Chiliz Price Prediction 2024: What is CHZ?

What's next for Chiliz?

Key Takeaways

- Chiliz was subject to the United States Securities and Exchange Commission’s assault on altcoins in early June 2023.

- CHZ had a poor 2023, falling at a time when the market rose.

- What’s next for Chiliz?

- One Chiliz price prediction says it can reach $0.3718 in 2025.

It was all going pretty well for Chiliz. The native token of the Socios network had stepped out of the shadows. When its mainnet came out in May 2023, it became a coin after spending rather too long as a token. Less than a month after it got a blockchain of its own, though, the crypto got a nasty shock. When the United States Securities and Exchange Commission (SEC) launched court cases against Binance and Coinbase in June this year, CHZ was on the list of more than 60 unregistered securities. This sent the price of the coin tumbling as investors looked to mitigate potential future losses.

However, early 2024 saw a turnaround. The blockchain celebrated its 10 millionth transaction as the price shot up. Investors will be hoping that CHZ can continue its upward momentum. A tweet just saying “17.01.24” with an eagle emoji also saw anticipation rise.

Chiliz did not immediately respond to a request for comment.

On January 17, 2024, CHZ was worth about $0.105.

But what is Chiliz (CHZ)? How does Chiliz work? Let’s take a look and see what we can find out, and also examine some of the Chiliz price predictions that were being made as of January 17 2024.

Chiliz Coin Price Prediction

Let’s examine some of the Chiliz price predictions being made on January 17, 2024. It is crucial to bear in mind that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate. Additionally, please remember that many long-term crypto price predictions are generated using algorithms, which means they can change at any time.

| 2024 | 2025 | 2030 | |

|---|---|---|---|

| Prediction #1 | $0.16 | $0.18 | $0.29 |

| Prediction #2 | $0.21 | $0.26 | $0.76 |

| Prediction #3 | $0.2656 | $0.3718 | $0.903 |

Firstly, CoinCodex made a short-term Chiliz price prediction that suggested things would get better. It said CHZ would reach $0.1124 by January 21 and $0.2691 by February 15. The site’s technical analysis was bullish, with 28 indicators sending positive signals and just three making bearish ones.

Chiliz Price Prediction for 2024

CoinPriceForecast said Chiliz would be worth $0.16 by the end of this year. DigitalCoinPrice thought it would comfortably break past 10 cents to trade at an average of $0.21. Bitnation , meanwhile, said that CHZ would trade at $0.2656 in 2024.

Chiliz Price Prediction for 2025

CoinPriceForecast said Chiliz would trade at $0.18 in 2025, while DigitalCoinPrice had it at $0.26. Bitnation was, again, more optimistic, saying CHZ would get to $0.3718 next year.

Chiliz Price Prediction for 2030

When it came to making a more long-term Chiliz price prediction, CoinPriceForecast said it would reach $0.29 in 2030. DigitalCoinPrice thought it would reach $0.76 that year. Bitnation’s CHZ price prediction said the token could reach $0.903 at the start of the next decade.

Google BardAI Price Prediction for Chilliz (as of January 17)

Google’s BardAI platform gave the following price prediction for Chilliz on January 17, 2024. Please remember that price predictions are very often wrong and that artificial intelligence should not be trusted.

Short-Term (3-6 months):

- Potential Low: $0.08

- Potential High: $0.14

Reasons:

- Current market sentiment: Cryptocurrency market volatility could limit significant upward movement.

- Technical indicators: Some indicators suggest possible consolidation or even slight dips.

- Upcoming catalyst: Upcoming Socios.com partnerships and fan token launches could provide positive momentum.

Medium-Term (1-2 years):

- Potential Low: $0.20

- Potential High: $0.40

Reasons:

- Fan token adoption: Increased adoption and usage of fan tokens on Socios.com could drive demand and token value.

- Sports partnerships: Expanding partnerships with major sporting leagues and teams could further boost visibility and adoption.

