Bitcoin As An Inflation Hedge – Truth Behind Theory That Fuels Growing BTC Following

The Truth Behind The Bitcoin Inflation Hedge Theory | Credit: Shutterstock

Key Takeaways

- Bitcoin, dubbed “digital gold”, offers a decentralized, fixed-supply hedge against inflation.

- Amid 2020’s inflationary concerns, Bitcoin’s resilience is evident in its 2023 recovery.

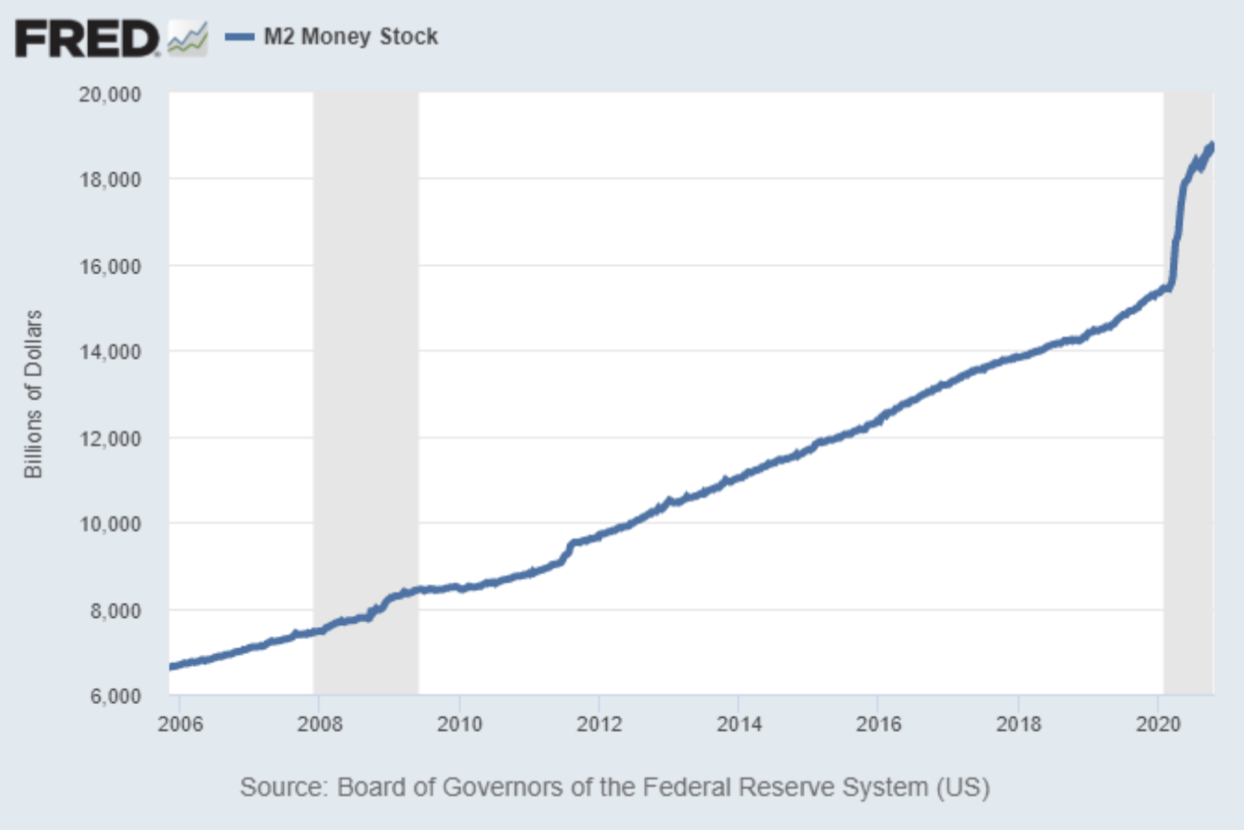

- 2020’s economic response, unlike 2008’s, directly increased broad money supply, causing swift inflation.

- Bitcoin’s inflation-hedge role is growing, yet remains unpredictable compared to traditional assets.

Bitcoin, often likened to digital gold by crypto enthusiasts, is a non-sovereign asset that holds promise as an inflation hedge versus fiat currencies, such as the United States dollar.

With a Bitcoin limited supply of 21 million and its decentralized protocol, Bitcoin positions itself as a hedge against war and inflation, making it an attractive proposition for investors worldwide. The ability to swiftly transfer vast sums of money globally further cements Bitcoin’s relevance as a revolutionary financial instrument.

Is Bitcoin’s Really A Hedge Against Inflation?

The global economic landscape has been rife with inflationary concerns since the pandemic in 2020, especially with central banks printing money at unprecedented rates over the last three years.

Amidst this backdrop, Bitcoin emerges as a potential hedge, with its fixed supply acting as a counter to inflationary pressures. However, it’s essential to note that while Bitcoin offers itself as an inflation hedge, it’s not immune to market dynamics.

