Dow Secures 7th Straight Gain Despite Skyrocketing Inflation

The Dow Jones continues its march to record highs amid positive progress in the trade war and central bank stimulus, even as US CPI hits a 10-year high. | Source: Spencer Platt / Getty Images / AFP

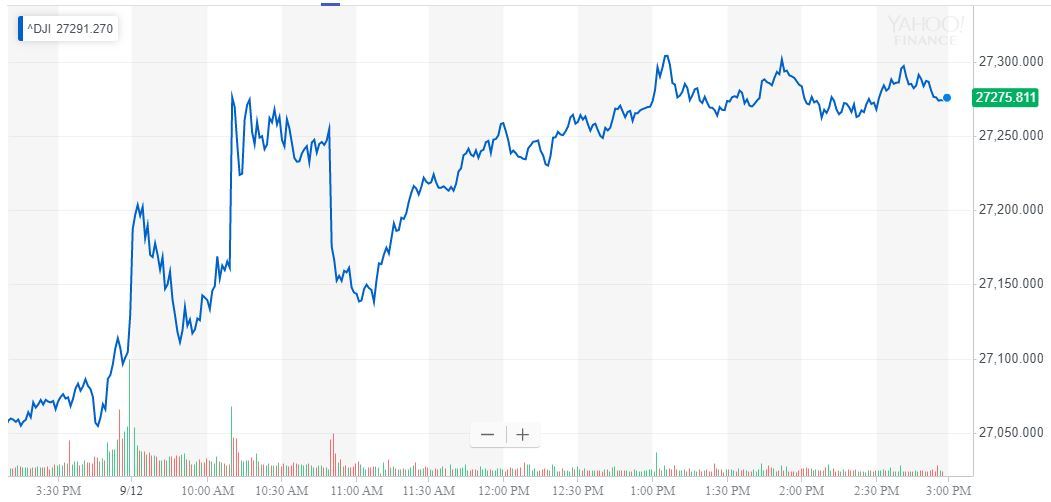

The Dow continued its rally to the brink of all-time highs on Thursday, as the ECB’s stimulus package raised expectations for the Federal Reserve to cut rates next week.

Traders also mulled the possibility of Trump offering a trade war olive branch to China, adding to the bullish mood on Wall Street.

Dow Booms as Dollar Falls on ECB Action

Shortly before Thursday’s close, the Dow Jones Industrial Average had advanced 116.47 points or 0.43%. The DJIA last traded at 27,253.51, a mere 150 points from its record high.

The S&P 500 and Nasdaq rose even further, adding 0.53% and 0.61%.

The outlook on Trump’s trade war has been a critical fundamental for the Dow Jones in recent weeks. Several mixed signals are currently being put out by the US administration, which seems conflicted about its next move. Nonetheless, it seems the deadlock has been broken, and speculators are betting on positive progress for the stock market.

With the world’s eyes on President Draghi’s parting shot, the outgoing ECB chief did his best to ease policy. Deposit rates were moved further into negative territory (-0.5%), and QE was relaunched.

The euro initially dropped, strengthening the dollar and sending the Dow plunging midday. Despite this skid, EUR/USD subsequently rallied strongly, with the weaker dollar cheered by stock markets around the world. Though the explanation for this is complicated, it appears investors are now close to certain the Federal Reserve will have to cut interest rates next week.

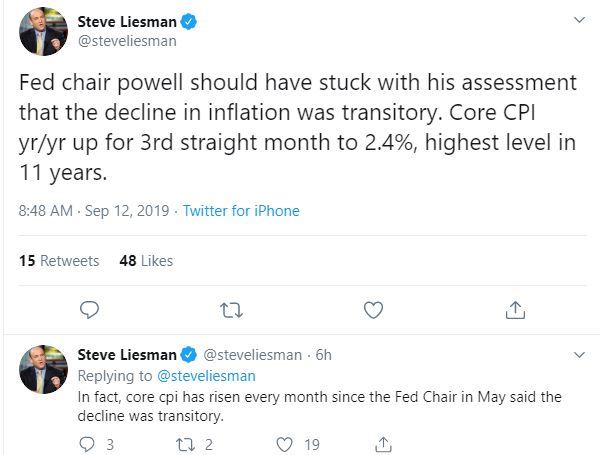

US CPI Posts Highest Reading in a Decade

Despite the market’s enthusiasm for a rate cut, the US Consumer Price Index (CPI) posted its highest reading in 11 years.

With the Dow back above 27,000 and inflation roaring, the stock market is looking increasingly complacent. The question is how much appetite there will be from a divided Federal Reserve to cut interest rates.

Looking for an explanation for the Fed’s approach, James Knightley, Chief Economist at ING, theorizes that a forward-looking Powell is more focused on an upcoming recession than rising price pressures, as he writes :

“We have to remember that inflation tends to be a lagging indicator and policymakers will instead be focusing on the deteriorating growth outlook when the Federal Reserve meeting starts next week. In this regard there are signals that the manufacturing sector is in or at least heading towards recession, the investment numbers are weakening, and businesses are becoming more cautious about hiring.”

Dow 30: Caterpillar & Boeing Weaken, Apple Continues to Climb

The Dow 30 was an odd mix on Thursday, as general improvements in risk appetite saw buying of the usual staples. Apple, Goldman Sachs, Microsoft, and Disney all enjoyed positive gains. The uniformity among these stocks suggested these moves may have been due to general index buying amid a weaker US dollar.

Interestingly, despite the positive rumblings from the White House, Caterpillar was down more than 1% as the trade war barometer stock failed to extend its rally. Boeing, another high-profile stock, was also struggling, as the company fears that the US-China situation endangers its 787 Dreamliner .

Click here for a live Dow Jones Industrial Average chart.