U.S. Treasury Yields Continue to Surge as Mnuchin Considers “Dangerous Temptation”

Steven Mnuchin's Treasury Department is getting tempted to issue ultra-long bonds. | Source: Chip Somodevilla / Getty Images / AFP

U.S. government debt yields rose on Thursday after core inflation exceeded analysts’ estimates, signaling that the economy is performing better than previously feared.

The inflation report seemed to strike a delicate balance on Wall Street: Firming expectations about the domestic economy without compromising the Federal Reserve’s plans to lower interest rates next week.

Treasury Yields Rise

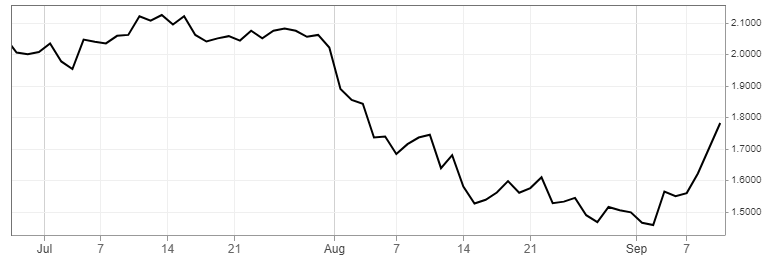

Government bond yields rose across the board Thursday, extending their September rally. The benchmark 10-year Treasury note peaked at 1.80%, the highest since Aug. 3, according to CNBC data. The yield was up around 5 basis points at the time of writing at 1.782%.

The yield on the 2-year Treasury note reached a high of 1.73%. It was last spotted just below peak levels.

U.S. 3o-year Treasury notes saw their yield rise by about 5 basis points to 2.261%.

Falling yields reflect higher prices for government bonds and lower appetite for risk-off assets. On Thursday, this environment propelled the Dow Jones Industrial Average (DJIA) toward its seventh consecutive gain.

Mnuchin: Treasury “Seriously Considering” 50-Year Bonds

Treasury Secretary Steven Mnuchin said on Thursday that his department is “seriously considering” issuing 50-year bonds as soon as next year as it seeks cheaper ways to finance its massive debt load.

Last month, it was reported that the Treasury Department was contemplating not just issuing 50-year bonds, but 100-year notes as well. Ultra-long bonds are becoming a “dangerous temptation,” according to Bloomberg, given how well Austria’s century debt has performed.

Mnuchin said no decision on ultra-long bonds has been made, though demand for such obligations is said to be rising.

“This is something I have talked about over the last two years, it is something we are very seriously considering,” he said on CNBC’s “Squawk Box.” “We’re looking at issuing a 50-year bond, what we could call an ultra-long bond. We think there is some demand for it. It is something we’ll very seriously consider for next year.”

Core Inflation Rises

A closely-watched measure of consumer inflation rose faster than expected in August, leading to the largest annual increase in a year.

The Labor Department reported Thursday that the so-called core consumer price index (CPI) – a gauge that strips away food and energy costs – rose 2.4% year-over-year. Analysts were expecting an increase of 2.3%.

Core consumer prices rose 0.3% from July, also higher than expected.

The main CPI figure came in at 1.7%, lower than July’s 1.8% reading. It was slightly lower than forecasts.