In 2022, Bitcoin endured a tough and brutal bear market that saw its price valuation fall roughly 76% from its high of $69K to $16.5K . However, in 2023, it has recovered by 100%+ making it the best performing asset in the world to date.

On Bloomberg’s “Merryn Talks Money” podcast, when asked to select the best asset class to hold over a decade, Wood unhesitatingly chose Bitcoin. She described Bitcoin as a safeguard against both inflation and deflation, citing its lack of counterparty risk and minimal institutional involvement, dubbing it “digital gold.” As a vocal proponent of cryptocurrency, Wood envisions Bitcoin reaping the rewards of the broader surge in technological advancements. She has even forecasted Bitcoin’s value to soar past $1 million within the next ten years, a bold prediction considering its current valuation of $35,000, which is about half of what it was at its peak in 2021.

Money Printing: In Response To Recession Of 2008 Versus The Pandemic Of 2020

In 2008, the financial crisis primarily centered on over-leveraged banks, necessitating a recapitalization through quantitative easing (QE). The Federal Reserve’s creation of new bank reserves to purchase assets like Treasuries didn’t significantly impact the broad money supply or consumer prices, leading to contained inflation despite predictions of hyperinflation.

Contrastingly, 2020 faced a broader economic crisis due to the pandemic. While banks were well-capitalized, the wider economy suffered. The response combined QE with massive fiscal stimulus, where the Federal Reserve’s purchase of Treasuries funded direct financial aid to the public, such as stimulus checks.

This approach directly increased the broad money supply, illustrated above, resulting in a swift rebound in inflation and asset prices. The future inflationary trajectory now hinges on continued large-scale fiscal interventions.

What Is Transitory Inflation?

Transitory inflation refers to a temporary rise in prices that is expected to subside or revert to its previous state after a certain period. It’s often caused by short-term disruptions or one-off factors that affect supply or demand, such as supply chain interruptions, natural disasters, or sudden spikes in demand for specific goods.

Central banks often look past transitory inflation when setting monetary policy, believing that its effects will fade without requiring intervention. However, distinguishing between transitory and more persistent inflation in real-time can be challenging but is highly important for any investor or trader to understand correctly when preserving individual wealth.

Bitcoin’s Inflation-Hedge Theory

Bitcoin’s potential as a hedge against transitory inflation stems from its decentralized nature, fixed supply, and growing acceptance as a store of value.

When compared to other markets such as equities, treasuries, precious metals and indices, Bitcoin has been proving its resilience in this tricky economic environment for over a decade and a half, by continuing to appreciate in value at a faster pace compared to other assets illustrated below.

2020-2023: Inflation Economic Landscape

The current economic environment suggests that inflation might not be as transitory as previously thought. The U.S. is now grappling with unparalleled debt levels, massive fiscal and monetary stimuli, and a shift away from globalization.

As a result, the economic environment favors Bitcoin ownership and starts to make a lot more sense to investors, traders, business owners and countries who wish to find a “flight to quality” , as described by Larry Fink, Chairman and CEO of Blackrock on Fox Business in 2023.

Conclusion

Bitcoin’s value is influenced by external factors such as interest rates, economic policies, and global events, making its performance as an inflation hedge somewhat unpredictable compared to gold.

Other assets like real estate, stocks, and commodities have historically served as inflation hedges. With the surge in Bitcoin’s popularity continuously growing, Bitcoin can be attributed not only to its potential as a hedge but also to investor sentiment and herd behavior, as individuals seek alternatives in uncertain economic times.

As for the future, expert opinions vary, but many believe that Bitcoin, given its growing acceptance and integration into the financial system, will continue to play a significant role in hedging against inflation, alongside traditional assets.

Disclaimer

This article is for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a financial advisor before making any investment decisions.

FAQs

What makes Bitcoin a potential inflation hedge?

Bitcoin, often likened to “digital gold”, has a fixed supply of 21 million and operates on a decentralized protocol. This makes it a promising hedge against inflation, especially when compared to fiat currencies like the U.S. Dollar.

How has Bitcoin responded to inflationary concerns between 2020 and 2023?

Amid rising inflationary concerns since 2020, Bitcoin has emerged as a potential counter due to its fixed supply. Despite market dynamics causing fluctuations, Bitcoin’s recovery in 2023 showcases its resilience as an asset.

What is the difference between the 2008 and 2020 economic responses in terms of inflation?

In 2008, quantitative easing primarily addressed over-leveraged banks, leading to contained inflation. In contrast, 2020’s response to the pandemic combined QE with direct fiscal stimulus, resulting in a direct increase in the broad money supply and a swift rebound in inflation.

How does Bitcoin’s role as an inflation hedge compare to other assets?

While Bitcoin offers potential as an inflation hedge due to its decentralized nature and fixed supply, its performance can be unpredictable compared to traditional assets like gold. However, its growing acceptance suggests a significant future role in hedging against inflation alongside other assets such as real estate, commodities and equities.