US Stock Market Looks Terrifyingly Weak If You Remove These 6 Super Stocks

Six massive tech stocks are six-handedly glossing the US stock market. | Source: Shutterstock; Edited by CCN.com

By CCN.com: After a decade-long bull market and 2019’s record-breaking start to the year, global stocks are close to all-time highs.

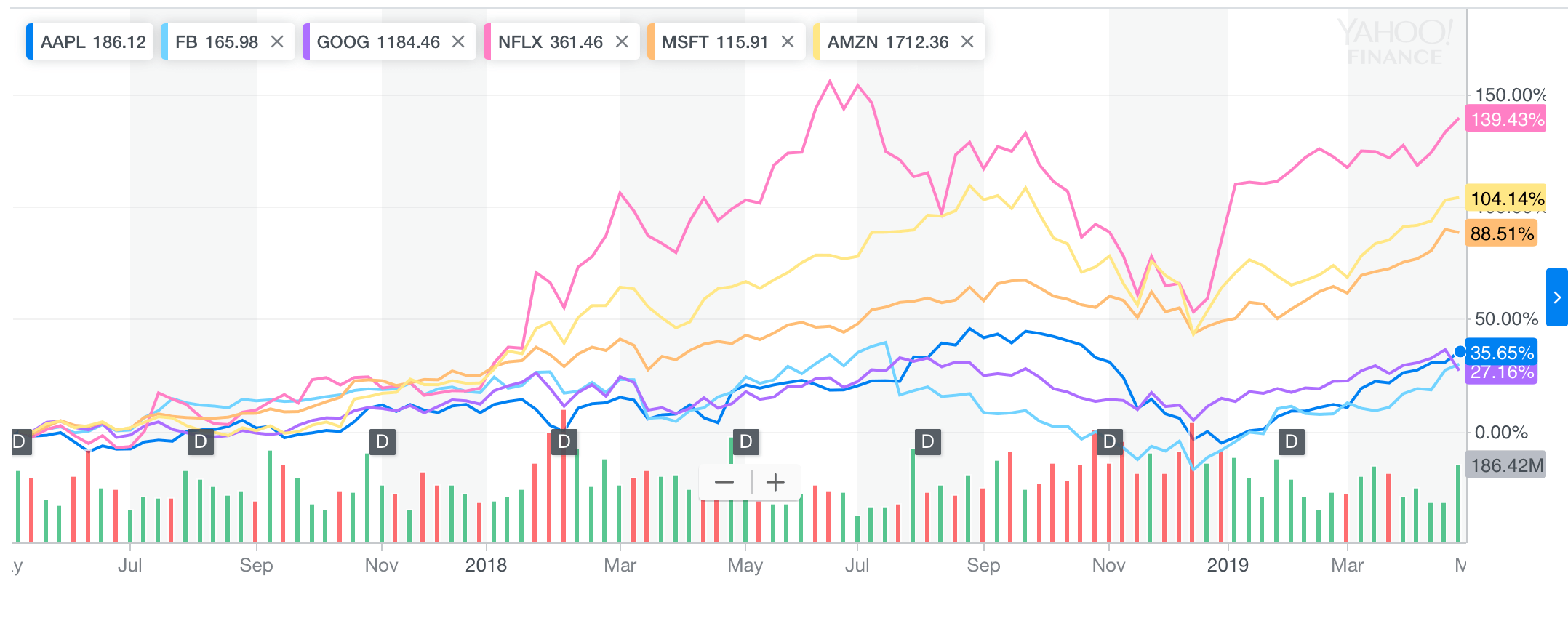

But if you look beneath the surface, there’s a scary trend lurking. The entire surge relies on just six stocks: Facebook, Amazon, Apple, Netflix, Google, and Microsoft. Remove these tech stocks and the global stock market looks very different: it’s flat.

Stock Market’s Scary Reliance on Tech Stocks

The worrying data was spotted by Bianco Research and refers to the FAANG group of stocks (plus Microsoft).

