Sorry Robinhood Bros, But You’re Not Gaming the Apple Stock Split

I suspect there’s a sizable minority of traders - i.e., the ones who follow Dave Portnoy on Twitter - who are chuckling to themselves greedily as they swipe up on their iPhones to add more shares of Apple stock to their Robinhood portfolios. | Source: AP Photo / Mark Lennihan

- Apple shares rose again as the upcoming stock split hit a key milestone.

- Retail investors may think they’re gaming the system by buying AAPL ahead of the split date.

- They’re sorely mistaken.

The countdown to the Apple stock split is officially on.

Monday marks the first key moment in the split: the Record Date. This determines which AAPL investors will receive additional shares on Friday (August 28) – the Split Date – when each share formally divides into four after the market closes.

Shares will begin trading at their new split-adjusted price – the Ex Date – when market activity resumes on August 31.

Apple Stock Shoots Higher as Key Split ‘Deadline’ Dawns

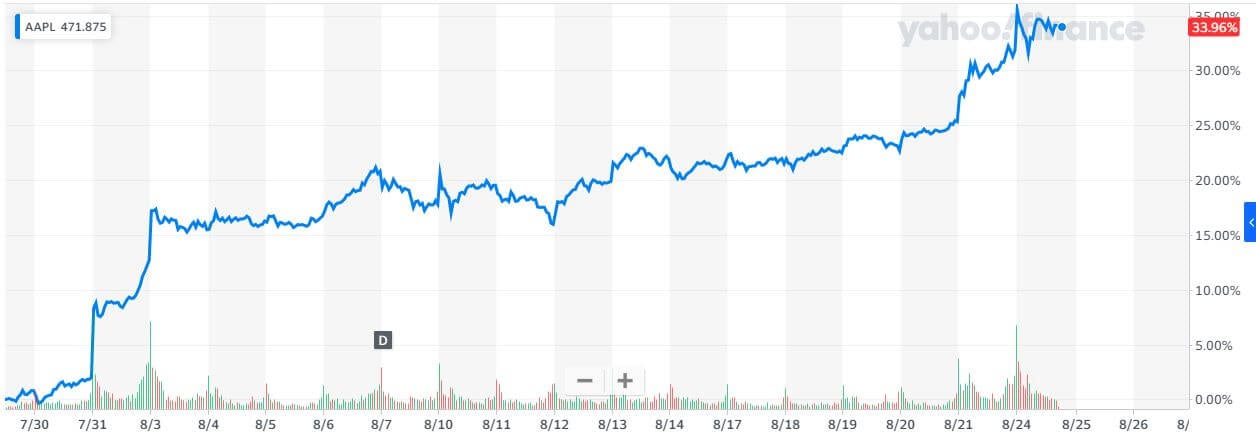

Apple stock had already shot up nearly a third since announcing the split on July 30, and the rally continued as the Record Date “deadline” dawned.

Shares rose 1.5%, lifting the world’s most valuable company’s market cap to a dizzying $2.16 trillion.

Unsurprisingly, the Robinhood retail bros thrust themselves into the thick of it. AAPL ranked as the brokerage’s second most popular stock today, adding more than 12,500 new investors .

On the one hand, this is standard behavior for Robinhood traders. Although Apple claims the stock split is necessary to make ownership “more accessible to a broader base of investors,” it’s already the most purchased stock on Robinhood over the past month.

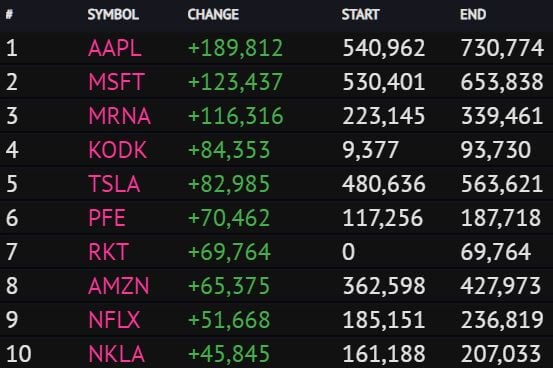

And it’s not even close. More than 189,000 new investors have purchased AAPL over the past 30 days, more than 50% greater than any other asset. Microsoft, the second most popular stock, joined 123,000 new portfolios during the same timeframe.

On the other hand, I suspect there’s a sizable minority of traders – i.e., the ones who follow Dave Portnoy on Twitter – who are chuckling to themselves greedily as they swipe up on their iPhones to add more shares of Apple stock to their Robinhood portfolios.

Why? Because they think they’re gaming the system.

The Genius Stock Market Scheme That Isn’t

While today is officially the Record Date for the split, shares won’t actually divide for another four days.

In theory, and if Barstool Sports is really the type of source you go to for investing advice, that means you can buy a share of AAPL today, sell it tomorrow, and still wake up to three “free” shares on August 31.

Except, as the Apple Investor Relations website explains , that’s not the case at all:

If you sell shares on or after the Record Date (August 24, 2020) but before the Ex Date (August 31, 2020) you will be selling them at the pre-split price. At the time of the sale, you will surrender your pre-split shares and will no longer be entitled to the split shares. Following the split, the new owner of the shares will be entitled to the additional shares resulting from the stock split.

In other words: No, you haven’t conjured up a way to game the stock market. Even though today is technically the record date, what matters is who owns the stock when it actually splits.

Do I have any hard evidence that an ill-fated arbitrage scheme is driving Robinhood traders into AAPL?

Admittedly, no – but I do have an ironclad piece of “anecdata.” This is the same cabal that sent shares of a bankrupt Hertz into the stratosphere .

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the stocks mentioned.