Dow Futures Pop Higher as Trump Gifts China Stay of Execution

US President Donald Trump is going soft on China, for now. | Source: AP Photo/Alex Brandon, File

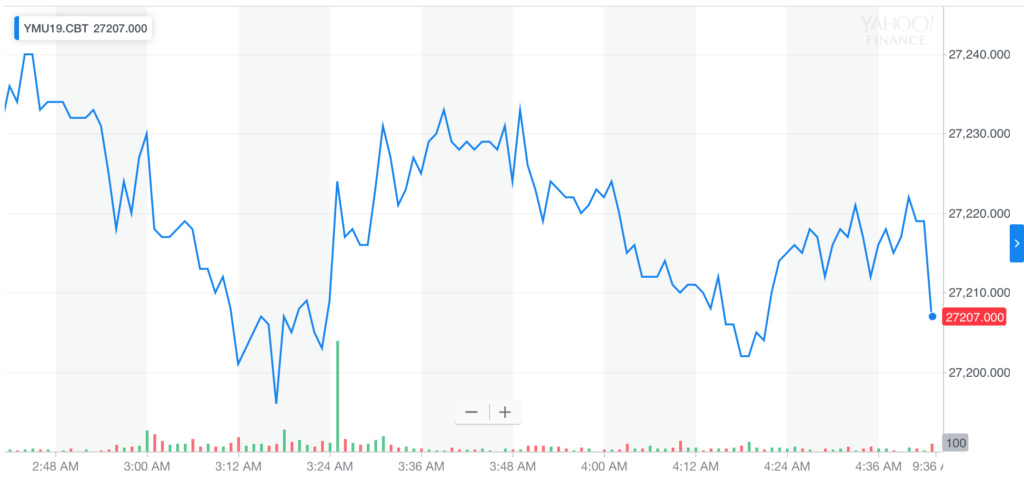

Dow Jones Industrial Average (DJIA) futures popped 75 points higher in early trading Thursday. Stock market optimism returned as President Trump gifted China a two-week stay of execution on looming trade war tariffs.

In a tweet last night, Trump said he would delay the 5% tariff increase on $250 billion worth of Chinese goods from October 1st to October 15th. The “gesture of goodwill” came at the request of Chinese Vice Premier Liu He and in respect for the 70th Anniversary of the People’s Republic of China.

Dow jumps 49 points on trade war easing

Dow Jones Industrial Average (DJIA) futures crept higher on Thursday morning, extending the stock market’s winning streak. At 7.16 am, Dow futures were 49 points up at 27,209.

S&P 500 futures were 0.12% higher while the tech-heavy Nasdaq Composite futures climbed 0.36%.

Trade war thawing?

The Global Times – China’s English language newspaper under the People’s Daily – said the move signaled a “trade war thaw” that could pave the way for more productive negotiation.

“There are more signs of a trade war thaw between Beijing and Washington. Following China’s exemption of punitive tariffs on 16 items of US goods Wednesday, Trump reciprocated delaying imposing 5% additional tariffs to Oct. 15, paving way for resumption of high-level trade talks.”

Global Times editor Hu Xijin echoed the sentiment, saying he welcomed the gesture from Trump.

“It should be seen as a goodwill gesture the US side made for creating good vibes for the trade talks scheduled in early October.”

Dow jitters could still persist

Unfortunately, not everyone is convinced. Speaking to CNBC , James McCormack of Fitch said it was little more than an empty gesture and that deeper sticking points remain unsolved.

“I wouldn’t want to read too much into a small concession suggesting that we’re on the road to this being resolved.”

Elsewhere, all eyes are on the European Central Bank (ECB) which is expected to loosen monetary policy even further in the eurozone. Already deep in negative interest rate territory, the ECB faces its biggest challenge yet as Germany teeters on the brink of recession.