Forget FANG Stocks, This Hidden Gem Points to Spectacular 200% Upside

The big tech stocks are insanely overvalued and there are better bets on small caps to be had. | Source: Shutterstock

By CCN.com: The salad days of the FANG stocks are over. The stock market is insanely overvalued, and those that led the charge will die on the hill.

All of the FANG stocks in the stock market, with the possible exception of Alphabet aka Google stock, are overvalued. At some point, something unexpected always lurches out of the darkness to take valuations down.

This time, it’s the DOJ antitrust probe, although that comes on top of privacy and censorship concerns.

There’s good news is that as the stock market dumps the FANG stocks, investors will look for stocks that can provide outsized returns.

That will take them to CURO Group Holdings (NASDAQ:CURO) .

The perfect peter lynch stock

CURO stock is the perfect Peter Lynch stock. It is small, barely covered, and operates in a sector that some find distasteful.

https://www.youtube.com/watch?v=jyuRx83wa4c

That sector is short-term consumer finance. These used to be known as “payday lenders”, but companies like CURO mostly moved away from those loans some time ago.

CURO stock’s US brand, known as Speedy Cash, has now expanded into an international provider of credit across the subprime consumer demographic.

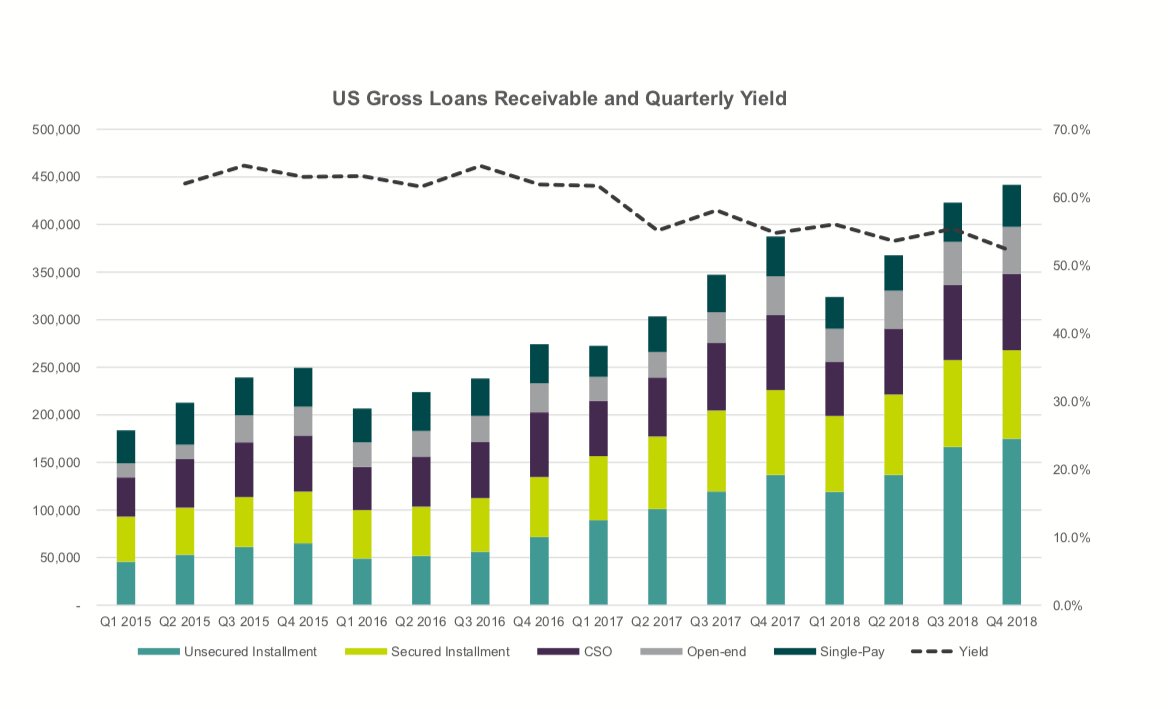

Consumer loan sizes run between $300 and $1,400, including everything from secured and unsecured installment loans, open-end lines of credit, and some single-pay products.

The yields on these loans are incredibly high. Even with defaults, net margins are rising and will pass 10% next year.

2018’s year-over-year loan growth jumped 32 percent.

Where else do you see that kind of volume growth? Not in most stocks.

CURO topped a billion dollars in revenue in 2018, and CURO stock generated a $250 million dollars in cash flow.

