Crypto Bull: Like Amazon Stock, Bitcoin Is a ‘Screaming Buy’

Bitcoin bull Tuur Demeester claims we're in the throes of a bitcoin bull market and that the bitcoin price will explode the same way Amazon stock did. | Source: Shutterstock

Bitcoin investor Tuur Demeester says despite the recent dip in crypto prices, we’re not in a bear market. Rather, he insists this is a “post ICO-bubble bitcoin bull market.”

The ICO bubble occurred during the 2017 crypto bull market, when the bitcoin price approached $20,000. BTC has since struggled to replicate those highs.

Trader: We’re in a bitcoin bull market

Demeester suggested on Twitter that bitcoin will eventually rocket the same way Amazon stock did. Accordingly, he considers bitcoin “a screaming buy,” notwithstanding its recent dip.

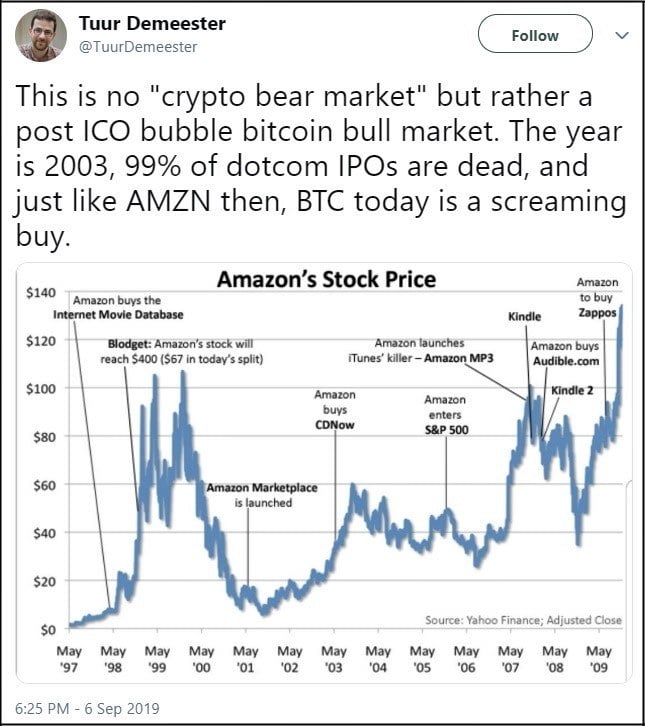

Demeester posted a chart showing Amazon stock’s erratic fluctuations from 1997 to 2009. In its volatility, AMZN during that time frame mirrored bitcoin’s current instability.

Presumably, Demeester is suggesting that like Amazon, bitcoin will weather a series of roller-coaster swings before exploding. Is he correct? Who knows?

That said, most in the crypto industry don’t think we’re in a bear market at the moment.

While bitcoin has plunged about 13% during the past four weeks, it’s still up dramatically since Jan. 1, when BTC hovered at $3,880.

Today, bitcoin is trading at roughly $10,400. That’s more than a 168% spike year-to-date. That’s hardly a bear market.

It’ll take years before bitcoin is considered another Amazon

Basically, Tuur Demeester claims that bitcoin right now is where Amazon was in 2003. “And just like AMZN, BTC today is a screaming buy,” he insists.

That’s a bold assertion by Demeester, the founder of Adamant Capital. Adamant calls itself a “bitcoin alpha fund” that promises to “outperform bitcoin in a tax-efficient manner.”

Nobody knows if bitcoin will mirror the incredible trajectory of Amazon, the most valuable company in the world. Keep in mind that Amazon stock struggled for years before it hit the Big Time.

When Amazon first went public in 1997, its stock was priced at $18 per share.

Between 1998 and 2008, Amazon stock traded between $15 a share and $96. It wasn’t until 2017 (two years ago) that Amazon broke above $1,000. Since then, Amazon has been crushing it. But it took more than 20 years to get there.

Crypto myopia is a fatal flaw

Similarly, bitcoin could very well surge to $250,000 within four years, as perma-bull Tim Draper predicts. However, that’s not a given. And most financial experts would probably advise against making such exuberant bets.

A major problem in the crypto industry is the shortsightedness of its participants. While many breathlessly insist that bitcoin is a store of value, they also whine every time its price drops.

This clown show spotlights the immature approach many take toward crypto. If you own a house, you don’t check its market value on an hourly basis. But bitcoiners do that.

Similarly, people who invest in a stock don’t obsess over its daily price fluctuations. The only people who do that are day-traders, who have short-term mindsets. Bitcoin fans claim it’s a revolution that will usher in the future. But you can’t say that while also crying over its hourly price changes. Can you?