What Is Elliott Wave Theory And How Does It Apply To Cryptocurrencies?

What Is Elliot Wave Theory And How Does It Apply To Cryptocurrencies? | Credit: Shutterstock

Key Takeaways

- Elliott Wave theory uses wave patterns to predict cryptocurrency price movements and market trends.

- The Elliott Wave theory accuracy in crypto trading varies, reflecting market patterns for more experienced traders and more subjective for newcomers.

- The theory identifies two main phases in crypto trading: the motive phase for price advancement and the corrective wave for retracements.

- Modern tools like Telegram bots can enhance Elliott Wave analysis, providing real-time updates and precise interpretations.

The Elliott Wave Theory is a strategic approach traders use in the financial markets. Essentially, it serves two essential functions. Firstly, it’s a form of technical analysis, which means traders use it to study and interpret market data.

Secondly, it focuses on identifying patterns in market cycles. Doing so helps traders predict how these markets might behave in the future, allowing them to make more informed decisions about when to buy or sell.

Created by Ralph Nelson Elliott (28 July 1871 – 15 January 1948), this theory examines repeating fractal wave patterns in stock market trends and consumer actions.

Elliott Wave Theory, Explained

The Elliott Wave Theory provides a framework for understanding market trends, particularly in cryptocurrency. This theory suggests that market prices, including those of cryptocurrencies, exhibit predictable patterns over time.

These patterns, known as waves, are influenced by investor sentiment and are visible in both trending and reversal phases of the market. Elliott’s inherently subjective theory categorizes these market movements into two main types: impulse waves, indicating the direction of the market trend, and corrective waves, signifying trend reversals or corrections.

The Role Of Elliott Wave Patterns In Cryptocurrency

In the context of cryptocurrency, Elliott Wave Theory offers valuable insights into price fluctuations. The theory’s fractal structure, comprising impulse and corrective waves, helps investors understand and anticipate market movements.

For example, a corrective wave pattern observed on a long-term crypto chart might suggest a bearish trend. At the same time, a shorter-term analysis could reveal a developing impulse wave, hinting at a bullish phase.

This approach underscores the theory’s utility in providing predictive insights into cryptocurrency market movements, reflecting the broader patterns of human social behaviour in financial markets.

