashing: 3 Reasons Why

Gold plunges below $1,500 an ounce Monday. Here are the reasons behind the collapse. | Image: Shutterstock.com

The price of gold plunged anew on Monday, extending last week’s slump as the U.S. dollar notched fresh two-year highs and stocks resumed their upward momentum.

Futures on December gold delivery reached a session low of $1,472.20 a troy ounce on the Comex division of the New York Mercantile Exchange, putting them on track for the lowest settlement in almost two months. The yellow metal has dropped 5.6% from its most recent six-year high set on Sept. 4.

December gold was last down 2.2% at $1,473.90 a troy ounce.

Bullion’s slide has been underpinned by three interrelated forces: technical trading, a surging U.S. dollar and improving risk appetite.

Technical Pullback

Gold’s freefall hastened Monday after the December contract fell below $1,500 and subsequently failed to hold the $1,490 support level . The sharp decline follows a failed breakout attempt last week that pushed prices to within $20 of their most recent peak.

December gold is the most actively traded futures contract, so there could be plenty more volatility in the near term as the price gives back some of 2019’s stellar gains.

U.S. Dollar

Precious metals contracts are priced in U.S. dollars, which makes them highly sensitive to sharp swings in the greenback.

The U.S. dollar index (DXY), which tracks the greenback’s performance against a basket of six rivals, jumped to fresh two-year highs on Monday. DXY peaked at 99.46, its best reading since April 2017. It was last up 0.3% at 99.39.

DXY has been rallying over fears that the Federal Reserve’s intervention in the overnight repo market was covering for a severe shortage of dollars in circulation. Although Fed stimulus is unlikely to help the dollar in the long run, greenbacks are in high demand in the short term.

The dollar is also outperforming comparatively weak currencies like the euro and pound, which continue to be pressured by a combination of ultra-loose monetary policy, Brexit and ailing local economies.

Risk Appetite Returns

Demand for riskier assets returned on Monday, with Wall Street and European stocks registering sizable gains. The Dow Jones Industrial Average (DJIA) rose by as much as 166 points, where it came within 420 points of a new all-time high.

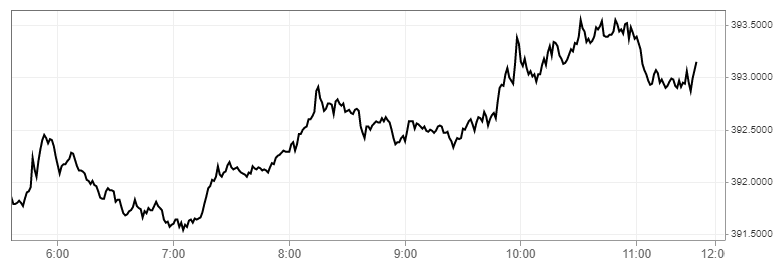

Across the Atlantic, the pan-European Stoxx 600 index rose 0.4% to close at 393.15.

Gold and stocks have moved in lockstep with one another this year, but the latest move into risk assets has left traditional safe havens on the outs. The divergence could be tied to growing optimism over U.S.-China trade talks that are scheduled to resume next month.