U.S. Futures Plunge as Eurozone Fails Crucial Coronavirus Stimulus

Eurozone finance ministers have failed to agree on a unified economic stiumulus response to the coronavirus pandemic crisis. | Source: REUTERS/Lucas Jackson/File Photo

- The eurozone failed to finalize a massive stimulus deal to lift the stock market.

- It applies further pressure on small businesses as major European economies free fall into recession.

- U.S. stock market is at risk of a further downtrend despite coronavirus containment progress in Asia.

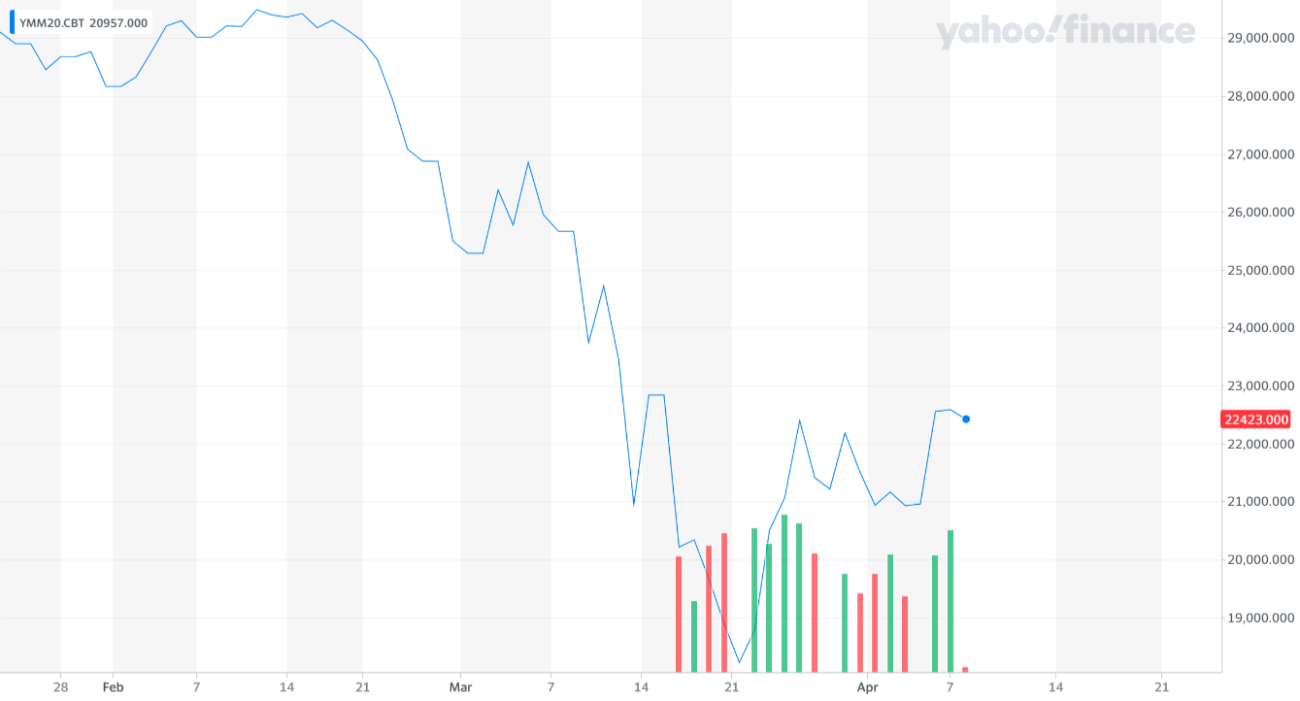

The U.S. stock market futures reversed from an initial 1.3% gain to a sharp loss as the eurozone failed to achieve a deal on a stimulus package after 16 grueling hours of discussion.

French finance minister Bruno Le Marie stated:

The Dow Jones closed with a slight drop on Tuesday as investors remain cautious about the short-term trend of the stock market ahead of Q2 earnings.

Major U.S. conglomerates in the likes of Apple have confirmed that they will not be able to hit their guidance , which may rattle the stock market by the month’s end.

Europe’s disappointment sends shock waves to the U.S. stock market

A driving factor of the momentum in the U.S. stock market recovery in recent weeks is the $2 trillion Senate stimulus package.

It alleviated significant pressure off of small business owners during a critical period, allocating hundreds of billions of dollars to assist companies lacking revenues amidst a global pandemic.

The eurozone hoped for a similar stimulus package from its central bank.

As major European economies, including Italy “free fall” deep into recession, businesses and investors anticipated a swift approval of the €500 billion deal to vamp up economic activity in the region and trigger a much-needed stock market recovery.

Despite the emphasis on the necessity of a deal to provide a safety net to businesses by the eurogroup president and euro zone’s chairman of the ministers Mario Centeno, finance ministers failed to reach an agreement.

Ceteno said of the deal:

It is arguably the most sizable and ambitious package ever prepared by the Eurogroup. It builds on unprecedented efforts already take by governments and monetary authorities.

https://www.youtube.com/watch?v=cWDJ_RTeqhk

A part of the expectations of investors in the stock market following the $2 trillion stimulus deal in the U.S. was that other key economies would follow, especially Europe.

The lack of urgency in restoring business productivity and appetite in the markets by finance ministers in the eurozone is beginning to slow down the newly found momentum of the U.S. stock market.

There is optimistic data in Asia

Prior to the Eurozone meeting, the U.S. stock market was climbing upwards based on the success in Asia in containing coronavirus.

Wuhan, the epicenter of the coronavirus outbreak, reopened for the first time in 76 days , demonstrating the confidence of the Chinese authorities that the peak of the virus has passed in China.

55,000 individuals from Wuhan are expected to leave the Hubei region in the next 24 hours to manufacturing-centered cities for work.

There are hopes that the passing of the coronavirus peak in Singapore, China, South Korea, Taiwan, Vietnam, Thailand, and several other Asian countries would pave the way forward to flatten the coronavirus curve in the U.S. and Europe in the near-term.

The U.S. surpassed 400,000 confirmed coronavirus cases as of April 8, as coronavirus hot spots including New York and California face dire shortages of medical equipment and ventilators.

Strategists say that the U.S. stock market recovery will be at risk of a sharp correction if fiscal policies are the sole factor behind the stocks’ rebound.