SEC Lawyers Quit Over DEBT Box Scandal, But Unlikely to Assuage Industry Criticism

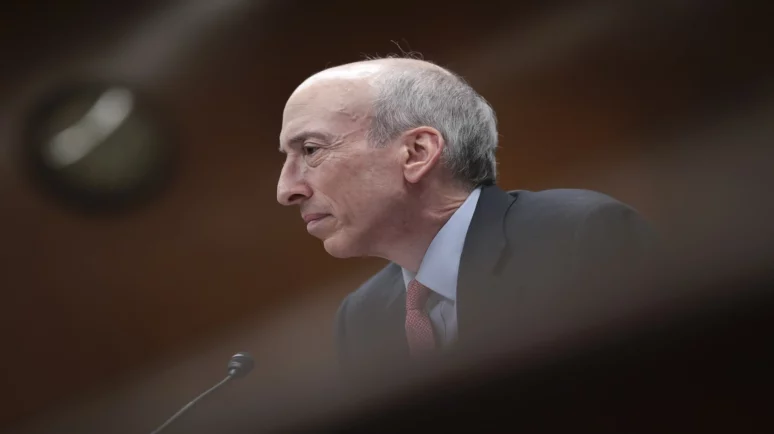

2 SEC Lawyers have departed over the DEBT Box scandal. Image Source: Shutterstock.

Key Takeaways

- Two SEC attorneys responsible for actions that a judge characterized as a “gross abuse of power,” have stepped down.

- The scandal relates to the SEC’s handling of its lawsuit against DEBT Box.

- However, the resignations are unlikely to appease the agency’s critics.

Last month, Judge Robert J. Shelby reprimanded the Securities and Exchange Commission (SEC) for misconduct in its efforts to freeze assets belonging to DEBT Box.

The two lawyers responsible for what Judge Shelby described as “gross misconduct” have since resigned. But were they one-off rogues or does the scandal implicate the entire agency?

DEBT Box Controversy Escalates

In his ruling, Judge Shelby found that the SEC presented misleading evidence in its request to freeze DEBT Box’s assets and withdrew a temporary restraining order against the firm.

After he accused the agency of a “gross abuse of power,” the two attorneys who led the case have been forced out.

According to Bloomberg , Michael Welsh and Joseph Watkins resigned earlier this month after an SEC official informed them they would lose their jobs if they didn’t leave. The report did not mention the official by name and CCN could not reach either lawyer for comment.

Judge Shelby’s ruling chimes with widespread criticism of how the agency has handled crypto regulation.

However, it would be a mistake to lump the complaint against DEBT Box together with other SEC crypto enforcements.

This Time it Really Might be a Security

To take just one example, the company’s Black Gold Token (BGLD) can be mined by anyone who buys the necessary software license. Money raised from software sales is then directed into oil drilling projects, with the returns used to buy and burn BGLD. This pushes the asset’s price higher, thus rewarding miners.

Unlike XRP, Solana and many of the decentralized cryptocurrencies the SEC has previously claimed are securities, it’s hard to argue that the agreement between DEBT Box and its customers is anything other than an investment contract. And yet, because the company sells tokens, not shares, that’s what it claims.

Crypto Sector Dissatisfaction With SEC Entrenched

Big Crypto has been peddling the “regulation by enforcement” narrative for so long that it has almost lost all meaning. Indeed, many crypto advocates immediately side with token issuers over the SEC without taking time to consider the nuance of each token.

But the point remains. Relying on laws that were written in the 1930s to solve these issues in court could be creating unnecessary tension.

In an already polarized debate, Welsh and Watkins’ misconduct helps cement a suspicion the SEC is simply out to get crypto firms.

The two lawyers immediately responsible may have left. But as far as many people in crypto are concerned, the scandal encompasses the entire agency.