- Platform development: Development of new features and functionalities on Socios.com could attract new users.

Long-Term (5+ years):

- Potential Low: $0.50

- Potential High: $1.00

Reasons:

- Mainstream integration: Integration of Chiliz technology into broader entertainment and fan engagement platforms could significantly increase user base and value.

- Metaverse and Web3 applications: Growing popularity of the metaverse and Web3 could create new opportunities for Chiliz and fan tokens.

- Regulations and legal clarity: Favorable regulations and legal clarifications around fan tokens could provide an environment for sustained growth.

Additional points:

- The success of Chiliz is heavily dependent on the adoption of fan tokens and the growth of the Socios.com platform.

- Competition from other blockchain-based fan engagement platforms may pose challenges.

- Unforeseen events, both positive and negative, can significantly impact the cryptocurrency market and CHZ’s future price.

It added: “These predictions are based on current information and market trends, and should not be considered financial advice. Please conduct your own research and consult with a financial advisor before making any investment decisions.”

Recent Updates from Chiliz

On January 17, 2024, Chiliz announced that the Chiliz blockchain had just had its 10 millionth transaction. That date was already something Chiliz investors would have been curious about. This was because, on January 10, it had tweeted that date next to an eagle emoji.

CHZ Price History

It’s now time to take a look at the Chiliz price history . While past performance should never be taken as an indicator of future results, knowing what the coin has done in the past – including during the long period when it was a token – can help give us some much-needed context when it comes to making and interpreting Chiliz price predictions.

When Chiliz first came onto the open market in September 2019, it was worth about $0.01. It stayed somewhere around that level until March 2021 when, as the crypto market blossomed, CHZ exploded, shooting up to what still serves as an all-time high of $0.8915 on 13 March that year.

While it then fell down as the market slumped over the summer, things picked up again in the Autumn. Dreyfus announced Socios would spend $60m on tokenization, while the overall market flourished as Bitcoin (BTC) reached new heights. The NFT craze also had an impact and, on 13 November it reached a high of $0.5935. After that, it sank as the market ran out of steam over economic worries relating to the Omicron variant of Covid-19 and it closed the year at $0.2837.

Overall, things looked promising in early 2022, as the then-token rallied to a high of $0.3287. It slid down again. Things got worse following a series of market collapses and it was worth just $0.08135 on 18 June.

Again, the autumn looked like it would be a time of recovery, with CHZ reaching a high of $0.2816 on 23 September. The collapse of the FTX (FTT) exchange in November saw it close the year at $0.1002, a loss of about 65% throughout 2022.