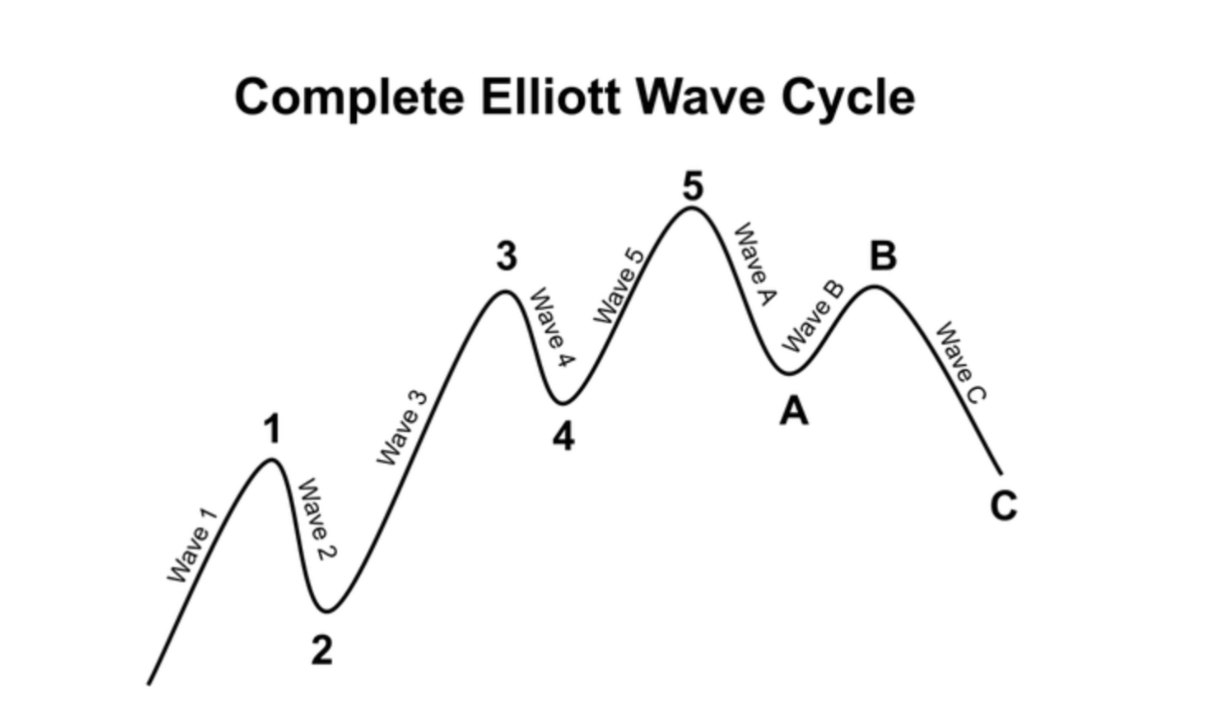

A complete price cycle is characterized by two distinct phases: the “motive” phase, which propels the price forward, and the “corrective wave,” which involves a retracement. In this cycle, the motive waves are identified using numerical labels, while the corrective phases are marked with alphabetical labels.

Consequently, an entire cycle that includes motive and corrective trends consists of eight waves depicted in the complete Elliott wave cycle above.

Application Of Elliott Waves In Crypto

As mentioned earlier, the Elliott Wave price cycles are evident in the cryptocurrency markets. The inherently volatile and emotionally driven nature of cryptocurrency trading makes it an ideal candidate for Elliott Wave analysis.

Traders with a basic understanding of Elliott Wave principles and patterns can effectively identify emerging cryptocurrency trends such as Bitcoin and Ethereum.

Elliott’s insightful analysis revealed two critical phases in market cycles. Due to the fractal nature of the market, these phases appear across different time frames on price charts, indicating that the patterns recur in both micro and macro scales.

It’s crucial to recognize that identifying the motive and corrective phases depends significantly on the wave degree under analysis.

Elliott Wave Trends And Analysis In Bitcoin’s Market Dynamics

The application of Elliott Wave Theory in cryptocurrency can be firstly interpreted as a fractal, meaning the structure repeats itself on smaller scales within larger waves. This repeating nature is evident in the charts, as smaller wave structures can be seen within the larger waves.

In the context of Bitcoin, illustrated below, these patterns are interpreted with the understanding that market sentiment and trader psychology play a significant role in the cryptocurrency’s highly volatile price movements.

Bitcoin’s Price During The Motive Or Impulse Phase (2017-2019 and 2019-2023)

Wave 1

The initial wave off a significant low shows a sharp and robust move in Bitcoin prices that establishes the direction of the trend. The psychology here is often driven by a shift in market sentiment where early adopters begin to enter the market.

Wave 2

A retracement of Wave 1 occurs, which is typically shallow and does not exceed the start of Wave 1. This wave reflects the market’s disbelief in the emerging trend, often leading to a correction.

Wave 3

This is usually the longest and most robust wave, where the majority of the market acknowledges the trend, and more significant market participation is seen, propelling prices further in the direction established by Wave 1.

Wave 4

Another retracement that is more complex and diverse than Wave 2. It represents profit-taking and consolidation before the final push. It never overlaps the price territory of Wave 1.

Wave 5

The final leg in the direction of the dominant trend. This wave is characterized by a euphoria or “blow-off top” where valuations can reach extremes. After Wave 5, a significant correction is often expected as the cycle completes.

Bitcoin’s Price During The Corrective Phase (A-B-C):

Wave A

The beginning of the market correcting itself can be sharp and substantial. It often catches investors off-guard as it typically follows the euphoria of Wave 5.

Wave B

A retracement of Wave A can sometimes resemble a continuation of the previous uptrend, leading to false optimism. However, this is typically lower in volume and is a setup for the final wave in the correction.

Wave C

The final wave in the corrective phase often resembles or exceeds the intensity of Wave A. It completes the entire cycle and sets the stage for the market to begin another motive phase.

How Accurate Is The Elliott Wave Crypto Trading?

The reliability of the Elliott Wave Theory is a subject of debate. Advocates with experience in the method assert that it accurately reflects market patterns, while those new to the concept may find it open to interpretation and challenging to apply.

