Bitcoin Surge Proves It’s a Haven from Stock Market Turmoil: Circle CEO

The bitcoin price is surging because investors are embracing it as a "safe haven" amid the US-China trade war, says Circle CEO Jeremy Allaire. | Source: REUTERS/Kai Pfaffenbach (i), Shutterstock (ii). Image Edited by CCN.com.

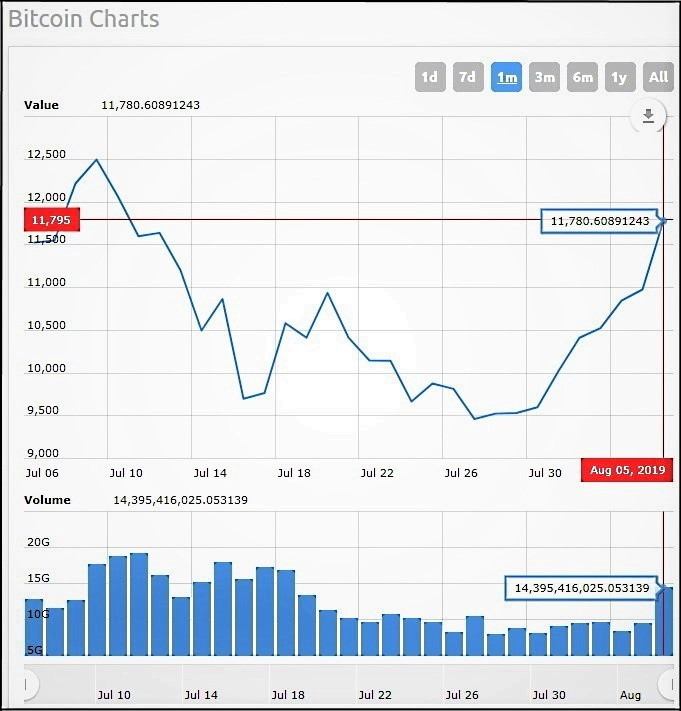

The bitcoin price is surging because investors are increasingly flocking to it as a “safe haven” amid the escalating US-China trade war. That’s what Circle CEO Jeremy Allaire told CNBC, when he praised bitcoin as a reliable store of value during stock market turmoil.

“Humanity has now created a non sovereign, highly secure mechanism to store value that can exist anywhere that the internet exists,” Allaire gushed. “It’s uncensorable, it’s unseizable.”

Allaire: Bitcoin gets more attractive as trade wars intensify

Like other crypto evangelists, Allaire claims bitcoin is becoming a “really attractive asset” during times of financial upheaval caused by rising geopolitical tensions.

Allaire’s comments echoed the observations of Binance Research, the research arm of crypto exchange Binance. As CCN.com reported, Binance Research claims that the latest bitcoin price rally is due to President Donald Trump’s trade war with China.

The trade conflict between China and the United States is heating up. Both economic superpowers refuse to back down from their threats of retaliatory tariffs.

Allaire: Expect more stock market upheaval

Jeremy Allaire attributes the overnight bitcoin price spike to panic caused by China devaluing its currency , the yuan. Allaire says rising nationalism, increasing currency conflicts, and mushrooming trade wars all support a non-sovereign, highly secure digital store of value.

When asked if the US stock market sell-off was partly fueled by Chinese investors flooding into bitcoin, Allaire says it’s possible. He explained that despite China’s crypto crackdowns, there’s a significant amount of crypto activity in China through offshore platforms.

Meanwhile, gold bugs beg to differ.

Dow Jones tanked after China devalued currency

This morning (August 5), China hit back at President Trump’s proposed tariffs by devaluing its currency to near-historic lows.

In a fiery tweet, Trump slammed China for “currency manipulation,” and warned that this ploy would weaken the Chinese economy over time.

China’s central bank, the People’s Bank of China, allowed the yuan to fall below the key 7 yuan-per-dollar level for the first time since 2008.

In a statement, the People’s Bank of China cited “protectionist trade measures and expectations of tariffs against China” as the reasons for its currency devaluation.

Reminder: Always maintain perspective, since the media tends to hype market turmoil for ratings and website clicks.

In percentage terms, today’s decline in the Dow (-2.90%) was the 390th largest 1-day decline. To break the top 20 you need a drop of over 7%. $DJIA pic.twitter.com/QwtbL7oYlG

— Charlie Bilello (@charliebilello) August 5, 2019

Allaire: China set to launch a global crypto

Circle CEO Jeremy Allaire says despite its anti-crypto rhetoric, China is leading the charge to launch a global digital currency as a way to cement its status as a financial superpower.

Allaire says China is “mobilizing to launch a global digital currency,” leveraging the distribution power it has with major Internet and tech enterprises.

Allaire says this move is partly a response to Facebook’s proposed launch of its Libra stablecoin, which shows that non-state actors can launch digital currencies that instantly have the global reach of the Internet.

However, Allaire says China’s foray into crypto is also part of its long-term strategy to “expand its footprint of how trading counter-parties, businesses, and consumers interact with China.”

In other words, China is working on all cylinders to supplant the United States as the world’s richest, strongest economy.

“China is way out ahead on this,” Allaire said. “I think the U.S. is falling behind.”

Jeremy Allaire: Bitcoin will win the ‘Crypto Hunger Games’

Allaire is a bitcoin perma-bull whose exuberant outlook has never wavered, even during the brutal 2018 crypto bear market.

In December 2018, Allaire boldly predicted that the bitcoin price would rocket over the next three years, and crypto valuations would spike accordingly.

When asked why people who lost money in the crypto downturn will return, Allaire said it’s because the fundamentals of bitcoin haven’t changed simply because its prices cratered last year.

Regardless of its daily price fluctuations, Allaire insists that bitcoin has a “very significant role” to play as a non-sovereign store of value. Moreover, he’s confident that bitcoin will survive over the long haul, and so will other cryptocurrencies.

Allaire said some cryptocurrencies would die off in an overcrowded market due to competitive forces, but it’s not a zero-sum game where the success of one digital currency means the death of all the others. But no matter what happens, Allaire insists that bitcoin will survive the crypto hunger games.

Click here for a real-time bitcoin price chart.