JNJ Stock Laughs Off $572 Million Opioid Fine With DJIA-Best Rally

The opioid case ruling was announced yesterday and Johnson & Johnson was ordered to pay $572 million. However, the stock surged on the news. Find out why. | Source: Shutterstock

Johnson & Johnson has been at the center of controversy as of late. The multinational pharmaceutical company faces backlash for its alleged role an opioid crisis in Oklahoma as prosecutors accuse the firm of promoting drugs (Duragesic and Nuncyta) that fueled overdose cases in the state.

$572 Million Judgment Doesn’t Phase Investors

The ruling was announced yesterday , and the drugmaker was found to have “compromised the health and safety of thousands of Oklahomans.” Johnson & Johnson was ordered to pay $572 million.

With the company losing the case, one would expect that their shares would plunge. On the contrary, JNJ stock surged in after-hours trading and leads the Dow Jones Industrial Average on Tuesday with an index-best gain of 2.22%.

Many investors believe that JNJ shares shot up because the multi-million dollar fine did not come close to the $17.5 billion payment requested by state prosecutors . According to CNBC reporter Meg Tirrell , Wall Street expected a fine between $1 billion and $2 billion.

Nevertheless, technical analysts only need to study JNJ’s chart to understand why the share price would eventually have surged – no matter the outcome.

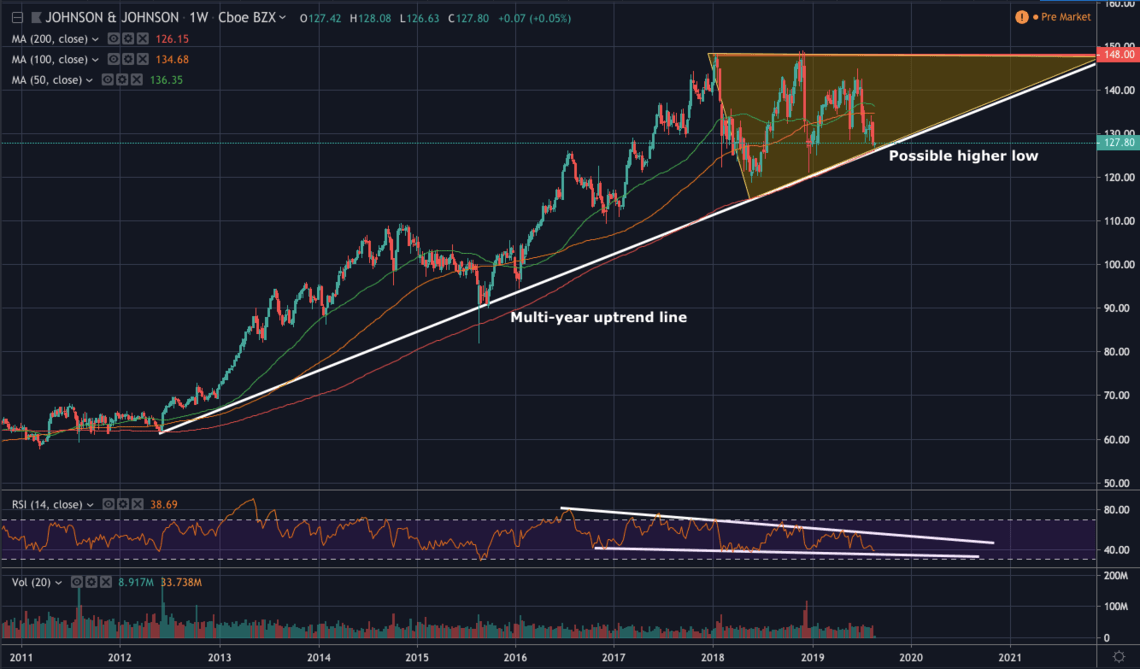

A quick look at the weekly chart reveals multiple bullish signals:

JNJ shares were in the green yesterday, as the stock bounced off the multi-year uptrend line. This diagonal support has been in existence since June 2012.

With bulls defending the long-term trendline, JNJ appears to be painting an ascending triangle pattern. This is a continuation pattern indicating that the uptrend is likely to resume once bulls take out resistance of $148.

The weekly RSI supports our stance. It is trading within a falling wedge and it appears due for a bounce. The expected resurgence of momentum can push the stock close to resistance of $148.

The owner of Wyckoff Stock Market Institute , Todd Butterfield , shared his view on JNJ with CCN.com:

“Johnson & Johnson has been trading in a wide trading range for the last 20 months between $116-141. Its Technometer is oversold with a reading of 36, and it has sprung a short-term support area as shown in the dashed line. This would be a natural spot for demand to come in and take the stock back to its resistance at $141, and possibly jump the resistance and take the stock to new all-time highs.”

JNJ may pay millions in fines, but its valuation is likely to soar in the future.

If you’re a long-term stock investor, this is one name that should be part of your watchlist.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.