Disruptive tech stocks have hit headlines in the last 12 months with Apple, Amazon, and Microsoft all hitting $1 trillion valuations at some point. Facebook continues to beat expectations despite a flood of privacy scandals. And Netflix has doubled its market capitalization in a little under 18 months.

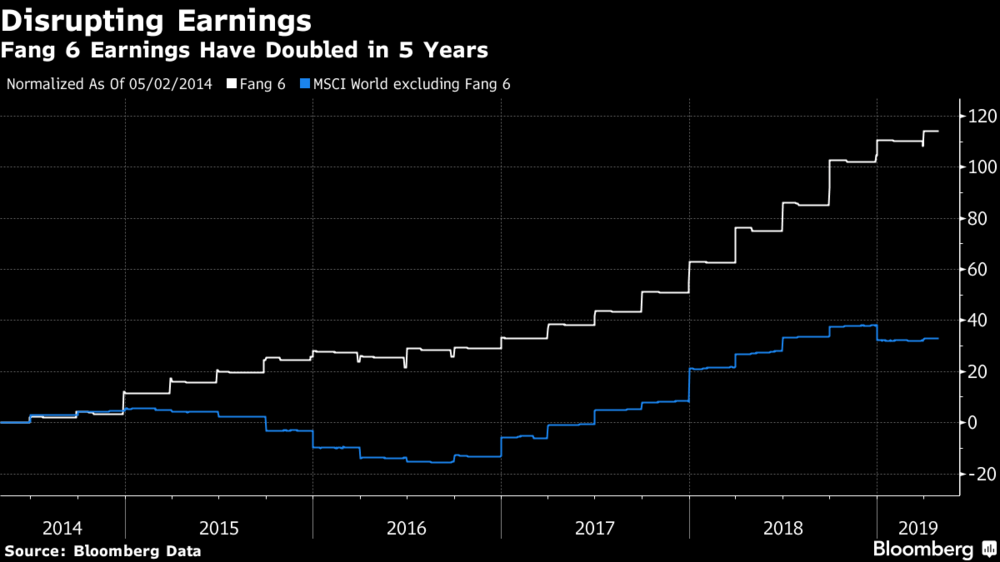

Earnings for this small group of stocks has doubled in the last five years, but the wider economy has stalled.

Every Other Sector Is “Unimpressive”

As Bloomberg pointed out , the growth in tech stocks is masking a weak global economy:

“Earnings for companies outside the Fang 6 have been thoroughly unimpressive.”

It’s also a dangerous concentration of wealth in a handful of small players. Bianco Research admits that stock market growth is often powered by a small number of blue-chip stocks. But the dominance of one industry is unprecedented:

“It is not that unusual for stock market returns to be concentrated in a few large stocks. However, in the past, these large stocks would come from vastly different industries and be fairly unrelated to each other, only sharing size as a common theme.”

Non-Tech Stocks: Worse Than Treasury Bills

Take the FANG 6 out of there equation and stocks in the United States are performing worse than Treasury Bills – a relatively low-yield investment vehicle.

“When these disruptor stocks’ returns are removed from the equation, the last sixteen months have seen rest of the non-FAANMG U.S. stock market underperform Treasury Bills. Globally, the non-disruptor MSCI World Index is still at a loss.”

The analysis helps explain why the International Monetary Fund (IMF) continues to slash global forecasts , despite the record stock market performance. In its latest downgrade, the IMF cited a “depressed outlook for corporate profitability.”

Such pessimistic forecasts seem at odds when you look at the stock market’s incredible growth. But when you exclude tech stocks, the analysis makes more sense.

Collapse in Tech Stocks Will Be an Earthquake for Global Markets

The entire global stock market is propped up by just six stocks. That’s a scary place to be if growth stalls for Facebook, Apple, and co.

Google may have issued the first warning sign last month when it reported slowing growth in its first quarter. Netflix also revealed weaker-than-expected guidance for the coming year. Is the tech boom coming to an end? If it is, rest assured, the rest of the market will come down with it.