Massive U.S. Dollar Shortage to Weaken Economic Activity and Keep Markets Volatile

A massive U.S. dollar shortage in the near term could impact everything from economic growth to inflation, analysts warn. | Image: Shutterstock

Most people are engrossed in the trade war and how it affects the stock market. Only a handful of people can see what’s actually happening behind the curtains.

The surging rates in the repo market last month was a signal of a looming crisis obscured to the general population. It is veiled not because the authorities are purposefully hiding it but because they don’t understand it .

We’re talking about the global U.S. dollar shortage. In other words, almost all countries in the world, especially the U.S., need liquidity in the form of the U.S. dollars to meet their financial obligations and liabilities.

What Is the Global Liquidity Crisis?

If you think that the Federal Reserve’s QE program to print $4.5 trillion was an awful monetary policy, then you’re not ready for the global dollar squeeze. According to financial analysts, the world is short by $12.8 trillion.

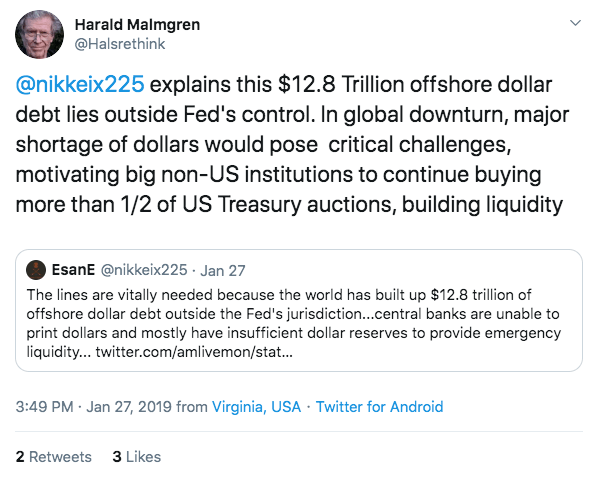

A tweet by economist Harald Malmgren elegantly describes this global crisis.

This problem did not happen overnight. According to Jeff Snider’s Eurodollar University , the roots of this global crisis can be traced as far back as the 1960s. Back then, foreign banks that were outside of the jurisdiction of the Federal Reserve created money out of thin air. They did this by leveraging the fractional reserve system.

Snider used an oil sheikh depositing $1 million to a bank in London as an example to illustrate how this $12.8 trillion shortage began. Since the bank is outside the purview of the Fed, it can loan the $900,000. The $100,000 balance is the reserve requirement (fractional reserve system). Let’s say the borrower used the $900,000 to purchase wood from a Russian company. In this case, the bank where the money was deposited could also leverage the $900,000. This would create more U.S. dollars out of thin air.

With this “fractional system outside of a fractional system,” the world has created a massive appetite for U.S. dollars. Unfortunately, there’s no Federal Reserve for the entire world that can step up to the plate and print U.S. dollars. Hence we have a U.S. dollar shortage.

How Will the U.S. Dollar Shortage Impact the Economy and the Stock Market?

To answer this question, we sought the expertise of Emma Muhleman , a global macro strategist and an equity analyst. The analyst exclusively spoke to CCN.com and said,

The Fed’s failure to fully understand the plumbing of the global financial system, particularly the eurodollar markets and how a global shortage of U.S. dollar liquidity is causing banks and businesses to hoard cash to meet dollar payment/liability requirements.

She then added,

This has and continues to drive contraction in economic activity as limited global money supply stymies business investment activity and lending. With the lagged effects of QT kicking in, large and growing demands from the Treasury to replenish its cash balance by year-end, and central banks outside the US electing to park their reserves in cash with the Fed as opposed to the Treasury markets, we could continue to see pressure in overnight lending markets.

The overnight lending market that she’s referring to is the repo markets, which have recently grabbed headlines due to funding and collateral issues.

In the end, the analyst concluded,

A global flight to safety will likely continue to drive demand for dollars and capital inflows into domestic Treasury markets as global investors seek safety and dollar liquidity.

In other words, this shortage may very likely force investors to sell their stocks in favor of being liquid. This can trigger volatility and even panic as sellers drive prices down. This may leave retail investors with very little options but to cut their losses, which may cause prices to further plummet.