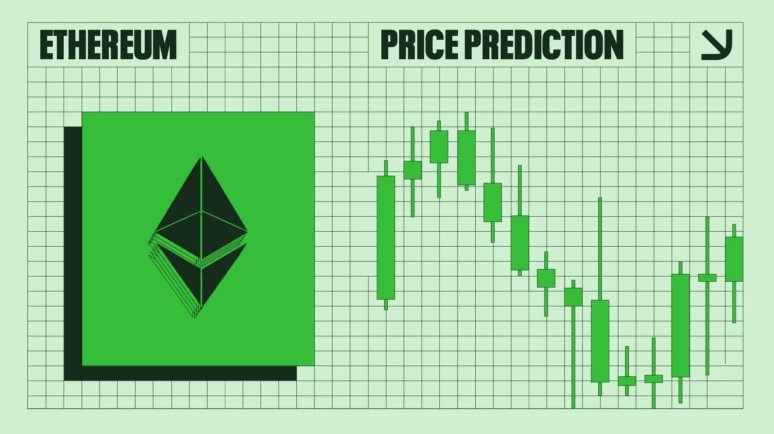

Ethereum RSI and MACD Readings Reflect Those Preceding 2020 Bull Run – Will ETH Price Repeat?

Can ETH Price Repeat 2020 Bull Run | Credit: Getty Images

Key Takeaways

- Ethereum’s long-term RSI and MACD give similar readings to June 2020.

- The ETH price has fallen 25% since reaching a yearly high in March 2024.

- Will the indicator signal catalyze an appreciation similar to that in 2020?

The MACD and RSI are momentum indicators used to determine an assets trend. In Ethereum’s case, the indicators gave a specific signal in the 2020 bull run, which is being repeated in April 2024.

Since history often repeats, traders are looking at this as a potential opportunity for significant gains if the ETH price undergoes a comparable appreciation.

How Do Ethereum’s Reading Compare to 2020 Bull Run?

In the previous market cycle, ETH reached its absolute bottom in December 2018. After creating a higher low in March 2020, it accelerated its rate of increase toward a new all-time high.

The aforementioned weekly RSI and MACD signal has three parts:

- Firstly, the RSI moves into overbought territory for the first time in over two years (white).

- Secondly, the RSI falls back below 70 (red), seemingly marking a shift back to consolidation.

- Finally, the MACD rejects a bearish cross (green circle), while the RSI moves back into overbought territory (green).

In 2020, this signal occurred exactly 700 days after the absolute ETH price bottom and 70% below the then all-time high. After the signal, the ETH price increased by 1,000%, culminating with the current all-time high price of $4,868 in November 2021.

Current ETH Readings

The current ETH price and indicator readings are similar to those in 2020. In February 2024, the weekly RSI moved into overbought territory (white). Then, it fell back below 70 in April (red).

If the pattern is followed, the MACD will reject the bearish cross and then RSI will cross into overbought territory the week of May 13 (green), exactly 700 days after the absolute bottom.

The main difference between the two movements is that ETH is 40% below its all-time high in 2024. Comparatively, it was 70% below in 2020.

ETH Price Prediction: New All-Time High Soon?

The daily time frame outlook for ETH suggests the correction will end soon, if it has not done so already. The decrease since March 11 is an A-B-C corrective structure, contained inside a descending parallel channel. This decrease has caused average transaction fees to fall to their lowest level of the year at $5.

Giving waves A:C a 1:1 ratio will lead to a low of $2,730, validating the channel’s support trend line. The April 13 ETH price low of $2,852 barely missed this target, so it is unclear if the correction is over or another slightly lower low will happen.

The long-term count (white) points to the decrease being part of wave four in a five-wave upward movement.

If the count is accurate, the ETH price will complete wave five near $4,880. The target is created by the 3.61 extension of wave one (red) and the 1.61 external retracement of wave four. It represents a 60% increase from the current price.

Conversely, a breakdown from the channel will invalidate the count. Currently, this seems unlikely.

Ethereum Increase Awaits?

Despite the ongoing correction, the long-term bullish trend for ETH is still intact. If the weekly MACD rejects is bearish cross, it is possible the ETH price will accelerate its rate of increase and reach a new all-time high in May or June. A very similar movement transpired in 2020. However, there are concern’s with Ethereum’s ability to sustain the movement in its channel.