CZ and other crypto leaders prepare for legal battles throughout 2024

-

CryptoRipple Price to Pump After Whale Withdraws More Than $10 Million XRP From Binance?February 28, 2024 10:16 AM

-

CryptoSolana Price Slides 10%, But Pantera Capital Purchases Locked SOL, Bullish Wave Count Remains IntactFebruary 28, 2024 10:16 AM

-

CryptoBinance Faces Spotlight as Ripple Proposes $10 Million Settlement Fee in XRP vs SEC CaseFebruary 28, 2024 10:16 AM

-

Projected US Interest Rates in Five Years: Will the Fed Opt For No Cut In 2024?February 28, 2024 10:16 AM

- Changpeng Zhao has been asked to surrender all passports by U.S. prosecutors.

- Terraform Labs co-founder Do Kwon’s criminal case is to begin on March 25.

- XRP has been hit with another lawsuit.

It’s set to be another pivotal year for crypto. 2024 will see the sentencing of former Binance CEO Changpeng ‘CZ’ Zhao, the beginning of Terraform Labs co-founder Do Kwon’s fraud trial, and yet another lawsuit for Ripple (XRP) despite an ongoing battle with U.S. lawmakers.

Confidence in crypto is being tested, and the outcomes of these hearings may set a precedent for lawmakers and regulators, which may affect the crypto industry and the market overall. Is this a time of reckoning for crypto, or is it about time the bad apples finally fell off the tree?

Changpeng ‘CZ’ Zhao Passports to be Seized

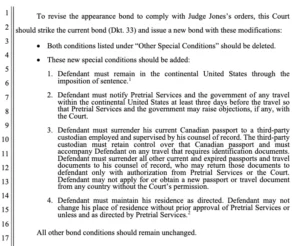

With just under a month to go before his criminal sentencing hearing, U.S. prosecutors are attempting to place stricter travel restrictions on Zhaowith a recent court filing requesting that he surrender his Canadian passport, as well as any other passport or travel document he has, including expired ones.

It is also being requested that Zhaonotify the courts with “at least three days’ notice” if he wishes to travel anywhere within the United States. This comes a month after CZ was denied the right to travel to the United Arab Emirates (UAE) despite offering his $4.5 billion Binance stake as a bond.

Originally scheduled for February 23, 2024, CZ’s sentencing was rescheduled for April 30, 2024. Though there are calls for him to be locked away for years, Zhao may only spend around 18 months in jail.

Do Kwon Could Miss US Trial Start

Another former crypto Founder, Terraform Labs founder Do Kwon is due to begin his trial on March 25, 2024, however, unlike Zhao and other beleaguered industry players, this crypto founder isn’t exactly playing ball, or even trying to.

Following the collapse of Terra in May 2022, Kwon’s whereabouts were more or less unknown, with an Interpol red notice issued for the arrest of Kwon in September 2022, Kwon appeared to be doing his best to evade authorities. He wasn’t rediscovered until March 2023 when he was arrested in Montenegro for using fake travel documents, landing him four months in jail.

Since being arrested, Kwon, who faces allegations of wire fraud, securities fraud, commodity fraud, and conspiracy charges relating to market manipulation, has been detained in Montenegro whilst the U.S. prosecutors work to have him extradited to the States for his trial.

Both U.S. and South Korean authorities have been battling to get him first, but Kwon’s lawyers have managed to successfully appeal the courts and have them reject extradition requests in the past, and whether or not he’ll be present for the first day of his hearing on March 25, 2024.

Fresh Lawsuit for XRP

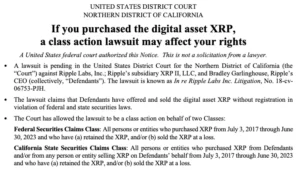

Crypto legal battles don’t come bigger than Ripple and the SEC. Now, Ripple Labs and CEO Brad Garlinghouse have an additional lawsuit against them, with Californian regulators filing against the firm for violating securities laws in their sale of XRP tokens.

Filed with the Northern District of California, the suit claims Ripple sold an XRP as an unregistered security between July 3, 2017, and June 30, 2023. Resuming the stance it has taken against the SEC, which has also sued Ripple for the same reason, Ripple argues that the token is not a security and therefore does not require registration.

As per the filing, affected parties have until April 5, 2024, to decide if they want to pursue or abandon the lawsuit, with the trial scheduled for October 2024.

The battle between the SEC and Ripple is seen by many as one of the most important for the entire crypto industry. If it is found that XRP is indeed a security, it and many other crypto tokens may find themselves being delisted, which would spell disaster for the market and industry overall.

Is Crypto Maturing?

Despite approving spot Bitcoin (BTC) exchange-traded funds (ETFs) in January this year, the SEC has been increasingly aggressive over the years, with the Winklevoss Twins (Gemini), Justin Sun (Tron), Alex Mashinky (Celsius), and many others in their crosshairs.

We lost SBF, CZ, Do Kwon, and Mashinsky in this bear market.

The sacrifice we needed to start the crypto bull run. pic.twitter.com/wXK2YBuz2O

— Milady 5673 (Aevo Intern) (@aevo_intern) February 27, 2024

But it’s important to remember that the likes of Sam Bankman-Fried (SBF), and other heads of crypto who now face severe legal consequences for their actions, are merely representatives of the industry and not the market.

Ideally, these unfortunate moments in crypto history are simply the teething problems of a rather young industry that is growing up a little too quickly.

Arguably, if the SEC is successful in classifying the likes of XRP and other crypto tokens as securities, then there are wider implications for the entire crypto industry, but given that the SEC has made little to no progress in any of their unregistered securities lawsuits, 2024 could be a huge victory for crypto.