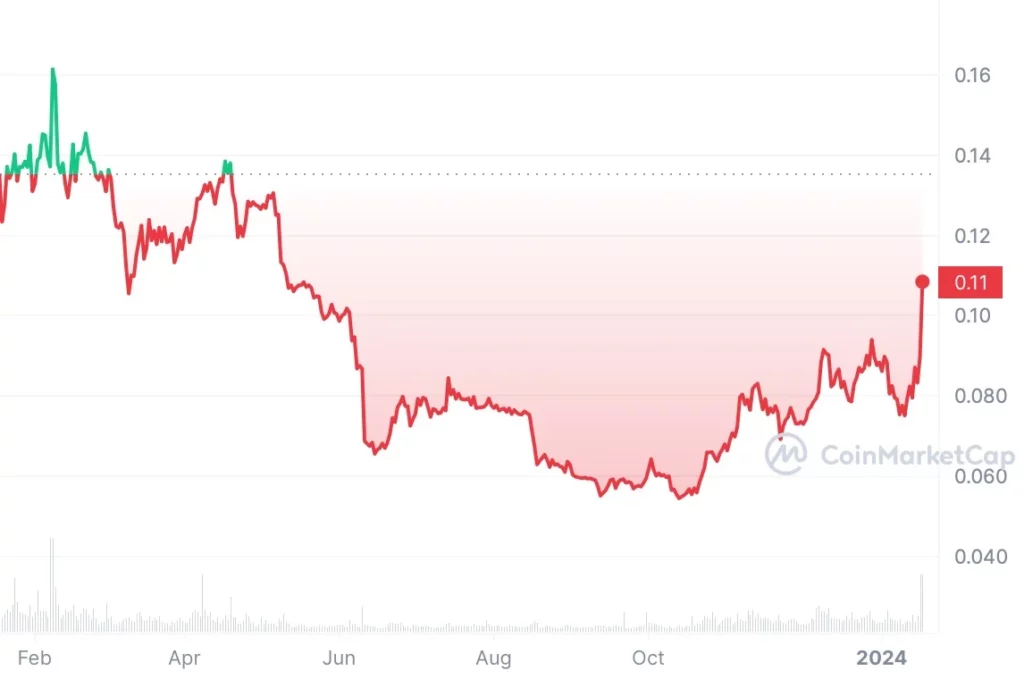

Chiliz in 2023 and 2024

2023 started promisingly. It rallied to peak at $0.1779 on 8 February, but then it was all downhill. While the news of the new blockchain in May saw its decline stop as it stayed at a little over $0.10, the news that the SEC considered it to be an unregistered security saw its price collapse again. By 14 June it was down to $0.06405.

Chiliz was able to make a recovery, reaching $0.08583 on 13 July, but entered another decline. August’s news that Elon Musk’s SpaceX had some billions of dollars worth of Bitcoin (BTC) sank the price further. By October 12, it was worth $0.0538. The coin then made something of a recovery, closing the year at $0.08612. This meant Chiliz lost nearly 15% of its value over the course of 2023, a time when the market more than doubled.

There was some fightback in the new year and, on January 17, 2024, CHZ was worth about $0.105.

At that time, there were a 8,888,292,417 CHZ in circulation out of a total supply of 8,888,888,888. This gave the coin a market cap of about $932 million, making it the 71st-largest crypto by that metric.

Chiliz Price Analysis

After reaching a low in October, the price of CHZ rose. It has doubled since that month’s nadir.

It looks set to reach $0.15 and could even top out at $0.17 before falling back down. If that happens, it could represent the first uptrend in a long bull cycle.

Is Chiliz a Good Investment?

Things looked like they were turning round for CHZ in May, when the crypto finally got its own blockchain. Ironically, though, this may have been the thing that spelled disaster for Chiliz, as its new status as an altcoin meant that it entered the sights of the US financial regulators.

Going forward, a lot will depend on the outcome of any court cases even tangentially involving CHZ. While the token and its platform’s fan tokens are relatively popular, potential investors will need to have the assurance that their holding will not find themselves the subject of any legal bans. Either way, it is vital that you do your own research before deciding whether or not to invest in CHZ.

Will Chiliz go up or down?

In all honesty, no one can really say whether or not CHZ will rise. While the price forecasts are positive, price predictions have a well-deserved reputation for being wrong. Remember, too, that prices can, and do, go down as well as up.

Should I invest in Chiliz?

Before you decide whether or not to invest in Chiliz, you will need to do your own research, not only on CHZ but on other coins and tokens such as Cardano (ADA) and Solana (SOL). More importantly, you should never invest more money than you can afford to lose.

Who is the Founder of Chiliz?

Crypto entrepreneur Alex Dreyfus founded Socios, which aims to turn sports fans into participants in their chosen clubs via the power of blockchain technology, in 2016. CHZ is Socios’ native token.

Who Owns the Most Chiliz (CHZ)?

On January 17, 2024, one wallet held more than 20% of the supply of Chiliz.

Richest CHZ Wallet Addresses

As of January 17, 2024, the five wallets with the most CHZ were

- 0xcd38983905eb4a433fc44b3c90321522d8340bf2. This wallet held 2,018,107,599 CHZ, or 22.7% of the supply.