The accuracy of Elliott Wave Theory in crypto trading relies on interpreting market sentiment and price patterns. While it offers a structured framework to forecast market movements based on wave patterns, its accuracy can vary due to the subjective nature of wave identification and the influence of external factors in the highly volatile cryptocurrency market.

Traders often use it as a tool alongside other indicators to gauge potential price movements, but its predictive accuracy remains a subject of debate, impacted by the complexity and rapid shifts within cryptocurrency markets.

For those intrigued by the potential of Elliott Wave Theory, a deep dive into its historical background and practical usage may prove necessary to grasp it properly. Approaching Elliott Wave Theory is akin to learning a complex skill, demanding dedication and a nuanced understanding of market intricacies.

However, should investors be willing to invest the required time to learn Elliott Wave theory, investors and traders can benefit from an insightful perspective on market trends, potentially leading to more reliable trading opportunities.

Elliott Wave Theory Using Telegram Bots

Elliott Wave Theory can be seen more accurately by traders using modern technology, such as Telegram bots, which can assist traders in monitoring and analyzing market patterns. One such bot is “89WAVES | Elliott Waves Trading & Analytics”, which currently serves as a digital tool designed to streamline Elliott Wave principles to trading strategies.

By leveraging the capabilities of this bot, traders can receive updates, analytics, and trading signals that align with Elliott Wave patterns, making it easier to interpret complex market data and potentially increase the precision of their trading decisions.

Benefits And Drawbacks Of The Elliott Wave Theory In Crypto Trading

The Elliott Wave Theory is a technical analysis framework used to forecast market trends by identifying investor sentiment and psychological extremes. Elliott Wave theory illustrates how markets tend to move in repetitive cycles, which are reflected in wave-like patterns.

The benefits and drawbacks associated with this technical analysis tool and philosophy are outlined below:

Benefits Of Elliott Wave Theory

Comprehensive Framework

Elliott Wave theory offers a holistic view of market trends, capturing both macro and micro-economic factors within its wave patterns.

Predictive Potential

When applied correctly, Elliott Wave Theory can provide foresight into the likely future movements of market prices, offering a strategic edge to investors and traders.

Risk Management

Elliott Wave theory allows traders to identify potential reversal points, helping in setting stop-loss orders and managing risk more effectively.

Drawbacks Of Elliott Wave Theory

Complexity

Elliott Wave theory is complex and can be quite subjective, leading to varied interpretations among traders.

Time-Consuming

Elliott Wave theory requires a significant investment of time to learn and correctly apply, with accurate wave counting being a skill that takes time to develop.

Inflexibility in Rapid Market Changes

The theory of Elliott Waves may not always account for sudden economic events or news that can cause rapid market shifts, leading to inaccuracies in wave predictions.

Conclusion

Elliott Wave Theory offers a lens to view and predict cryptocurrency market movements through patterns that echo investor behavior.

While it’s intricate and requires deep understanding, it empowers traders to navigate the sentiment and nature of crypto markets, using waves to anticipate price changes.

FAQs

What is Elliott Wave Theory and how does it apply to cryptocurrencies?

Elliott Wave Theory, created by Ralph Nelson Elliott, analyzes market trends through identifiable wave patterns. In cryptocurrencies, it helps traders predict price movements by understanding investor sentiment-driven waves, including impulse and corrective phases.

How accurate Is Elliott Wave trading in cryptocurrencies?

The accuracy of Elliott Wave trading in cryptocurrencies varies. Experienced traders often find it reflective of market patterns, while newcomers may see it as subjective and challenging, hence the need for investors to invest time to understand Elliott Wave theory.

What are the key phases in Elliott Wave Theory for crypto trading?

Elliott Wave Theory in crypto trading identifies two main phases: the motive phase, driving prices forward, and the corrective wave, indicating retracements. These phases help traders anticipate market trends and price movements.

Can Elliott Wave Theory be enhanced with modern tools like Telegram bots?

Yes, modern tools like Telegram bots can enhance Elliott Wave analysis by providing real-time updates and analytics. Bots like “89WAVES” offer trading signals aligned with Elliott Wave patterns, aiding in more precise market interpretations.