Active Trader Predicts a Stock Market Crash in Q4 Due to Liquidity Crisis

A severe shortage of U.S. dollars could ignite the next major stock-market correction, analyst warns. | Image: Shutterstock.com

The S&P 500 (SPX) may have bounced from last week’s selloff but it seems that investors remain jittery.

You can’t blame them.

Uncertainties from the trade war, global dollar shortage, and weak manufacturing data are all threatening an index that’s trading close to all-time highs. As a result, fear is driving stock market sentiment.

It appears that the future may be starting to look gloomy for the index. We talked to an active day trader and she revealed that a frightening fourth quarter may be coming for the S&P 500.

Analyst: The Market Will Crash Due to Liquidity Crunch

It appears that the global dollar squeeze will be the culprit that ignites a major stock market correction.

At LaDuc Trading , Samantha LaDuc leads the analysis, education and trading services; she’s also CIO for LaDuc Capital LLC. She spoke to CCN.com about the near-term prospects of the S&P 500. We were shocked to hear her forecast:

Market will crash starting in Q4 and take gold and bitcoin with it. A true liquidity crisis creates panic – everything sells off – and only those who are sitting on the sidelines will be in a position to pick up shares on the cheap.

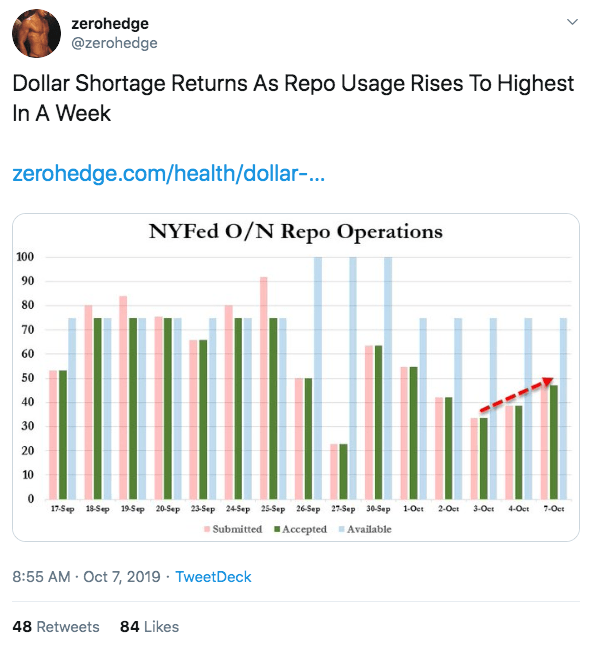

The liquidity crisis started to rear its ugly head in September when interest rates in the repo market suddenly surged. The Federal Reserve had to step in and offer funding to keep the overnight lending market stable. What was supposed to be a quick fix has turned into a long-term intervention as the New York Fed announced that it will extend its operations into November .

The dollar shortage can make its way into the stock market. As liquidity dries up, investors might be forced to dump their shares to meet liabilities and financial obligations. In a note to clients, the Bank of America Merrill Lynch said,

Over the past year we have seen liquidity risks bubbling up. When the wall of worry turns to panic selling, we worry about an unlikely area of liquidity risk: the S&P 500.

It seems that Samantha LaDuc is onto something.

LaDuc: Stock Market to Drop by 30%

In addition, the active day trader believes that the crash will be nothing like the downturn in 2008. She said,

I also don’t think shorting will be a six month ride down the hill like in 2008. This current correction will morph into panic from a liquidity Flash Crash event and convulse lower over maybe six weeks.

She added,

Risk premiums will be so quickly elevated in this race for liquidity that, again, even those who try to short let alone protect in the thick of this downdraft will be played by Market Makers. I see the asymmetrical rewards of playing this game of trading to benefit those who are either positioned short now or have the patience to wait for the reset about 30% lower.

LaDuc is not alone in this stance. Author Holger Zschaepitz also believes that the S&P 500 may be headed into a recession. In a tweet, he wrote,

S&P 500 fall at least 30% if downturn occurs

It may be possible that, in the next few months, cash will be king. That appears especially true now that we seem to be facing a global liquidity crisis.

Disclaimer: The above should not be considered trading advice from CCN.com.