Dow Futures, Bitcoin Slide as US & China Conclude ‘Deep and Meticulous’ Trade Talks

Both the cryptocurrency and US stock markets slipped into the red on Thursday, with the bitcoin price and Dow Jones Industrial Average futures taking losses ahead of the opening bell despite a bevy of positive news for equities traders.

As of am 8:12 am ET, Dow futures implied opening bell losses of 70 points or 0.29 percent, while S&P futures were down 0.42 percent and Nasdaq futures were flashing losses of 0.5 percent.

At one point on Wednesday, a buoyant Dow looked like it would smash through 24,000, but the rally stalled at 23,985 and the index ultimately closed at 23,879.12 for a gain of 91.67 points. The S&P 500 gained 0.4 percent to close at 2,584.96, and the Nasdaq rose 0.87 percent to 6,957.08.

US & China to Keep in ‘Close Contact’ on Trade Deal

This morning’s pullback, which could end the Dow’s winning streak — its longest since November — came despite more indications that the United States and China made significant progress toward forming a trade agreement that will end the trade war between the two economic heavyweights.

On Thursday morning, China’s Commerce Ministry released a short statement that referred to the recently-concluded round of talks as “broad, deep and meticulous” discussions that laid the “foundation for addressing areas of common concern.”

Here’s the full statement (translation by CNBC):

From Jan. 7 to 9, China and the U.S. held discussions in Beijing at a vice-ministerial level over the issue of trade. Both sides enthusiastically implemented the important agreement of the heads of both countries, and held broad, deep and meticulous discussions on shared observations on trade issues and structural problems, laying the foundation for addressing areas of common concern. Both sides agreed to continue to keep in close contact.

The official US statement was somewhat less magnanimous, but it nevertheless highlighted “ China’s pledge to purchase a substantial amount of agricultural, energy, manufactured goods, and other products and services from the United States.”

It increasingly appears that the two sides will strike a deal before the tariff truce expires on March 1, but perhaps the markets are leery of pricing that in too quickly.

Government Shutdown: Trump Storms out on Pelosi and Schumer

There was positive news on the domestic front, too, as the Federal Reserve published minutes from its December meeting that affirmed the independently-run central bank could “afford to be patient about further policy firming” and that several Fed officials believe the bank will adopt “ a relatively limited about” of interest rate hikes in the near future.

Fed Chair Powell had previously stated that the bank would be cautious on tightening its balance sheet, a comment that helped the Dow assemble a massive rally earlier in the year, and the Fed’s meeting minutes initially buttressed the markets heading into Wednesday’s close.

However, the lingering US government shutdown — now entering its 20th day — may have muddied investor optimism.

US President Donald Trump stormed out of a meeting with Democratic congressional leadership, tweeting later that the discussion with House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer was a “total waste of time.”

As a result, prospects for an agreement that would end the partial government shutdown — or at least fund individual departments — look grim. Trump wants his wall, and the Democrats refuse to give it to him.

Bitcoin Price Fails to Defend $4,000

Though perhaps not directly connected, the cryptocurrency market took losses too, as the bitcoin price proved unable to defend the psychologically-significant $4,000 barrier.

Bitcoin’s recent move above $4,000 had been welcomed by cryptocurrency investors, but analysts said that the flagship cryptocurrency would need to break higher toward $4,500 to confirm that the market was turning bullish. Failing that, they said, bitcoin could see further losses ahead.

The bitcoin price had spent most of the past several days bouncing around the $4,000 mark on Coinbase and other BTC/USD exchanges, and almost no one was surprised when it finally broke to the south. Bitcoin has now erased its 2019 gains and is currently down 1.17 percent since Jan. 1.

