1inch Price Prediction 2024: What’s Next for 1INCH DEX Token?

What's next for 1inch?

Key Takeaways

- The native token of the 1inch crypto exchange fell to an all-time low in September 2023.

- 1INCH has struggled in recent months.

- Can 1INCH ever recover?

- One 1inch price prediction says it can reach $1.10 in 2025.

The 1INCH token had a tough time in 2023, barely climbing in a year when the overall crypto market doubled.

Holders of the crypto, which supports the 1inch Network decentralized exchange and aggregator, will be hoping that a more sustainable fightback can take place.

On February 15, 2024, 1inch was worth about $0.4475.

1inch did not immediately respond to a request for comment

But what is 1inch (1INCH)? How does 1inch work? Let’s see what we can find out, and also take a look at some of the 1inch Price Predictions that were being made as of February 15 2024.

1inch Price Prediction

Let’s examine some of the 1Inch price predictions being made on February 15 2024. It is crucial to bear in mind that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate. Additionally, please remember that many long-term crypto price predictions are generated using algorithms, which means they can change at any time.

| 2024 | 2025 | 2030 | |

|---|---|---|---|

| Prediction #1 | $0.5666 | $1.10 | $1.50 |

| Prediction #2 | $0.88 | $1.07 | $2.60 |

| Prediction #3 | $0.6275 | $0.9296 | $5.68 |

First, CoinCodex had a short-term 1inch price prediction which saw the token drop to $0.4136 by February 20 before suggesting it would hit $0.491 by March 16. The site’s technical analysis was bullish, with 25 indicators sending signals and just four making bearish ones.

1inch Price Prediction for 2024

CaptainAltCoin said 1INCH would climb to $0.5666 in December. DigitalCoinPrice was more optimistic, saying it would get to $0.88 this year, while PricePrediction.net thought it would be worth $0.6275 in 2024.

1inch Price Prediction for 2025

Moving on, DigitalCoinPrice said 1Inch would get to $1.07 in 2025, while PricePrediction.net had it trade at $0.9296. CaptainAltCoin said 1INCH would reach $1.10 next year.

1inch Price Prediction for 2030

Looking forward to a more long-term 1inch price prediction, PricePrediction.net was out in the lead, saying the token would reach $5.68 in 2030. DigitalCoinPrice had it trade at $3.20 that year. Meanwhile, CaptainAltCoin had a 1INCH price prediction which said it would get to $2.76 at the start of the next decade.

Google Gemini AI Price Prediction for 1inch (as of February 15)

Google’s Gemini AI platform gave the following price prediction for 1inch on February 15. Please remember that the exact price prediction of an asset or cryptocurrency in the future is nearly impossible to achieve. Additionally, artificial intelligent price predictions are predicated on past performances and are in no way entirely accurate.

Short-term (next 3 months):

- Reasonably bullish: The current positive market sentiment and potential partnerships could push 1INCH to $0.50 – $0.65.

- Possible retracement: Concerns about the wider crypto market or DeFi space could lead to a dip to $0.35 – $0.45.

Medium-term (next 12 months):

- Moderately optimistic: Increased adoption of the 1Inch aggregation protocol and its governance features could lift the price to $0.70 – $1.00.

- Cautious outlook: Competition from other aggregators and DeFi platform advancements could limit growth, keeping 1INCH around $0.45 – $0.65.

Long-term (next 5 years):

- Highly optimistic: Integration with major protocols, successful expansion into new chains, and wider DeFi adoption could see 1INCH reach $2.00 – $5.00.

- Conservative approach: Regulatory hurdles, technical challenges, and shifting market trends could result in a range of $0.75 – $1.50.

Reasons for potential growth:

- Aggregation protocol strength: 1Inch’s efficient routing and deep liquidity access could attract more users and developers.

- Governance participation: Active community engagement and DAO-driven decision-making could foster long-term value.

- Defi ecosystem expansion: 1Inch’s multi-chain support and integrations with various DeFi protocols could benefit from ecosystem growth.

Reasons for potential decline:

- Competition: Other aggregators offering similar features or superior incentives could challenge 1Inch’s market share.

- Regulatory uncertainty: Stringent regulations on DeFi activities could impact 1Inch’s functionality and user base.

- Market volatility: Broader market downturns could drag down the price of DeFi tokens like 1INCH.

It added: “These are just potential scenarios, and the actual price of 1INCH could go significantly higher or lower. It’s crucial to do your own research and understand the risks involved before making any investment decisions.”

Recent updates from 1INCH

On February 14 2024, 1inch held a Valentine’s Day giveaway, offering competition winners t-shirts.

1INCH Price History

Let’s now take a look at some of the highlights and lowlights of the 1inch price history . While past performance should never be taken as an indicator of future results, knowing what the token has done can help give us some very useful context when it comes to either making or interpreting a 1inch price prediction.

