Cardano Active Wallets Addresses Peak at 600,000 — What Next For ADA?

Cardano could be poised for more upside movement as strong fundamentals suggest.

Key Takeaways

- Cardano user engagement surges as active wallets exceed 600,000.

- ADA’s price trends upward, achieving a 76% increase.

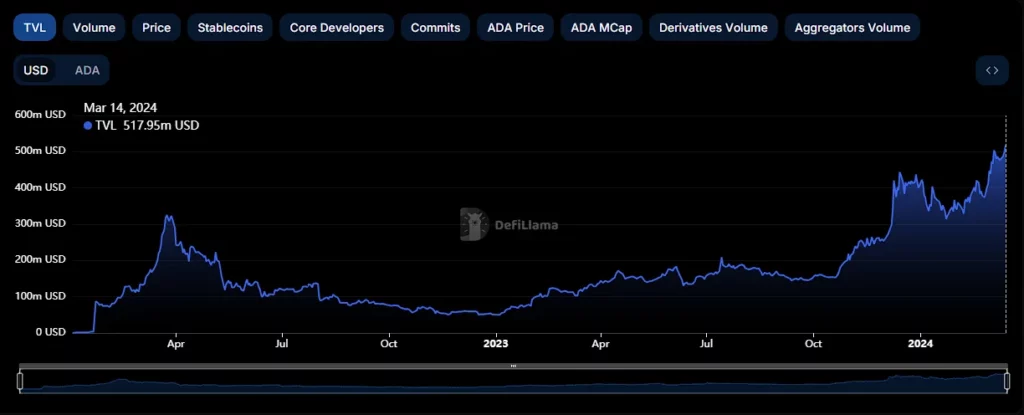

- The TVL in Cardano’s DeFi ecosystem reaches over $517 million.

Over the last month, Cardano (ADA) has witnessed a remarkable surge in user engagement, with active wallet addresses reaching a new high of over 600,000, marking a nearly 40% increase. This growth in activity coincides with a significant interest in the broader DeFi sector.

ADA’s price saw a climb of 76% from its January 22 low of $0.46 to a high of $0.80. These values were last seen in May 2022. With ADA being in a larger 227% uptrend from October 23 last year, what’s next in store for ADA?

Cardano Fundamentals

Cardano’s ecosystem has been thriving, as shown by a substantial increase in the Total Value Locked (TVL) on its decentralized finance (DeFi) platforms. From the start of 2023, the TVL soared from about $60 million to over $517 million as of March 14.

This growth is not solely attributed to rising asset prices. ADA locked-in DeFi protocols have also expanded significantly, from 200 million ADA at the beginning of the year to over 650 million.

Among the leading projects in Cardano’s DeFi landscape, Indigo’s collateralized debt protocol stands out with over $120 million in TVL. Following that are the decentralized exchange Minswap with $100 million, and lending protocol Liqwid with $63 million. Minswap has also led in terms of active wallet addresses in the past month, with 30,677 addresses.

Cardano (ADA) Price Analysis

On October 19, Cardano experienced a significant price increase, climbing from a support base of $0.23 to a high near $0.70 by December 13 of the previous year. Following this peak, the price entered a period of decline. This downward movement brought Cardano‘s value back down to a resistance level it had earlier exceeded. Its price on January 22 reached a low of $0.45, matching the previous high set on April 14, 2023.

January’s low is the point from which the current uptrend started. It reached a higher high than in December and will likely proceed higher. If we saw the start of a larger five-wave pattern from October 19, the current uptrend is its wave 3.

At its typical point, it comes to a 1.618 Fibonacci extension around the horizontal resistance of $1.10. After a minor retracement for its wave 4 ADA, it could break this resistance and enter its last advance – wave five.

The next zone above that can serve as resistance would be $1.60. Depending on the momentum, however, ADA could continue pushing higher.

Disclaimers

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.