Dow Hesitates as Trump Trade Hawk Slams ‘Irresponsible’ Fake News

The Dow hesitated on Monday after Trump trade hawk Peter Navarro ripped into a Bloomberg report exposing White House trade war strategy. | Source: Spencer Platt / Getty Images / AFP

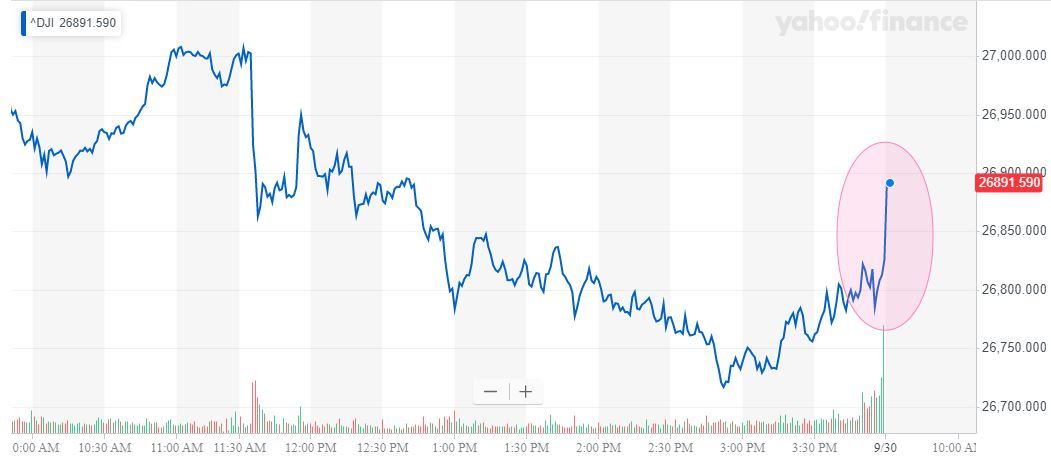

A hesitant Dow fought to close the third quarter in positive territory as Wall Street wrestled with a growing list of international and domestic threats.

But while new risks – like impeachment – engross the talking heads on cable news programs, it’s an old risk – the US-China trade war – that commands the bulk of Wall Street’s attention.

Dow Crawls Toward Moderate Recovery

Wall Street’s major indices strolled toward slight recoveries during September’s final trading session.

The Dow Jones Industrial Average ticked higher at the opening bell, and by 9:33 am ET it had crawled to gains of 83.51 points or 0.31%.

Dow futures briefly pointed to a triple-digit recovery after the markets opened on Sunday evening, but those gains declined as the pre-market session matured.

The S&P 500 rose 7.71 points or 0.26% to 2,969.50. Ten of 11 primary sectors reported gains, led by technology (+0.52%).

The Nasdaq closed out a mildly bullish morning with a gain of 19.02 points or 0.24% to 7,958.65.

Wall Street Grapples With Uncertain Trump Trade War Strategy

Wall Street continues to wrestle with concerning – and conflicting – reports about the White

House’s trade war strategy.

On Monday morning, Trump administration trade advisor Peter Navarro slammed a Bloomberg report that purported to expose a White House strategy to potentially choke the Chinese economy by restricting US investment in China. The most controversial provision would have seen Chinese companies blocked from listing their shares on US stock exchanges.

“That story, which appeared in Bloomberg: I’ve read it far more carefully than it was written,” Navarro told CNBC . “Over half of it was highly inaccurate or simply flat-out false.”

Navarro, a China hawk, lobbed several more similar attacks, though he stopped short of refuting any specific allegation that Bloomberg reported.

Navarro’s bombastic retort followed a more measured statement from a US Treasury spokesperson, who said that the White House was not currently discussing the most controversial aspects of the initial report.

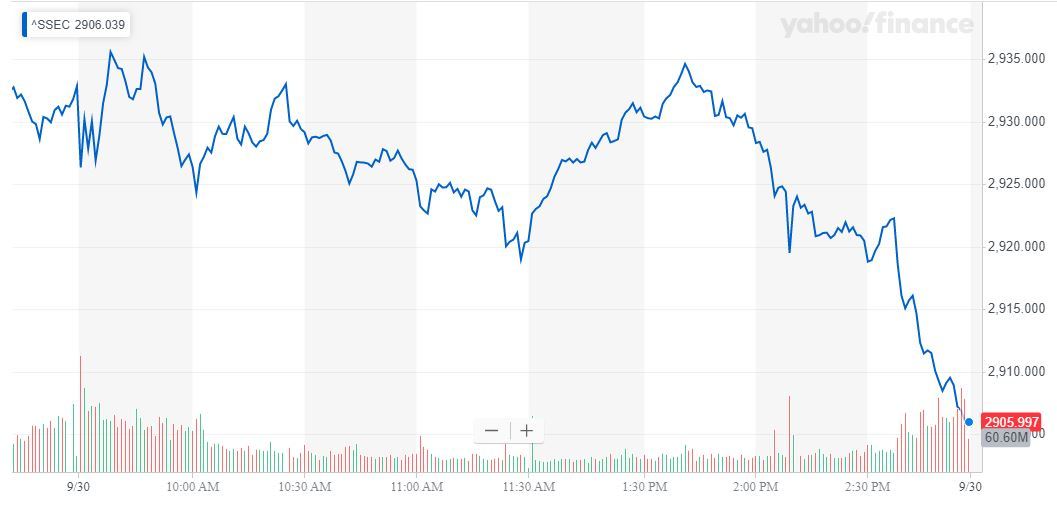

Chinese Stocks Plunge Ahead of Market Holiday

Those statements could have helped stabilize the Dow after its Friday downturn, but Chinese investors remain on edge ahead of five straight market holidays that will occur from Oct. 1 to Oct. 7.

On Monday, mainland Chinese stocks suffered in their first trading session since Bloomberg published its report. The Shanghai Composite Index plunged 26.98 points or 0.92% to 2,905.19.

The losses might have been worse had it not been for a better-than-expected Chinese manufacturing report. According to Reuters , the Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) spiked to 51.4 from 50.4 in September, recording its best reading in 19 months.

However, official manufacturing PMI – which measures the health of large, state-owned companies rather than smaller, privately-owned firms – came in at 49.8 to post its fifth straight month of contraction .

Click here for a live Dow Jones Industrial Average chart.