Ethereum Price Slides Below $3,100 But Recovers — Threat Of ETH Long Position Liquidations Ahead

Ethereum dips below $3,100 with a threat of long positions getting liquidated. However it quickly recovered.

Key Takeaways

- Ethereum’s 25% decline risks $212 million in liquidations.

- Market volatility drives significant losses, with $624.4 million liquidated.

- Ethereum shows resilience, potential for recovery above $5,000.

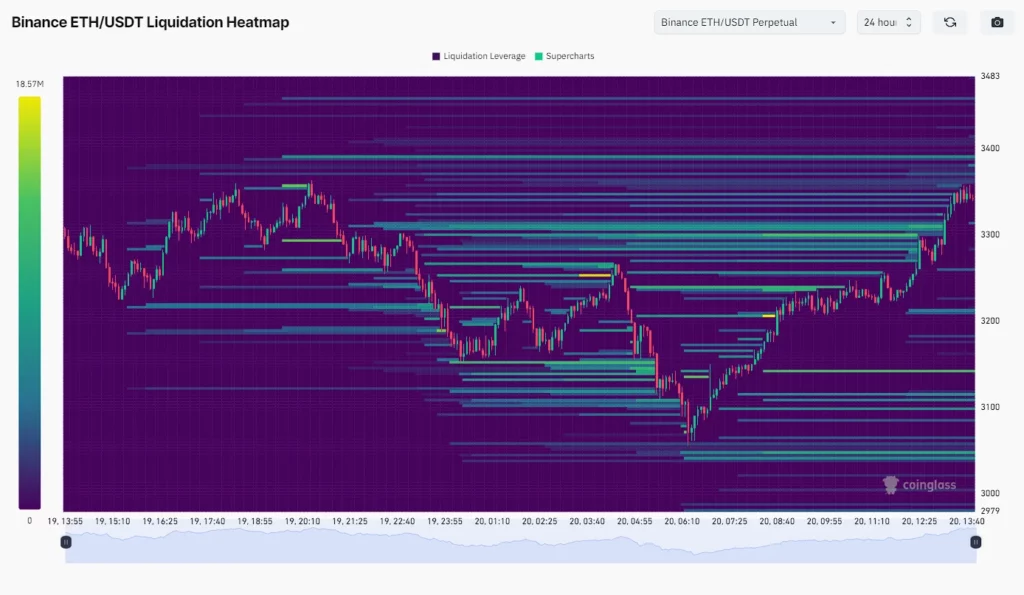

The price of Ethereum has been on a 25% decline since March 12, dipping below $3,100 on March 20. The cryptocurrency market is precarious, with ETH potentially seeing over $212 million in leveraged long positions liquidated if its value falls below $3,100, according to CoinGlass data.

The recent market volatility has led to significant losses, especially for long positions, with total liquidations reaching $624.4 million in the past day.

Liquidations Threat

The recent market volatility has led to significant losses, especially for long positions, with total liquidations reaching $624.4 million in the past day. The OKX exchange bore the brunt of these liquidations. Amid these market dynamics, a Bitfinex report highlighted Bitcoin’s downturn and its impact on institutional interest, suggesting a potential market recalibration.

On the liquidation chart heatmap, we can see that there is a cluster below $3,050 with around nine million positions. Should the price worsen and go below this area, these long positions could face termination, turning them into sellers.

Yesterday, March 19, there were $131 million worth of longs liquidated compared to $22 million in short positions. This is a bit smaller on the long side, but the derivatives data still favors a bearish sentiment.

Despite the sell-off, the altcoin sector, including Ethereum, shows signs of resilience with growing investments and significant Ethereum withdrawals from exchanges, indicating a bullish outlook for Ethereum and similar blockchain projects.

Ethereum (ETH) Price Analysis

Ethereum broke past $4,000 on March 11, reaching close to $4,100. However, this surge might mark the peak of its recent growth. Since then, it has started to retreat, falling to $3,062 at its lowest point on March 20. Ethereum bounced, however, lifting the price by 10% with ETH now trading at $3,360.

The Relative Strength Index (RSI) on the daily chart is around 40%, suggesting Ethereum may be slightly oversold. However, the overall market momentum is positive at the moment, indicating that a larger recovery might occur.

Today’s downfall could have signaled the end of a corrective fourth wave out of a larger five-wave one. This adjustment phase should happen within a larger market cycle, potentially lowering Ethereum’s price below $3,000. However, an expected upward movement following this correction could propel Ethereum to new heights, surpassing $5,000.

Despite imminent short-term fluctuations, Ethereum’s long-term outlook remains optimistic, with expectations of continued growth, although some signs of caution are present in the short-term.

Disclaimers

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.