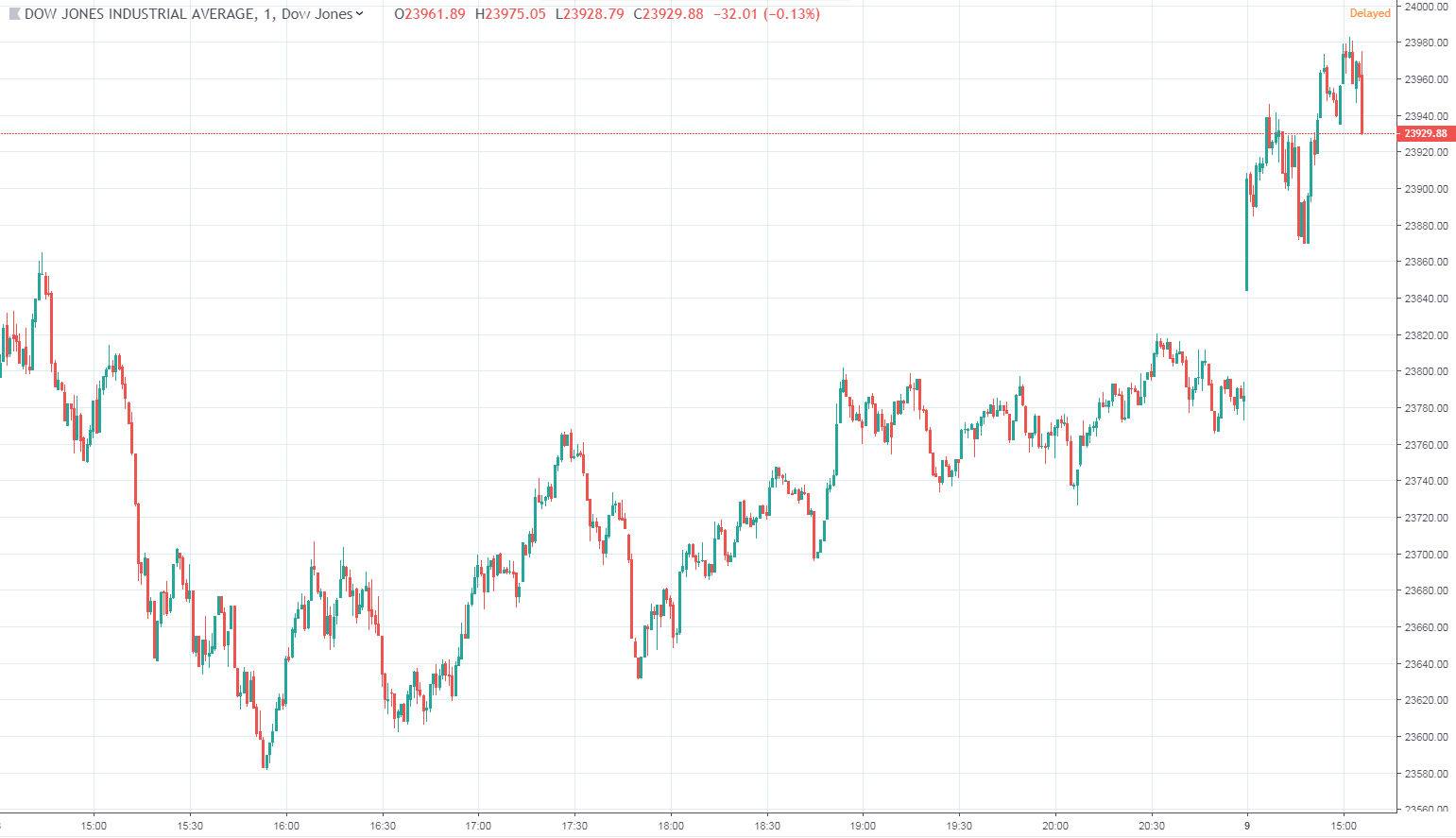

Dow Rally Plows Ahead as China Trade Optimism Grows

Stock indices including the Dow traded higher after Wednesday’s open and were on track for their fourth consecutive daily advance, as sentiment around U.S.-China trade negotiations improved following the conclusion of mid-level talks in Beijing.

Recovery Continues

All of Wall Street’s major indexes were holding onto firm gains as of mid-morning, with the Dow Jones Industrial Average rising 45.56 points, or 0.19%, to 23,833.01. Visa Inc. (V), Boeing Co (BA) and Chevron Corp (CVX) emerged as the early leaders, each rising at least 1.6%.

The broad S&P 500 Index rose 0.06% to 2,576.01. The technology-heavy Nasdaq Composite Index advanced 0.29% to 6,916.85.

Since entering bear-market territory last month, the S&P 500 and Nasdaq have recovered 10% and 11%, respectively. All indexes bottomed on Christmas Eve before staging a large recovery on Boxing Day. The relief rally has extended into the new year thanks to a combination of trade optimism and stronger than expected data.

Stocks rose more than 1% on Tuesday ahead of President Trump’s first prime-time address to the nation. The president made one of his strongest cases yet for increased border protection between the United States and Mexico but held off on declaring a national emergency that may have given him the latitude to move forward with an extension of the southern barrier. More on this story: President Trump Makes His Case for a Border Wall as Economy Hangs in the Balance.

Trade Optimism Builds

The first round of trade negotiations between the United States and China concluded on a positive note Wednesday, setting the stage for continued dialogue after a “good few days ,” according to a U.S. official who attended the meetings.

Ted McKinney, the U.S. Undersecretary of Agriculture for Trade and Foreign Agricultural Affairs, said the meetings “went just fine” without elaborating. The negotiations went a day longer than planned, which means both sides are treating the matter seriously. According to CNBC , both sides made progress on key issues related to the purchase of U.S. farm and energy commodities and increased access to China’s domestic market.

The negotiations were the first face-to-face meetings since President Trump and Chinese counterpart Xi Jinping agreed in early December to put their trade war on hold for 90 days. The 90-day window expires in March.

Featured image courtesy of Shutterstock. Chart via TradingView.