$500 Apple Catapults S&P 500 to New Record High

Apple is a $2 trillion company, but at least one Wall Street mega-firm thinks it's still cheap. | Image: REUTERS/Dado Ruvic/Illustration/File Photo

- Apple hit a new milestone Monday, crossing $500 a share.

- The S&P 500 and Nasdaq touched new all-time highs.

- Morgan Stanley believes Apple is still cheap as a $2 trillion company.

The Dow and broader U.S. stock market rallied sharply on Monday, as surging tech and energy shares propelled the S&P 500 and Nasdaq to new all-time highs.

Dow, S&P 500, Nasdaq Rally

All of Wall Street’s major indexes traded sharply higher at the start of the week, reflecting strong futures activity in the pre-market.

The broad S&P 500 Index of large-cap stocks rose 1% to close at 3,431.26. Ten of 11 primary sectors reporting gains . Energy stocks rallied 2.8%, financials gained 2.3% and industrials companies rose 1.8% as a whole.

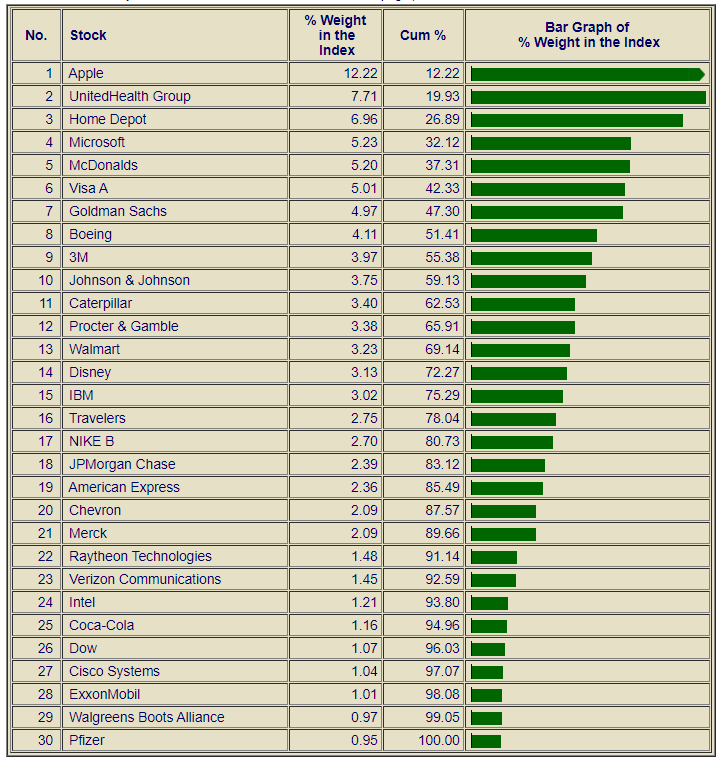

The technology-focused Nasdaq Composite Index gained by as much as 1.3% before paring gains. It closed up 0.6% at 11,379.72. The Dow Jones Industrial Average jumped 378.13 points, or 1.4%, to 28,308.46.

Apple Crosses $500

Apple’s (NASDAQ:AAPL) gravity-defying rally continued on Monday, as the share price rallied to a high of $515.14. At current values, the iPhone maker has a market capitalization of $2.15 trillion.

Since bottoming in March, Apple’s stock has surged 126%. The stock went on a tear last week, gaining more than 8% across four sessions to become the first U.S. company to reach a $2 trillion market cap.

Apple’s stock has gained more than 31% since the company announced a four-to-one reverse split on July 30 . Shares will be distributed to investors at the close of business Monday and will trade at their new split-adjusted price on Aug. 31.

Apple Is Still Cheap: Morgan Stanley

With a $2 trillion market cap, Apple’s growth story is not as compelling as it was before, especially as the company continues to rely on extensive buybacks to prop up its stock. But according to Morgan Stanley, the iconic tech company is still cheap even at today’s levels.

Apple is still undervalued based on free cash flow, which has been growing more than 20% annually for the past four years, Morgan says.

The Wall Street firm raised its price target for AAPL to $520 per share from $431.

In a note to investors (via CNBC), Morgan analysts wrote :

At 25x FCF, AAPL trades at a discount to both tech platforms and strong consumer brands.

They added:

In our eyes, these results underscore the strength of Apple’s broad ecosystem of products and services, a change from past years where Apple was more reliant on the success of the iPhone to drive growth… These results also demonstrate the increasing engagement and stickiness of Apple’s customer base, and as a result, we increasingly believe that Apple should be valued like a technology or consumer platform, rather than a more cyclical hardware company.

Disclaimer: The author holds no investment position in the above-mentioned securities.