- 0xf977814e90da44bfa03b6295a0616a897441acec. This wallet, listed as Binance 8, held 1,285,871,053 CHZ, or 14.47% of the supply.

- 0x3dd509eea1cbe2fe00fbbce496dd453bfde74e7f. This wallet held 690,001,000 CHZ, or 7.76% of the supply.

- 0x45a2eb4d96a84a1b408e98f04a3908776f2a41b4. This wallet held 493,433,133 CHZ, or 5.55% of the supply.

- 0xcc477b21d471fb9394a56aace72c8d59ac80f6af. This wallet, listed as Chiliz: Multisig, held 445,951,872 CHZ, or 5.02% of the supply.

Fact Box

| Supply and distribution | Figures |

|---|---|

| Maximum supply | 8,888,888,888 |

| Circulating supply (As of January 17, 2024) | 8,888,292,417 (99.99% of maximum supply) |

| Holder distribution | Top 10 holders owned 67.78% of supply, as of January 17, 2024 |

From the Whitepaper

In its technical documentation, or whitepaper , Chiliz says it is designed to support fan tokens.

It says CHZ is a “utility cryptographic decentralized token issued by the company based on the Ethereum protocol (ERC-20 token) being the token which can be used by sports fans to acquire Fan Tokens.”

Chiliz (CHZ) Explained

Chiliz is the native token of the Socios.com web platform.

The Chiliz (CHZ) token helps power the system. Holders vote on which sports teams will join the likes of Manchester City, Barcelona, Inter Milan and Galatasaray as one of more than 100 sporting organizations with their own Socios-based tokens.

How Chiliz Works

For a long time, Chiliz was based on two other blockchains, Ethereum (ETH) and Binance (BNB). In May 2023, though, this changed when the Chiliz blockchain was publicly launched . This meant Chiliz, which had been a token since it first hit the open market in 2019, was now officially a coin.

Chiliz is used in a governance role, with holders able to vote on changes to the network. People can also buy fan tokens with CHZ and can buy, sell, and trade it on crypto exchanges.

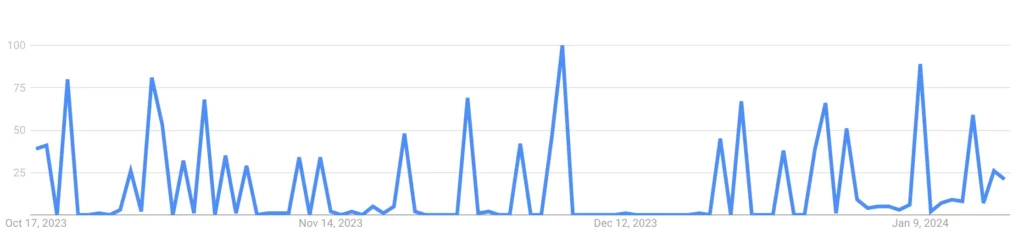

Chiliz (CHZ) Attention Tracker

Here is a chart for Chiliz (CHZ) Google search volume for the past 90 days. This represents how many times the term “Chiliz (CHZ)” has been Googled over the previous 90 days.

FAQs

Will Chiliz reach $1?

It might do but, if it does, it may not happen for quite some time. DigitalCoinPrice and Bitnation both said the coin should break past the dollar in 2031. However, not only are price predictions likely to be wrong, but also keep in mind that CHZ has never traded that high. It’s record price, set on March 13, is $0.8915.

What is Chiliz used for?

The Chiliz coin helps power the Socios.com network. Holders can vote on which new sports teams will get their own fan token. People can buy, sell, and trade it on exchanges.

Further reading

KuCoin Token Price Prediction 2023: What is KuCoin Token (KCS)?

Moonbeam Price Prediction 2023: What is Moonbeam (GLMR)?

Kaspa Price Prediction 2023: What is Kaspa (KAS)?

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.