Wall Street Analyst: Buy the Dip in this Chip Stock for Great Returns

Nvidia is down by almost 40% from its all-time high. The gaming segment is strong, so an analyst raised his price target for the stock. | Image: AP Photo/Chiang Ying-ying

Chip stocks may be selling off today amid fears of an escalation in the U.S.-China trade war, but a strong gaming sector could lift one stock out of the doldrums.

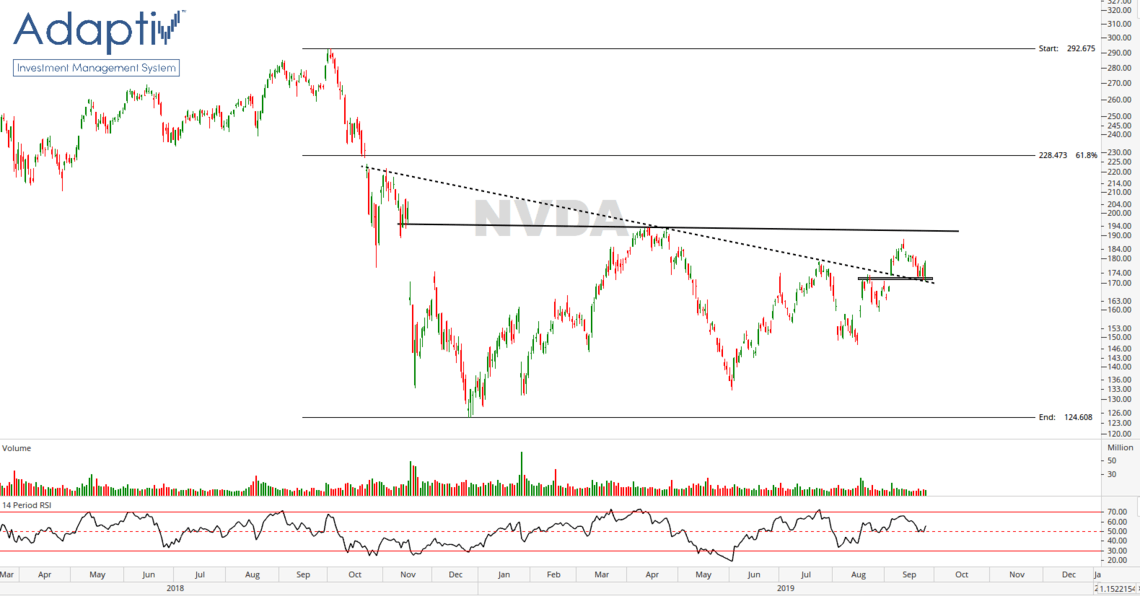

Nvidia Corporation (NVDA) is down by almost 40% from the all-time high of $292.76. The retracement is the equity’s worst corrective period since it launched its parabolic run on the monthly time frame in October 2014.

Even after a deep correction, some traders are betting that the stock will continue to plunge.

While the technicals of the stock are less than stellar, its fundamentals appear to be on the rise. This prompted a Wall Street analyst to raise the price target of the stock from $179 to $192.

Analyst: Gaming Segment to ‘Deliver Strong Sequential Growth’

In the last couple of years, Nvidia has been making a killing selling GPUs to cryptocurrency miners. CCN.com reported in February that the tech company generated $1.95 billion in revenue from its crypto business.

However, the boom was short-lived after the bear market gripped the cryptocurrency industry and demand for GPUs fizzled. In August, The Next Web reported that the chipmaker’s chief finance officer Collette Kress said that their business has normalized. Nvidia noted that it doesn’t expect cryptocurrency mining to boost revenues in the coming months.

This is where the firm’s gaming sector comes into play.

CNBC reported that Goldman Sachs analyst Toshiya Hari is betting on the gaming segment to drive earnings in the second half of the year. In a note to clients, the analyst said,

We expect the company to deliver strong sequential growth in FY3Q (Oct) in the Gaming segment supported by the normalization in channel inventory and the launch of its new products.

In the last few quarters, the splendid performance of the gaming segment helped to clear out the surplus of channel inventory that stunted sales growth, no thanks to the capitulation of cryptocurrency miners.

With the normalization of inventory, the chipmaker is reportedly set to release a new line of graphics cards next month. Tom’s Hardware revealed that the new Nvdia GeForce GTX 1660 Super cards are rumored to be coming out in October. The GTX 1660 Super cards are expected to carry 6GB of GDDR6 memory at 14 Gbps, which is superior to the current GTX 1660 that has 6GB DDR5 at 8Gbps.

Market Technician: Higher Targets Ahead

In addition, Ian McMillan, CMT, a market technician at ClientFirst/Adaptive spoke to CCN.com to share his bullish view on the stock. The trader wrote,

From here, I would have a target of $194. If we get above that, I would have a target of $228, which is both a gap fill from last October and a 61.8% retracement of the recent correction.

Fundamentals and technicals don’t often agree but when they do, the investment may be one worth considering.