Curo stock has atleast 200% upside, possibly more

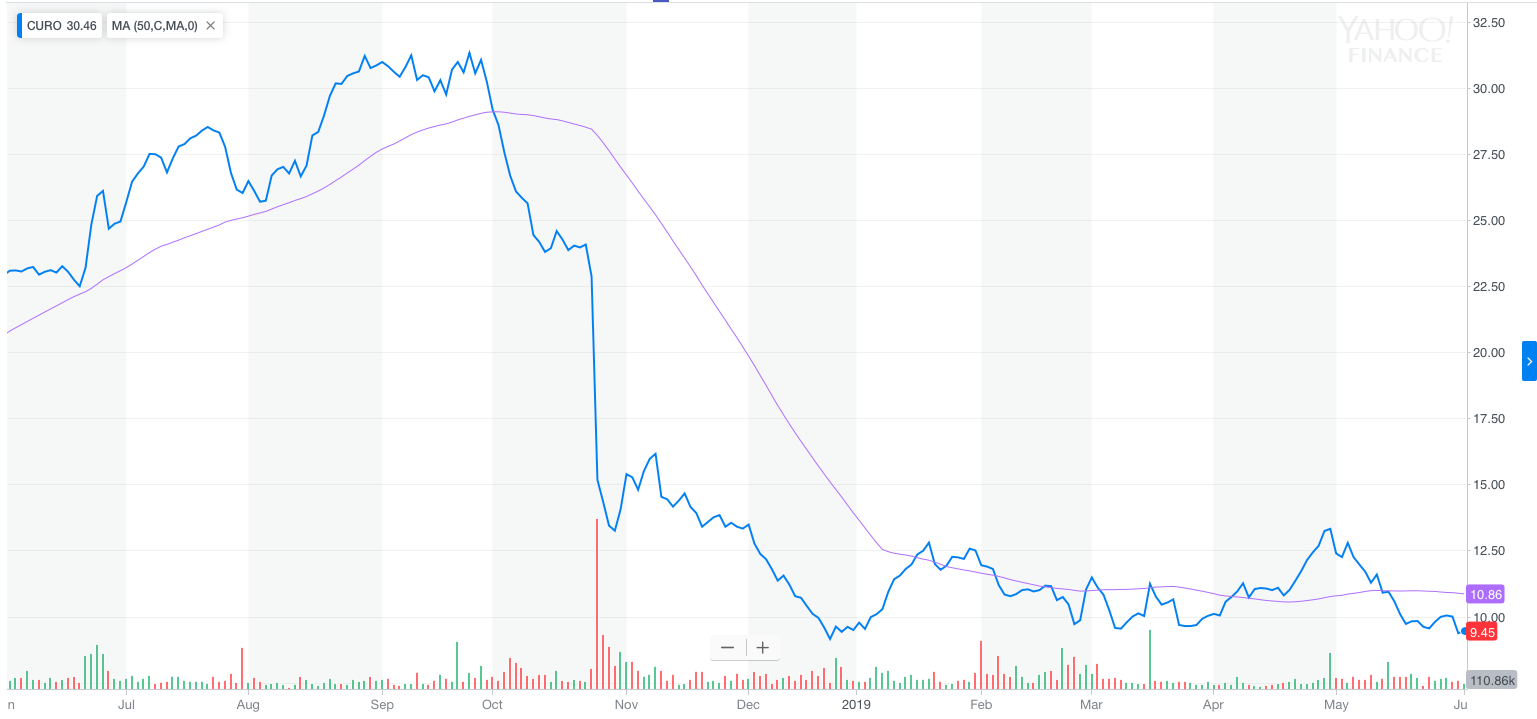

CURO stock can more than triple from its current $9.35 price. In fact, it’s already traded in the low $30’s.

Why? Net income is poised to grow 21 percent annually for the next five years , yet CURO trades at only 4x forward earnings.

Stock prices follow earnings growth. The stock market is only pricing in 4 percent earnings growth for next year when CURO stock is poised to grow 20 percent.

That means CURO stock should be trading at a P/E ratio of 20, not 4. That means CURO stock should be trading at five times present value, or $45 per share.

Why is curo stock so cheap?

Why is CURO stock trading at such a discount? There are two reasons.

First, the market has been swooning over the FANG stocks and other growth stocks. Small caps get left by the wayside because they require patience before delivering multi-baggers, and investors have short attention spans.

Second, the market misread how the CFPB might regulate this sector. Once Mick Mulvaney took over the CFPB, he gutted the agency’s rules on short term loans.

What might have once been a threat to the payday loan business of CURO is now no more . Additionally, CURO pro-actively moved into loans that are not covered by the rules.

CURO made $90 million last year and has a $450 million market cap. That implies 5 percent growth.

Yet CURO stock management has guided to $2.50 per share in earnings this year – up 20 percent — which would put CURO stock at less than 4x earnings.

CURO stock is a triple waiting to happen. Dump the FANG stocks.