CEOs Quitting in Record Numbers Could Signal Total Stock Market Collapse

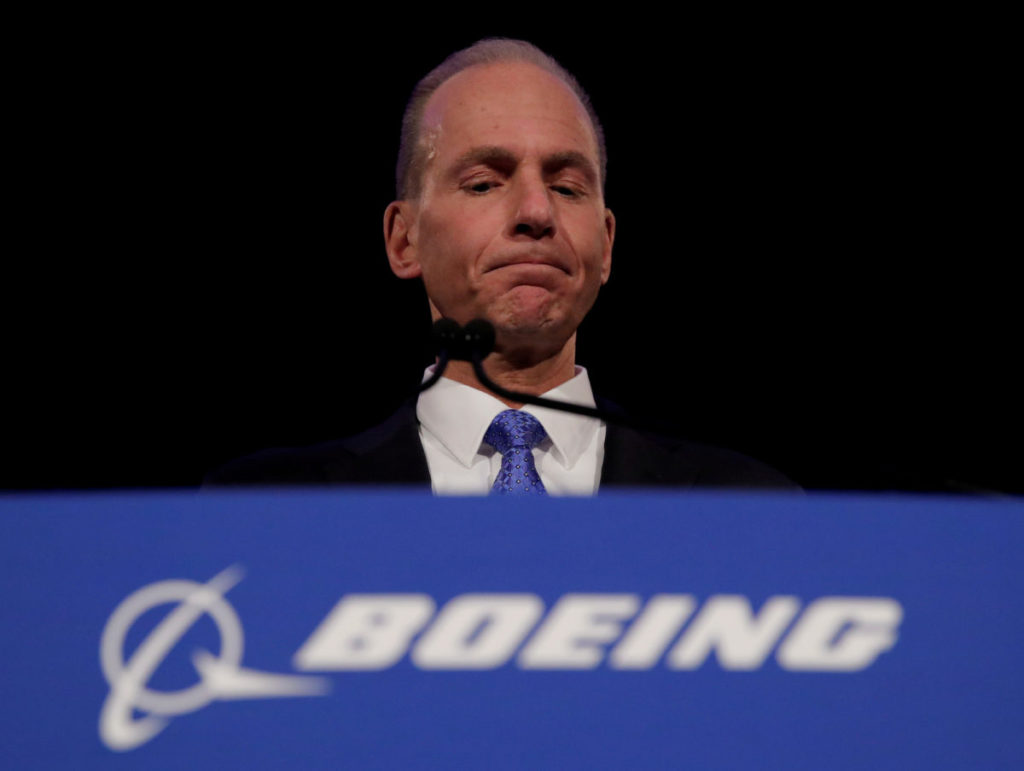

Boeing CEO Dennis Muilenburg was one of thousands of corporate executives to leave his post in 2019. | Image: Jim Young/Pool via REUTERS/File Photo

- CEOs are departing in droves.

- America’s corporate insiders, which include chief executives, dumped company shares at record levels.

- One Wall Street firm is projecting a stagnant year for U.S. companies.

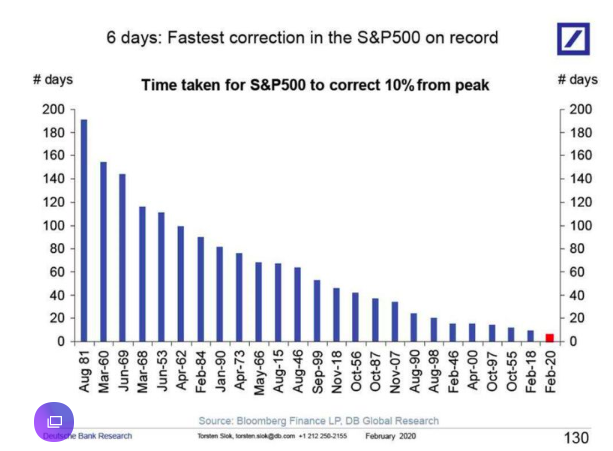

The stock market is in trouble. The Dow Jones Industrial Average printed its worst one-day point drop in history after plunging 1,191 points Thursday. The S&P 500 is also making history. Over the last six days, the index tumbled by 10% from the all-time high at a pace never seen before.