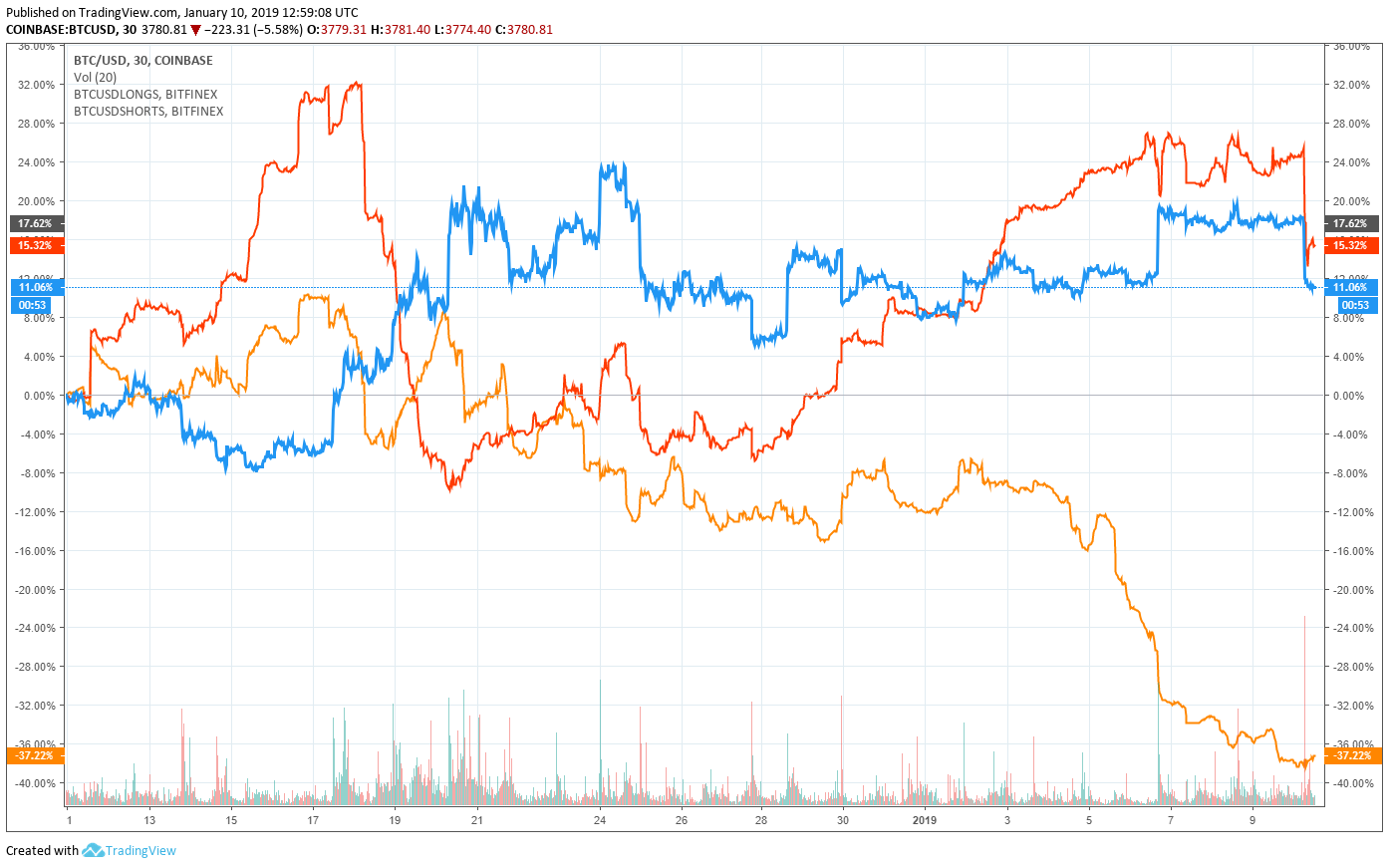

Of course, it’s not all bad news for bitcoin. As first noted by eToro Senior Market Analyst Mati Greenspan, the number of BTCUSD shorts on cryptocurrency exchange Bitfinex has declined considerably since mid-December, particularly since Jan. 5. Longs, along with the bitcoin price, have increased, perhaps suggesting a real shift in trader sentiment.

That said, today’s pullback was accompanied by a noticeable reversal in this trend, with shorts ticking up and longs experiencing a sharp drop.

Featured Image from Shutterstock. Price Charts from TradingView .