50% Stock Surge Will Launch Amazon to a $1.3 Trillion Valuation: Analyst

Amazon stock will surge 50% over the next year and will top $2,750 a share, according to a senior analyst with equity-research firm Pivotal Research Group. | Source: AP Photo/J. Scott Applewhite

Billionaire Jeff Bezos should buckle up because Amazon stock will surge 50% over the next year to top $2,750 a share. That’s the bold prediction of Michael Levine, a senior analyst with New York equity-research firm Pivotal Research Group.

Analyst: Amazon’s Valuation Will Soar to $1.35 Trillion

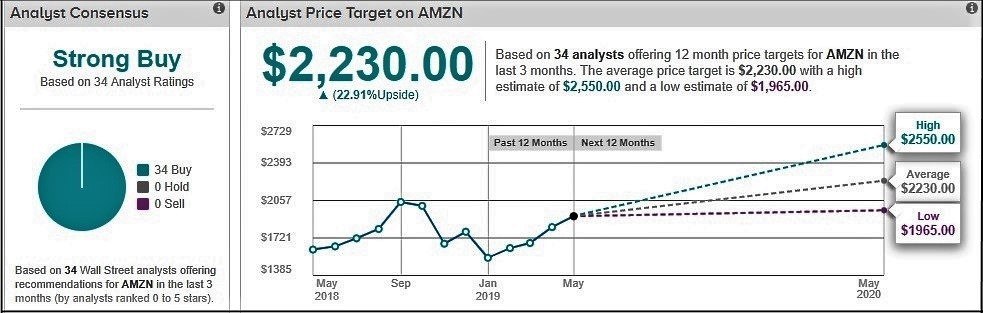

Levine’s bullish Amazon price target is well above the second-highest forecast of $2,500 by Cowen, according to Tip Ranks .

Using Levine’s projection, that means Amazon — which is currently valued at about $893 billion — could rocket to $1.35 trillion by 2020.

‘A Must-Own Name With Huge Upside Potential’

Amazon stock will soar because it has “the highest-quality management and franchise within global internet,” Levine wrote in an investor note . Accordingly, it is “a must-own name with huge upside even from here.”

Moreover, Levine says Amazon’s move toward one-day shipping is a major catalyst that’s propelling it to “owning the consumer’s wallet.” Levine says even in spite of Amazon stock’s recent slowdown, it’s still set to explode in the near term.

“Despite deceleration, AMZN remains the most open-ended story in large-cap tech,” Levine said.

Levine is also bullish about Amazon Web Services’ cloud business, which he claims “will surprise” investors with its meteoric growth.

Warren Buffett: Amazon Surpassed My Expectations

Michael Levine’s exuberant outlook echoes the unbridled optimism expressed by billionaire investor Warren Buffett. In early-May, Buffett revealed that he now owns Amazon stock and was “an idiot” for not investing in the e-commerce giant sooner.

As CCN.com reported, Buffett said he regretted underestimating Jeff Bezos and his relentless will to win.

“I’ve been an idiot for not buying [Amazon stock sooner],” Buffett said.

Jim Cramer: Jeff Bezos Is Relentless

In 2018, Buffett gushed that Amazon had exceeded his wildest expectations, and said he regretted dismissing it for so long.

“It’s far surpassed anything I would have dreamt could have been done. I had no idea that it had the potential,” Buffett said. “I blew it!”

If Amazon stock is soaring and its dominance continues to mushroom, it’s because its relentlessly ambitious CEO, Jeff Bezos, takes a ruthless approach to annihilate his competitors.

In April 2019, Amazon’s Whole Foods subsidiary launched a scorched-earth price war to decimate rival Walmart, which has a successful grocery-shopping business.

To this end, Amazon slashed prices on 500 grocery items at Whole Foods to chip away at Walmart’s market share. That was the third round of price cuts the specialty grocer instituted since being acquired by Amazon in 2017.

CNBC commentator Jim Cramer, who owns Amazon stock, says Jeff Bezos will stop at nothing to nuke his foes.

“They hate, hate, hate Walmart! Walmart is the biggest grocery chain in the country,” Cramer crowed. “Amazon will stop at nothing to take away the [market] share that Walmart has gained.”