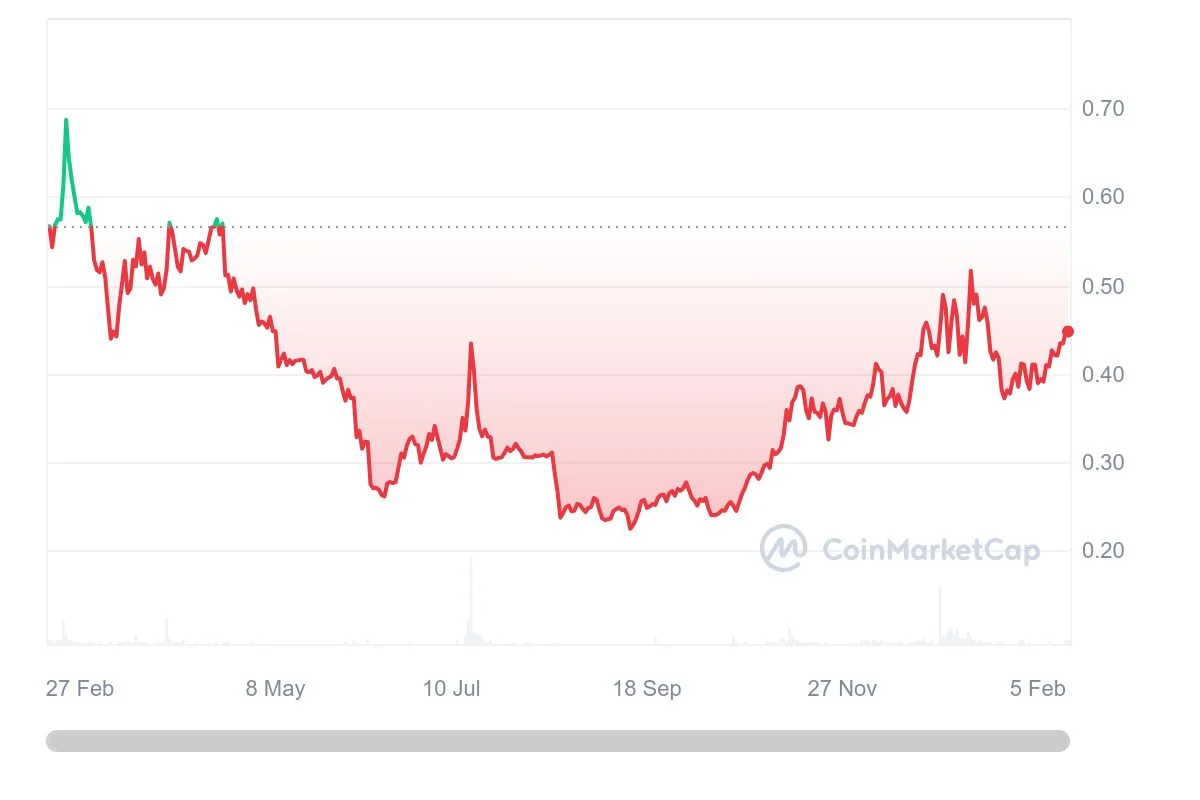

When 1INCH first came onto the open market in late 2020, it was worth about $1.60. Early 2021 saw the crypto market flourish and the token was able to capitalize, reaching an all-time high of $7.87 on May 8 before slipping to close the year at $2.89.

2022 was not a good year for either crypto or 1Inch. The token fell below the dollar in May, and a series of market crashes left it closing the year at $0.384, representing an annual loss of more than 80%.

1inch in 2023 and 2024

On one hand, 2023 was a relatively good year for 1inch but, on the other hand, it was a relatively bad one. Although a buoyant market saw it reach a peak of $0.6896, things got bad over the following months. On June 15, in the wake of the United States Securities and Exchange Commission announcing it was suing the Binance and Coinbase crypto exchanges, 1INCH sank to an all-time low of $0.2535.

After that, there was a small recovery, and the token spiked on July 17, reaching a high of $0.5811 as it became the hot topic on Upbit. After that, though, it crashed back down again. On September 11, it fell to an all-time low of $0.2211. By October 19, 2023, it was worth about $0.254.

The token was able to recover and it closed the year at $0.4265. While an annual increase of 10% may sound encouraging, that has to be put into the context of a crypto market which ended up doubling in 2023.

By February 15, 1inch was worth about $0.4475.

At that time, there were just over 1.1 billion 1INCH in circulation out of a total supply of 1.5 billion. This gave the token a market cap of around $510 million, making it the 117th largest crypto by that metric.

1inch Price Analysis

The 1INCH token peaked in May 2021. From there, it started its multi-year bear market, falling more than 95% and bottoming out in September 2023.

Although it recovered somewhat by early January 2024, that upturn has ended. However, a recent recovery could see it rise above $0.55 this year.

