Dow Flinches at China’s Trade War Bait & Switch

The Dow flinched on Monday after a Bloomberg report exposed China's plans to leverage impeachment to narrow the scope of trade negotiations. | Source: AP Photo/Richard Drew

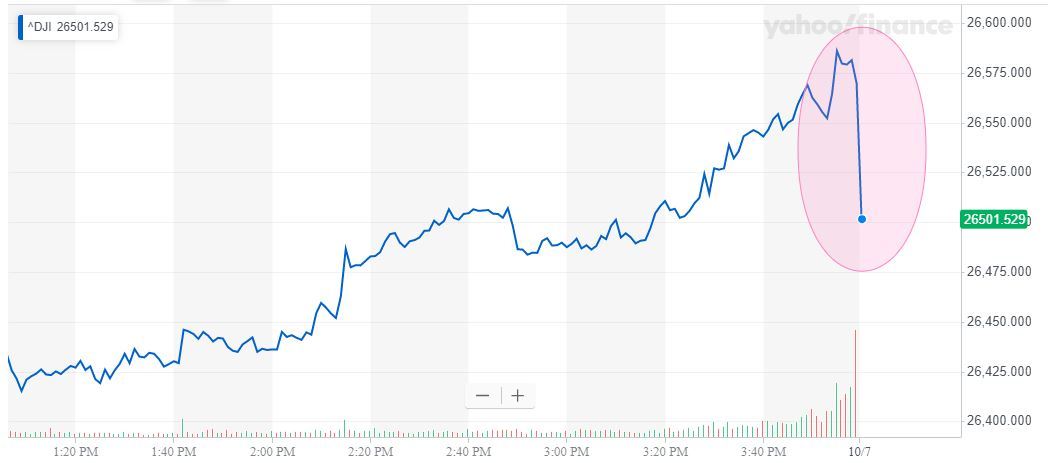

The Dow struggled on Monday as investors wrestled with Beijing’s risky attempt to leverage the damage from President Donald Trump’s impeachment fight to narrow the scope of a new round of impending US-China trade negotiations.

Dow Sputters Ahead of US-China Trade Talks

Wall Street’s three major indices stumbled during the morning session. The Dow Jones Industrial Average slid 74.35 points or 0.28% to 26,499.37, retracing a small portion of Friday’s 372 point rally.

The S&P 500 declined 8.49 points or 0.29% to 2,943.52. All 11 primary sectors reported losses, with industrials (-0.53%) suffering the largest pullback.

The Nasdaq dipped 16.93 points or 0.21% to 7,965.54.

China Rolls the Dice on Impeachment

The Dow and its peers reacted negatively to a Bloomberg report that revealed a dramatic shift in the outlook for US-China trade negotiations, which will resume this week in Washington.

According to Bloomberg, Chinese officials believe the Trump impeachment inquiry has shifted the balance of power in the trade war. While US tariffs had visibly begun to choke an already-slowing Chinese economy, Beijing suspects that an impeachment fight will exert comparable pressure on Trump’s political fortunes.

Against this backdrop, Chinese officials, including Vice Premier Liu He, have reportedly made clear that they will only discuss a narrow range of topics this week. Two topics that they say must remain off the table are government subsidies and industrial policy.

By refusing even to discuss core US demands, Beijing is gambling that Trump is desperate enough for a political victory – or will be soon – to agree to dramatic compromises that remove the focus from his alleged wrongdoings and reinforce the narrative that he is a president who “gets things done.”

Adding to Beijing’s perceived leverage is a spate of mixed data that, according to analysts, suggests that the trade war has pushed the US economy to the brink of a recession.

“The rise in protectionism, pervasive trade policy uncertainty, and slower global growth are considered key downside risks to U.S. economic activity,” said NABE survey chairman Gregory Daco, chief U.S. economist, Oxford Economics, in remarks cited by CNBC .

However, Beijing’s gambit risks triggering a retaliatory response from Trump, who has not been shy about imposing massive tariffs on China, seemingly at the drop of a hat.

The White House has also discussed opening another front in the trade war by heavily restricting US investment in China, which has sought to offset its economic slowdown by encouraging larger foreign capital inflows.

Click here for a live Dow Jones Industrial Average chart.