Here’s How Much Nvidia Actually Made from Crypto Mining Sales

A shocking percentage of crypto mining operations are located on college campuses. | Source: Shutterstock

According to a report by Markets Insider, Nvidia generated $1.95 billion in revenue from its crypto business.

Although the official financial statement of the company disclosed a $602 million crypto-related revenue, RBC analyst Mitch Steves said that the actual number is at least three times higher.

“We think NVDA generated $1.95 billion in total revenue related to crypto/blockchain. This compares to company’s statement that it generated around $602 million over the same time period,” Steves said.

Did Crypto Cause Nvidia to Underperform?

In the third quarter of 2018, Nvidia chief financial officer Colette Kress told investors to not expect any revenue from its crypto business.

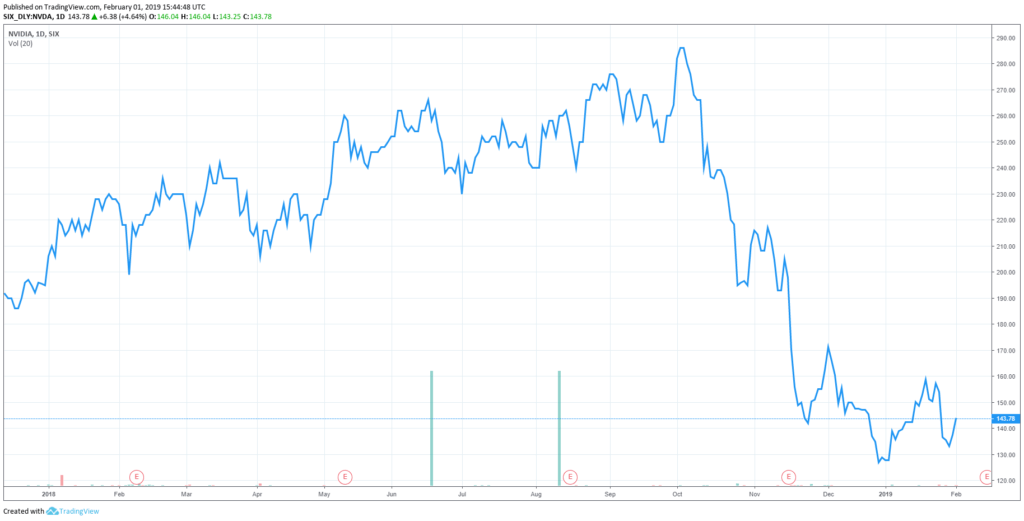

At the time, the company’s shutdown of its cryptocurrency venture led to the decline in its stock price.

Kress said in August:

“We believe we’ve reached a normal period as we’re looking forward to essentially no cryptocurrency as we move forward. Our revenue outlook had anticipated cryptocurrency-specific products declining to approximately $100 million, while actual crypto-specific product revenue was $18 million, and we now expect a negligible contribution going forward.”

However, throughout the past five months, many analysts have attributed the decline in the performance of the company to the 85 percent drop of the cryptocurrency market.

Given that Nvidia CFO Colette Kress already emphasized in August that it has pulled out of the crypto sector, the narrative that the correction in the cryptocurrency market is hurting the firm’s numbers has intensified.

A new report released by RBC claimed that the company’s ties with the crypto market are deeper than how they were initially presented late last year.

RBC analyst Mitch Steves said that the revenue Nvidia generated from its crypto mining equipment manufacturing business from April 2017 to July 2018 is estimated to be $2.75 billion.

Noting that the numbers cannot be fully confirmed, Steves suggested that the company had 75 percent control over the GPU-related crypto mining market — and possibly the entire GPU market — alongside AMD.

From January 25 to 29, the stock price of Nvidia dropped from $160.15 to $131.6, by more than 18 percent. For a major technology conglomerate, such a large short-term drop in market valuation is unprecedented.

But, throughout the past month, analysts have said that the overall decline in demand for Nvidia’s gaming GPUs negatively affected the firm’s performance rather than the struggling crypto market.

Nvidia GPUs Reportedly Not Appealing to Gamers

The Motley Fool reported that gamers are not compelled to purchase Nvidia’s newest and high-performance GPUs because of three main factors:

- Most popular PC games are not graphically intensive

- Gamers are not upgrading GPUs as frequently as before

- New GPUs do not have killer features

Newzoo, a games, esports, and mobile market research firm, said that the most sought out GPUs in the market are the GTX 1060, GTX 1050 Ti, and GTX 1070

Essentially, Nvidia challenged AMD, another dominant graphics card manufacturer, in taking control of the low-end GPU market. While Nvidia was successful in doing so, the consequence of the strategy was an overall decline in demand for high-end and expensive GPUs, a market where Nvidia dominates.

The struggle of graphics card manufacturers has not been exclusive to Nvidia. AMD and smaller GPU makers have also demonstrated poor performance throughout the last quarter of 2018.

In December 2018, when Nvidia first started to show signs of underperformance, CNBC Mad Money host Jim Cramer said that it was a forecasting mistake that caused Nvidia’s stock to drop rather than variables like the crypto market (video above).

“Nvidia still makes the best graphics chips, which have become more powerful than traditional microprocessors. It still has a lead over the competition in a lot of uses, although you could argue that AMD’s catching up to them in the data center while Intel rivals them in self-driving vehicles. I think Nvidia made an honest forecasting mistake, although given that some of us saw it coming, it was definitely an avoidable mistake,” Cramer said.

Featured Image from Shutterstock. Price Charts from TradingView .