The stock market is cratering and corporate America’s chief executives have been a step ahead of the disaster. Many have been dumping shares prior to the correction. On top of that, top honchos of big U.S. companies are leaving their posts in record numbers. These signs indicate that the longest bull market in history may be over.

Corporate Captains Are Abandoning Ship

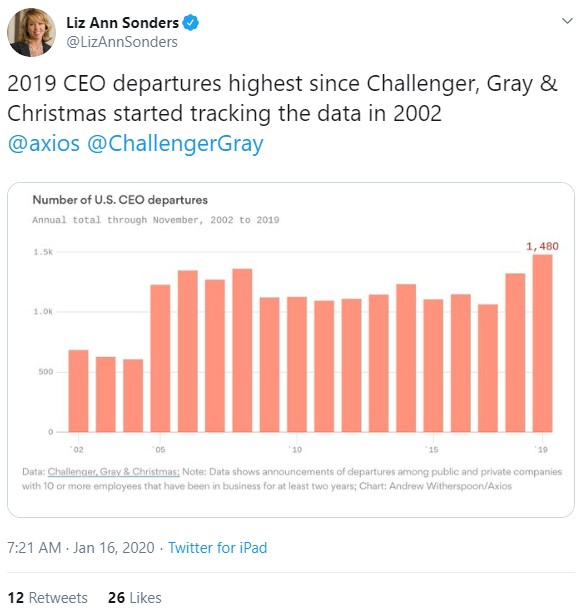

Chief executives of top companies in the U.S. are leaving their posts at a pace not seen in nearly two decades. Challenger, Gray, and Christmas reported that 1,480 CEOs departed in 2019. This caught the attention of some analysts as C-level executives don’t often step aside while both the economy and the stock market are booming.

The trend continued in January 2020 with 219 chief executives calling it quits. The number represents the highest CEO departures on a monthly basis since 2008 . Are they getting out while the getting is good?

When CEOs vacate their positions while the stock market is trading at record highs, it can be a sign that the business cycle has peaked. Massive insider selling of shares adds weight to this theory.

Financial Times reported that corporate insiders, such as chief executives and chief financial officers, sold an estimated $26 billion worth of shares in 2019 . This puts insider selling at the highest level since 2000 when corporate insiders sold $37 billion worth of stock in the midst of the dotcom bubble.

Jeff Bezos alone sold $4 billion worth of Amazon stock in a week. Meanwhile, Warren Buffett has been patiently sitting on a cash pile worth $130 billion. The writings on the wall suggest we may be witnessing the beginning of the end of the longest bull market in history.

Earnings Growth for U.S. Companies Will Be Flat This Year

To add fuel to the fire, one Wall Street firm estimates that 2020 will be a stagnant year for U.S. companies. Goldman Sachs revised its earnings estimates for 2020 to $165 per share from $174 per share. The change represents 0% growth for the year.

The multinational investment bank expects coronavirus to shock both supply and demand in China and the United States. In a note to clients, Goldman equity strategist David Kostin wrote,

We have updated our earnings model to incorporate the likelihood that the virus becomes widespread.

He added,

Our reduced profit forecasts reflect the severe decline in Chinese economic activity in 1Q, lower end-demand for US exporters, disruption to the supply chain for many US firms, a slowdown in US economic activity, and elevated business uncertainty.

Once again, it appears that many chief executives are a step ahead of a disaster. The captains of corporate America are fleeing like rats on a sinking ship while dumping shares in record numbers. The best days of the longest bull market in history may be over.

The above should not be considered trading advice from CCN.com. The opinions expressed in this article do not necessarily reflect the views of CCN.com.