On the other hand, it could also fall to $0.30.

Is 1inch a Good Investment?

It is difficult to tell. Although there is a theory that you should buy during the dip, with 1INCH not that far away from an all-time low, we don’t know when the dip will end, nor how much of a recovery the token can make.

On the other hand, 1Inch does provide a useful service and the token does have some potential.

As ever with crypto, you will need to make sure you do your research before deciding whether or not to invest in 1INCH.

Will 1inch go up or down?

No one can tell right now. While the 1inch crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can, and do, go down as well as up.

Should I invest in 1inch?

Before you decide whether or not to invest in 1inch, you will have to do your research, not only on 1INCH, but on other, related, coins and tokens such as Uniswap (UNI). Either way, you will also need to make sure that you never invest more money than you can afford to lose.

Who are the Founders of 1inch?

Computer programmers Sergej Kunz and Anton Bukov founded 1inch in 2019. Kunz has since founded the IT firm Bulktrade, while Bukov previously served as a software engineer for the Near Protocol (NEAR).

Who owns the most 1INCH Tokens?

The wallet with the most 1INCH as of February 15 2024 was linked to the 1inch network. It held more than 13% of the token’s supply.

Richest 1INCH Wallet Addresses

As of February 15 2024, the wallets with the most 1INCH were

- 0x9a0c8ff858d273f57072d714bca7411d717501d7. This wallet, listed as 1inch: Governance Staking, held 202,368,236 1INCH, or 13.49% of the supply.

- 0x6630444cdbd42a024da079615f3bbce8edd5a7ba. This wallet held 104,764,763 1INCH, or 6.98% of the supply.

- 0xf977814e90da44bfa03b6295a0616a897441acec. This wallet, listed as Binance 8, held 101,964,964 1INCH, or 6.8% of the supply.

- 0x23360d94c13c1508bda63beb5a404b9e2e3f62b5. This wallet held 96,500,000 1INCH or 6.43% of the supply.

- 0x4942b20750163675ddf004476ffe46626652dfd0. This wallet held 75,000,002 1INCH or 5% of the supply.

Fact Box

| Supply and distribution | Figures |

|---|---|

| Total supply | 1,500,000,000 |

| Circulating supply (as of February 15, 2024) | 1,141,358,310 (69.53% of total supply ) |

| Holder distribution | Top 10 holders own 52.83% of total supply as of February 15, 2024. |

From the Whitepaper

In its technical documentation or whitepaper , 1inch says that offers people the chance to access a wide range of liquidity sources.

It says: “The 1inch Network is composed of three distinct groups of stakeholders: the 1inch Foundation, the 1inch core contributors, and the 1inch DAO. All stakeholders are working towards the common goal of growing the 1inch Network in a decentralized manner.

“Though they share a common goal, each group operates independently.”

1inch (1INCH) Explained

The world of cryptocurrency is, in its way, reliant on exchanges. Because crypto does not have any intrinsic value, a place where a price can be set and people can get hold of coins and tokens is vital.

Crypto exchanges can be divided into two categories. Centralized exchanges, or CEXes, make use of currency reserves and have their prices and what cryptos can be traded set by a central authority. Decentralized exchanges (DEXes), on the other hand, make use of smart contracts, computer programs that automatically execute once certain conditions are met, and liquidity pools to let people list the cryptos they want for a price set by the market.

1inch is one of the many operators in the DEX space. What makes the platform different is that it is not a single decentralized exchange. Rather, it takes prices from a range of DEXes, puts them together, and, at least in theory, allows people to find the best price for the cryptos they want to get hold of.

1inch, which is based on the Ethereum (ETH) blockchain, is supported by the 1INCH crypto token.

How 1inch Works

1inch uses software called Pathfinder to trawl the blockchain, looking for the best prices. It also features a liquidity protocol to protect users from system attacks and a limit order protocol that allows the system to host auctions and gives people the chance to put in place stop-loss orders so they can avoid losing too much money when they trade.

The platform also has its crypto wallet.

In terms of the 1inch token itself, holders can vote on both changes to how the network is run, but also on how liquidity pools are run.

Because 1INCH is based on Ethereum, it is a token, not a coin. You might see references to such things as a 1inch coin price prediction, but these are wrong.

1Inch Attention Tracker

Here is a chart for the 1Inch Google search volume for the past 90 days. This represents how many times the term “1Inch” has been Googled over the previous 90 days.

FAQs

Will 1inch reach $1

It could do. DigitalCoinPrice and CaptainAltCoin think it can get there as soon as next year. Keep in mind that 1INCH has traded above the dollar before, but not since May 2022.

What is 1inch used for?

The 1INCH token is used to vote on changes to the 1Inch decentralized exchange and can also be bought, sold, and traded on exchanges.

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability, and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto user should research multiple viewpoints and be familiar with all local regulations before committing to an investment.